IOSG Ventures: Teknoloji devlerinin ve AI aracı yenilikçilerinin karşılaştığı zorluklar ve ikilemler

Original source: IOSG Ventures

This article is for learning and communication purposes only and does not constitute any investment advice. Please indicate the source for reprinting and contact the IOSG team to obtain authorization and reprint instructions. All projects mentioned in the article are not recommendations or investment advice.

Acknowledgements: Thanks to Wang Chao from Metropolis DAO for the valuable suggestions for revising the article!

1. The Promise of Centralized AI Agents

AI agents have the potential to revolutionize the way we interact with the web and perform tasks online. While there has been a lot of discussion around AI agents leveraging cryptocurrency payment rails, it is important to recognize that established Web 2.0 companies are also well-positioned to offer comprehensive suites of agent products.

Most of the agents of Web2 companies appear in the form of assistants or vertical tools, with only weak execution capabilities. This is due to the fact that the basic model is not mature enough and the regulatory uncertainty. The current agents are still in the first stage. They can do well in specific areas, but they have basically no generalization capabilities. For example, Alibaba International has an agent that specializes in helping merchants reply to emails about credit card disputes. It is a very simple agent that calls up data such as shipping records, generates and sends according to templates, and has a high success rate that allows credit card companies to not deduct money.

Tech giants like Apple and Google, and AI expert companies like OpenAI or Anthropic, seem particularly well-suited to explore synergies in developing agent systems. Apples advantage lies in its consumer device ecosystem, which can serve as a host for AI models and a portal for user interaction. The companys Apple Pay system can enable agents to facilitate secure online payments. Google, with its vast web data index and ability to provide real-time embedding, can provide agents with unprecedented access to information. At the same time, AI powerhouses like OpenAI and Anthropic can focus on developing specialized models that can handle complex tasks and manage financial transactions. In addition to Web2 giants, there are also a large number of startups in the United States that make such agents, such as helping dentists manage appointments, or assisting in the generation of post-treatment reports, which are very detailed scenarios.

However, these Web 2.0 giants face the classic Innovators dilemma. Despite their technological prowess and market dominance, they must navigate the treacherous waters of disruptive innovation. Developing truly autonomous agents represents a significant departure from their established business models. Furthermore, the unpredictable nature of AI, combined with the high stakes of financial transactions and user trust, poses significant challenges.

2. The Innovator’s Dilemma: Challenges Facing Centralized Providers

The innovator’s dilemma describes the paradox that successful companies often have difficulty adopting new technologies or business models, even when those innovations are critical to long-term growth. At the heart of the problem is the reluctance of existing companies to introduce new products or technologies whose initial user experience may be less sophisticated than that of their existing products. These companies fear that adopting such innovations could alienate their current customer base, which has become accustomed to a certain level of sophistication and reliability. This hesitation stems from the risk of undermining users’ long-cultivated expectations.

2.1 Proxy Unpredictability and User Trust

Large tech companies like Google, Apple, and Microsoft have built their empires on proven technologies and business models. The introduction of fully autonomous agents represents a significant departure from these established norms. These agents, especially in the early stages, will inevitably be imperfect and unpredictable. The non-deterministic nature of AI models means that even after extensive testing, there is always a risk of unexpected behavior.

The stakes are very high for these companies. A misstep could not only damage their reputation, but could also expose them to significant legal and financial risk. This creates a strong incentive for them to tread carefully, potentially missing out on first-mover advantage in the agent space.

For centralized providers considering deploying agents, the risk of customer protests is significant. Unlike startups that can pivot quickly and without much to lose, established tech giants have millions of users who expect consistent, reliable service. Any major misstep by an agent could result in a PR nightmare.

Consider a scenario where an agent makes a series of poor financial decisions on behalf of a user. The resulting outcry could erode years of carefully built trust. Users might question not only the agent but all of the company’s AI-based services.

2.2 Ambiguous evaluation criteria and regulatory challenges

Further complicating the issue is how to evaluate what is a “correct” agent response. In many cases, it’s unclear whether the agent’s response was truly incorrect or simply an accident. This gray area can lead to disputes and further damage client relationships.

Perhaps the most daunting hurdle facing centralized agent providers is the evolving and complex regulatory landscape. As these agents become more autonomous and handle increasingly sensitive tasks, they enter a regulatory gray area that can present significant challenges.

Financial regulations are particularly tricky. If an agent makes financial decisions or executes trades on behalf of a user, it may be regulated by a financial regulator. Furthermore, compliance requirements can be extensive and vary significantly across jurisdictions.

There’s also the question of liability. If an agent makes a decision that causes financial loss or other harm to a user, who should be held responsible? The user? The company? The AI itself? These are questions that regulators and lawmakers are just beginning to grapple with.

2.3 Model bias can be a source of controversy

Additionally, as agents become more sophisticated, they could run afoul of antitrust regulations. If a company’s agents consistently favor that company’s own products or services, that could be seen as anticompetitive behavior. This is particularly relevant for tech giants, which are already under scrutiny for their market dominance.

The unpredictability of AI models adds another layer of complexity to these regulatory challenges. Web2 has difficulty ensuring regulatory compliance when it cannot fully predict or control the behavior of AI. This unpredictability may lead to slower innovation in Web2 agents as companies need to grapple with these complexities, which may give an advantage to more flexible Web3 solutions.

3. Opportunities of Web3

As the capabilities of the underlying LLM model improve, agents will have the opportunity to enter the next form, with relatively high autonomy. At present, it seems unlikely that large companies will dare to touch this aspect. Helping users order a pizza may be the limit. Startup'lar may be bold, but they will face many technical obstacles. For example, the agent itself does not have an identity, and any operation requires the identity and account of the agent user. Even if the identity is borrowed, it is not easy for the traditional system to support the agent to operate freely. Web3 technology provides a unique opportunity for the development of artificial intelligence agents, which may solve some challenges faced by centralized providers. Under the Web3 system, agents can realize multiple DIDs by mastering wallets. Whether it is payment through encryption or the use of various permissionless protocols, it is very friendly to agents. When agents begin to perform complex economic behaviors, agents and agents are likely to have high-intensity interactions. At this time, if the mutual suspicion between agents cannot be resolved, the agent economic system is not a complete economic system. This is also an aspect that can be solved using encryption technology.

Additionally, crypto-economic incentives can facilitate agent discovery and provide a penalty for agents to misbehave by slashing their stake or slashing their stake. This creates a self-regulating system where good behavior is rewarded and bad behavior is punished, thus potentially reducing the need for centralized oversight and providing a level of peace of mind to early adopters of delegating financial transactions to fully autonomous agents.

Crypto-economic staking serves a dual purpose, requiring slashing when misbehaving, while also serving as a key market signal in the agent discovery process. The intuition is simple, both for other agents and for people looking for a specific service, that the more staking there is, the higher the market trust in a particular agent’s performance, and the more peace of mind users will have. This could create a more dynamic and responsive agent ecosystem, where the most effective and trustworthy agents naturally stand out.

Web3 also enables the creation of open agent markets. These markets allow for a greater degree of experimentation and innovation than trusting centralized providers. Startups and independent developers can contribute to the ecosystem, potentially leading to faster advancement and professionalization of agents.

Additionally, distributed networks like Grass and OpenLayer can provide agents with access to both open internet data and closed information that requires authentication. This broad access to diverse data sources may enable Web3 agents to make more informed decisions and provide more comprehensive services.

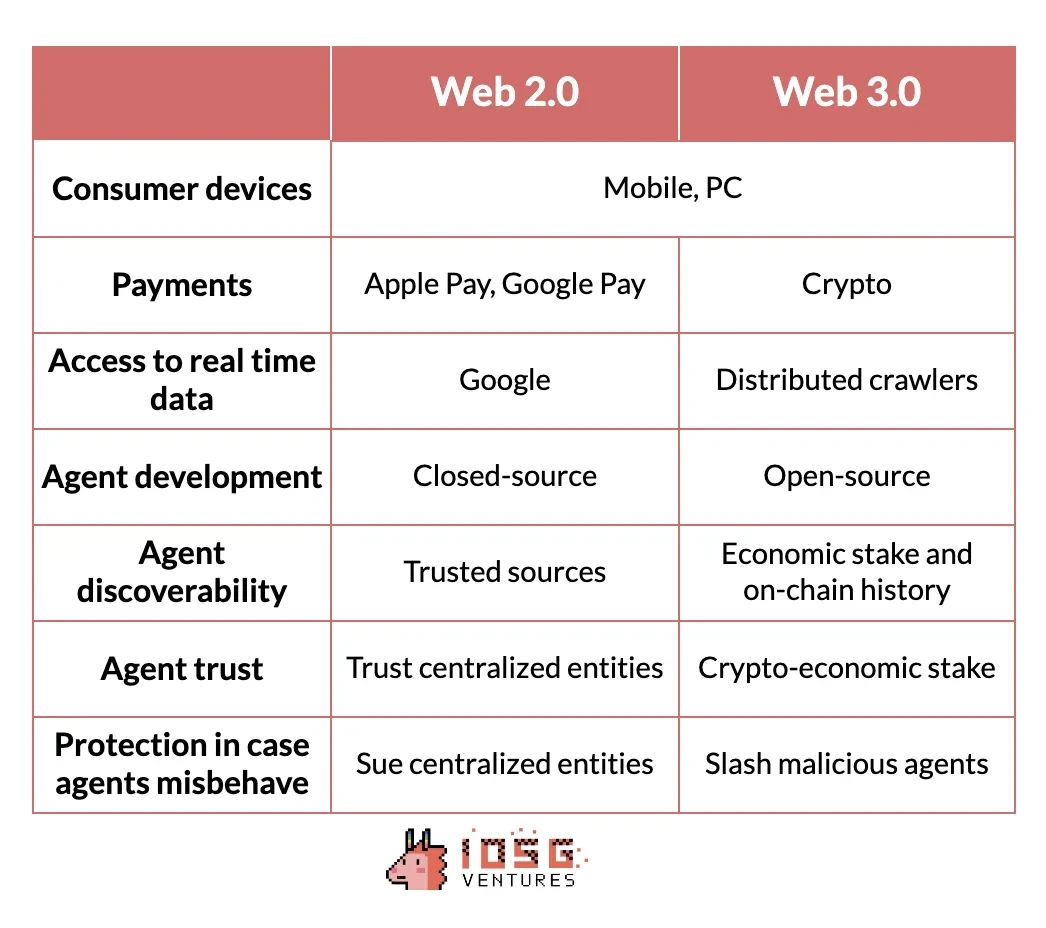

Web 2.0 vs Web 3.0

4. Limitations and Challenges of Web3 AI Agents

4.1 Limited Adoption of Crypto Payments

This post would not be complete if we did not reflect on some of the adoption challenges that Web 3.0 agents will face. The elephant in the room is that the adoption of cryptocurrencies as payment solutions for the off-chain economy is still limited. Currently, only a handful of online platforms accept crypto payments, which limits the actual use cases of crypto-based agents in the real economy. Without deep integration of crypto payment solutions with the broader economy, the impact of Web 3.0 agents will continue to be limited.

4.2 Transaction size

Another challenge is the size of typical online consumer transactions. Many of these transactions involve relatively small amounts of money, which may not justify the need for a trustless system for most users. The average consumer may not see the value in using a decentralized agent for small, everyday purchases if a centralized alternative exists.

5. Sonuç

The unpredictability of non-deterministic models has led tech companies to be reluctant to offer fully autonomous AI agents, creating opportunities for crypto startups that can leverage open markets and crypto-economic security to bridge the gap between agent potential and actual implementation.

By leveraging blockchain technology and smart contracts, crypto AI agents have the potential to provide a level of transparency and security that is difficult to match with centralized systems. This could be particularly attractive for use cases that require a high degree of trust or involve sensitive information.

In summary, while both Web2 and Web3 technologies offer avenues for AI agent development, each approach has its own unique strengths and challenges. The future of AI agents may depend on how these technologies can be effectively combined and refined to create reliable, trustworthy, and helpful digital assistants. As the field develops, we may see a convergence of Web2 and Web3 approaches, leveraging the strengths of each to create more powerful and versatile AI agents.

This article is sourced from the internet: IOSG Ventures: Challenges and dilemmas faced by technology giants and AI agent innovators

Original author: Tommy Original translation: Ismay, BlockBeats Editors Note: This article summarizes insights into the current state of the industry, from the dominance of infrastructure projects, to the waning interest of venture capital in high-valuation early-stage rounds, to changes in market narratives and intensified competition among market makers, as well as future market catalysts such as ETH ETFs, elections, and interest rate changes, providing a panoramic observation and analysis. These insights not only reveal the current state of the industry, but also provide profound thinking and foresight for future development trends. During @EthCC, I spent most of my time in 1:1 discussions with developers, VCs, and market makers. Here are my reflections on the current state of the industry: Blame the game, not the players “We love consumers, but 90%…