Ever heard of the “Bitcoin write problem”? Without getting too technical, it boils down to Bitcoin’s limited programmability. This is why we don’t see the same types of DeFi applications on other chains on Bitcoin. However, for a decentralized economy to work, users need to be able to swap, borrow, and earn yield on their holdings.

This limited programmability led to the emergence of blockchains such as Ethereum, which offer more web3 functionality and custodial “wrapped bitcoin” tokens that reflect the value of bitcoin. However, compromises on security and reliance on centralized entities have led to countless hacks, bankruptcies, and billions of dollars in losses.

A solution is needed to leverage Bitcoin beyond the base layer. In this article, we explain why Web3 needs Bitcoin and introduce sBTC: a non-custodial Bitcoin pegging mechanism that will become the backbone of decentralized finance.

Why Bitcoin Web3?

The Bitcoin blockchain has never experienced a vulnerability or hack in 15 years of use and holds over $1.2 trillion in network value, four times that of Ethereum. Web3 requires the decentralization, security, and durability that only Bitcoin can provide.

Merkezi olmayan yönetim

Bitcoin’s governance rests with its holders, miners, node operators, and other network participants, with its rules encoded in its protocol. This decentralization is demonstrated when the Bitcoin community resists changes to the protocol.

In contrast, Ethereum’s governance structure is more centralized, with a charismatic co-founder and influential entities who can make changes to the Ethereum blockchain and monetary policy. This includes rolling back transactions that have already been settled. This flexibility allows for experimentation, but also undermines the security and durability of the blockchain, which is essential to building trust in a public economic system.

Emniyet

Ethereum has transitioned from a Proof of Work (PoW) consensus mechanism to a Proof of Stake (PoS) mechanism to improve scalability. However, PoS has several fundamental issues that compromise security.

For example, those who hold tokens are also those who validate the chain. This leads to a concentration of decision-making power and financial rewards in the hands of the wealthiest currency holders, and relies on a measure of wealth that is determined internally rather than externally by the system. Since the largest holders will make decisions in their own favor, this could lead to further centralization – the long-term effects of this are unclear.

In contrast, Bitcoin’s proof-of-work mechanism, which relies on external resources to verify blocks and rewards users for honest verification, provides a secure, tamper-proof and decentralized settlement layer that is valuable for a range of applications.

Durability

Bitcoin has a long history and is not prone to change, making it stable and reliable. Ethereums experimental spirit and frequent rule changes make it less reliable. The interconnectedness of Ethereums settlement and smart contract functions poses a challenge to ensuring the security of the system. In contrast, Bitcoins minimal and pure settlement layer is seen as sacrosanct, helping to ensure the stability of the system.

Bitcoin was designed to be the base layer for high-value settlements. Now it’s time to add layers to introduce more powerful and expressive smart contracts that DeFi applications require.

Stacks Bitcoin Layers

Layers can provide scalable web3 solutions.

We have seen the Ethereum layer bring about the entire decentralized application ecosystem and attract more capital and market value. Introducing a layer for Bitcoin will also bring innovation and continued growth.

Currently, the number one project in Bitcoin Web3 is the Stacks Bitcoin layer launched in January 2021. Stacks extends the functionality of Bitcoin, using the security of Bitcoin as an anchored base layer without making any changes to Bitcoin itself to provide smart contract functionality, thereby supporting the development of decentralized finance (DeFi) and other Bitcoin-powered Web3 applications.

Proof of Transfer (PoX)

Using a unique consensus mechanism called Proof of Transfer (PoX), Stacks can read the Bitcoin chain state and anchor its own blocks to Bitcoins Proof of Work (PoW). When Bitcoin forks, the Stacks layer also forks, and has a built-in BTC price oracle: Stacks miners spend BTC to mine STX, and this spend rate is an excellent on-chain proxy for the BTC to STX price.

The advanced smart contracts needed to leverage Bitcoin’s security, capital, and network functionality are now possible without making any changes to Bitcoin itself.

Clear language

Stacks uses the Clarity smart contract language, which is decidable and human-readable. Unlike Ethereum’s Turing-complete language, Clarity provides developers with a secure way to build complex smart contracts on Bitcoin. Ethereum’s Turing-complete language cannot be formally verified and may lead to more undiscovered vulnerabilities.

speed

Once the Nakamoto upgrade is complete, Stacks will receive speed upgrades (up to 5 second block confirmation times) to help scale Bitcoin. One potential unlock is lightning-fast payments on the Stacks layer that benefit from Bitcoin finality. Additional layers built on top of it, called “subnets,” can further increase speed and scalability, enabling lightning-fast payments with Bitcoin finality.

sBTC: Bitcoin’s Web3 Holy Grail

Despite significant progress made by Stacks, it is still not possible to transfer BTC in and out of smart contracts in a completely trustless manner. This has been the “holy grail” problem of Bitcoin for nearly a decade.

sBTC is a non-custodial form of pegged Bitcoin with 100% Bitcoin finality. sBTC will soon be available on the Stacks Bitcoin layer, enabling smart contracts on Bitcoin. Get ready for DeFi, NFTs, and DAOs running entirely on Bitcoin, using Stacks as a stealth smart contract layer.

How does sBTC work?

sBTC works by using a synthetic asset model on Stacks. To obtain sBTC, users must redeem their BTC for sBTC through a smart contract on the Stacks network without relying on a centralized entity.

This is achieved by using the PoX consensus mechanism that is connected to Bitcoin and facilitates sBTC’s novel trustless peg design. Additionally, since sBTC is a 1:1 Bitcoin-backed asset, sBTC holders can represent their BTC holdings as sBTC on the Stacks network.

This synthetic representation allows users to participate in DeFi activities such as lending or trading while still retaining ownership and earnings of their underlying Bitcoin. In addition, users do not have to pay any fees when converting between BTC and sBTC, except for Bitcoin transaction fees.

If you need full programmability, sBTC is the closest currency to native BTC. It has all the advantages of Wrapped Bitcoin (wBTC) without any of the disadvantages of wBTC. You no longer need to trust a custodian to back the wrapped token and real Bitcoin at a 1:1 ratio as you do with wBTC.

Here’s a quick breakdown of the design of the peg mechanism, which is rooted in security, decentralization, and usability:

Transfer-in hook

First, users convert native BTC to sBTC on Stacks 1:1 by sending BTC to a native Bitcoin wallet. This wallet is controlled by a decentralized open membership group called stackers who lock STX tokens in Stacks PoX consensus mechanism. Through BTC rewards, stackers are financially incentivized to process pegs/outs through the capital they lock in Stacks and the rewards they earn.

These rewards provide them with a strong economic incentive to participate in the peg/exit without introducing additional peg fees. sBTC is then minted on the Stacks layer while still being secured by Bitcoin (since Stacks follows Bitcoin’s finality).

Source: sBTC White Paper

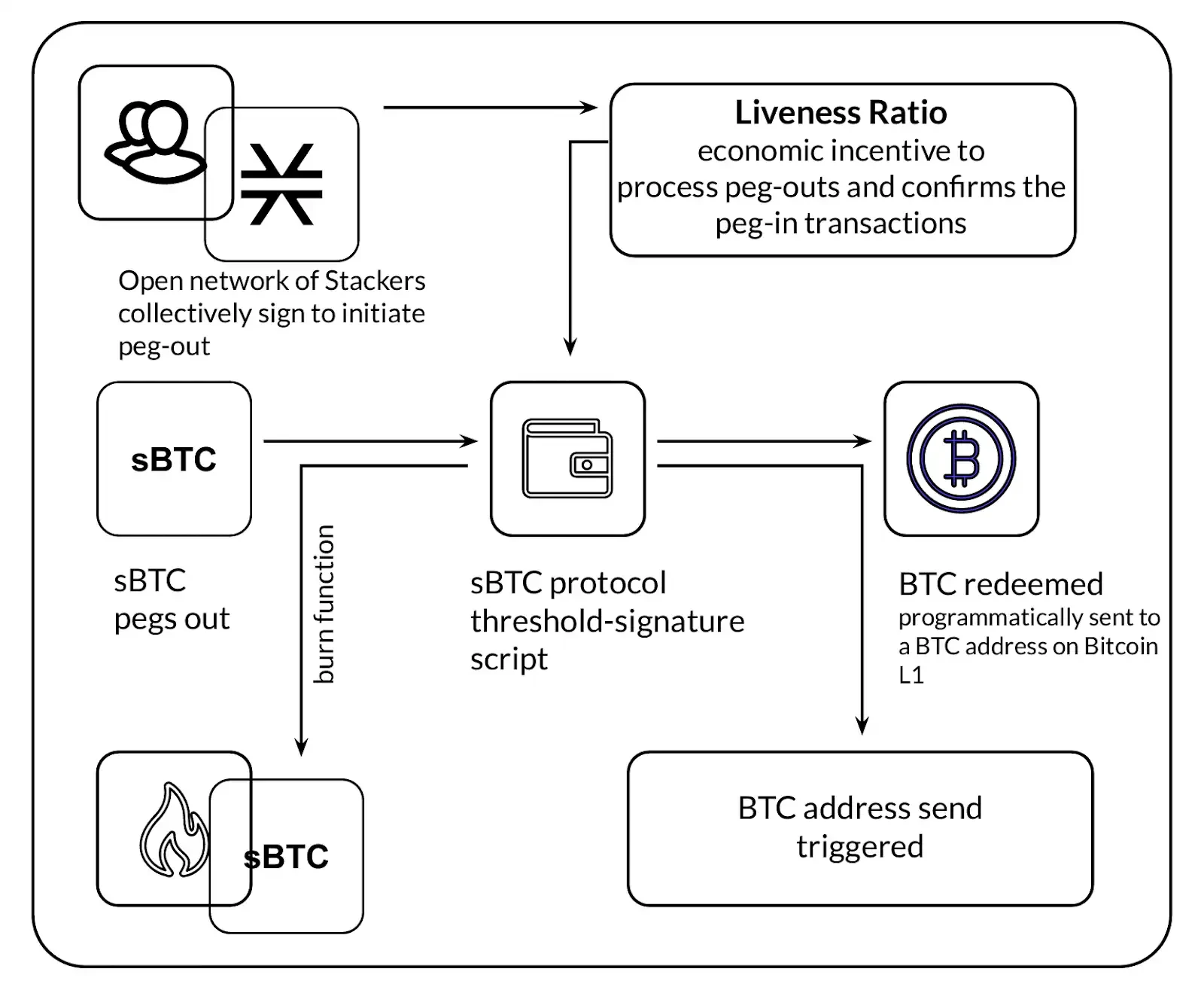

Transfer-out hook

In order to peg and redeem native BTC, users need to send a request to the staker, which is processed in the same way as BTC transactions.

Then, more than 70% of the stakers must collectively sign to destroy the sBTC and programmatically send the corresponding native BTC back to the users BTC address. This process may take up to 24 hours.

Source: sBTC White Paper

sBTC upholds the spirit of Bitcoin

The spirit of Bitcoin has always been to advocate self-custody.

“Bitcoin is a purely peer-to-peer electronic cash that allows online payments to be sent directly from one party to another without going through a financial institution.” — Satoshi Nakamoto, 2008

The sBTC white paper was written by the sBTC Working Group, which is open to the public and includes contributions from computer scientists at Princeton University, developers at the Stacks layer, and anonymous contributors.

The failure of centralized entities such as FTX, Genesis, and Voyager has cost users more than $2 trillion in losses in 2022. These failures demonstrate the importance of reaffirming the spirit of Bitcoin: creating a truly decentralized and transparent system.

sBTC is based on these basic principles, solves the Bitcoin write problem, opens a new era of Bitcoin applications, and can rapidly accelerate the Bitcoin economy.

sBTC is designed to be both decentralized and secure, especially when transferring BTC to another layer that supports smart contracts and decentralized applications (dApps).

The digital asset enables Bitcoin holders to maintain ownership of their BTC holdings and benefit from the security of Bitcoin, while also providing access to the growing Bitcoin DeFi ecosystem.

Will the stacker behave incorrectly?

sBTC is trust-minimized and incentive-compatible: these properties are identical to the security of Bitcoin itself. Stakeholder groups will be rewarded in BTC for processing sBTC transactions.

Additionally, the threshold wallet is based on a 70% threshold. This means that more than 70% of stakers would have to collude in an economically irrational way to attempt an attack. If at least 30% of stakers are honest, then a malicious peg cannot occur.

In addition, there is a recovery mode where BTC rewards will be used to satisfy peg requests. Therefore, native BTC will not be stuck. In addition, the process is completely transparent, so anyone can see on-chain how much BTC is in the wallet and how much sBTC has been minted.

To ensure that the system remains incentive-compatible, the maximum active ratio of circulating sBTC is 50% of the total STX locked. If the maximum ratio is reached, no peg service will be provided until the ratio is restored. This means that even if the price of STX drops significantly relative to BTC, incentive compatibility will be preserved.

What is the Stacks Nakamoto Upgrade?

The Stacks Satoshi upgrade is a hard fork of the Stacks Bitcoin layer that aims to unlock the full potential of Bitcoin by improving block creation speed, Maximum Extractable Value (MEV) vulnerability, and transaction finality for Stacks.

– Faster block times: The Nakamoto upgrade decouples Stacks block production from Bitcoin block arrival times, allowing Stacks blocks to now be produced every 5 seconds.

– Finality: The Stacks network anchors its chain history to the Bitcoin chain history to ensure that transactions are irreversible. In addition, Stackers monitor miner behavior on the network and ultimately decide whether to include a block in the chain.

– MEV Protection: Upgrades ensure fair distribution of rewards and avoid Maximum Extractable Value (MEV) manipulation. MEV refers to the profit gained by reordering transactions that have not yet been confirmed.

With the update, Stacks will become a more efficient and scalable layer for DeFi and Web3 on Bitcoin.

How the Satoshi Upgrade Paved the Way for sBTC

The Satoshi upgrade introduced some features to Stacks, paving the way for the launch of sBTC by allowing trustless transfers of BTC from Bitcoin to sBTC on Stacks through a peg/peg mechanism managed by a group of decentralized participants, the sBTC signers.

sBTC signers are stackers who lock the BTC sent to them by users in a multi-signature wallet, then mint sBTC on Stacks and send it to users.

The Nakamoto upgrade also increases transaction speeds on the Stacks network, reducing settlement times from minutes to seconds. This makes sBTC deployment in DeFi protocols on Stacks faster and more efficient.

In addition, this upgrade introduces an improved PoX consensus model that links the history of Stack to the history of Bitcoin, so that in every new Bitcoin block, the state of the Stack network is also recorded, making it impossible to change the history of the network without changing the history of Bitcoin.

In addition, stackers can monitor the behavior of miners and decide whether to add blocks to the chain, thereby enhancing the security of the Stacks network.

By providing a fast and more versatile infrastructure, the Nakamoto upgrade gives sBTC everything it needs to power DeFi and Web3 on top of the popular Bitcoin layer.

What’s next for sBTC?

The introduction of sBTC will emphasize that Bitcoin is more than just a store of value. sBTC is built as a decentralized and secure digital asset that will expand the functionality of BTC.

In addition to launching on Stacks, sBTC will also be available on Aptos Network and Solana to further enhance Bitcoin’s role in the growing cross-chain DeFi ecosystem.

With sBTC, builders can realize the full potential of Bitcoin as a fully programmable asset, paving the way for the creation of Bitcoin-backed DeFi, non-fungible tokens (NFTs), and more.

This article is sourced from the internet: What is sBTC? A Guide to Non-Custodial Native Bitcoin DeFi

Related: BSC DEX transaction volume exceeds Solana, will it become the new MEME hot spot?

Original author: Frank, PANews Recently, the performance of the BSC chain has once again attracted the attention of the market. From August 21 to 23, the trading volume of BSC DEX has surpassed Solana for three consecutive days, ranking second only to Ethereum. There are also signs of increasing discussions on BSC chain MEME coins on social media. In addition, Binance founder Zhao Changpeng is said to be released from prison on September 29, which will also bring positive additions to the development of the BSC chain ecosystem. From all indications, the BSC chain seems to be making efforts secretly, and it is possible to become a new MEME hot spot? One is gaining ground while the other is losing ground, surpassing Solana In fact, the gap between the BSC…