Grayscale liderini değiştiriyor. Eski kripto şirketi neden bir Wall Street dümencisi seçti?

Leo Schwartz'ın orijinal makalesi, Fortune Magazine

Orijinal çeviri: Luffy, Öngörü Haberleri

Peter Mintzberg has officially taken over as CEO of Grayscale, handing power to a Wall Street veteran at one of the oldest companies in the cryptocurrency industry. Mintzberg previously held senior positions at Goldman Sachs and BlackRock, and the appointment raises questions about Grayscale and the future direction of the cryptocurrency industry.

Under the leadership of former CEO Michael Sonnenshein, Grayscale brought traditional investors into the crypto space through its Bitcoin Trust product. Then in August 2023, Grayscale won a legal battle with the U.S. Securities and Exchange Commission (SEC), which advanced the process of the Bitcoin ETF. Sonnenshein joined Grayscale as a salesman in 2014 and became CEO in 2021.

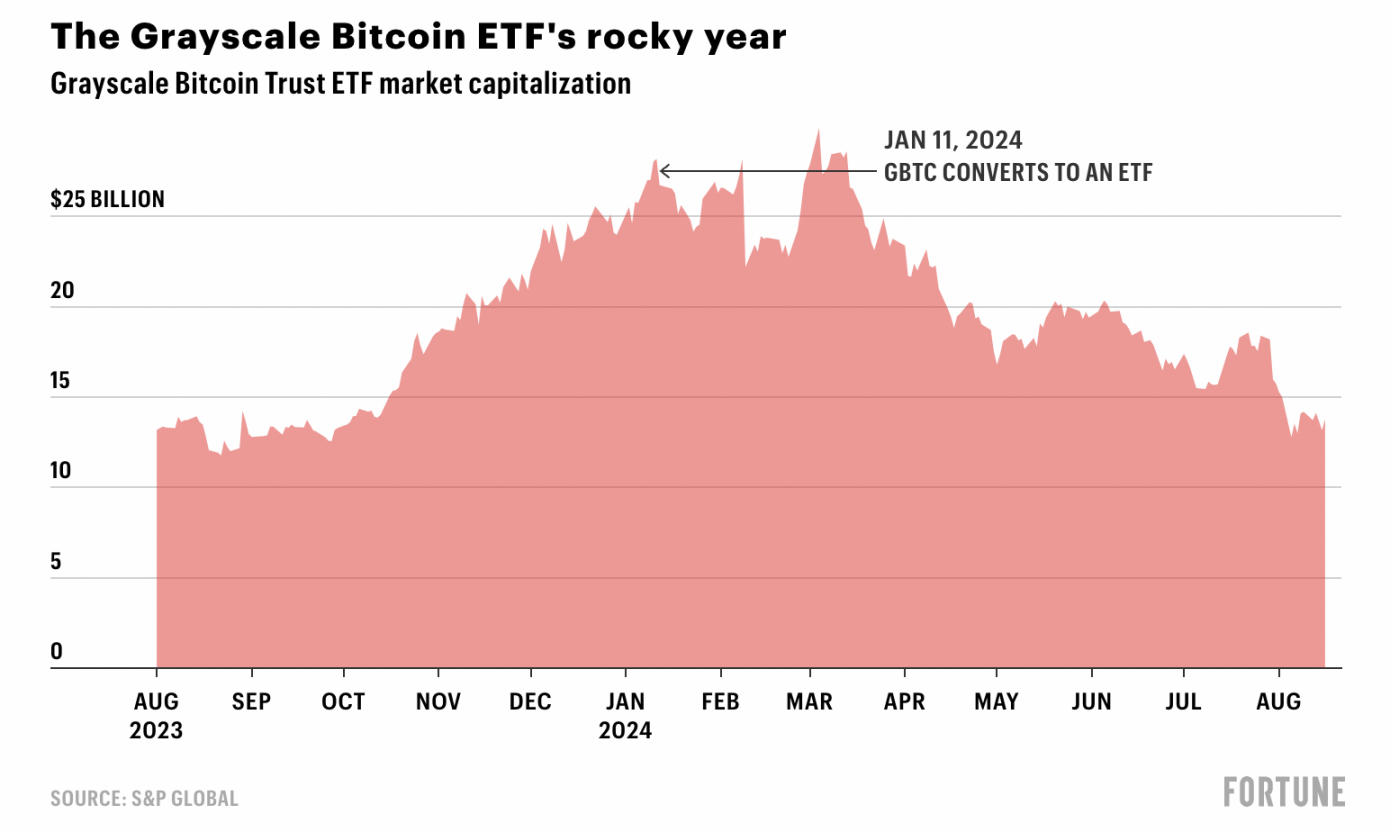

However, while Grayscale paved the way for the now-thriving Bitcoin ETF, it also forced him to face larger competitors such as BlackRock and Fidelity. Since the launch of the Bitcoin ETF in January, Grayscale has continued to outflow crypto assets managed by it. To make matters worse, its parent company Digital Currency Group (DCG) has also been busy dealing with lawsuits from the New York Attorney General and the U.S. Securities and Exchange Commission.

Mintzberg previously worked at Grayscale’s competitor for 20 years and has an impressive resume and track record in traditional finance. But as an industry outsider, it remains to be seen whether he is suitable to lead a crypto company that is trying to reinvent itself.

Peter Mintzberg, Grayscale’s new CEO

The Cryptocurrency Arms Race

When Grayscale launched the Bitcoin Trust in 2013, it created something truly novel: a way for accredited investors to gain exposure to cryptocurrency in the form of shares, which was a very attractive alternative to the many non-compliant institutions that were selling cryptocurrency directly at the time.

In 2015, Grayscale’s Bitcoin Trust began trading publicly on the over-the-counter market, creating lucrative arbitrage opportunities for qualified investors who were the first to buy GBTC (the ticker symbol for the Bitcoin Trust). These investors rushed to buy GBTC (and later trust products for assets such as Ethereum), and then resold them at a premium to retail investors who wanted to participate in the crypto craze a few months later, earning huge profits.

But the trust structure also means that investors cannot redeem their GBTC shares for the price of physical Bitcoin, and these trust products began to show a discount in early 2021. Dominoes fell, and several cryptocurrency companies such as Three Arrows Capital and FTX announced their closure the following year. To make matters worse, investors were angry that Grayscale continued to charge management fees of up to 2%.

This led Sonnenshein to sue the U.S. Securities and Exchange Commission (SEC) to force the SEC to approve its long-standing application to convert the trust product into an ETF, as ETFs would allow investors to redeem physical Bitcoin. In 2023, the court sided with Grayscale in a ruling. The ruling was hailed as a major milestone for cryptocurrency and ultimately promoted the launch of a Bitcoin ETF in January 2024.

Although Sonnenshein has led Grayscale to success, the company still faces a series of challenges. New competitors such as BlackRock and Fidelity set ETF fees at near-zero levels, but Grayscale only reduced its fees from 2% to 1.5%, and investors flocked out of Grayscale and embraced its competitors. Bloomberg analyst Eric Balchunas told Fortune: Sonnenshein is in a dilemma. On the one hand, the company needs funds, and on the other hand, it wants to remain competitive in the ETF field. This is mutually exclusive.

Grayscale Bitcoin Trust and ETF market value, source: SP GLOBAL

According to the Wall Street Journal, Grayscales board of directors and DCG began looking for a new CEO at the end of 2023, when the Bitcoin ETF had not yet received official approval, but the court victory had paved the way for it.

According to people familiar with the matter, the board’s decision to remove Sonnenshein was driven by a desire to find a more experienced leader for Grayscale’s new growth phase, enabling the company to compete with larger firms like BlackRock and Fidelity. A person close to Sonnenshein disputed that characterization, saying the decision was mutual given that Sonnenshein had been with the company for 10 years.

“Peter brings the experience, vision, and maturity of a seasoned C-level executive who has worked at some of the largest asset managers in the world,” Mark Shifke, DCG CFO and chairman of Grayscale’s board, said in a statement shared with Fortune. “Under Peter’s leadership, Grayscale is well-positioned for its next phase of growth.”

Regulatory Burden

Although Sonnenshein successfully completed the conversion of the trust product, the continued outflow of about $20 billion from ETFs has brought new pressure to the company. This momentum of capital outflow is difficult for Grayscale to bear, Balchunas said. I have never seen anything like it.

An unnamed executive at another ETF issuer told Fortune that Grayscale may be looking for a leader without the regulatory burdens of Sonnenshein, who has never been accused of any financial wrongdoing. At a time when large investment banks such as Morgan Stanley are beginning to allow advisors to recommend Bitcoin ETFs to clients, Grayscale wants its product to be included on the list of trusted products. They want someone who is experienced in this area and who doesnt have any regulatory issues, the executive said.

Grayscales old rival Valkyries chief investment officer Steven McClurg once bid to manage the Grayscale Bitcoin Trust. McClurg told Fortune that Grayscale has been working to prove its legitimacy by hiring David LaValle. LaValle, who previously worked at State Street and Nasdaq, joined Grayscale as global head of ETFs in 2021. Hiring Mintzberg represents Grayscales next move.

“Grayscale has a lot of work to do to catch up to Invesco, BlackRock and Fidelity,” McClurg said. “DCG has enough problems already, and it may be several years before they can get out of their regulatory troubles.”

Mintzbergs Arrival

Mintzberg joins Grayscale at a critical time. Grayscale has launched two key products in recent weeks, including an ethereum ETF and a “mini” version of the bitcoin ETF that charges lower fees. Grayscale had $28 billion in assets under management at the end of the second quarter, according to a letter DCG shared with shareholders this week, providing a significant revenue stream for the parent company.

However, Grayscale’s future path is unclear as its two flagship products face competition. At the time of the Bitcoin ETF launch, there were rumors that Grayscale was about to be acquired, but its high price and regulatory burdens deterred potential buyers. An unnamed competitor told Fortune that hiring Mintzberg could be seen as a commitment to keep Grayscale competitive or a strategy to improve the company’s image ahead of a potential acquisition.

Mintzberg is an experienced operator who has held strategy and investor relations roles at firms that currently offer crypto ETFs, including BlackRock and Invesco. He also led Goldman Sachs’ crypto asset strategy from 2021 to 2023, according to Mintzberg’s LinkedIn information.

Mintzberg also seems happy with this career transition. He spent his last day at Goldman Sachs last Wednesday, hours before starting his new role at Grayscale, according to a person familiar with the matter. Mintzberg declined to be interviewed for this article, keeping a remarkably low profile for an incoming CEO.

“Peter is a veteran of the asset management industry with deep expertise and leadership in driving client-centric growth strategies,” a Grayscale spokesperson told Fortune.

Born in Brazil, Mintzberg attended Harvard Business School in the late 1990s before beginning his career in asset management consulting at McKinsey.

Mintzberg was still at Invesco when Oppenheimer Funds was acquired in 2019. Loren Starr, former chief financial officer of Invesco, told Fortune that Mintzberg played an important role in helping the new company handle investor relations during a period when Invescos communications with investors were muddled together. Mintzberg will face similar challenges at Grayscale as it tries to compete with larger, cheaper rivals.

Balchunas said that in addition to expanding its product range (including new products focused on artificial intelligence), Grayscale’s main task is to use its relationships with large institutions to participate in ETF negotiations. “Sonnenshein is more famous as a crypto fund manager, while Mintzberg has a wealth of traditional financial experience and background,” he told Fortune. “If you want to cultivate the perfect CEO for an asset management company, then Mintzberg is the best choice.”

This article is sourced from the internet: Grayscale changes its leader. Why did the old crypto company choose a Wall Street helmsman?

Original author: Noah Ho , YuppieZombie , Lumos Ngok introduction In recent days, the blockchain community has witnessed significant controversy surrounding the ZkSync and LayerZero airdrops. These events have sparked widespread discussion, prompting us to pause and reflect on the current and future state of airdrops in the crypto ecosystem. This article will discuss the historical evolution of airdrops, highlight several important projects that have shaped this space, and analyze the controversial airdrops of ZkSync and LayerZero in detail. Finally, we propose some key reflections and considerations for the future of airdrops. Airdrop in blockchain In the field of blockchain, airdrop refers to the act of sending free tokens or cryptocurrencies to a specific digital wallet address. In laymans terms, airdrop is the act of a project giving away crypto…