Ana ağ lansmanından önce fraktal airdrop, domuz paçası pilavı değil, evrensel musluk mu?

Orijinal | Odaily Planet Daily ( @OdailyChina )

Yazar: Golem ( @web3_golem )

On the evening of September 6, Fractal Bitcoin announced that it would airdrop FB to eligible UniSat users and OKX wallet users. Users can check the amount of FB they have received on the UniSat reward query page and the OKX reward query page respectively. As long as they meet the requirements, one address can also receive airdrops from both sides at the same time. The airdrop will automatically arrive at the users address after the mainnet is launched.

This airdrop totals 1 million FB, accounting for 0.47% of the total token supply. UniSat and OKX wallets each allocate 500,000 FB to eligible users.

Fractal is one of the projects that has received the most attention and money in the Bitcoin ecosystem during this period. Therefore, once the token query news came out, major Bitcoin ecosystem communities became lively. However, various FUD voices are also spreading on social media and communities:

-

“The airdrop to the community is too small, accounting for only 0.5% of the total. The project owner is too stingy.”

-

“The amount of rewards for loyal addresses such as OG cards, Prime cards, and early BRC 20 swap users is actually on the same level as the minimum living allowance for holding assets on the mainnet testnet.”

-

“The testnet uses a new address, and there is no balance on the mainnet. This airdrop completely excludes me.”

-

“The balance requirements for the main network and test network have been raised, and those who used to only play on the test network have no chance anymore.”

-

……

So, how exactly are Fractal’s airdrop rules designed before the mainnet launch? Why is there so much negative reaction from the community? In this article, Odaily Planet Daily will explain Fractal’s token economics, airdrop rules, and OTC price information in detail.

Project and Jeton Economics Analysis

Fractal Bitcoin is a Bitcoin expansion solution that aims to use the BTC core code to recursively create an infinite expansion layer on BTC to improve transaction processing capabilities and speed, while maintaining full compatibility with the existing Bitcoin ecosystem. Fractal Bitcoin was developed by UniSat, a Bitcoin ecosystem infrastructure, which has received multiple rounds of financing from Binance, OKX Ventures, and others.

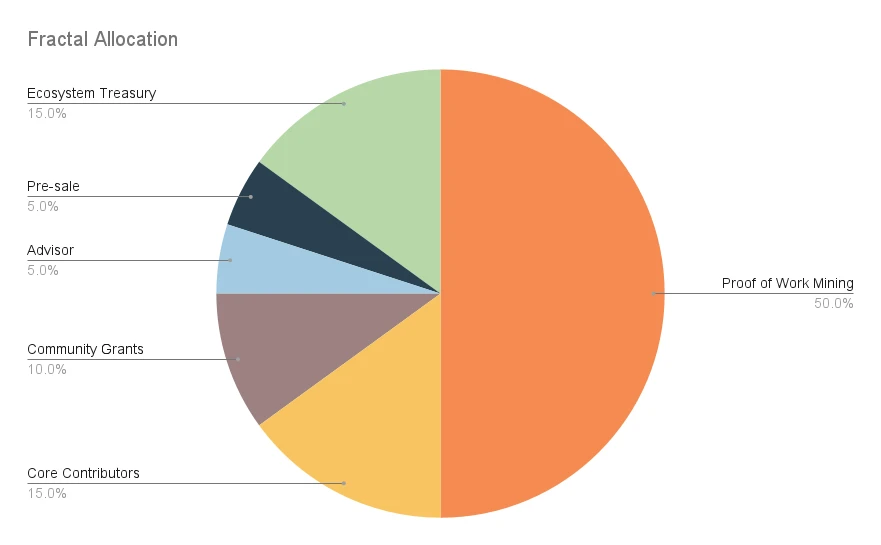

Fractal announced the token economics on August 27, with a total of 210 million tokens, of which 80% is allocated to the community and 20% to the team and contributors . The specific distribution is as follows:

-

POW Mining 50%: Half of the total token supply is allocated to Proof of Work (PoW) mining;

-

Ecosystem Treasury (15%): 15% of tokens are reserved for the Ecosystem Treasury, which is used exclusively for investment in the Fractal ecosystem. This treasury supports and funds initiatives to improve the ecosystem and provides funding for continued core improvements of Fractal;

-

Presale (5%): 5% of tokens are allocated to the presale, targeting early investors and network participants. These funds are essential to cover initial development and operational costs and to conduct security audits to ensure the robustness of the network. All tokens are locked for 6 months and will be released linearly over 12 months;

-

Advisors (5%): Another 5% of tokens are currently reserved for advisors who will provide strategic advice and support for the continued development of the Fractal network;

-

Community Funding (10%): 10% of tokens are used for community funding, which will be used to establish partnerships and liquidity programs;

-

Core Contributors (15%): The remaining 15% of tokens are allocated to core contributors who build and maintain Fractal’s core software.

From the perspective of token economics, Fractal has not set aside a specific portion to facilitate the airdrop, and many in the community speculate that Fractals airdrop will be allocated from the ecosystem treasury or community funding.

From the circulation situation, the current airdrop accounts for 0.5% which can be ignored, and the majority is in the daily output of miners and the hands of the team. If the average block is produced every 30 seconds and each block is rewarded with 25 FB, about 72,000 FB can be produced every day, and 720,000 FB can be produced in 10 days, accounting for 0.3% of the total. Even if the 15% taken by the team is included, the initial circulation is not high. In addition, after the mainnet is launched, players have the need to consume FB to participate in the ecosystem. The shortage of supply may cause the price of FB to rise in the early stage of the mainnet launch.

Airdrop Rules Analysis

The airdrop rules for UniSat and OKX wallet users are different.

The airdrop qualification conditions for OKX wallet users are as follows: those who meet qualification one will receive a basic reward of 6.6 FB, and those who meet qualification two will receive an additional reward of 30 FB:

-

Condition 1: At 00:00 on September 1 (UTC+8), you have more than 100 USD worth of BTC in your EOS wallet, and you have traded Ordinals, Runes, and Atomicals assets more than 3 times using EOS Web3 Market in the past 6 months.

-

Condition 2: Rank in the top 5,000 in terms of BTC ecosystem activity on OKX Web3 Wallet.

The airdrop eligibility criteria for UniSat users are as follows, with a snapshot of the past 90 days:

-

You can get 5 FBs if you meet any of the following conditions: trade more than 0.001 BTC on the UniSat market and get more than 10 UniSat points.

-

You can get 10 FBs if you meet any of the following conditions: holding a UniSat OG card, holding a UniSat Prime card, interacting with the BRC 20 swap on the mainnet in the early stage, holding 0.001 BTC on the Bitcoin mainnet, and holding 0.002 tFB on the Fractal testnet.

-

You can get 15 FBs if you meet any of the following conditions: ranking in the top 5,000 in the UniSat market, ranking in the top 5,000 in UniSat points.

At the same time, after personal testing, the editor found that as long as the above conditions are met, one address can receive FB rewards on UniSat and OKX at the same time.

It can be seen that Fractal’s airdrop is aimed at rewarding real users of UniSat and OKX wallets. On the one hand, it enables most real users to obtain a minimum guarantee of 6.6 or 10 FB, and on the other hand, it also pleases “big loyal players”.

However, UniSat’s airdrops to the platform’s OG cards, Prime cards, BRC 20 early experience users and top-ranked addresses have caused dissatisfaction among players. The reason is that they believe that as loyal and “high-value” users of the platform, the airdrops they receive are at the same level as the minimum guarantee rewards for holding assets on the main network and test network.

However, Fractal also made changes to the minimum living allowance reward eligibility for 10 FB last night, from as long as you hold a balance on the mainnet and testnet to mainnet requires 0.001 BTC and testnet requires 0.002 tFB, which actually further raised the airdrop threshold. Many people also complained that there were 10 yesterday, but today it was 0.

OTC Price

Currently, the OTC price of FB in the community is between 5-8 U. Based on this price, the total market value of FB has exceeded 1 billion U.S. dollars. It can be seen that even if there is some dissatisfaction with the airdrop, the community still has a positive expectation for the price of FB after it goes online.

Most users query the number of airdrops between 10-40 (assuming there are two numbers). If sold at $6 (if someone accepts small orders), they can get a pig trotter meal income of $60-240 in the OTC market. However, there are only 1 million FBs traded in the OTC market. After the main network is launched, the daily output of miners will become dominant. Whether the price of FB can be strong at that time also requires further observation of market sentiment.

Not pork trotter rice but universal tap?

Judging from the number and eligibility requirements of this airdrop, Fractal may not be intentionally distributing pig trotter rice to users, but rather it is more like actively distributing mainnet taps for real users, so that everyone has the conditions to participate in the Fractal mainnet ecological project test.

Before Fractal conducted this airdrop, the community had extensive discussions on whether Fractal would conduct airdrops, the airdrop rules, etc. Among them, there was a view that from the perspective of ecological construction, Fractal would conduct some airdrops, otherwise users would not have FB tokens to experience the Fractal ecological project in the early stages. If they all went to miners to buy, the price volatility caused by supply and demand might also inhibit users enthusiasm for participation.

This airdrop is actually reminding us how we should continue to participate in the Fractal ecosystem. We should stop the previous blind testnet interactions. The “big thing” may come after the mainnet is launched.

This article is sourced from the internet: Fractal airdrop before mainnet launch, not pork trotter rice but universal faucet?

Kelp DAO, a leading liquidity re-staking protocol, is launching a new product, Gain , to optimize rewards. Gain simplifies access to multiple reward strategies while increasing users’ earning opportunities through airdrops and points. Overview Gain is a vault program that provides users with access to multiple top Layer 2 network rewards through a diverse single strategy. By integrating Layer 2 protocols and DeFi rewards, the program simplifies the way users participate in various DeFi strategies, and users no longer need to manage each position separately. What is a vault? Vault is essentially a smart contract that automatically deploys assets according to a given yield strategy. The strategy manager is responsible for designing the yield strategies that need to be covered, the allocation of deposits among the strategies, and the regular…