Stablecoin APY Kazanç Rehberi: Kripto Varlıklarınızın Kiranızı Ödemesine İzin Verin

There is a characteristic of the crypto market: everyone is talking about how to make money and how much money others have made, but few people talk about how to control drawdowns, how to deal with the stablecoins earned, and how to have a more reasonable cash flow.

After all, the crypto industry is highly reflexive. When the bull market comes, even pigs can fly, but when it is in free fall, it is like hell on earth. In the monkey market stage when there are not so many new narratives in the market, it is very likely that more mistakes will be made. At this time, it may be a good thing to be familiar with some crypto-native financial management methods and means to form a more reasonable allocation of funds.

Previously, Binance co-founder He Yi also said that financial management is a low-risk option.

In fact, not many people in the industry are talking about the financial management market. In addition to the funding issue, the main reason may be that this type of financial management is a one-time deal, and you only need to deposit funds to realize after-sleep income. There are not many angles to discuss, so more often sharing is only between some specific communities and acquaintances, just like the Benmo community in the Chinese-speaking area. Moreover, this kind of real income often has a limited ceiling, so in order to avoid dilution of income, it is less spread. But the benefits of this field are obvious. In addition to the non-existence of the take-over-losing money feature of the secondary market, it can also let you sleep like a baby.

Rhythm sorted out some APY projects that have been discussed in the community recently, mainly stablecoins and derivative tokens. Among them, the TVL of DeFi projects is more than 50 million, and explained the corresponding sources of income. The main source of DeFi is the subsidy of the protocols own tokens. CEXs financial management projects come from the cooperation between CEX and projects. Among them, the highest-yielding activity APY is as high as 200%. Although it has ended temporarily, the ideas can still be used as a reference. The following projects do not constitute investment advice and are sorted according to community popularity.

PayPal USD

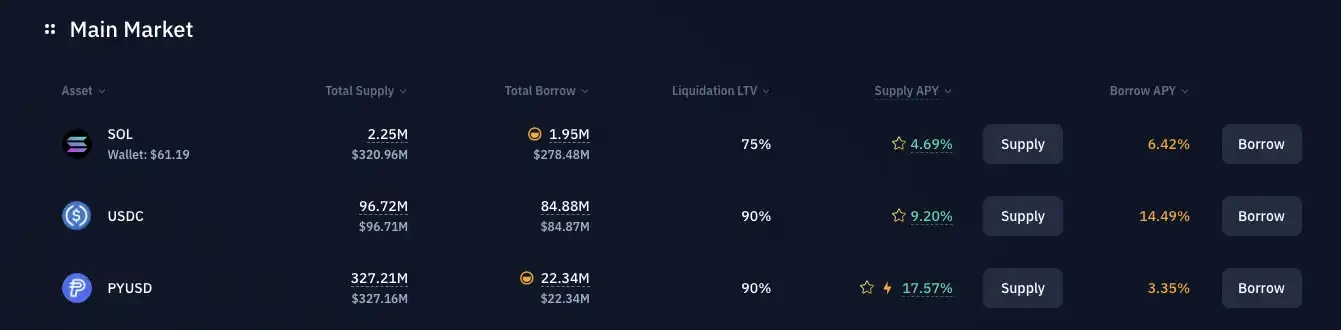

The most discussed stablecoin investment project in the community is PayPal USD (PYUSD), a stablecoin launched by payment giant Paypal and issued by Paxos. Currently, the APY yield of PYUSD on the Solana chain is generally higher than 15%. Taking Kamino, the largest lending platform on Solana, as an example, 320 million PYUSD enjoys an APY of 17.57% borrowing income, and another lending platform Marginfi has an APY of over 18%.

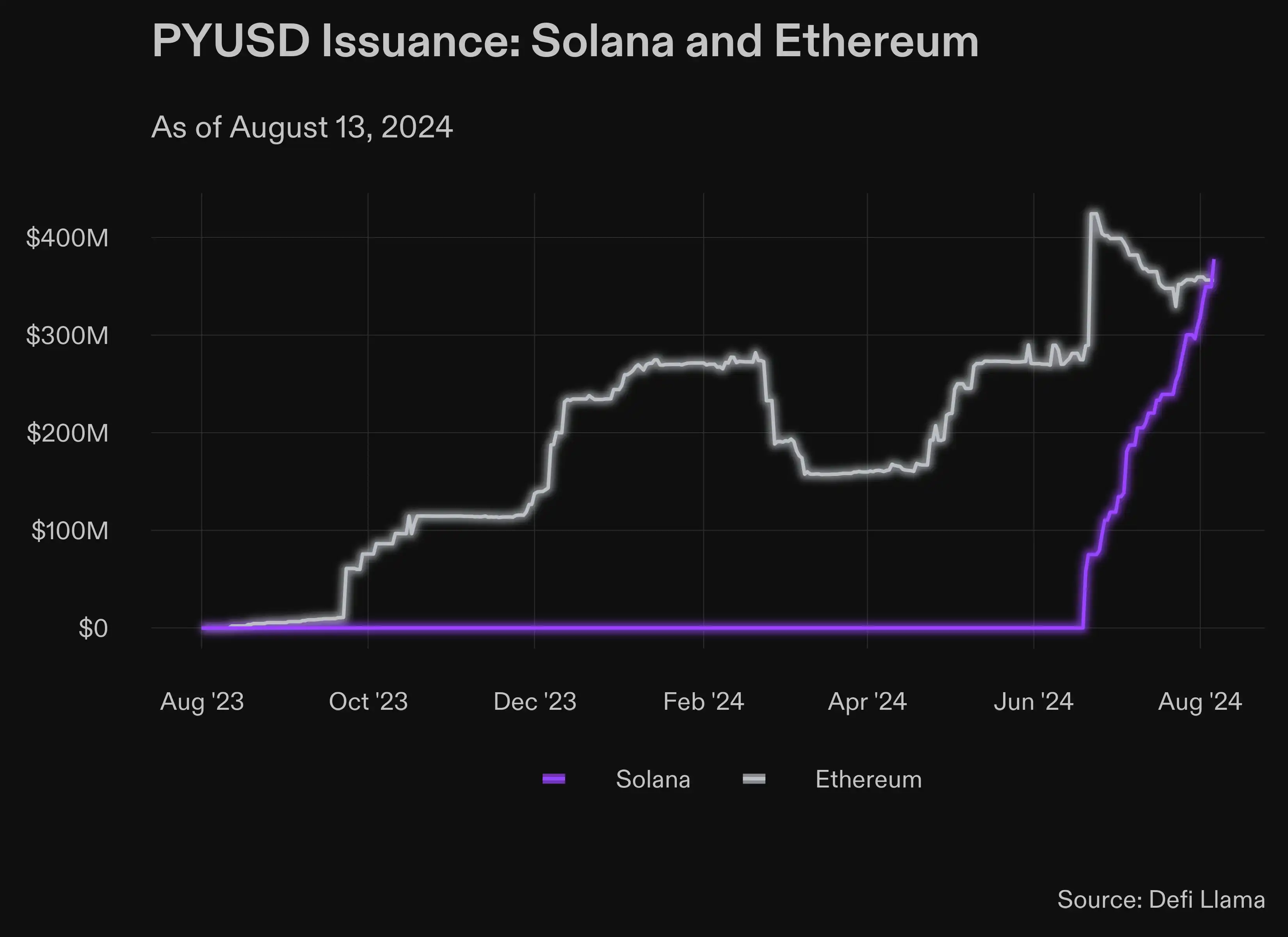

Perhaps it is related to the recent efforts of the Solana Foundation to vigorously promote payment and PayFi. According to the community, the high incentives for PYUSD on the Solana chain are provided by Solana and Paypal, but there is no clear statement about the source of the subsidy. With the endorsement of Paypal and the high interest, the issuance of PYUSD on the Solana chain surpassed Ethereum in mid-August, becoming the largest issuance platform for PYUSD.

USDC-Sui

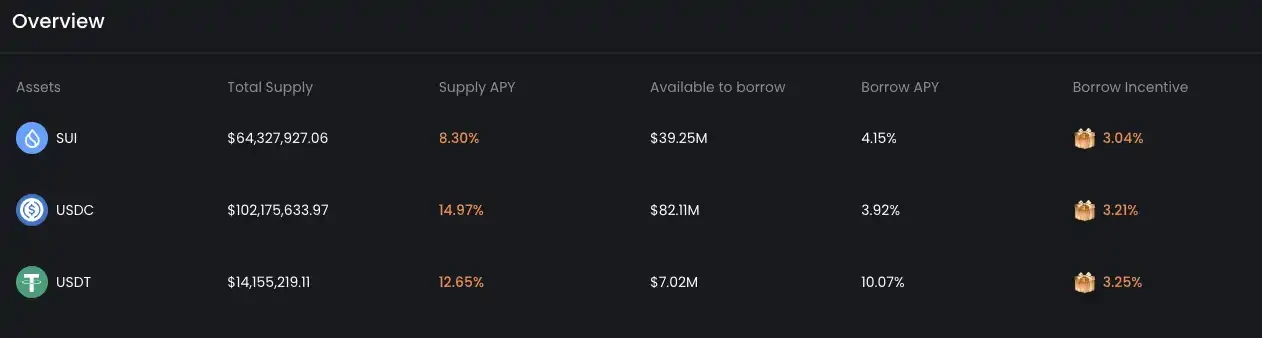

As a popular Sol Killer recently, in addition to technological development, Sui has never stopped promoting the development of DeFi on its own network. As the largest lending platform on the Sui network, USDC on NAVI currently has a TVL of over 100 million US dollars and provides an APY return of 14.9%. Similarly, most of the income comes from Suis incentives to users.

Since the current entry and exit of the USDC network requires cross-chain methods such as Wormhole, and Wormhole has performance restrictions on cross-chain, users who want to participate in the Sui network need to plan their time reasonably and have a time margin.

Bybit-USDE

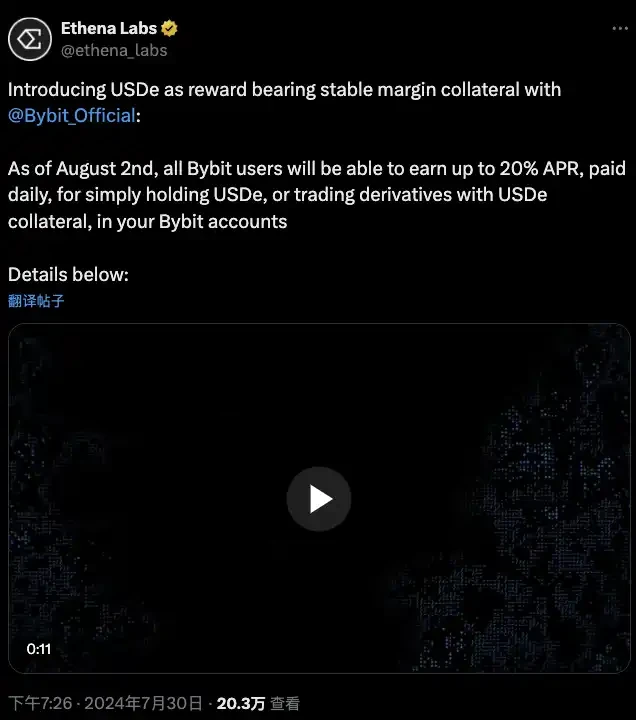

As previously reported by Rhythm, on July 30, Ethena Labs announced that starting from August 2, all Bybit users can earn up to 20% APY income, paid daily, by simply holding USDe in their Bybit accounts or using USDe as collateral to participate in derivatives transactions…

As of todays posting, Bybits USDe APY is 12.47%, which is still competitive. However, according to the event announcement, the total prize pool for this event is 3.3 million USDe. If users still want to participate in the USDe event, they should reasonably estimate the event stop time to avoid concentrated sales after the event stops, which may cause potential slippage of USDe. It is worth noting that due to the recent perpetual contract funding rate being lower than 0, the overall income of the Ethena protocol has also been greatly affected. Its official website shows that the APY of sUSDe is 4%.

Aave GHO

Aave, one of the benchmarks of DeFi protocols, is also providing incentive subsidies for its stablecoin GHO. The incentive plan has increased GHOs APY to more than 20%. Currently, about 75 million GHO is staked in it.

After staking GHO, users need to claim this part of the incentive reward on the merit interface built by the community.

But it is worth noting that the unlocking period of GHO pledged to the protocol is 20 days, which makes the liquidity flexibility of GHO less than that of other protocols.

Binance-TON

Binance Launchpool not only launched Toncoin, but also launched a series of financial activities related to TON. The most notable one is the Super Earn activity that has ended. The activity provides TON holders with a high annualized APY of 300%, even if each user only deposits a maximum of 1,350 TONs and the activity market is 20 days. But the expected income is more than 200 TONs. As expected, Super Earn reached the subscription limit within a few minutes after it was opened.

Since this activity requires the deposit of non-stable coins, as an optimization method, users can pledge stable coins on CEX to borrow Ton, and get this APY without considering the rise and fall of Ton. If you are a DeFi Degen, you can pledge USDT on the Ton network to borrow Ton. In this case, you don鈥檛 even need to pay the borrowing APY, because USDT鈥檚 APY is higher. This method can be widely used in scenarios that require non-stable coins.

The above article summarizes some of the ways of stable financial management that are highly discussed in the community. As for ways to earn higher APY returns, such as DeFi鈥檚 second pool and the airdrop gameplay of LuMao Studio, the stability of the returns, the source of returns, and the time of redemption are uncertain, so they are not involved yet.

By continuously looking for risk-free returns like this, any user familiar with cryptocurrencies will have the opportunity to participate and enter a Fire-like state where income covers daily expenses. I hope that this basic stablecoin APY income strategy will allow everyone to have the last piece of land for themselves while facing the anxiety of the myth of getting rich quickly.

This article does not constitute investment advice. Users should consider whether any opinions, views or conclusions in this article are suitable for their specific circumstances. Investing based on this information is at your own risk.

This article is sourced from the internet: Stablecoin APY Earnings Guide: Let Your Crypto Assets Pay Your Rent

İlgili: Derinlemesine analiz: L2'de MEV ölçeği ne kadar büyük?

Orijinal yazar: sui 14 Orijinal çeviri: Ladyfinger, BlockBeats Editör Notu: Bu makale, Dencun yükseltmesinin Ethereum L2 ağı üzerindeki etkisini derinlemesine analiz ediyor, yükseltilen L2 ağının işlem maliyetlerini azaltma, kullanıcı etkinliğini ve varlık girişlerini artırma konusundaki olumlu sonuçlarını ortaya koyuyor ve MEV etkinliklerinin neden olduğu ağ tıkanıklığı ve yüksek geri alma oranı gibi olumsuz etkilere dikkat çekiyor. Makale, topluluğun dikkatini çekmeye ve Ethereum ekosisteminin sağlıklı gelişimini desteklemek için L2 özelliklerine uyum sağlayan MEV çözümlerini birlikte geliştirmeye çağırıyor. Giriş Bu yazıda, L2'nin mevcut durumuna ilişkin veri odaklı bir genel bakış sunmayı amaçlıyoruz. Mart ayında L2 için Dencun yükseltmesinin gaz ücreti indiriminin önemini izliyoruz, bu ağlardaki etkinliğin nasıl evrildiğini inceliyoruz,…