Büyüme odaklılığa dönüş: VC coin'leri anlatının ikileminden nasıl kurtulabilir?

Original author: Loki, BeWater Venture Studio

Özetle;

-

The essence of the VC coin collapse is the over-investment and irrational valuation in the primary market during this cycle, which allowed VCs and projects that should have been eliminated to survive, raise funds, and appear in the secondary market at unreasonable valuations.

-

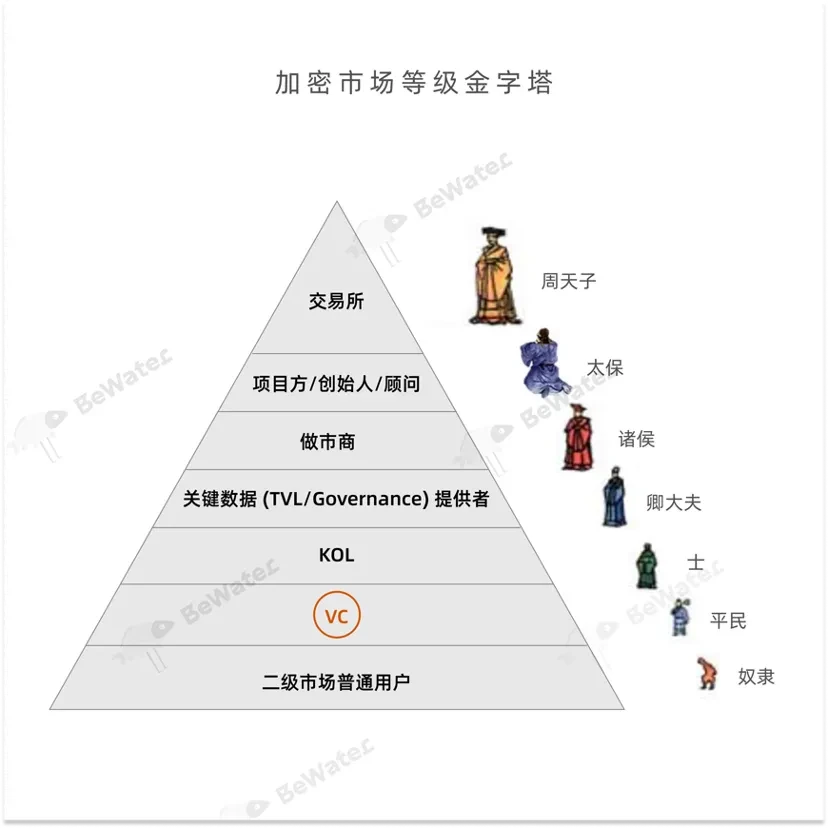

In the absence of external cash inflows, the degree of involution in the crypto market is rising to an extreme level and has formed a pyramid-like class structure. The profits of each level come from the exploitation of the level below it and the withdrawal of liquidity from the market. This process will lead to increased distrust at the next level, making the involution more and more serious. In addition to VCs, there are a large number of higher levels in the pyramid.

-

In the era of great involution, the mortality rate of projects and tokens will increase significantly. The top-down technology theory, background determinism and narrativeism will change from sufficient conditions to necessary conditions to a greater extent. The only thing the market believes in is real growth, real user growth, real revenue growth and real adoption rate growth.

1. It’s not just VC coins that are in crisis, it’s the entire crypto market

VC and VC coins have become the scapegoats in the era of great internal circulation. Although there are many opinions that VC coins have become the culprit of this round of bull market without mutual support, this is not the case. As long as we compare them, we can soon find that it is not only VC coins that have significantly underperformed BTC and continued to fall, but also fully circulated altcoins, Meme coins and even ETH. The initial circulation rate of most tokens in the DeFi Summer era did not exceed 5%, which shows that the simple circulation of tokens cannot explain the continued collapse of Alts.

From a macro perspective, the constant era of a deterministic bull market every four years is no longer sustainable. Since Q2 2024, the market has fallen into an abnormally low liquidity state. On the one hand, the top of BTCs market share lags behind the top of BTCs price. In the past few cycles, the top of BTCs market share usually corresponds to the bottom of the market cycle, but in this round of bull market, BTCs breakthrough of new highs did not bring about a general rise in altcoins, including ETH. This also proves one point: it is not just VC coins that are in crisis, but all tokens or the entire crypto market.

Source: Tradingview

This is not difficult to understand. On the one hand, the BTC halving leads to a reduction in supply, driving the supply and demand curve up until a new balance, but after multiple halvings, the marginal effect of the BTC inflation rate continues to weaken, and the larger base also limits the multiple space. The BTC ETF drives the price increase and the halving cycle overlaps in time, giving us the illusion of a bull market, and this bull market may not have existed from the beginning. On the other hand, since the birth of BTC, the global economic cycle is generally still in an upward or stable cycle, so the so-called cycle is more like a small cycle within the trend line, but this trend is also changing.

2. The “VC Coin Effect” is just the beginning of the era of great internal circulation

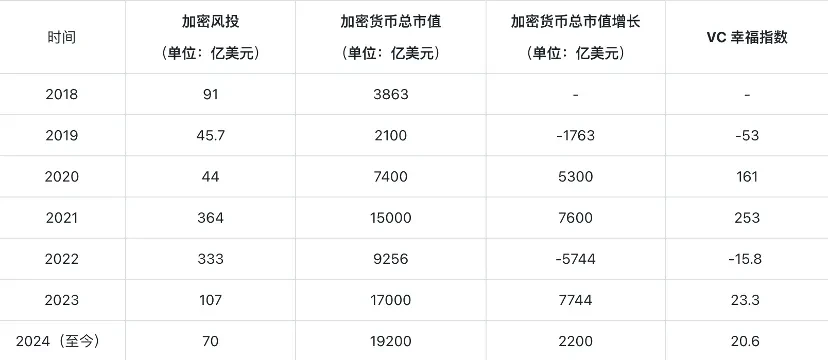

From an industry perspective, the consequences of overinvestment and mispricing are emerging. In 2021, we proposed the VC Happiness Index indicator, which is calculated by dividing the current cycles cryptocurrency market value growth by the previous cycles total blockchain industry financing. The logic of this indicator is also very simple. The purpose of VC investment is to generate profits, so their investment needs to be realized through the market value growth of the next cycle. The higher this indicator is, the greater the probability that VC will earn high returns.

In fact, a cycle theory similar to the Merrill Lynch clock will be formed here. The speculative market value of cryptocurrencies is largely driven by exogenous factors. If there is little investment for a period of time, then the next cycle will easily produce a wealth effect and create a bull market. The bull market will bring Fomo sentiment and financing convenience, leading to overinvestment. Overinvestment makes it impossible to realize the next cycle, forming a bear market. The bear market will lead to insufficient investment, and the cycle of bull and bear will repeat.

Source: CBinsights, public data

2020-2021 is the happiest time for VCs in the post-ICO era. VCs with normal rhythms made money in 2021-2022, which led them to expand their financing scale several times. So we can see that the total financing amount in 2021-2022 exceeded 30 billion US dollars, and projects with valuations of hundreds of millions or even billions of dollars followed one after another. However, to this day, there are only thirty crypto projects with annual protocol revenue exceeding 30 million US dollars.

Kaynak: Jeton Terminal

The prosperity of 2020-2021 allowed some funds that should have gone bankrupt or should have gone bankrupt in the future to survive, and they also got money that they should not have raised. This money allowed some projects that should not have existed to continue to exist in 2021-2022, and even raised unreasonable amounts of money at unreasonable valuations, which ultimately led to these projects appearing in the secondary market at unreasonable valuations in 2023-2024.

So far, it seems that VC is the culprit of the market downturn, but things are still changing rapidly. This large-scale (-3, -3) is like a black hole, engulfing more and more participants, and VC is the weaker party in this battle royale game due to contract and vesting restrictions. According to the ranking of easier to obtain low cost and high liquidity, VC can only be ranked in the 6th tier.

In the absence of external cash flow (market-wide protocol revenue or new capital inflow), the profits of each level come from the exploitation of the level below it and the withdrawal of liquidity from the market. This process will lead to increased distrust at the next level, making the internal circulation more and more serious.

3. Growth, growth, growth!

In the era of great involution, the mortality rate of projects and tokens will increase significantly. The top-down technology theory, background determinism and narrativeism will change from sufficient conditions to necessary conditions to a greater extent. The core driving factor will switch to real growth, real user growth, real revenue growth and real adoption rate growth.

1. Organic growth: The salary of a qualified CMO should not be lower than that of a CTO.

There are two common misconceptions in the current market:

-

Technology or products are more important than the market. The essence of all protocols or projects is a business, and the essence of business is profit, so everything can be simplified into two steps: (1) create a product; (2) sell the product. For most Crypto projects, (1) corresponds to technology and products, and (2) corresponds to the market. Sufficient liquidity means that supply exceeds demand, and any product can find a suitable buyer, but in the era of great internal circulation, liquidity is severely scarce, and the only thing a project faces is growth or death.

-

The growth of data is growth. It is undeniable that task platforms/social tools/operational activities are playing an increasingly important role, but neither the Marketing Team nor the Marketing Agency should rely too much on them and become a tool porter.

Realize social media growth through task platforms, package and wholesale KOLs to forward repeated information, accumulate 1000+ GM/GN in Discord, open 1000 more accounts under incentives for Airdrop Hunter, attract big investors with 8% fixed income, and eventually achieve 500,000 community scale, 1 million exposures per day, 200,000 valid accounts, 1 billion US dollars TVL and other cold data appearing on financing decks and exchange listing decision meetings… This is obviously a kind of real growth, and real growth should be highly integrated with product strategy, match the operation route, and maintain a high retention rate when non-sustainable factors (such as lotteries, short-term incentives, points) are eliminated.

A truly outstanding CMO should spend 70% of his time on strategic observation and thinking, 20% on planning, and 10% on execution to achieve 100%+ results.

2. The first step in KOL cooperation is to communicate with the CEO one-on-one

The role of KOLs is underestimated and mismatched, and the core reason lies in the wrong path. On the one hand, KOL or KOL round has almost become a derogatory term recently , because some KOLs or matrix accounts promote indiscriminately and without any bottom line, which makes people scare people to talk about KOLs. However, there are still many very high-quality KOLs in the market . The 80/20 rule also exists in market growth, and 80% of the influence is provided by 20% of people. Moreover, these KOLs often have multiple attributes. What they can provide is far more than the market and brand level, including product and strategic level suggestions, resource networks, and even some KOLs can get investments that are not less than small and medium-sized VCs. While these KOLs contribute their own value, they also bear the blame of cutting leeks and even lose more money, from the first level to the 1.5 level, then to the KOL round, and finally the secondary market.

This is a typical adverse selection. The lower the quality of the KOL, the stronger the motivation to participate in promotion or KOL rounds, and the lower the quality of the project, the more favorable the conditions given, and it can even be sold in packages. For founders, are you really willing to believe that a KOL who is willing to take on any promotion task can bring growth to your project?

In a sense, KOLs are also a kind of customers. On the one hand, if even 10-20 KOLs don’t believe in your plan, how can the market believe it? On the other hand, if the founder is not familiar with the key KOLs, how can he be familiar with the entire track? So the solution is also very simple. KOL List, Agency or middleman can only play a supporting role. The founder or team members must have at least one-on-one communication with each important KOL.

3. Prioritize contract revenue as the highest growth indicator

A major illusion brought by the crypto market is that it is easy to issue coins, easy to assetize, and easy to exit, which makes people ignore the fact that the growth of asset stimulation (including token/NFT/points issuance, task platform, incentive test network, etc.) is always one-time, and the real sustainable growth comes from sustainable income brought by a sustainable business model.

The first step to sustainability is to have a reliable source of income. Objectively speaking, Crypto has not achieved large-scale adoption, which also means limited protocol income. Generally speaking, there are two sources of protocol income. The first is external sources, such as Tether can earn income by earning the interest rate difference between RWA and Stablecoin. The second is internal sources, such as public chains can earn Gas Fee, exchanges can earn transaction fees, and on-chain transactions and secondary market transactions are both objective transactions. If the agreement; the second step to sustainability is to ensure that the agreement has the possibility of achieving surplus. Protocol income is similar to the main business income of an enterprise, but the main business income does not mean profit. There is a saying that if a protocol needs to rely on issuing coins to maintain, then his issuance of coins is meaningless. The logic here is that issuing coins is a kind of external blood transfusion. We can rely on blood transfusion to operate once or for a period of time, but it cannot be permanent. After many years of development, we can see that many protocols have done this, such as some exchange platform coins maintain net deflation, and the protocol income of some blue-chip public chains/DeFi has exceeded token inflation.

The third sustainable step is to build an effective governance mechanism and economic model design. Even if the first two steps are achieved, we may still encounter some problems, such as some protocols paying tens of millions of dollars in operating expenses each year, some protocols lack long-term incentives for teams to continue to invest in construction after all tokens are released, and unfair token distribution. These problems require the joint efforts of multiple parties including the core team, investors, and the community to be solved.

4. 90% of projects do not have a real economic model

The problem faced by most VC coins is the mismatch between the growth of token circulation and the business. For example, within the period of 6 months to 2 years after going online, the team/foundation/investor/developer incentives/users who started holding positions all began to unlock, the most notable of which are OP and ARB. The circulation rate of these two is still around 30%, and the peak period of ecological development is ahead of the Token cycle. The problem of some new competitors is even more serious, and a large number of ToC/ToB incentives ultimately did not form any retention. A true economic model needs to meet the following conditions:

-

Sustainable protocol revenue can be earned or may be earned in the future. For example, many protocols have achieved or may actually achieve sustainability, such as: (1) Curve protocol distributable revenue has exceeded inflation output. (2) MakerDAOs annualized protocol net revenue exceeds US$50 million, and the formal implementation of Endgame also began this quarter. (3) Uniswap introduced front-end fees. Although it was questioned in the early days, Uniswap has now earned tens of millions of dollars in revenue through this mechanism.

-

The token cycle matches the project growth cycle. Increasing the initial circulation rate of tokens reduces the long-term inflation rate, reducing the market value miscalculation caused by virtual circulation rate, extending/postponing the token unlocking cycle, and establishing a transparent and deterministic profit distribution/repurchase mechanism. These are shallow but effective solutions.

-

Treat incentives as investment behavior rather than consumption behavior. Many projects (especially the big Infra of the public chain) have launched large-scale ToC incentives in the past period of time, and also derived the airdrop industry, but this incentive is essentially a consumption behavior. Users contribute Txs and the public chain pays incentives. The problem is that this is a one-time behavior, and most users will not stay. On the contrary, incentivizing developers is an investment behavior. With ecological projects, users transaction needs can be met, and Txs will be generated. After the project is supported, the project can provide secondary incentives. This kind of investment behavior is sustainable.

-

Solve the class solidification problem of the chip structure. As we pointed out in the previous chapter, current market participants have formed a clear 7-layer structure, and the difference in chips at each level is becoming larger and larger. In this process, it is inevitable that there will be room for evil, such as distributing low-cost or free chips in an opaque manner through some means. After all these behaviors are accumulated, the weighted average chips are infinitely reduced, which in turn leads to an inverted market valuation and aggravated internal circulation. There are only two end points for class solidification, one is reform and the other is revolution . It is unsustainable to dilute the chip cost without a lower limit. In fact, users have already voted with their feet and chose inscriptions and MEME.

This article is sourced from the internet: Return to growth-driven: How can VC coins escape the dilemma of narrative?

Original author: 0x Facai On August 20, 2024, the Chinese 3A masterpiece Black Myth: Wukong that millions of players have been looking forward to was finally officially launched. The number of online players of the game once exceeded 1.4 million, ranking fourth in the history of Steams highest number of online players. Not only in China, Black Myth: Wukong also continues to dominate the list of Steams global best-selling products. In addition, on the homepage of todays Youtube live broadcast, almost all of them are Black Myth game live broadcasts. As the first truly 3A masterpiece, Black Myth received relatively high scores from foreign media such as IGN in its first battle, and countless Chinese players sighed: When playing games, I finally dont have to go online to search for…