Orijinal yazar: Biteye çekirdek katılımcısı Viee

Original translation: Biteye core contributor Crush

Black Myth: Wukong became a top-tier game overnight, topping the Steam online rankings on the first day of its release, setting a record for the number of online users for a stand-alone game.

TON ecosystem Meme coin DOGS has been launched on Binance’s 57th new coin mining phase for the first time, and will be opened on leading exchanges such as Binance, OKX, and Gate.io in two days.

These two things should be unrelated, but one is a AAA masterpiece that took 7 years to develop and cost 400 million RMB. You play for 1 hour and they spend 20 million RMB. The other is a token that is low-cost and airdropped to spread by FOMO across the network. Nothing, and the current market value is 1 billion US dollars.

In this comparison, the willow stick in Wukongs hand is like a boomerang, hitting many Web3 people in the chest and back. One has to ask, how far is Web3 from Black Wukong? When will the source be cleared?

01 DOGS market value is 1 billion US dollars, what is its value

DOGS is a Meme token based on the Telegram platform, designed to embody the spirit and culture of the Telegram community.

The project is inspired by Spotty, the mascot created by Telegram founder Pavel Durov. This black and white dog is not only the iconic image of the project, but also represents the vitality and innovation of the Telegram community.

The DOGS project attracts Telegram users to participate through airdrops. The project team hopes to further spread Spottys image and spirit to a wider range of fields through DOGS, giving it unique cultural value.

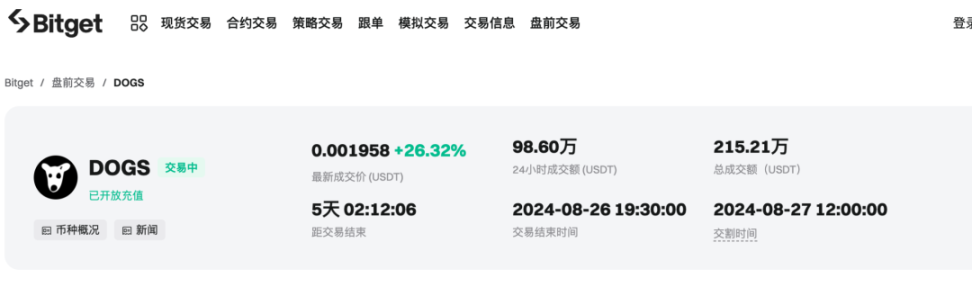

With the viral spread of social media, this black and white puppy quickly triggered FOMO across the entire network. DOGS, with its combination of Meme and TON ecology, opened the door to Binance online trading. So far, DOGS has performed well in the pre-market trading market of Bitget Exchange, with a turnover of 2.15 million US dollars, showing the markets high attention and enthusiasm for it.

Low development costs, coupled with widespread airdrops, do not seem to have the so-called value in DOGS. If there must be a secret to success, it cannot escape the rise of Meme, consensus, and TON ecology…

However, projects like DOGS, which started out as a project but have become popular, are not uncommon in the crypto industry. Short-term speculation seems to have become the norm, and it is unknown how much of this high valuation is real value.

02 Wukong concept Meme coin increased by 1,000 times, causing controversy

The myth of Meme coin has been enduring in the currency circle, and the launch of Black Wukong is no exception. This wave of Web2 traffic has been forcibly poured into the Meme coin liquidity pool in the crypto market.

MEME coins have seen an astonishing increase. According to data from Dexscreener, $Wukong issued on Tron increased by 3980% in 24 hours. Multiple MEME coins with the same name appeared on different blockchains with different increases. $WuKong on ETH also performed well.

Such a rapid market has once again hurt the hearts of Web3 people. Many projects lack a sense of value, and the lifeless market still needs this monkey to drive it. Without the presence of value investment, Meme coins have become a rare liquidity. No wonder some KOLs lamented that the cryptocurrency circle is in urgent need of a clean stream, Black Wukong.

In the past six months, there have been many debates in the market about Meme coins and VC coins. A KOL once said that MEME is like opium, which has affected the entrepreneurial direction of the Eastern crypto community. For example, Jocy, the founder of IOSG, believes that the craze for MEME is obsessed with short-term speculation, which may lead to the bursting of the market bubble.

Another voice believes that the current trend of high FDV, low circulation in the market has caused public concerns about the sustainable investment potential of the crypto market. Many people believe that these tokens are the culprit of the market decline, causing retail investors to choose to participate in MEME coins. The hot discussions around high FDV (full circulation market value) VC coins can be described as waves.

No matter which voice it is, you will find that value investing is rarely mentioned and seems to be invisible.

03 Crypto investing is a game of attention

In the crypto market, value investing always seems to stumble, and fundamental investing basically makes no money.

The logic of high performance supports high stock prices in the traditional financial market rarely holds a foothold in the crypto market. Many people wait for their altcoins to be rediscovered by the market, but in the end they find that their assets are nothing but dust blown away by the wind.

When a crash hits, we have to face the situation where the mainstream falls like a copycat, the copycat falls like a local dog, and the local dog falls like air. In this era when long-termism is constantly praised, it is repeatedly criticized in the cryptocurrency circle.

The K-lines are all ups and downs, but what has changed about human nature of greed and fear?

The answer is simple. In the crypto market, fundamentals are gradually being redefined.

Web2 projects place more emphasis on technical strength, user data and financing background, and the crypto industry also places importance on these indicators. However, no matter how much space is spent emphasizing these indicators, they may often not be as good as hot gossip, celebrity endorsements, or even negative news.

This has led to many bizarre situations: when a certain track such as MEME coin or AI becomes popular, even if the technology of a project is not outstanding, as long as it can catch up with the hot topic, it can easily attract a lot of funds.

Furthermore, if a project is recommended by a KOL, even if its strength is mediocre, it can quickly attract fans with the help of the celebrity effect.

What’s more, after being hacked or exposed in negative news, it can attract more attention because many people think that such projects are full of drama and more worth a try.

In short, in this imaginative world of cryptocurrencies, the traditional “fundamentals” are no longer applicable. Attention is the fundamental, the most inconspicuous value.

This can explain why the low-cost investment of DOGS can be worth 1 billion US dollars, and the seemingly beautiful capital power of Wukong concept Meme coin has increased by a thousand times, but it has caused controversy and reflection.

04 Sonuç

Even if there are still controversies in the current crypto market, we don’t have to be too anxious. Just as the law of survival of the fittest and elimination of the unfit, if the market no longer accepts the high FDV game rules, VCs will inevitably adjust their strategies.

Similarly, the rise of MEME coins is also the result of natural selection in the market. They can attract a large number of new users. Good projects will eventually survive in the bubble, and those air coins disguised as value coins will also be eliminated.

Regardless of whether there is a Black Wukong to rectify the situation for Web3 or not, the evolution of the market will always follow the law of natural selection and eventually reach higher heights.

We should keep an open mind and focus on truly valuable projects. As market participants re-examine value and market mechanisms continue to improve, I believe that in future competition, outstanding projects and teams will stand out and lead the industry into a more prosperous period.

This article is sourced from the internet: Black Wukong hurts Web3 people

Related: RWA 10,000-word research report: The first wave of tokenization has arrived

Original author: Will Awang, investment and financing lawyer, Digital Assets Web3; independent researcher, tokenization RWA payment. If I were to imagine how finance would work in the future, I would undoubtedly introduce the many advantages that digital currency and blockchain technology can bring: 24/7 availability, instant global liquidity, fair access without permission, asset composability, and transparent asset management. And this imagined future financial world is being gradually built through tokenization. Blackrock CEO Larry Fink emphasized the importance of tokenization for the future of finance in early 2024: “We believe that the next step in financial services will be the tokenization of financial assets, which means that every stock, every bond, every financial asset will run on the same general ledger.” Asset digitization can be fully rolled out with the maturity…