Yesterday might be a good day for cats to come out and bask in the sun, at least, in the Bitcoin ecosystem. In one day, we saw three Bitcoin FT protocols driven by OP_CAT – CAT 20 on Fractal, CATNIP of the Quantum Cat team, and Danny CAT 20 of the Moto series.

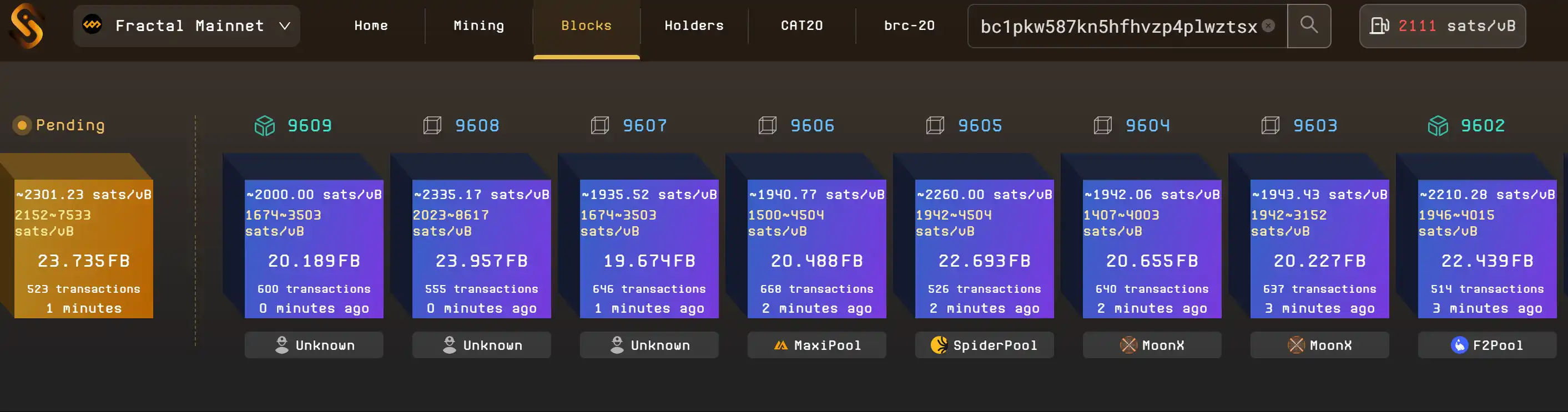

Among the three, CAT 20 on Fractal has already been launched and is in full swing. The price of $FB once exceeded $30. When I wrote this article, the miner fee on the Fractal chain was as high as 2000 sats/vb.

The CATNIP of the Quantum Cat team is just an official announcement, and its implementation will have to wait until the revival of OP_CAT on the Bitcoin mainnet.

The Danny CAT20 of the Moto Series was proposed by @bc 1 plainview, the founder of Motoswap and OP_NET, two hours after the release of CAT 20. He said that he was the first to propose the idea of OP_CAT driving the Bitcoin FT protocol. I will not elaborate on my opinion here, and I will talk about it when we discuss it next.

Lets start with CAT 20 on Fractal, which is already playable.

CAT 20

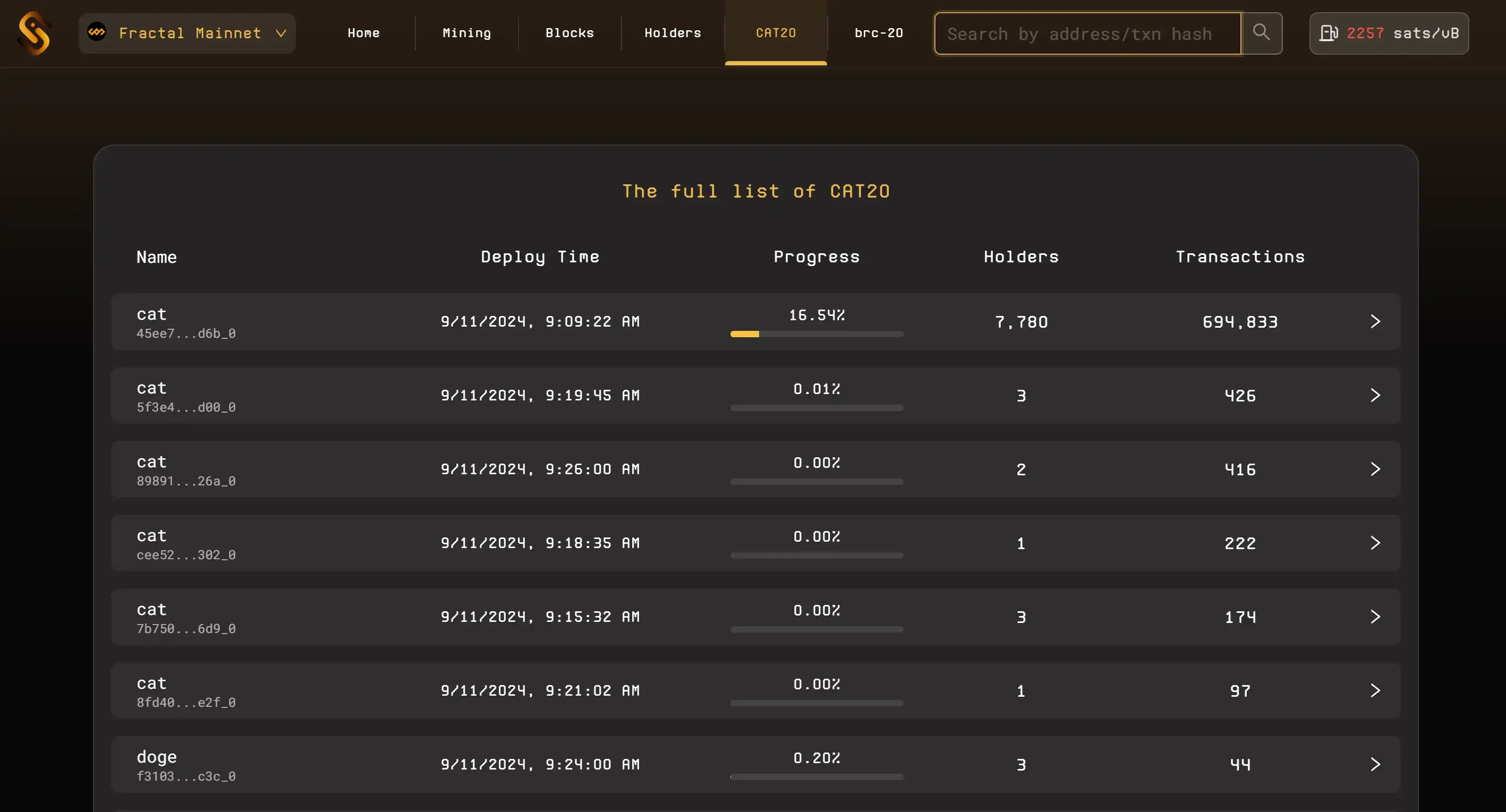

CAT 20 was not that popular when it was discovered and spread by players in the early days, because until last night, I could still get some with a fee of 300-500 sats/vb. It really became popular because at about 11 oclock last night, a CAT 20 column suddenly appeared on Fractals block explorer, and I was completely FOMO.

The data here has not been moved since it came out last night, so it is hard to tell how long it will take for $CAT to finish.

If the price of $FB is 30 U, and the fee rate is raised to 2000 sats/vb, the cost of a single ticket is close to 1 U, which means that in this case, $CAT is actually purchased based on the market value of 21 million US dollars.

The technical documentation of CAT 20 is quite professional, and the Github page is also quite neat. It is a FT protocol driven by OP_CAT technology. It is difficult to come up with something of this level if it is not an individual or team who has deeply studied Bitcoin technology.

What does FT protocol driven by OP_CAT technology mean? The answer is in the words of the official document, Any rules governing the token minting process are executed in smart contracts. Based on this, CAT 20 has these features (please refer to the official document for more features)

– No asset burning. You can directly use the UTXO used to mint tokens to continue minting tokens, because in essence, CAT 20 is equivalent to writing data in UTXO and then the smart contract handles it. In the past, we usually understood asset burning as colored coins – I spent a UTXO with an inscription or colored coin, and I can never get it back. But CAT 20 is not like this. The on-chain data cannot be lost, and the contract handles changes by checking the on-chain data (transactions). Our UTXO is actually spent on contract interactions, like ERC-20.

– Tickers are repeatable. Although tickers are repeatable, the txid and output index of each token in the genesis transaction are different. Together, they constitute a unique tokenid for a token, which is used to distinguish different tokens with the same ticker.

– The minting rules are more free. There are no artificial regulations. It all depends on how the contract is written when the token is deployed. Some use cases mentioned in the official documentation include pre-sale, pre-mining, PoW mining, minting by designated token holders, staking minting, etc.

The CATNIP of the Quantum Cat team is similar to CAT 20 in implementation, so in the following CATNIP section, I would like to focus on the potential huge impact of this thing on the Bitcoin ecosystem.

CATNIP

First of all, I would like to remind everyone that CATNIP will only be launched after the official resurrection of OP_CAT on the Bitcoin mainnet. Before that, there will be no way to participate. This is not like Rune, which can be preempted by imitating Caseys idea. The reason is actually explained in the CAT 20 section above – without OP_CAT, it is impossible to achieve any rules governing the token casting process are executed in smart contracts.

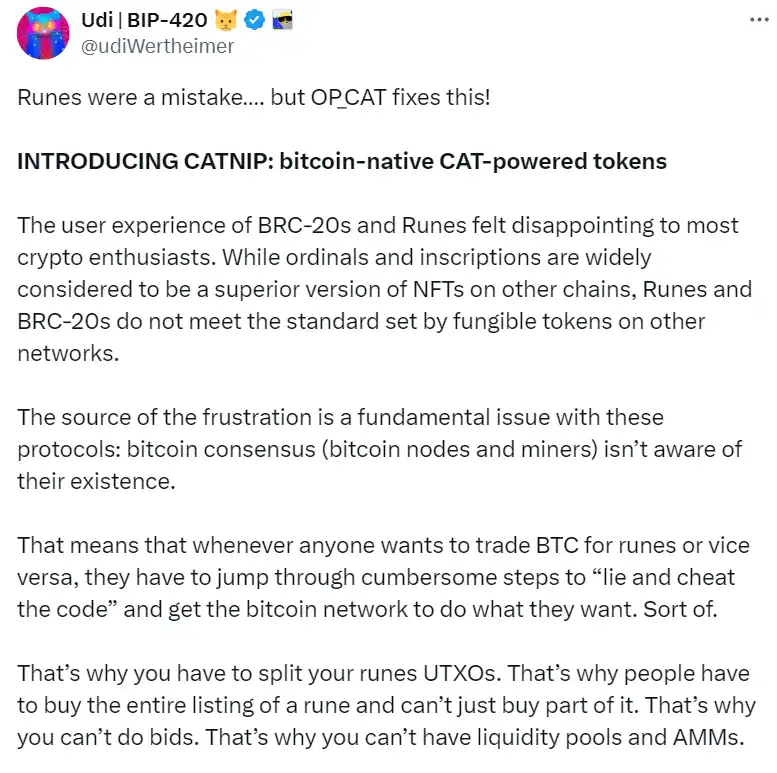

When I saw CATNIP, my first thought was that @udiWertheimer seemed to have finally shown his fangs and wanted to break away from the Ordinals…

Why do you say that? Take a look at his tweet:

He said that the user experience of BRC-20 and runes disappointed most Crypto enthusiasts. Although Ordinals and inscriptions are widely regarded as NFT implementations superior to other chains, BRC-20 and runes do not meet the FT protocol standards on other chains. The reason is that Bitcoins consensus (nodes and miners) do not know their existence, and runes must bypass restrictions through code tricks and cheat (not attack, just a description) to be implemented on the Bitcoin network. This is why the UTXO of runes must be cut, otherwise transactions cannot achieve partial purchases, and it is impossible to have AMMs and liquidity pools.

If Bitcoins consensus accepts OP_CAT, there will be no need to try every possible way to cheat, and more can be achieved.

Since the birth of Ordinals, most of the Bitcoin ecosystem innovations have revolved around Ordinals, including FT and NFT. With Udis move, perhaps the attention of the Bitcoin ecosystem will be split in half, with one half being OP_CAT and FT, and the other half being Ordinals and NFT.

If OP_CAT on the Bitcoin mainnet is successfully resurrected, one of the biggest beneficiaries will undoubtedly be the “Great Wizard” and “Quantum Cat” teams and holders. Even now, we can guess the two benefits for the holders of these two projects: the first CATNIP token will be airdropped to “Great Wizard” and “Quantum Cat”, which is a direct benefit; and the community will mobilize to lead the OP_CAT resurrection movement and eventually succeed, and its status as an NFT project will be difficult for anyone to reach, which is an indirect benefit.

In addition to enthusiasm, I think they also have practical reasons to revive OP_CAT. After all, The Great Wizard received $7.5 million in financing.

The short-term follow-up development will be interesting. Will Udi have a debate with Ordinals supporters (or even Casey)? CAT20 on Fractal already has a first-mover advantage. Will there be competition between the two, for example, CAT20 will be launched on the mainnet in the future? And will this lead to a new wave of China and foreign countries do not take over each other?

Danny CAT 20

Compared with the above two, this contestant is really more fucking… To be honest, I was confused after reading @bc 1 plainview s tweet – Brother, how dare you say that you invented CAT 20 a month ago…

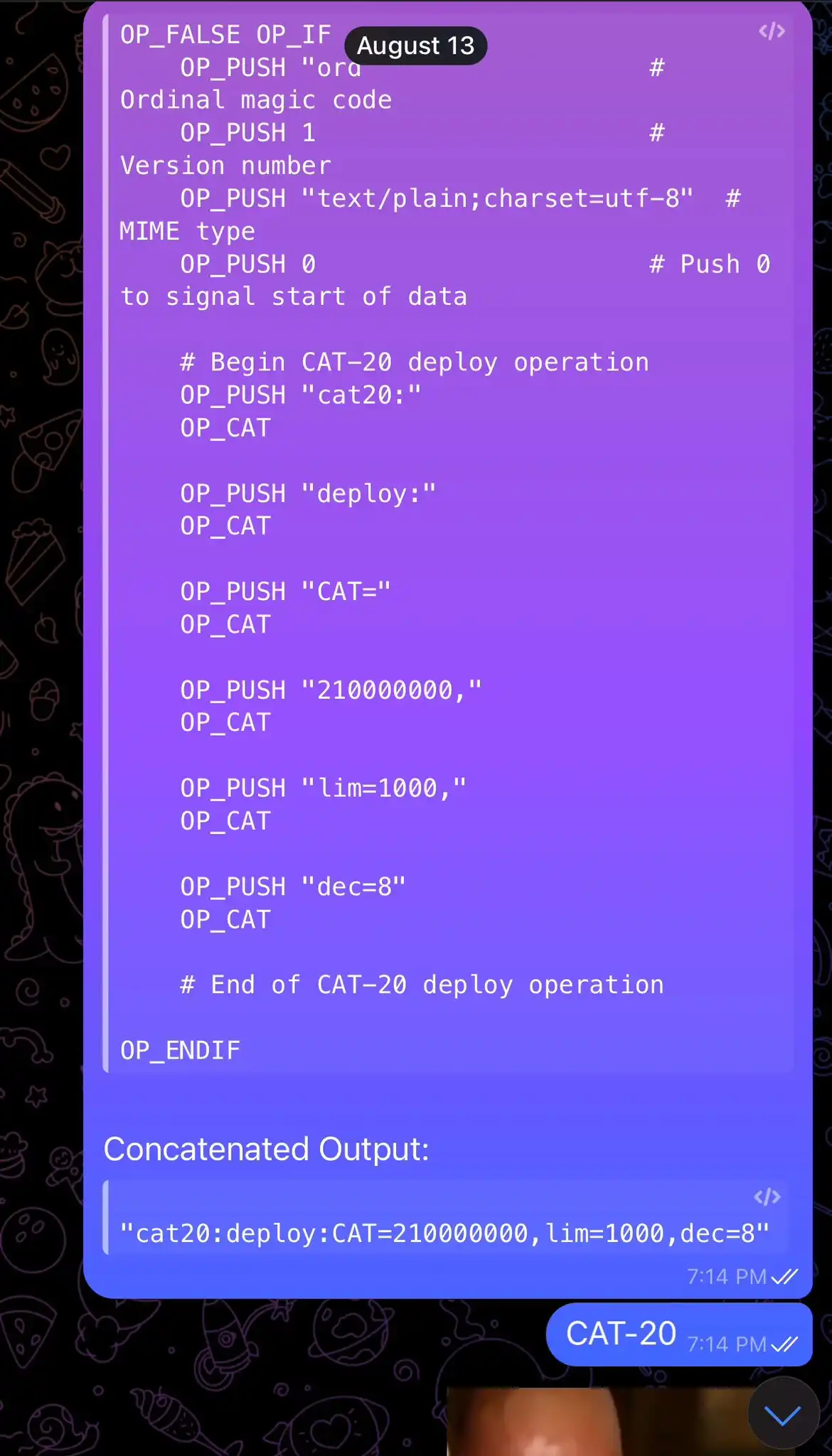

There is no professional technical documentation like CAT20, or even a tweet that elaborates on the implementation process like CATNIP, only this Telegram screenshot. OK, it doesn’t matter, I will explain the idea behind this picture – it actually uses OP_CAT to string together several fields of the Mint inscription. OK, I have invented the OP_CAT version of BRC-20.

This is totally unrelated to CAT20. In essence, this thing is the same as BRC-20, built on the Ordinals protocol, so he said that it must wait until the Ordinals protocol is activated on Fractal at block height 21000 before it can be launched. Secondly, CAT20 and CATNIP both use contracts to drive the entire FT protocol, and this Danny CAT20 is actually driven by inscriptions, but the way to create casting inscriptions has been changed, and the words on the casting inscriptions are strung together using OP_CAT…

Its like a piece of beef. CAT20 and CATNIP are exploring how to upgrade the pot into an alchemy furnace and make the beef into Tang Monk meat. The big brother came out and said, steak can be fried as a whole, cut into pieces, skewered and grilled, I am a player of the same level as you…

It’s time to put an end to the opportunistic “plate-making innovation”.

Çözüm

CAT 20 and CATNIP are definitely exciting for me. I wanted to write about OP_CAT before, but the technical principles are really obscure, and there are no direct use cases that can be explained and shared with everyone. With the emergence of these two, I think we will see more OP_CAT applications.

Ordinals opened the door to Bitcoin innovation and exploration, but the road is long and arduous. It would be lonely and abnormal for Ordinals to exist alone. We are happy to see more exploration. For Fractal, the emergence of CAT 20 is an excellent interpretation of its experimental field positioning, and it also makes me look forward to the future development of Fractal.

This article is sourced from the internet: Three OP_CAT protocols a day, is the Bitcoin ecosystem going to change?

Related: How to Play the Trump Trade in Cryptocurrency

Original text translation: TechFlow Moderators: James Seyffart , Analyst, Bloomberg Intelligence; Alex Kruger , Founder, Asgard; Joe McCann , Founder, CEO CIO, Asymmetric Guest: Jack Platts, Co-founder and Managing Partner of Hypersphere Ventures Podcast source: Unchained How to Play the Trump Trade in Crypto: Bits + Bips Air date: July 18, 2024 Background Information In this episode of Bits + Bips, hosts James Seyffart, Alex Kruger, and Joe McCann are joined by guest Jack Platts to discuss the market’s reaction to the assassination attempt on former President Donald Trump and analyze how this event could affect the 2024 U.S. presidential election and the cryptocurrency market. They also explored potential rate cuts: Will there be a rate cut in July? How big a cut might be in September? And could the…