Fractal Bitcoin, Bitcoin zincirindeki işlem gücünün sınırlarını aşabilir mi?

Introduction: Bitcoin is the core driving force of the current bull market cycle, and its related concepts have attracted much attention. With the continuous development and improvement of the Bitcoin ecosystem, the scalability problem has become increasingly prominent, and the concept of fractal Bitcoin has emerged. This innovative idea was originally proposed by the Unisat team to explore the scalability of the Bitcoin network. However, fractal Bitcoin is not a strictly Bitcoin second-layer solution (L2), and its essence is closer to a sidechain structure.

1. Concept Analysis of Fractal Bitcoin

Definition and core characteristics of fractal Bitcoin

Fractal Bitcoin is an innovative blockchain expansion solution based on recursive virtualization technology that enhances Bitcoins scalability by creating a multi-layer network structure while maintaining a secure connection to the main network.

Core Features:

1) Recursive virtualization:

Fractal Bitcoin uses recursive virtualization technology to create multiple layers on the Bitcoin blockchain. Each layer runs as an independent instance, but is anchored to the main Bitcoin network, ensuring that the security and consensus mechanism of the entire network are maintained.

2) Unlimited scalability:

By continuously creating new layers, Fractal Bitcoin is able to handle the ever-increasing volume of transactions and data without causing network congestion. This allows it to adapt to the growth in processing power and storage requirements brought about by the increasing popularity of blockchain technology.

3) Dynamic load balancing:

Fractal Bitcoin can dynamically allocate resources based on real-time demand and distribute transactions to different layers. This feature prevents a single layer from becoming a performance bottleneck, ensuring smooth operation even during peak usage.

4) Security and consistency:

Fractal Bitcoin is a fork of Bitcoin, not a direct extension, and it uses the Proof of Work (PoW) consensus mechanism and applies it to all levels. This ensures the security and consistency of the entire network, and enjoys the same trust and reliability as Bitcoin.

5) Faster block confirmation:

Compared to Bitcoin鈥檚 usual 10-minute block confirmation time, Fractal Bitcoin reduces the confirmation time to 30 seconds or less. This greatly improves the user experience and supports high-frequency applications and transactions.

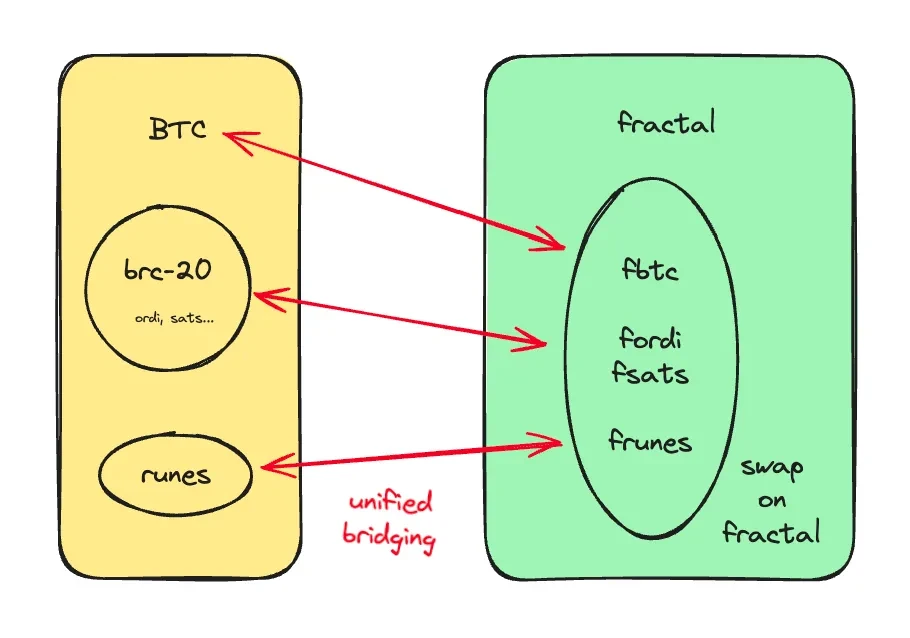

6) Efficient asset bridging:

Fractal Bitcoin introduces a powerful asset bridging feature that allows users to securely transfer various digital assets between different network layers without wrapping the tokens, thereby maintaining the integrity and usability of the assets.

Overall, Fractal Bitcoin maintains the basic security and reliability of the Bitcoin network while increasing scalability.

Background of Fractal Bitcoin

The creation of Fractal Bitcoin originated in 2023, when the emergence of Ordinals and related applications attracted widespread attention, turning the attention of developers to the wide application potential of Bitcoin, but for security reasons, Bitcoin has implemented restrictions on opcodes and block storage space in its iterations. In order to solve the inherent limitations of the Bitcoin blockchain, especially the limitations in on-chain computing power and block space, the concept of Fractal Bitcoin was proposed.

In mathematics, fractal patterns repeat themselves at every scale, a principle reflected in the architecture of fractal Bitcoin. Each layer can be seen as a smaller replica of the entire network, able to scale infinitely to accommodate more users and transactions. This not only ensures that the network remains efficient and fast, but also provides a strong framework for future growth and innovation. Some solutions for Bitcoin L2 are more like building a side chain, requiring cross-chain operations, so developers seek to enhance its functionality without compromising core principles to become the optimal solution.

Of course, the introduction of technologies such as SegWit and TapRoot has made this idea possible, thereby improving the programmability and efficiency of Bitcoin. It also lays the foundation for exploring more complex solutions to improve the scalability and practicality of Bitcoin.

2. Technical Implementation of Fractal Bitcoin and Other Scaling Solutions

Create multiple independent layers on the Bitcoin blockchain. Each layer runs as an independent instance, but is still anchored to the main Bitcoin network. This layered architecture allows Fractal Bitcoin to disperse the transaction load, and each layer can handle a large number of transactions at the same time. In order to manage these layers, Fractal Bitcoin implements a dynamic load balancing system. This system can flexibly allocate resources and distribute transactions according to fluctuations in transaction demand, preventing any single layer from becoming a bottleneck. In order to achieve cross-layer asset transfers, Fractal Bitcoin uses a rotating multi-party computation (MPC) signature system. This system allows efficient and secure asset transfers without the need for users to wrap their tokens, maintaining the integrity and availability of assets within the ecosystem.

Image credit: DaFi Weaver

In practical applications, Fractal Bitcoin creates dedicated instances for specific purposes. For example, it creates a dedicated instance for ordinals, ensuring 100% compatibility and optimizing the handling of these assets. This dedicated instance uses a mechanism to lock and map specific satoshis on the main chain to the instance, allowing ordinals to circulate seamlessly within the instance while guaranteeing that they retain the original inscription when returned to the main chain.

Basically, by decoupling these transactions from the main network, Fractal Bitcoin reduces potential friction while keeping Bitcoin鈥檚 main use case pure.

Sidechain Technology: Expanding the Possibility of Bitcoin

Sidechain technology achieves this by creating an independent blockchain that is interoperable with the Bitcoin main network. This mechanism allows users to deposit their Bitcoin into a contract on the Bitcoin blockchain, which then creates an equal amount of Bitcoin for use on the sidechain. This two-way peg not only enhances Bitcoin鈥檚 functionality, allowing for experimentation with new features and applications without changing the main network, but also solves scalability issues by moving transactions off the main blockchain. Sidechains can support a variety of use cases, such as smart contracts and decentralized applications, broadening Bitcoin鈥檚 utility and promoting innovation within its ecosystem.

Lightning Network: Layer 2 Solution

As a key second-layer solution, the Lightning Network allows multiple off-chain transactions to occur instantly by creating bidirectional payment channels between users, significantly reducing the congestion issues typically associated with the Bitcoin main blockchain. This innovative approach not only reduces transaction fees – making microtransactions economically viable – but also improves the overall user experience by eliminating the long confirmation times for on-chain transactions.

The Lightning Networks routing system is able to facilitate payments even between users who dont have direct payment channels, similar to how Internet packets are routed, making the payment process more efficient. As a result, the Lightning Network positions itself as a transformative solution that solves Bitcoins scalability challenges, making it a practical option for everyday transactions and facilitating wider adoption of cryptocurrencies in everyday commerce. The implementation of the Lightning Network brings multiple benefits to the Bitcoin ecosystem. Not only does it enhance Bitcoins functionality as a means of payment, it also opens up new application possibilities, such as micropayments.

RGB Protocol: Bringing Smart Contract Functionality to Bitcoin

The RGB protocol introduces a groundbreaking approach to the Bitcoin ecosystem, integrating smart contract functionality into Bitcoin. By leveraging off-chain data storage and client-side verification, RGB allows smart contracts to be executed without overloading the main blockchain with data, thereby maintaining its efficiency. The protocol uses cryptographic commitments to ensure the authenticity of data while enabling dynamic interactions through state transitions that can track and verify the state of the contract.

This approach brings several key advantages to Bitcoin. First, it expands the scope of Bitcoins functionality, making it more than just a digital currency, but also a platform that supports complex financial operations. Second, due to the use of off-chain processing and client-side verification, the RGB protocol avoids excessive burden on the Bitcoin main chain, maintaining the efficiency and scalability of the network.

In addition, the RGB protocol is designed with privacy in mind, allowing users to keep transaction and contract details private when needed. This feature enables Bitcoin to support a wider range of commercial and financial applications while still maintaining its core security and decentralization.

3. Main Fractal Bitcoin Project Ecosystem

1) Fractal Bitcoin is the first example of applying virtualization methods to Bitcoin, gradually expanding the Bitcoin blockchain into a scalable computing system without destroying the consistency with the Bitcoin main chain. Currently, there is only one ecological platform issued on the native Bitcoin protocol. This project is currently very popular. According to official social media, it is ready to launch the main network in September.

2) UniWorlds, mainly a gaming infrastructure platform built on the Bitcoin ecosystem, using fractal Bitcoin technology. We provide a comprehensive set of tools to develop and manage mobile games and gamification environments, 38,000 followers on Twitter, and few Bitcoin-related game application projects.

3) Motoswap, a DeFi sector, is a decentralized exchange built on Bitcoin layer 1 and will be deployed on Fractal.

4) Satspumpfun, the Bitcoin version of Pumpfun, allows users to create tokens and automatically deploy them to Motoswap, similar to Pumpfun.

Image source: Unisat

4. Potential risks of fractal Bitcoin

Currently, the Fractal Bitcoin project is experiencing a highly hyped phase, similar to the situation before other early cryptocurrency projects such as Runes were launched. In this craze, a large number of projects have emerged quickly to try to catch the market heat. However, some risks will arise.

1) The quality of the projects varies. Although there are some teams with real strength involved, most of them are projects hastily established just to catch up with the trend.

2) Insufficient technical understanding: Many teams may not have a deep enough understanding of Fractal鈥檚 underlying mechanisms, which may lead to their lack of actual delivery capabilities.

3) Uncertain development prospects: The real important development will most likely not appear until the mainnet is launched, and the current enthusiasm may not be sustainable. A specific example of this situation can be seen from the failure of the Fractal-420 project. The project was an asset management project in the Fractal Bitcoin ecosystem, but it failed due to unclear external factors.

4) Centralization risk: Some key functions of Fractal Bitcoin seem to rely on centralized servers. This architecture is contrary to the decentralized core concept of blockchain technology and may introduce single point failure risks and trust issues.

In addition, there are controversies on the network about fractal Bitcoin. Fractal Bitcoin can solve the disputes and compatibility issues brought by ordinal transactions by creating specialized ordinal instances, but they deviate from the traditional Bitcoin usage and believe that ordinals are an abuse of the network because they usually involve transactions that are different from standard Bitcoin operations.

This article is sourced from the internet: Can Fractal Bitcoin break the limitations of computing power on the Bitcoin chain?

Related: ETH Beta earnings review: MEME performed best, but collectively failed to outperform BTC

Original author: Research institution ASXN Original translation: Felix, PANews There has been a lot of discussion around long ETH beta trades, with most people believing that with the successful passage of the ETH ETF, ETH will rise again, opening up room for ETH beta to rise. While this is a logical idea, does the data support this view? Research data from research firm ASXN shows that during the observation period, ETH beta underperformed ETH in absolute terms and after risk adjustment. In addition, all observed tokens, except SOL and ENS, underperformed BTC in relative and risk-adjusted terms. Asset performance varies more across cycles, and altcoins have generally performed poorly in this cycle, making asset selection more important than ever. prerequisites: The observation period is from May 1 to July 23,…