Son açıklamalar tartışma yarattı. Vitalik gerçekten DeFi'yi anlıyor mu?

Orijinal yazar: Alex Liu, Foresight News

The allegations against Vitalik

Vitalik Buterin’s controversial views on DeFi came from a post in which he responded to a thread accusing him of poor communication on the topic of DeFi . The post read:

“Vitalik, I think one of the reasons people are confused or frustrated about your views on DeFi is because of miscommunication:

It seems that in your opinion, DeFi is the mining craze and Ponzi scheme in 2021 ; but for many others (I would say most people), DeFi means saving and borrowing money on Money Markets such as Aave, CDPs such as RAI (which you also mentioned!), Synthetics, etc. These are all healthy decentralized financial applications – income comes from borrowers, transaction fees, etc. (Editors note: CDP, collateralized debt position, a decentralized stablecoin mechanism, and the representative project is Maker, whose decentralized stablecoin is DAI.)

This is perhaps why people are confused as to why Vitalik seems to be against DeFi but supports gambling/prediction markets like Polymarket and centralized stablecoins like USDC.

I agree that many of the “Ponzi economics” that are integrated into the DeFi ecosystem can only mean a temporary improvement in certain indicators, but this is not all DeFi is about.”

Vitalik’s Response

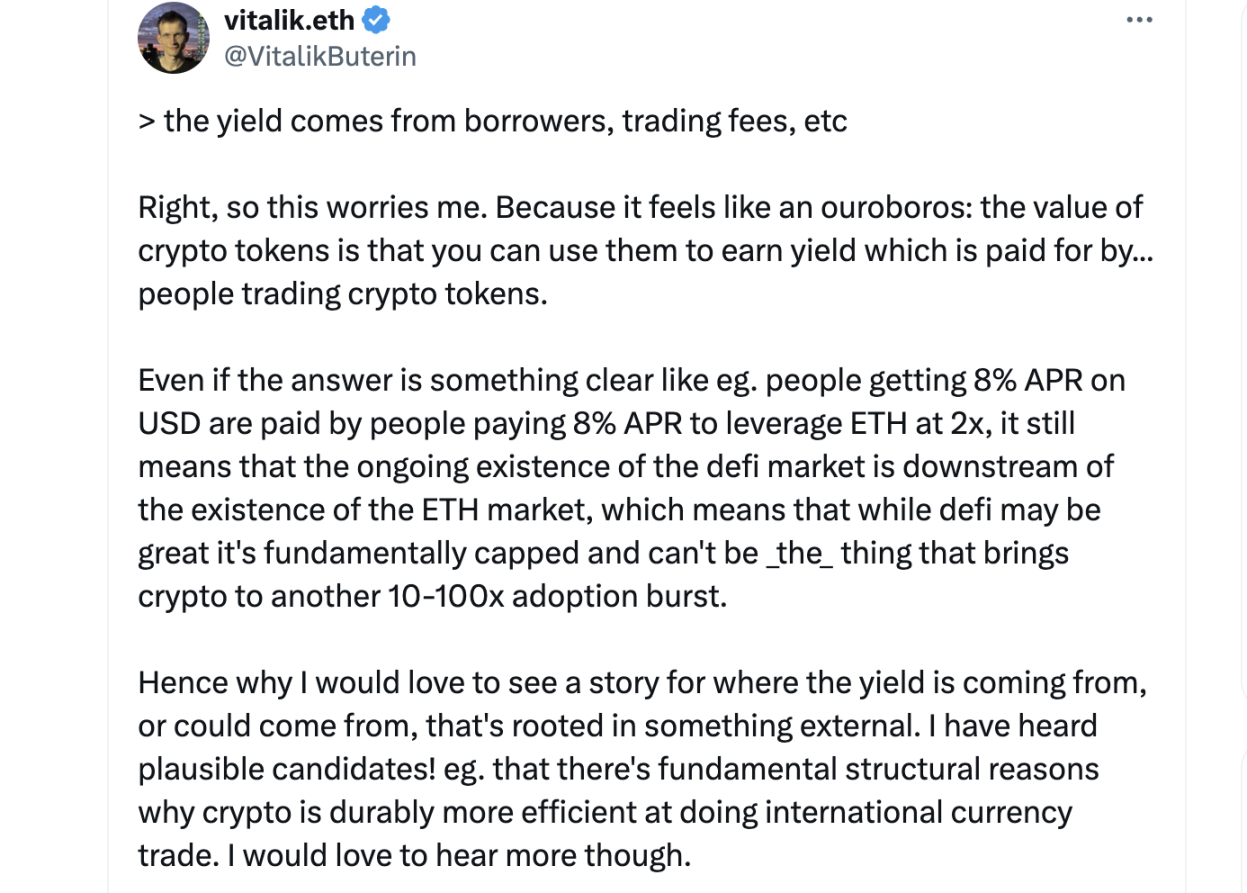

“The revenue comes from borrowers, transaction fees, etc.

Yeah, so that worries me. Because it feels like an Ouroboros: the value of crypto tokens is that you can use them to earn a yield, and the yield is paid by the people who trade crypto tokens.

The answer is clear, for example: those who earn 8% annual interest in USD are paid by those who pay 8% annual interest to go long ETH with 2x leverage, but this means that the DeFi market exists downstream of the ETH market, so while DeFi may be great, it is fundamentally limited and cannot become the explosive innovation that drives crypto technology to another 10-100x adoption.

That’s why I’d like to see a story about where the gains are coming from or could come from, that’s rooted in something external. I’ve heard of some plausible candidates! For example: cryptocurrencies are permanently more efficient at international currency transactions for fundamental structural reasons. I’d like to hear more.”

Ouroboros, the Ouroboros

Vitalik’s remarks sparked heated discussions, with many influential figures rebutting them:

Many rebuttals

Ken Deeter, Partner, Electric Capital

My knee-jerk reaction to Vitalik Buterin’s comment was: “ Doesn’t this describe all of finance? ”

Most finance is about “people expressing their views about the future through various instruments, and then a host of mechanisms to change that view and create markets for those who want to take the opposite view.”

In terms of structural advantages, I think DeFi through blockchain has one major advantage: decentralization allows more of the world’s capital to participate in financial opportunities that have been unavailable to them until now.

The passive capital you see in DeFi is a testament to market liquidity or lending liquidity — I bet that for many DeFi users, this type of opportunity is difficult to access outside of the blockchain , and the automated markets make it almost trivial. As more RWAs join, these opportunities will increasingly overlap with today’s tradfi.

Yes, in 2020, “Food Tokens” weren’t super efficient, but there were a ton of secondary effects — testing the spot market, testing the clearing system, testing what happens when the chain is congested, validating the need for it in advance for the blockspace explosion we’re seeing today, and other positive effects.

New platforms often become mainstream through use cases that many initially view as toys. These platforms gain enough traction to de-risk new technologies, paving the way for mainstream adoption. It’s hard not to see DeFi going through the same process today.

PaperImperium, KOL

“Vitalik’s comments reveal a misunderstanding of human economic history.

You could equally argue that all human markets are downstream of a few agricultural markets. However, barley is not necessarily a bigger base than all the “downstream” markets. ”

Cryptohuntz, CEO of Alphaverse Capital

“A failure perspective from Vitalik.

The value of any asset in the world, beyond holding or enjoying it, is that you can financialize it and earn a yield.

Decentralized financialization enables users to compete with large companies and middlemen and reap their benefits. ”

Vitalik’s joking response

In response to the opposition Vitalik received, someone defended him: You may be dissatisfied with Vitaliks comments on DeFi, but he is standing on a business standpoint . Vitalik responded humorously in his reply: In fact, I was sitting on a recent flight, and I was sitting in economy class.

Çözüm

The editor also clearly disagrees with Vitaliks point of view . Does Vitalik really understand DeFi? The answer may be yes, but not necessarily right.

Vitalik is the philosophical source behind Ethereum as a technology platform; but his understanding of finance and DeFi may not be correct. We don’t need to over-mythologize him. In fact: “Without DeFi, the price of Ethereum might still be $400.”

This article is sourced from the internet: The latest remarks sparked controversy. Does Vitalik really understand DeFi?

Related: Full record of Odaily editorial department investment operations (July 26)

This new column is a sharing of real investment experiences by members of the Odaily editorial department. It does not accept any commercial advertisements and does not constitute investment advice (because our colleagues are very good at losing money). It aims to expand readers perspectives and enrich their sources of information. You are welcome to join the Odaily community (WeChat @Odaily 2018, Telegram exchange group , X official account ) to communicate and complain. Recommended by: Asher (X: @Asher_ 0210 ) Introduction: Short-term contracts, long-term ambush of low-market-value cottages, gold farming in blockchain games, and money-grabbing parties share: 1.BTC: short at 67000, target 63000, stop loss 68000. It is believed that this is the last wave of pullback leading to the historical high. 2. Review of the last altcoin recommendation:…