Original article by Katherine Ross and David Canellis, Blockworks

Orijinal çeviri: BitpushNews Mary Liu

The cryptocurrency market is hinting that altcoin season is about to set in. Sadly, we are not there yet.

As with most things in this industry, there is rarely a formal definition that everyone agrees on.

Does a Bitcoin bear market begin, like traditional finance, when a correction of more than 20% from a local top begins? Clearly not.

Is the protocol decentralized because it has a governance token? If this is true, the project will not find everything difficult.

Since the beginning of the month, the total cryptocurrency market capitalization has risen nearly 20%, or more than $360 billion, to $2.35 trillion. Altcoins account for about 40% of the total market cap, with the rest coming from Bitcoin.

So, what exactly is altcoin season?

One sometimes-cited metric holds that altcoin season begins when three-quarters of the top 50 coins outperform Bitcoin over the past 90 days.

This time around, only 34% of the top 50 coins outperformed Bitcoin. While there was a very brief period at the beginning of the year when these conditions were met, there was no altcoin season.

As loyal Empire readers know, I have a different way of tracking altcoin seasons that extends well beyond just the top 50. But even so, we’re still a long way off.

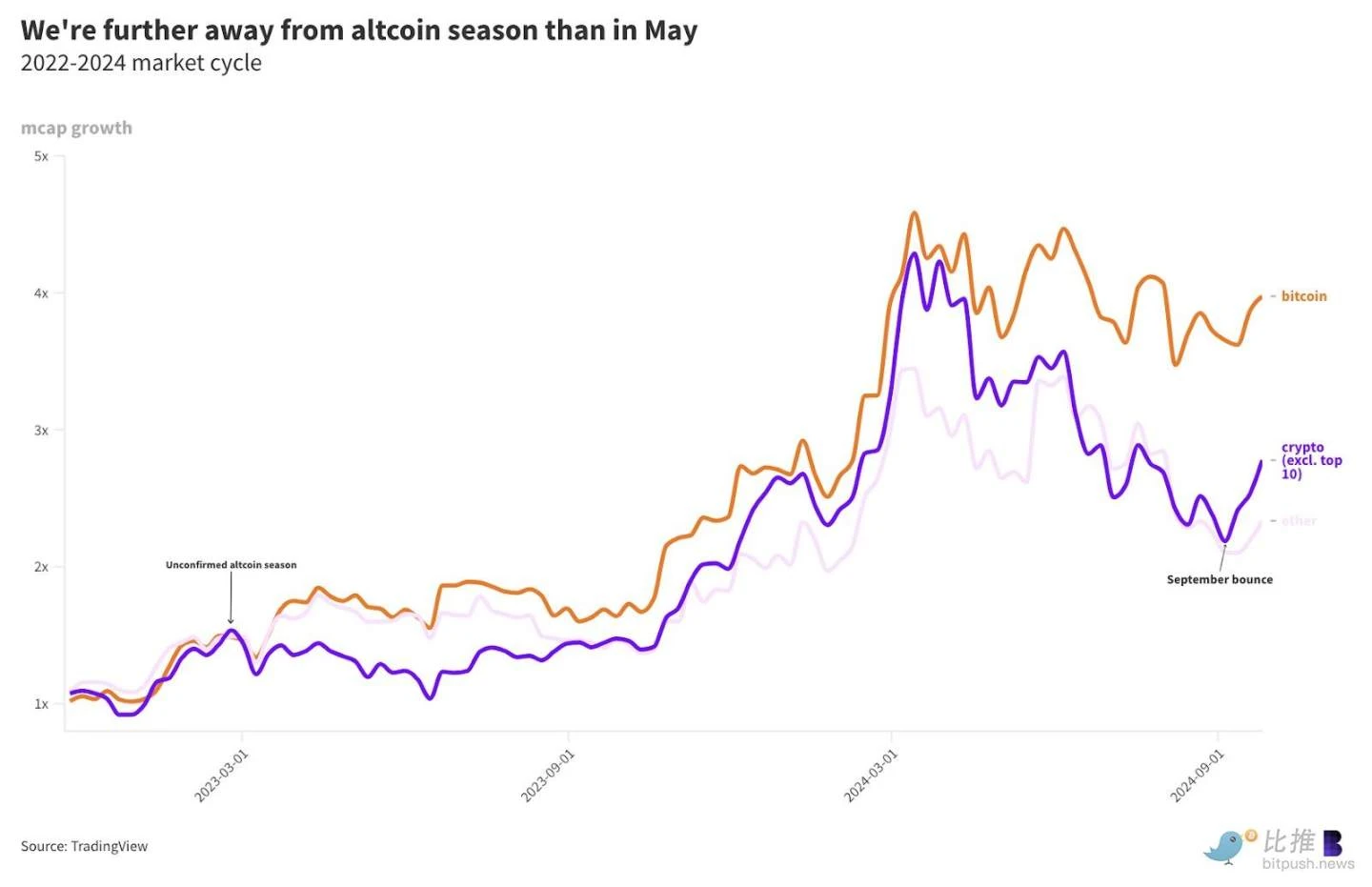

When the blue line (altcoins) is above the orange line (Bitcoin), an altcoin season is likely to occur.

My approach is this: when the market cap growth of the entire cryptocurrency market (minus the top 10) starts to exceed that of Bitcoin from the bottom of the cycle, the altcoin season is likely to begin.

Altcoin season can only be confirmed if the broader cryptocurrency market grows faster than Bitcoin for at least 90 consecutive days.

It’s not a perfect model, but it does hold up during the backtesting period. It’s also generous to altcoins: in many cases, market cap growth simply reflects the rate at which tokens are unlocked and added to circulating supply — not price appreciation.

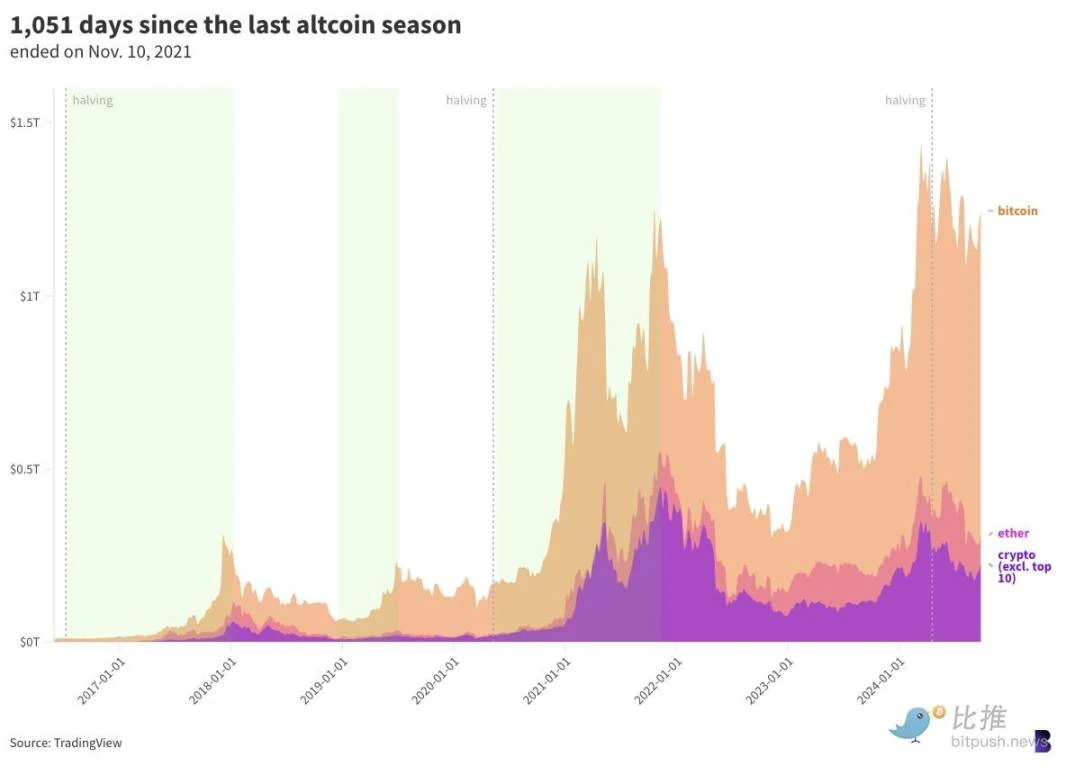

Based on these rules, cryptocurrencies have experienced three distinct altcoin seasons over the past eight years, as shown in the green shaded area in the chart below.

In the 18 months from July 2016 to January 2018 — Litecoin, Monero, Ethereum Classic, Dash and the original prediction market token Augur were in the top ten.

In the six and a half months between December 2018 and July 2019, Bitcoin Cash, EOS, Stellar, and Bitcoin SV approached blue chip status

For nearly 18 months, from May 2020 to November 2021, Polkadot and Chainlink topped the list.

The current market cycle began on November 21, 2022, when the total cryptocurrency market capitalization fell to $727.58 billion, the lowest point since December 2020, following the FTX crash.

Bitcoin’s market cap has nearly quadrupled from the bottom of the cycle, from $313.4 billion to $1.27 trillion (from $15,500 to $64,400).

Meanwhile, altcoins have grown less than 2.8x over the same period, meaning we are still a full order of magnitude away from an altcoin season.

The gap widened dramatically from April to the beginning of this month, when altcoins were furthest along in their peak season of the entire cycle. The gap was smallest when Bitcoin peaked in March.

All of this means that whatever gains altcoins are seeing right now are really just strong rallies. Altcoin prices have corrected sharply after Bitcoin’s recent all-time highs, and are only now roughly back to where they were in late July.

Bears will say that altcoin season won’t come until the bull market is over.

However, considering how far altcoins still have to go, bulls may be thinking that we are on the verge of the strongest altcoin season ever.

veri

BTC is up 1% over the past day and is on track to break through the $64,500 mark again, having bounced at least three times in the past seven days.

ETH is flat after reaching the $2,640 resistance level.

Only two top 100 coins were down this past week: KAS fell 6% and XMR fell 5%.

Ethereum fell into deflation again overnight, but this situation did not last long.

Base TVL hit a new record of over $2 billion for the first time, having increased by over $600 million in the past 18 days.

Take a deep breath

Volatility has been moderate this week, but it may not last long.

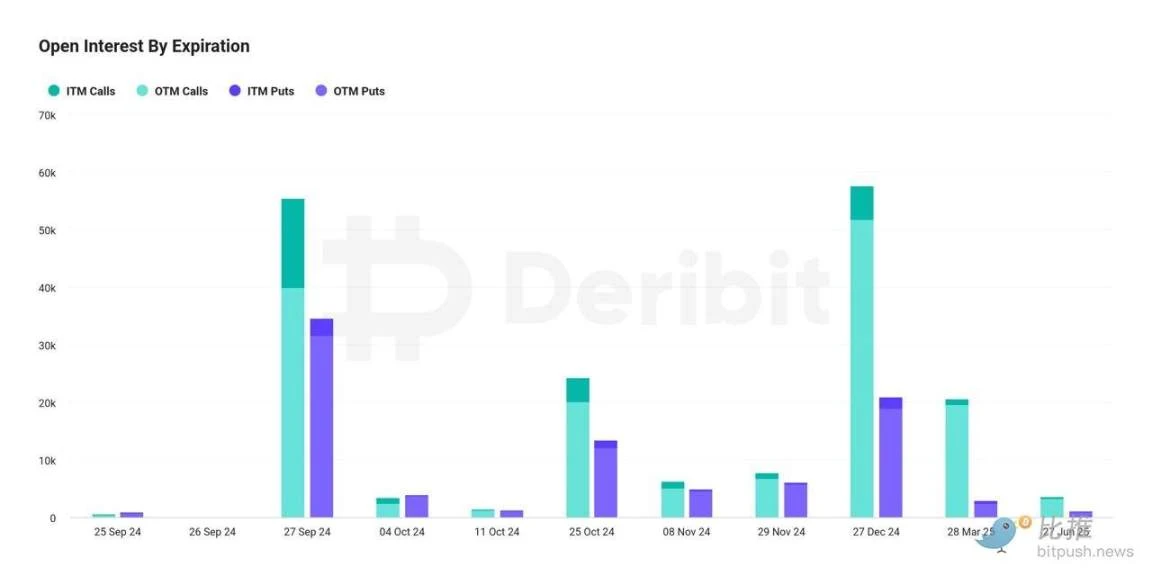

You see, theres $5.8 billion of options expiring tomorrow, one of the largest options expirations so far this year.

20% of bitcoin options are in-the-money, meaning larger expiration dates “could increase market volatility or activity as traders close or roll over positions, which could also impact prices,” said Luke Strijers, CEO of Deribit.

Strijers continued: “Overall, the options market has performed well this year, with volumes growing month on month. Despite a lot of new competition, our market share has not dropped significantly, which is a healthy sign as the market is growing – exchanges are not competing for the same customers, and we are collectively growing market share and attracting new customers.”

With that on the horizon, let’s look at the bigger picture and the broader market as David provides us with a great snapshot of altcoins. The K 33 report from earlier this week showed CME traders “cautiously optimistic.”

Analysts wrote: After the FOMC announced the rate cut, CMEs BTC and ETH premiums rose to 9%. After the FOMC announced the rate cut, CMEs open interest peaked at 161,040 BTC last Thursday, with active market participants significantly increasing their exposure by 6,500 BTC. Since then, open interest has fallen back to 152,000 BTC.

But perpetual swap traders are not so optimistic, with some bearish sentiment remaining, which could set the stage for a massive short squeeze.

Source: Deribit

Analysts Vetle Lunde and David Zimmerman said: Since the first FOMC-related rally, perpetual options traders have begun to turn conservative, and the perpetual options discount has continued to widen amid stable price action. This coincides with the increase in open interest, which remains around year-to-date highs.

For those who are following the Fear Greed Index, it is currently trading in neutral after showing some fear last week.

Macro influences aren’t going away anytime soon, K 33 noted: “We also expect economic indicators to continue to influence Bitcoin price action. Next week will see the release of important monthly US labor market statistics, while the Eastern Hemisphere will be welcoming the bank holiday season, which may heighten the focus on US-related data.”

We’re getting closer to the November election and the fourth quarter, which remains a potentially positive period for cryptocurrencies.

For bulls, the time to act is almost now.

This article is sourced from the internet: 1051 days have passed since the last copycat season

SOFA.org is a non-profit DAO organization dedicated to developing a decentralized clearing protocol. On August 29, SOFA.org had an in-depth discussion with Mr. John Cahill, COO of Galaxy Digital Asia, to explore the long-term value of the project as an industry-grade settlement system and its secure and reliable on-chain structured product suite. The discussion was hosted by the Real Moonlight Show on Binance Live. SOFA.org was established to lay the foundation for a digital clearing and settlement ecosystem for handling any financial asset on-chain, including RWAs and tokenized assets. SOFA.org was developed by professionals with rich institutional backgrounds to provide ordinary users with on-chain access to innovative products while leveraging the inherent security advantages of blockchain to ensure end-to-end transparent workflows and asset security. SOFA.org can completely eliminate trade execution…