ABD'nin son beş yıldaki kripto para yaptırım eylemlerinin gözden geçirilmesi: Uzlaşma fonları, FTX ve Alame ile birlikte toplam $32 milyara ulaştı

Orijinal yazar: Coingecko

Orijinal çeviri: Felix, PANews

Recently, Coingecko released a research report on US crypto enforcement actions. The research is based on official announcements from January 1, 2019 to October 9, 2024, and studies the monetary value settlements reached between crypto companies and US regulators in federal and state court cases, but does not include charges against individuals. The following are the details of the report.

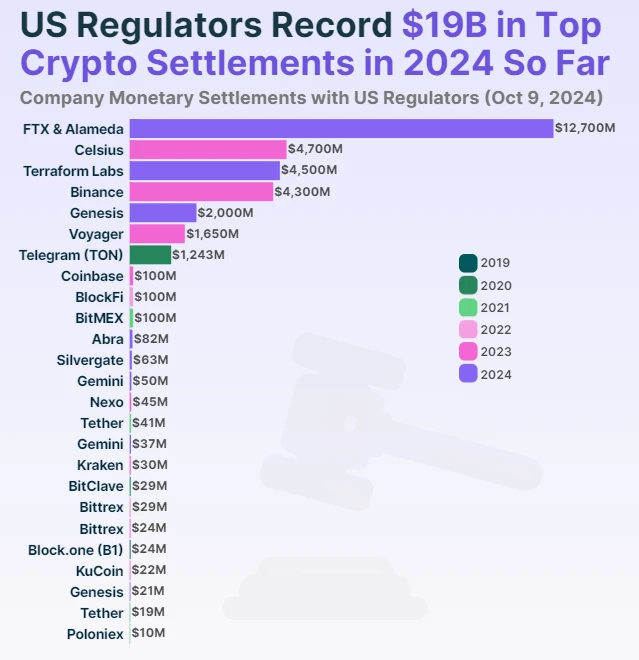

The total amount of settlement funds is nearly 32 billion US dollars, and FTX and Alameda account for nearly 40%

The most significant crypto enforcement action by U.S. regulators was against bankrupt crypto exchange FTX and its affiliated trading firm Alameda, which together paid the largest settlement to date at $12.7 billion. The FTX and Alameda lawsuit was led by the Commodity Futures Trading Commission (CFTC), and the settlement was announced in August 2024, less than two years after FTX collapsed. While the ruling does not include the CFTCs lawsuit against individual company executives, the $12.7 billion settlement will be used to repay FTX customers and creditors (approximately $11.2 billion).

The second largest crypto enforcement action by U.S. regulators was against bankrupt crypto lender Celsius ($4.7 billion), former industry leader Terraform Labs ($4.5 billion), and crypto exchange Binance ($4.3 billion). It is worth noting that the collapse of Celsius and Terraform Labs in mid-2022 was a key event marking the crypto markets bull-to-bear turn, which ultimately led to the decline of FTX and triggered a new round of regulatory scrutiny in the United States.

Binance鈥檚 settlement is a landmark victory for U.S. regulators, and although it ranks only fourth in terms of settlement amount, it is the only operating crypto company to have paid a multi-billion dollar settlement to date. The world鈥檚 leading crypto exchange agreed to plead guilty in November 2023 to resolve lawsuits with multiple U.S. regulators, including the Department of Justice (DOJ), the Treasury Department, and the Commodity Futures Trading Commission (CFTC).

U.S. regulators have now taken 25 crypto enforcement actions, with each settlement exceeding $10 million. Overall, the highest settlement amount against crypto companies by U.S. regulators has reached $31.92 billion.

Enforcement actions surged in the past two years, with settlements exceeding $19.4 billion this year alone

Of the 25 major crypto enforcement actions in the United States, 16 were settled in the past two years, reflecting increased regulatory scrutiny since the FTX collapse in late 2022. Specifically, U.S. regulators settled eight lawsuits in 2023 for a total of $10.87 billion, a record high, and settlement amounts increased by 8,327.1% compared to the previous year.

Subsequently, U.S. regulators have reached another eight settlements in 2024, worth $19.45 billion, accounting for almost two-thirds of the total settlement amount. Even with only a few months left in the year, the settlement amount in 2024 has increased by 78.9% over 2023. Given that U.S. regulators show no signs of slowing down their scrutiny of the crypto industry, 2024 may record more litigation settlements than last year.

Between 2019 and 2022, U.S. regulators won eight crypto lawsuit settlements. At the end of 2019, U.S. regulators reached the first major cryptocurrency lawsuit settlement with Block.one (now renamed B 1), the company behind EOS. The U.S. Securities and Exchange Commission (SEC) reached a $24 million settlement with Block.one.

The SEC won two more major crypto lawsuits in 2020, with ICO issuer BitClave reaching a $29.34 million settlement in May and Telegram reaching a $1.24 billion settlement over its Gram token offering under its subsidiary TON Issuer. The $1.24 billion Telegram settlement included $1.22 billion in disgorgement and a $18.5 million civil penalty.

During the 2021 bull run, U.S. regulators successfully brought three crypto enforcement actions against prominent industry players. Stablecoin issuer Tether reached an $18.5 million settlement with the New York Attorney General (NY AG) in February, followed by a $41 million settlement with the CFTC in October, claiming that USDT is fully backed by U.S. dollar assets. The CFTC also settled with Tethers parent company Bitfinex for a lower fine of $1.5 million for illegal trading. Meanwhile, crypto exchanges Poloniex and BitMEX settled in August for $10.39 million and $100 million, respectively.

In 2022, cryptocurrency lender BlockFi reached a $100 million settlement with the U.S. SEC and the North American Securities Administrators Association (NASAA), while cryptocurrency exchange Bittrex reached a $29 million settlement with the Treasury Department.

This article is sourced from the internet: Review of US crypto enforcement actions in the past five years: Settlement funds totaled $32 billion, with FTX and Alameda accounting for the majority

Related: A step-by-step guide to the five major projects invested by Binance Labs in August

Original | Odaily Planet Daily ( @OdailyChina ) Author | Asher ( @Asher_0210 ) Recently, although the trend of BTC is still unclear, the number of crypto projects that have received financing is increasing. Paying attention to the financing trends in the primary market may provide some insights into the hottest tracks in the future. Among many investment institutions, Binance Labs is the most concerned by the community. Therefore, Odaily Planet Daily has compiled the project profiles and interaction strategies of the five projects invested by Binance Labs as of August today, namely: MyShell, Particle Network, Corn, Sahara AI, and Solayer. MyShell: A decentralized AI ecosystem Project Introduction Image source: Official Twitter MyShell is a decentralized AI ecosystem that allows everyone to build, own and share artificial intelligence applications. It…