Dördüncü çeyrekte dikkat edilmesi gereken airdrop fırsatlarına göz atın

Orijinal makalenin yazarı: Stacy Duvar

Orijinal çeviri: TechFlow

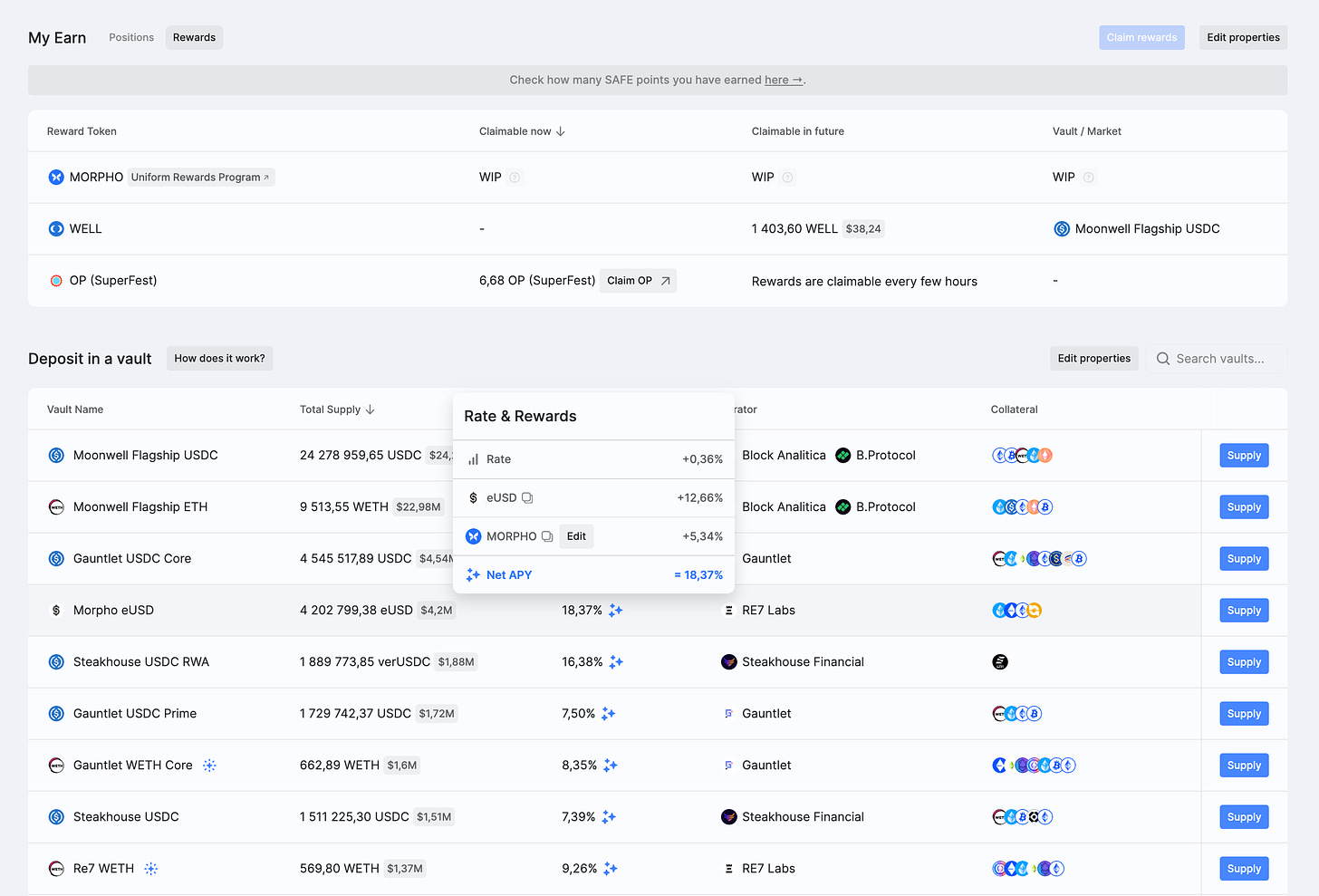

Morpho [Ana Ağ]

Morfo izinsiz piyasaların oluşumunu destekleyen güvenilir ve etkili bir kredi platformudur. DefiLlama'da toplam kilitli değer (TVL) açısından hızla altıncı büyük kredi pazarı haline geldi , şu anki TVL'si $1,4 milyar.

Nasıl Alınır Airdrop

Morphos airdrop kampanyası bir puan sistemine dayanmaz. Kullanıcılar beklenen tam seyreltilmiş değerlemeyi (FDV) belirterek varlık arzındaki ve yıllık borç verme getirisindeki (APY) değişiklikleri gözlemleyebilir. Örneğin, aşağıdaki örnekte $1 milyarlık bir FDV kullanılmıştır.

-

Morpho uygulamasına erişin (Ethereum ve Base'i destekler).

-

Kredi için mevcut çeşitli havuzlara ve varlıklara göz atarak sizin için en uygun havuzu seçin.

-

Ödüllerinizi Ödüller sekmesinden görüntüleyin.

İpuçları: Base'deki ödüller genellikle daha yüksektir ve Base bir OP Stack zinciri olduğundan, OP teşvikleri de alabilirsiniz. Bu nedenle, ben şahsen Base'de Morpho ödülleri almayı tercih ediyorum.

FDV Beklentileri

Daha önce de belirtildiği gibi, Morpho şu anda tüm blok zincirleri arasında altıncı en büyük borç verme pazarıdır. Başlıca rakipleri şunlardır: Birleştirmek (piyasa değeri $444 milyon FDMC), Venüs (piyasa değeri $210 milyon FDMC) ve Kamino Ödünç Vermek (piyasa değeri $660 milyon FDMC).

Morpho, 1 Ağustos'ta stratejik finansman turunda $50 milyon topladı (tam FDV açıklanmadı). Bu finansmanda tokenların 10-15%'sinin satıldığı varsayıldığında, bu FDV'sinin yaklaşık $330 milyon ila $500 milyon olduğu anlamına gelir. Tüm risk sermayesi turlarının genellikle indirimleri olduğunu düşünürsek, Morphos FDV'nin lansman fiyatının $1 milyara yakın olması bekleniyor.

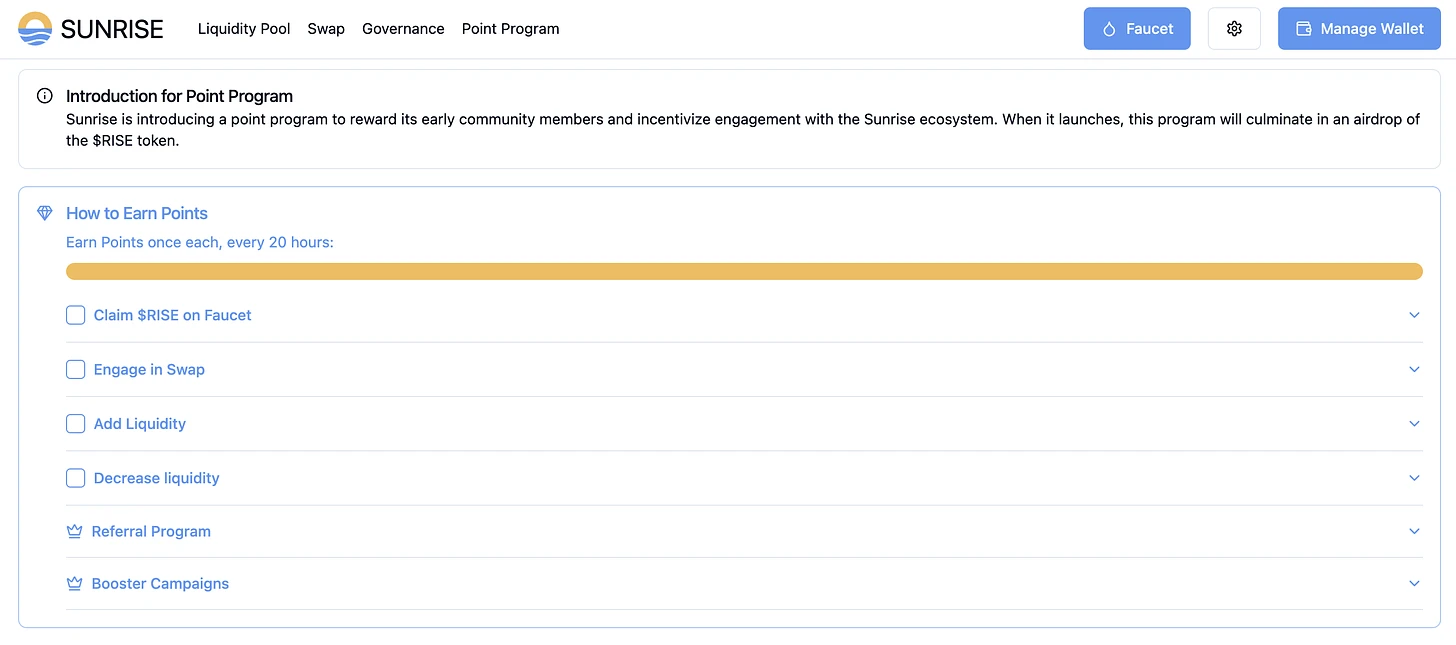

Gündoğumu [Testnet]

Sunrise, Likidite Kanıtı (PoL) ve ücret soyutlaması için tasarlanmış bir veri kullanılabilirliği (DA) katmanıdır. Kısa süre önce, ana ağ sürümüne doğru önemli bir adım olan teşvik mekanizmasına sahip genel bir test ağı başlattı. Test ağı aktif kullanıcıları ödüllendiriyor ve erken katılımcılar yaklaşan $RISE'ın en büyük payını alacak Jeton airdrop. Testnet'e ve musluğuna erişmek için kullanıcıların bir EVM cüzdanına (en az 0.001 ETH ve Ethereum ana ağında işlem kayıtları olan) ve bir Cosmos cüzdanına bağlanması gerekir.

Airdrop ödülleri kazanın

Katılımcılar, talep etme, takas etme, likidite sağlama ve yönetime katılma gibi testnet'teki günlük görevleri tamamlayarak puan kazanabilir ve ayrıca arkadaşlarını katılmaya davet ederek puanlarını artırabilirler. Başlangıçta, token arzının 7%'si TGE'nin ilk airdrop'u için tahsis edildi ve 5% daha gelecekteki planlar için ayrıldı. Sunrise şu anda bu iki bölümü birleştirmeyi düşünüyor ve Genesis airdrop'unda birlikte dağıtılacak toplam 12% token olacak.

Bazı istatistikler:

-

Testnet’e 200.000’den fazla kullanıcı katıldı.

-

Günlük aktif kullanıcı sayısı 50.000'e yaklaştı ve artmaya devam ediyor.

-

Sürekli olarak yeni testnet aktiviteleri başlatılıyor.

Yapılacaklar listesi:

-

Topluluğa katılın: Sunrise'ı sosyal medyada takip edin ve onlara katılın Anlaşmazlık .

-

Testnet'i kullanın : işlem yapmak veya likidite sağlamak.

-

Günlük görevleri tamamlayın.

-

Arkadaşlarınızı yönlendirme bağlantısı kullanarak davet edin

FDV Beklentileri

Sunrise Layer, zincir içi ve zincir dışı verileri sorunsuz bir şekilde entegre edebilir, ölçeklenebilirliği iyileştirirken ve maliyetleri azaltırken zincir içi çözümlerin güvenliğini ve şeffaflığını birleştirebilir. Bu hibrit model, yüksek verim ve güçlü veri bütünlüğü gerektiren merkezi olmayan uygulamalar için idealdir. Başlıca rakipleri arasında Celestia ($4,7 milyar FDV), Avail ($1,2 milyar FDV) ve KYVE ($24 milyon FDV) yer almaktadır. Lansmanda FDV'sinin $300 milyon ile $500 milyon arasında olmasını bekliyorum.

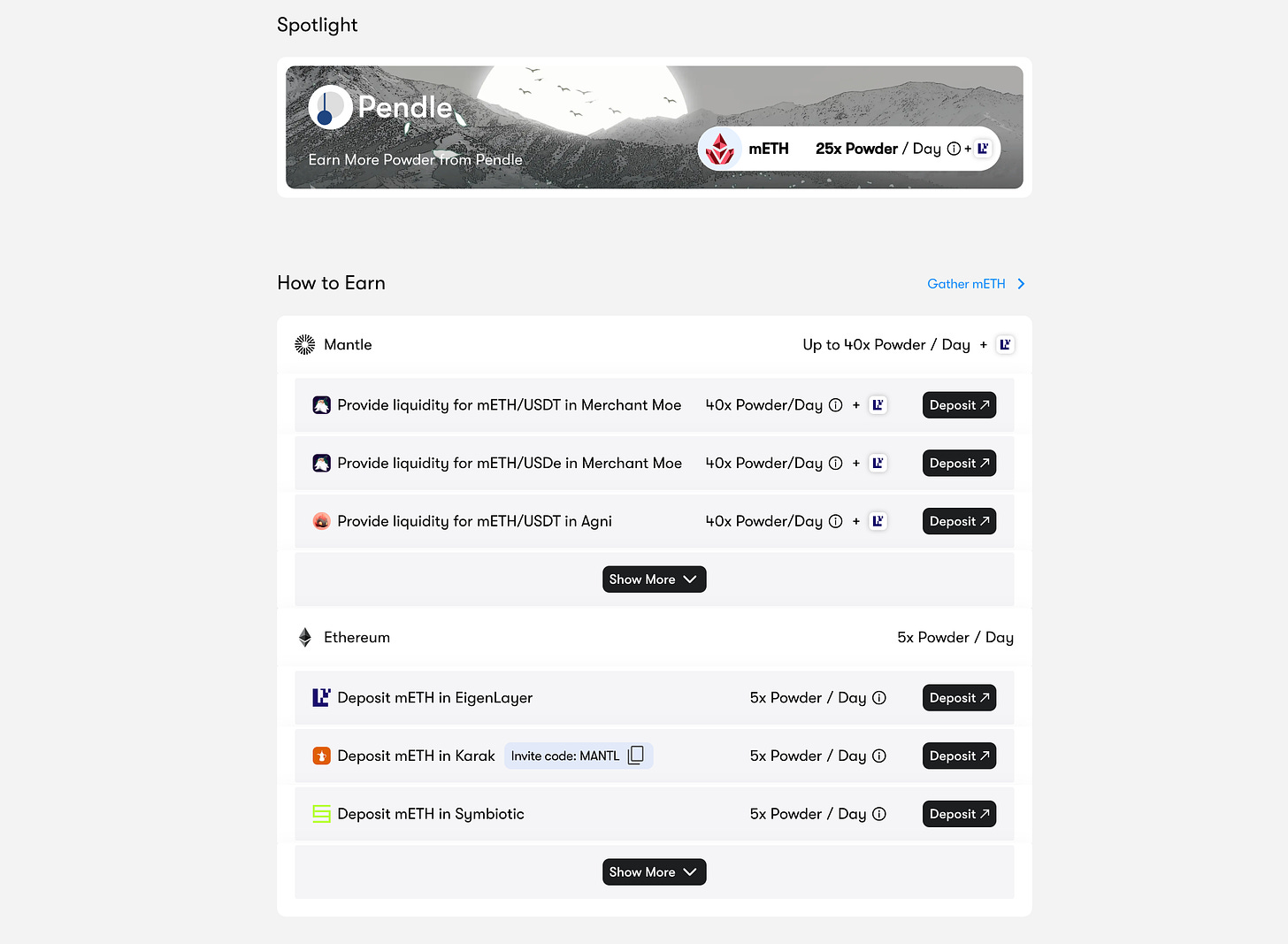

Mantle'ın COOK'u [Ana Ağ]

Ethereum'un ikinci katman ağı olan Mantle, şu anda Metamorfoz sürecindedir ve ardından topluluğa yeni $COOK token'ları dağıtılacaktır. $COOK, Mantle'ın LST'si (mETH, toplam kilitli hacim açısından en büyük LST'lerden biri) ve LRT'si (cmETH, yeni bir likit yeniden hisseleme modeli) için yönetim token'ı olacaktır.

Airdrop'u Alın

Yaklaşan COOK token'ını edinme süreci çok basittir ve çeşitli seçenekler sunar. Önemli olan, biraz mETH edinmek (tercihen Mantle'da, çünkü size her gün daha fazla Toz verir) ve ardından farklı DeFi etkinliklerine katılarak ödüllerinizi artırmaktır.

-

Web sitesini ziyaret edin ve cüzdanınızı bağlayın.

-

mETH token'ları almak için ETH stake edin.

-

mETH token'larını cüzdanınıza ekleyin ve Mantle ağına bağlayın.

-

Her 1 mETH için, günde 10 Toz elde edebilirsiniz. Aynı zamanda, mETH likiditesi sağlayarak ek Tozlar kazanabilirsiniz belirlenmiş protokollerde .

-

Ayrıca daha fazla ödül kazanabilirsiniz MNT'nizi kilitlemek .

FDV Beklentileri

mETH şu anda Jito'ya ($2,1 milyar FDMC) ve Marinade Finance'e ($100 milyon FDMC) yakın toplam kilitli hacimle beşinci en büyük likit staking token'ıdır. mETH ve yaklaşan cmETH (yeni bir tür yeniden staking token'ı) için yönetim token'ı olarak COOK ile lansmandaki FDV'si $150 milyon ile $300 milyon arasında olabilir. Umarım Mantle düşük dolaşım, yüksek FDV stratejisinden kaçınabilir.

Katılabileceğiniz diğer airdrop etkinlikleri

İşleri basit tutmak için, aşağıdaki airdrop açıklaması daha önce belirtilen üçünden daha az ayrıntılı olacaktır.

Hikaye Protokolü [Testnet]

Story, programlanabilir IP'yi destekleyen ve yeni nesil AI, DeFi ve tüketici uygulamalarının geliştirilmesini sağlayan dünyanın ilk IP blok zinciridir.

-

Ziyaret etmek web sitesi ve cüzdanınızı bağlayın.

-

IP, WETH, USDC, WBTC, USDT ve FATE'yi değiştirin.

Soneium [Test Ağı]

Soneium, Sony'nin Block Solutions Labs ekibi tarafından geliştirilen, duygulara ilham vermeyi ve yaratıcılığı teşvik etmeyi amaçlayan bir Katman 2 blok zinciridir. Web3 ile günlük İnternet hizmetleri arasındaki boşluğu kapatmaya ve blok zinciri teknolojisini küresel olarak daha erişilebilir hale getirmeye kendini adamıştır.

-

Elde etmek Sepolia ETH musluktan.

-

Web sitesini ziyaret edin ve cüzdanınızı bağlayın.

-

ETH'yi Sepolia'dan Minato testnet'ine ve tekrar geriye köprü testiyle test edin.

Hyperlane [Ana Ağ]

Hyperlane, modüler blok zinciri ekosistemleri için tasarlanmış bir birlikte çalışabilirlik katmanıdır. Katman 1, Rollup'lar ve uygulama zincirleri gibi farklı blok zinciri ortamları arasında izinsiz dağıtım yoluyla sorunsuz iletişimi mümkün kılar.

Hyperlane x Enjektif

-

Web sitesini ziyaret edin ve EVM/Solana ve Cosmos cüzdanlarınızı bağlayın.

-

$INJ token'larını inEVM ağına gönderin. Transfer tutarını girin, cüzdanı seçin, Devam'a tıklayın ve işlemi onaylayın.

hNFT Basımı ve Köprüleme

-

Web sitesini ziyaret edin ve cüzdanınızı bağlayın.

-

Sol tarafta NFT'yi basmak istediğiniz ağı seçin, sağ tarafta bastıktan sonra NFT'yi göndermek istediğiniz ağı seçin ve ardından Mint'e tıklayın.

-

NFT'yi başka bir ağa aktarmak ve işlemi onaylamak için “Köprüle”ye tıklayın.

-

İşlemin başarılı olup olmadığını görmek için Hyperlane tarayıcısını kontrol edin.

Bu makale internetten alınmıştır: Dördüncü çeyrekte dikkat edilmesi gereken airdrop fırsatlarına göz atın

İlgili: Uniswap Labs'ın son araştırması: Bitcoin fiyat eğilimlerini hangi faktörler belirliyor?

Bu makale What Drives Crypto Asset Prices? adlı kaynaktan gelmektedir. Orijinal yazar: Aus tin Adams, Markus Ibert, Gord on Liao Derleyen: Odaily Planet Daily Husband Uniswap Labs, Copenhagen Business School ve Circle araştırmacılarının ortak yazdığı What Drives Crypto Asset Prices? adlı makalede, Bitcoin'in yıllar içindeki fiyat eğilimlerini ve üç kurumsal şokun etkisini analiz etmek için VAR (yapısal vektör otoregresyon) modeli kullanılmış, Bitcoin'in piyasa performansı ortaya çıkarılmış ve hem bir değer saklama aracı hem de spekülatif bir varlık olarak ikili özellikleri gösterilmiştir. Bu makale çok fazla teknik içerik içermektedir ve Odaily Planet Daily, okuyucuların referansı için özel olarak basitleştirilmiş bir versiyon derlemiştir. Temel sonuçlar: Geleneksel para politikası ve risk primi şokları, kripto varlık fiyatları üzerinde önemli bir etkiye sahiptir. Daha fazlası…