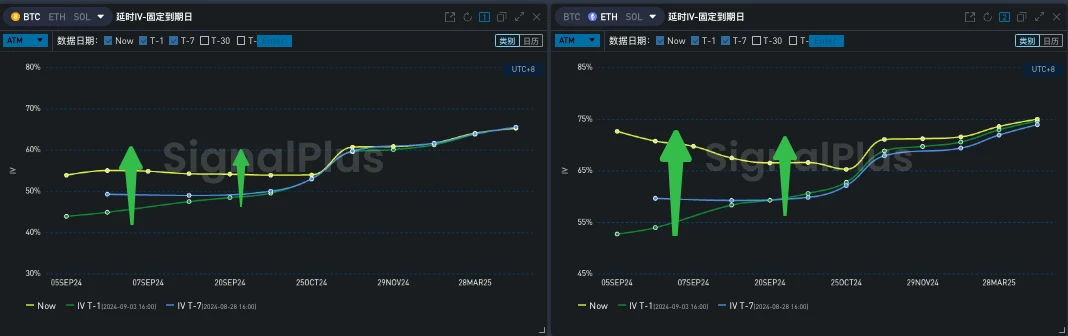

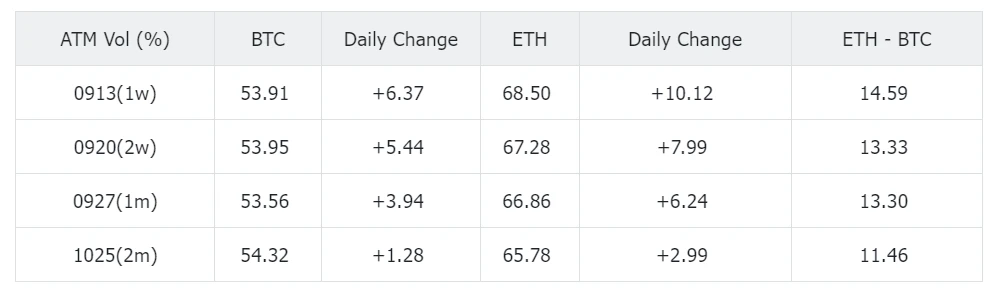

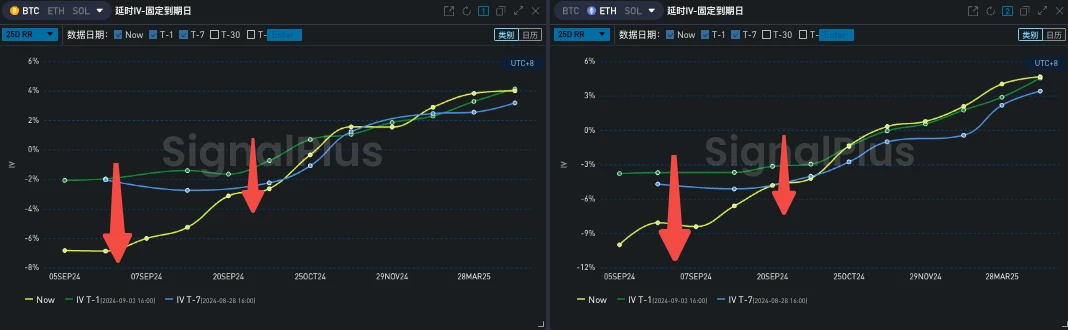

With the recent depressed sentiment, Bitcoin has performed poorly since last nights US trading session, falling 2.5% around 10 oclock, and continued to fall in the Asian session. A run occurred at one point, causing the price to fall to $55,606, and then rebounded slightly to around 56,000. The implied volatility maintains a negative correlation with the price during the day. After the violent intraday fluctuations, the term structure of BTC and ETH is bull flattening, with ETHs far end rising more significantly, and the volatility level at the front end shows a clear inverted pattern with the support of up to 85% RV during the day.

Kaynak: SignalPlus

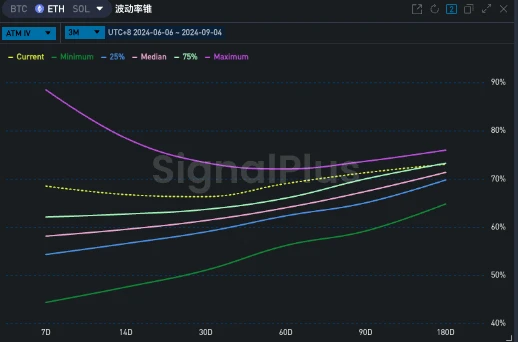

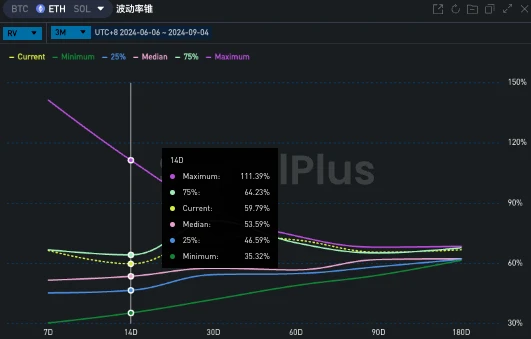

The IV change of ETH at the front end is not only higher than that of BTC. From a numerical point of view, the current IV of ETH is at a historical high (75 percentile and above), and the hedging cost implied by the volatility cone of RV also reflects the current rich VPR, which may attract bearish volatility strategies and weaken the upward shape of the term structure in the short term.

Kaynak: SignalPlus

Source: Deribit (As of 4 SEP 16: 00 UTC+ 8)

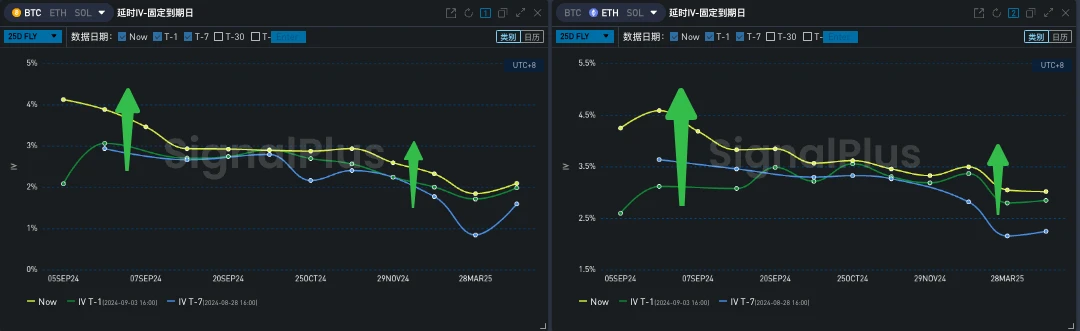

As the price fell further and broke the recent low, the front-end Skew gave up all the gains yesterday and returned to the low level. The Vol Premium at the end of each maturity was also set at a higher position, among which BTCs 8 Nov related to the US election rose the most significantly, and the two subsequent maturity dates rose together. ETHs convexity at the end of the year (27 DEC) still maintained a local high, rising to 3.53%.

Source: SignalPlus, Vol Skew

Source: SignalPlus, Fly

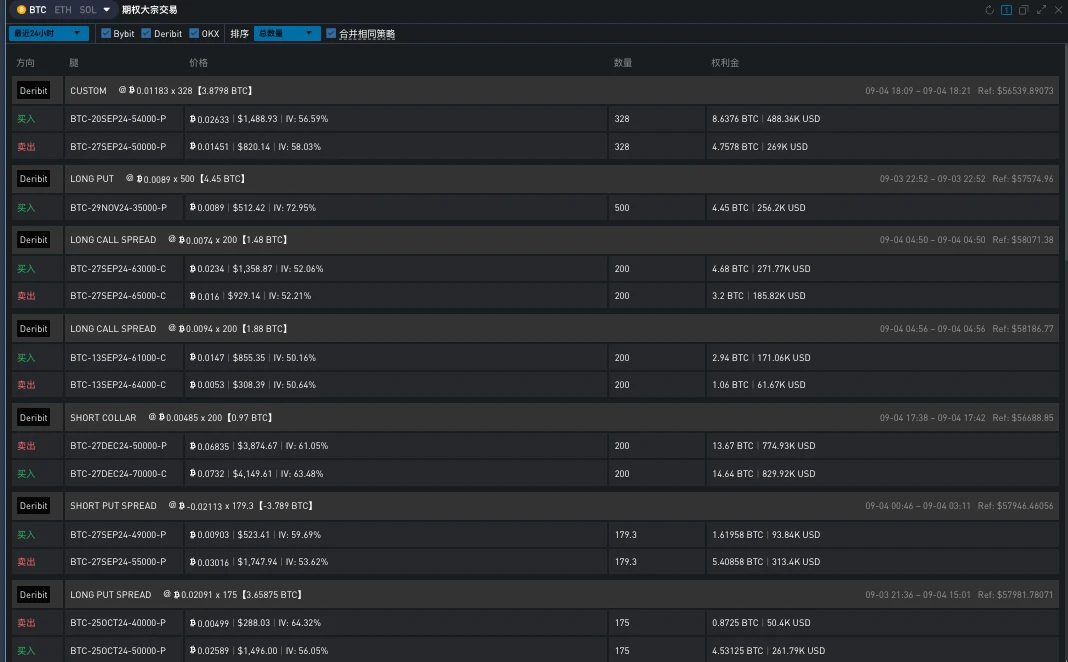

Judging from the transaction volume, the direction of BTC transactions is relatively balanced. The price drop reminds traders to set extreme scenario protection for their positions (such as 29 NOV-35000-P 500 BTC Long put). At the same time, it also provides those who insist on bullishness with a cheaper bullish strategy position building opportunity, such as 27 SEP 63000 vs 65000 Long Call Spread (200 BTC per leg).

Source: SignalPlus, Block Trade

Daha fazla gerçek zamanlı kripto bilgisi almak için t.signalplus.com adresindeki SignalPlus ticaret kanadı işlevini kullanabilirsiniz. Güncellemelerimizi hemen almak istiyorsanız lütfen Twitter hesabımız @SignalPlusCN'yi takip edin veya daha fazla arkadaşınızla iletişim kurmak ve etkileşim kurmak için WeChat grubumuza (yardımcı WeChat ekleyin: SignalPlus 123), Telegram grubumuza ve Discord topluluğumuza katılın.

SignalPlus Resmi Web Sitesi: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240904): Continuous decline

1. Introduction: Characteristics of the current cryptocurrency market The cryptocurrency market is well known in the financial world for its high volatility, high return potential, and high risk characteristics. As a relatively young and rapidly developing financial field, it exhibits dynamics that are very different from traditional markets. Every ups and downs of this market affect the nerves of investors around the world, and the driving factors behind it are often complex and diverse. This article will focus on understanding and analyzing the three key factors that affect the cryptocurrency market: market sentiment, political environment, and future expectations. These three factors are not only interrelated, but also largely dominate the short-term volatility of the market. 2. Keyword 1: Emotion A sharp shift in market sentiment The cryptocurrency markets sentiment tends…