Suları test etmek için Bitcoin satmak ve hiçbir şey yapmadan 5 haneli rakamlar kazanmak, küçük işletmelerin para kazanma felsefesidir.

Orijinal yazar: Jaleel Jialiu , BlockBeats

There are more complaints in bull markets than in bear markets.

Those who play with local dogs are left hanging on the top of the mountain, project owners lament the poor market conditions, hair-pulling studios are being reversed, and VCs are locked in with no chance to exit. Not being able to make money seems to be the root of all evil. The cruel thing is that even though complaints are coming one after another, there is never a shortage of people making money in the market.

For example, just selling test water on Bitcoin can make $10,000 a day. It is these small businessmen who are not in the mainstream in the eyes of many elitistists who can always find flexible new opportunities to make money in the cryptocurrency circle.

From selling water to renting mines, the philosophy of making money in small businesses

It is now the end of August. With the arrival of the golden September and silver October, all financial fields are about to get rid of the summer dilemma of tight liquidity. The cryptocurrency circle is no exception, and has shown some signs of recovery. Bitcoin has firmly stood on the high ground of $60,000, and the entire Bitcoin ecosystem has regained vitality.

Among them, the expansion solution Fractal Bitcoin (Fractal Network) launched by Unisat is particularly popular. This solution based on Bitcoin Core native code and integrated with the op_cat application, although still in the testing phase, has attracted more than 6 million addresses to participate in the test at the time of writing this article. Related reading: Experience Fractal Ecosystem Tutorial: The Next Bitcoin Ecosystem Explosion Point

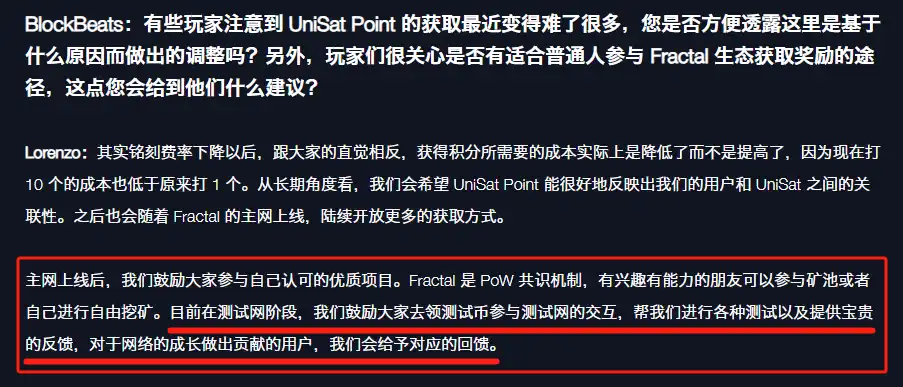

In an exclusive interview with Unisat by BlockBeast in mid-August, they also mentioned that users who contribute by providing feedback during various tests will be given corresponding feedback.

This statement caused a strong response in the community and was widely circulated, which to a certain extent also inspired everyone to participate in the test network. After the article was published, the number of addresses participating in the test network increased by millions in just one day. Related reading: Exclusive Interview with UniSat Founder: Fractal is Bitcoins Most Loyal Assistant .

However, the number of test coins given by the official test network’s water collection channel is limited. Only 0.02 FBTC can be collected each time, and it can only be collected once every 6 hours. This limits some users who want to have long addresses.

Thus, a new business opportunity emerged – selling FBTC test coins, commonly known as selling water. (Since the early platforms could flow out test coins like a faucet, they were called faucets, and test coins were also commonly known as water).

This is not the first of its kind in the cryptocurrency world, and FBTC is not the first test coin to be sold.

Before Ethereums Sepolia testnet was launched last year, Goerli TestNet was the most mainstream testnet of Ethereum. Several channels that provided faucet services only allowed users to receive a certain amount of money every day, and they also needed to complete a series of tedious social verification. In the context of some projects suggesting that testnet participation may bring blessings, Goerli ETH test tokens were also in short supply for a time, and each GETH could be sold at a price of 3 U at that time.

The secrets behind trading test coins

In contrast, the current price of FBTC is relatively affordable, about $0.4 per coin. Coupled with some rumors about test rewards, market demand continues to exist. Some studios even purchased a large number of test coins to create hundreds or thousands of addresses in order to increase their chances of obtaining potential airdrops.

“Most people who buy water now want semicolons. Assuming that an account is going to swipe 1 FBTC of TX, then 100 accounts will need 100 FBTC, and the required amount is quite large. There are currently 7 million test addresses. These people are all trying to bet on the airdrop.” Yan Sanxiu ( @practice_y 11 ) told BlockBeats.

Since the code of the Fractal Network was first launched on the test network, Yan Sanxius team has been working closely with Unisat, from understanding and running mining to the current very stable operation. Therefore, their next focus is to attract more free miners and build a mining pool MoonX.

Yan Sanxiu also explained the mining mechanism of the Fenxing network: the network adopts the same proof-of-work (POW) mechanism as the Bitcoin mainnet, and introduces the innovative Cadence Mining mining method, which aims to balance large mining pools and free mining. Ignoring the increase in block difficulty, the Fenxing network can produce about 72,000 FBTC per day, of which 33% comes from joint mining and 66% from free mining.

Currently, the top miner in free mining accounts for 66.91% of the computing power, and theoretically can mine about 30,000 FBTC per day.

Based on the current conservative market price of $0.3 per piece, assuming all of these goods can be sold, the daily income will reach about $10,000.

Cryptocurrency gold diggers change the situation to survive

However, too many fish are worthless.

Selling FBTC, large quantity, cheap price, some OTC dealers selling FBTC also shouted. As more and more miners joined, the sales of FBTC were somewhat sluggish. The price of FBTC dropped from the initial $1.5 to the current $0.4, and the daily trading volume also decreased.

There are even rumors in the market that channel dealers artificially raised the test network GAS fees in order to promote the sales of FBTC.

However, Yan Sanxiu believes that this is possible, but it is difficult to implement: The Fractal Network has one block in 30 seconds, which is too fast. Even if the previous block fee is 30, all transactions are packaged after two blocks, and the Gas will drop. Unless someone can really control the computing power of the Fractal Network to keep mining empty blocks, even if they keep mining empty blocks, they will still be packaged by joint mining blocks after 90 seconds, so this rumor is a bit unrealistic.

The supply of test coins exceeds the demand, and the Fractal Network plans to launch the main network on September 1, which means that the demand for test coins may further decrease. The small business of selling test coins FBTC may not make money for too long. After all, when a business can be written, it is no longer so profitable.

But for these mining players, crises often breed new opportunities. With the launch of the main network, new business models are brewing, such as renting computing power.

BlockBeats learned from the market that the current price of renting computing power on the Fenxing Network is 12 u/t per month, with a minimum rental of 200 T, which means that a user can earn $2,400 per month. And at present, the market demand for renting Fenxing Network computing power is still quite large.

“Indeed, many friends in the community have asked me if they can rent computing power. It depends on the market situation. Our mining pool may also consider adding this business in the future.” Yan Sanxiu revealed to BlockBeast.

If the market has demand, take action the next day; if the market loses interest, adjust direction immediately.

Today it may be selling water, tomorrow it may be renting a mine, and the day after tomorrow it may be a completely new business. Doing some flexible small business in the cryptocurrency circle, making quick adjustments according to market demand, and being flexible is also a good way to make a living.

After all, there are many businesses in this world that make money, but there are not many businesses that make money forever, and the cryptocurrency world is changing rapidly.

This article is sourced from the internet: Selling Bitcoin to test the waters and earning 5 figures without doing anything, the money-making philosophy of small businesses

Related: Web3 job market semi-annual report: Jobs surge after Bitcoin ETF approval

Original author: Jay Jo Yoon Lee Original translation: TechFlow Summary of key points Job postings surge after Bitcoin ETF approval: After the U.S. Securities and Exchange Commission (SEC) approved the Bitcoin ETF in January 2024, the number of global Web3 job postings increased significantly, increasing by about 20% year-on-year in the first half of 2024. Job postings increase in Asia: Job postings in Asia increased, further closing the gap with Europe. Singapore, India and Hong Kong were particularly active in hiring activity. Mainnet Job Postings in Asia: Although mainnet job postings in Asia have decreased since 2023, more and more global mainnets are expanding their recruitment in the region, highlighting Asia鈥檚 growing importance in the Web3 space. 1 Introduction A companys job openings reflect 1) the execution of the companys…