Bir zamanlar KOL'un en önemli isimlerinden biri olan Ansem neden ününü kaybetti?

Original author: Joyce, Weird Thinking

Original translation: Jack

Last week, Ansem, a well-known trader in the Solana ecosystem, published a tweet, admitting that his recent trading level was extremely poor and he made a series of wrong decisions. He completely lost his advantage in the current market and even considered cashing out and exiting the market.

As a trader regarded by the community as the Godfather of WIF, Ansem once had thousands of times of profit on WIF, which has a market value of over 1 billion. After WIF, he also witnessed the process of BILLY, which has a maximum market value of 200 million US dollars, and BODEGN, which has a maximum market value of 300 million US dollars, starting from scratch. However, after several iterations of the meme market gameplay on Solana, Ansems golden finger halo seems to have disappeared.

What has Ansem experienced in the past few months? The public address of Ansem on the Solana network circulated in the community is AVAZvHLR2PcWpDf8BXY4rVxNHYRBytycHkcB5z5QNXYm. BlockBeats counted the meme transactions that Ansems address actively participated in from February to August 20 this year based on the on-chain data analysis tool GMGN, trying to summarize its trading patterns. 531 pure selling transactions are excluded here, which are generally tokens given by the project party rather than actively purchased by the wallet address. The remaining 2590 transactions are regarded as meme transactions actively bought and sold by the address. It should be noted that due to the data format limitations of the Solana chain, the original data may be incomplete, and the analysis results are for reference only.

WIF Starts

Before the analysis, let’s talk about Ansem’s history on meme. WIF is the most important stop in Ansem’s legendary story. On December 1, 2023, Ansem spent $472 to buy the first WIF at a price of $0.0003. Eight days later, he added another $185. After that, Ansem frequently bought and sold WIF and called out orders on his Twitter account many times.

More than four months later, WIF reached a high of $4.9, which was nearly 16,000 times the price Ansem first bought it at. Ansem also became a legendary trader and gold finger caller in the Solana community because of his ambush on WIF.

Left: Dexcreener shows Ansem’s public wallet address’s transaction records on $WIF; Right: Ansem promotes $WIF on X

Although Ansem entered the market and called orders at the early stage of WIF development, Ansem is not a typical diamond hand. From the transaction records, Ansem is used to frequent buying and selling operations, buying more than 80 times and selling 110 times. According to cielos statistics, Ansems address invested a total of US$2.14 million in WIF, sold a total of US$2.85 million, realized a profit of US$804,000, and there is still US$745,000 in profit that has not been sold.

After WIF, Ansems address has been monitored by more and more people. Accordingly, many meme project owners have transferred their tokens to Ansems address, hoping to use Ansem holdings as an endorsement of the meme.

After WIF, Ansems brilliant trading record also includes BODEN. He bought BODEN in early March, and it experienced a continuous rise for more than a month after the purchase, and finally made a profit of 540,000 US dollars. Ansem sold it soon after holding it, but the signal of Ansem is in the car spread widely on Twitter. In the data of GMGN, the token cost in several records of BODEN sold by Ansem was 0, indicating that this part of the shares came from external transfers rather than active purchases by the address.

Left: Dexcreener shows Ansem’s public wallet address’s transaction record on $boden; Right: Community discussion on Ansem’s purchase of $boden

The price of whales

What happened after WIF? According to GMGN statistics, Ansem has deposited $1.93 million of SOL in the past eight months, most of which occurred in July, with $1.32 million of SOL invested. Correspondingly, its cost of meme transactions in July was the highest, at $3.39 million. Ansems single purchase volume is not small. From April to now, its average single transaction volume is around $3,000-9,000.

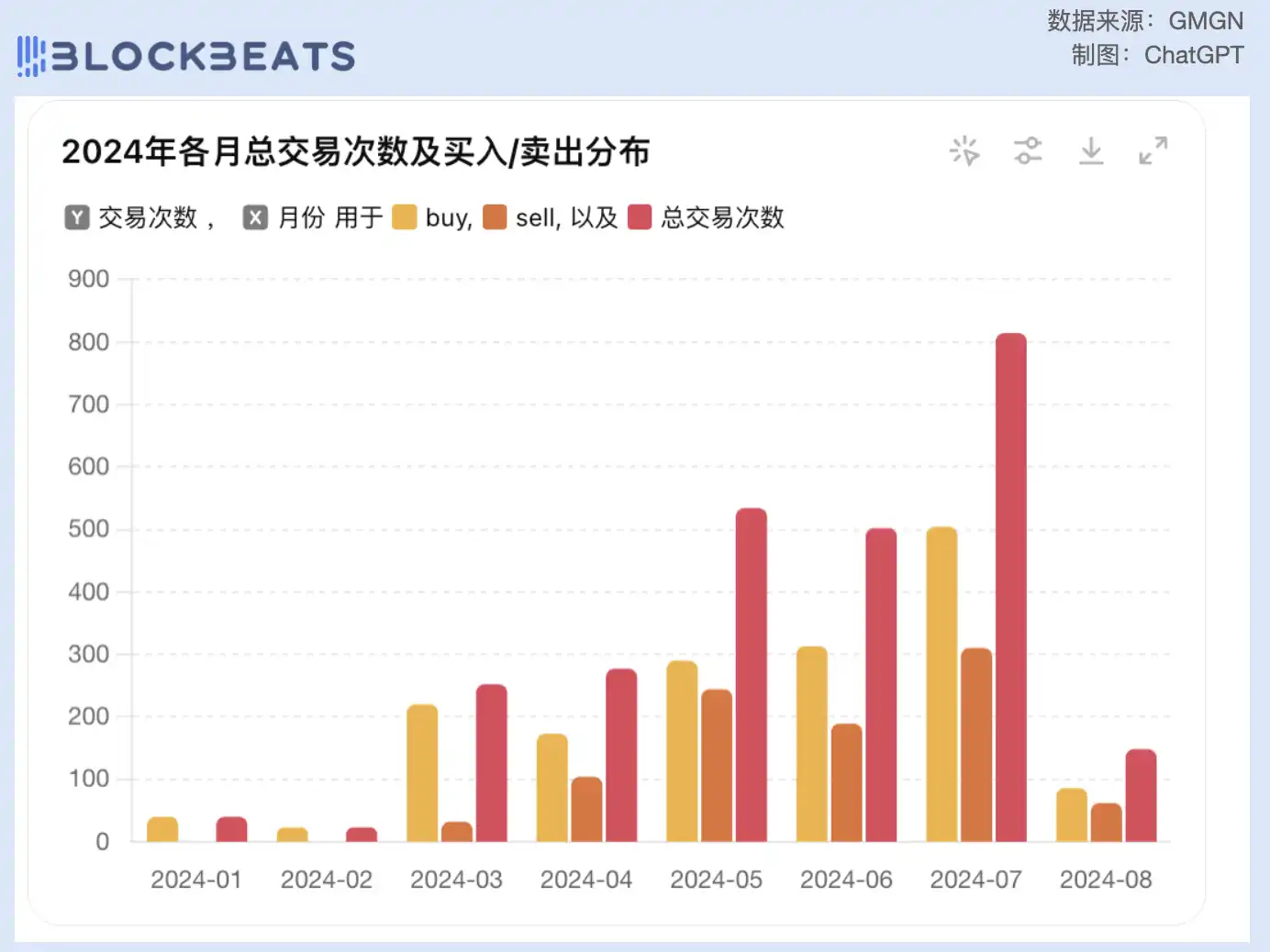

Judging from the number of transactions, Ansems transactions have been increasing over the past 8 months, with the peak of investment occurring in July, when the number of purchases reached 500 and the total number of transactions exceeded 800.

Over the past few months, high-frequency trading operations have become the survival rule for meme players in the Solana ecosystem. Many players trade more than a dozen tokens a day. It can be seen that Ansem is gradually learning to adapt to this trading style. As the number of transactions becomes more frequent, Ansem has also invested more funds into the meme market. With more capital to support it, Ansems highest single-transaction profit barely maintains an upward trend.

If the delivery time is defined as the time between the first purchase and the first sale of the same coin, the average delivery time for the tokens purchased by Ansem in January and February was 91 days and 157 days, and these tokens were not sold until April-August. After that, Ansems holding time became shorter and shorter.

Judging from the multiples, Ansem’s peak of wealth creation ended in May, and its return efficiency fell precipitously after May. The return in August was likely mainly from the meme coins he had ambushed in February. On the other hand, the ratio of Ansem’s trading operations with a profit of more than 200% to selling transactions also began to gradually increase after the precipitous drop in May. Perhaps Ansem has gradually learned to “double the investment”.

But in general, Ansems trading volume is still large compared to ordinary players, which is reflected in his trading records as slow profit taking, frequent position increases and the diamond hand habits that have not been fully adapted.

Neiro Waterloo

In August, Ansem suffered a real Waterloo, with a loss of $448,000. The losses in August mainly came from Neiro. Ansem made 28 purchases on Neiro and continued to increase his position when it fell, investing a total of $350,000, but eventually closed out his position with a loss of 77% and $270,000.

Before this, the disadvantages of Ansems trading habits had already been reflected. Ansems trading style tends to be diamond hands. He prefers to focus on a certain token and continue to bet, but it seems out of place in the current meme market. HAMMY, which was born in March, was bought and sold by Ansem for two months after its rise, with a total investment of $200,000, and finally liquidated with a loss of 5%.

In July, Ansem made a single sale of the meme coin BILLY with a profit of $21,000. BILLY was launched on June 24, and Ansem bought it shortly after the market opened, successfully waiting for the high multiple returns after it took off. The highest market value of BILLY reached $281 million, and Ansem also earned hundreds of thousands of dollars.

But after BILLY reached its peak, Ansem continued to increase his position, and his profit on BILLY continued to shrink. In the past month, Ansem has lost a total of $80,000 on BILLY, and the cumulative profit has shrunk to $107,000. As early as August 20, Ansem was still increasing his position in BILLY, and BILLY also became Ansems most traded token, reaching 255 times.

A KOLs meme business

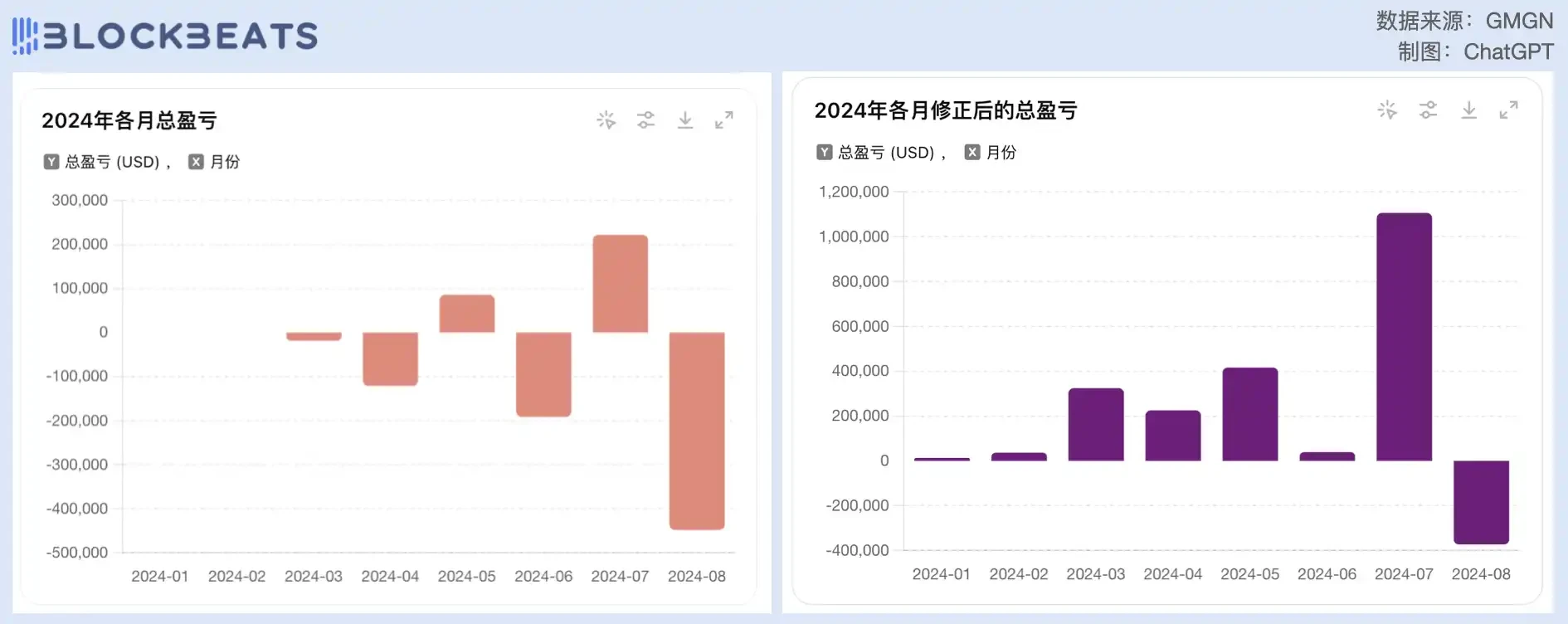

Do KOLs really lose money? If we only count the active buy and sell transaction records of Ansem’s public wallet address, based on the existing data, we will find that Ansem’s address lost $470,000 in these eight months.

However, in this calculation process, the situation where funds from other addresses were transferred to this wallet address and then sold by this wallet address has been eliminated, and the actual selling profit of this part is 2.25 million US dollars.

There are two situations in which tokens are transferred to the Ansem wallet address. One is that the project party transfers a certain amount of tokens to Ansem in order to create the selling point of Ansem holdings, and the other is that Ansems other wallet addresses buy tokens and then transfer them to the public wallet address. In either case, this part of the income is beyond the reach of ordinary retail investors.

After adding the income from external transfers, the total profit of Ansems public wallet address is 1.78 million US dollars. After becoming famous, even if the understanding and trading ability of the meme market begin to degenerate, a KOL can still use its influence to obtain considerable income.

Looking back, Ansems trading experience shows the discomforts that a lucky person who seized the opportunity to become a well-known whale experienced in the face of a rapidly changing market. There are no eternal winners in the crypto market. But on the other hand, after advancing in the food chain, Ansem no longer needs to make profits through sweeping transactions again and again. From starting with a thousand-fold WIF to tweeting self-deprecatingly retiring, Ansem seems to be out of date, but a new legendary trader is on the way.

This article is sourced from the internet: Why did Ansem, once a top meme KOL, lose his glory?

Related: DWF Labs sticks to its original aspiration despite unpredictable market environment

Against the backdrop of a cooling market environment, DWF Labs, a new generation of Web3 market maker and investment company, announced a series of growth plans and continued its commitment to driving growth and innovation. Since its inception, DWF Labs has continued to expand and plans to continue to grow steadily and aggressively in the future. The launch of the new website is one of many recent initiatives taken by DWF Labs to increase market transparency and fairness. In 2023, DWF Labs was ranked as the most active investor by Binance and a top market maker on Bybit. The company said it will continue to advance its expansion and hiring plans in 2024 and beyond, and will increase its investment even if other venture capital firms choose to withdraw or…