Dikkat Ekonomisini Benimsemek: TON, Solana ve Base Ekosistem Düzenine Genel Bakış

Original author: YBB

Orijinal çeviri: Yerel Blockchain

The current development path is shifting from competing for TVL and building the DeFi ecosystem to focusing on the attention economy. In Web3, SocialFi and Meme represent the attention economy, while TON, Solana, and Base stand out.

TON has great potential, and mini-games and mini-apps are gaining unprecedented attention and attracting the attention of major trading platforms. Solanas Blink has many potential problems and is difficult to achieve widespread adoption. Base has grown steadily under the management of Coinbase.

The best economic models may not require any economic models at all; once something can be calculated accurately, its lifespan and upper limits become limited.

1. Embrace the attention economy

After Ethereum completed the transition from 0 to 1, the entire industry fell into the dilemma of how to go from 1 to N. Most of the articles this year focused on how the infrastructure can solve the lack of modularity, while there was less discussion on applications and ecosystems. In a previous article, we mentioned that the reason for the lack of applications is that Layer 2 is still not enough to support the emergence of super applications. In addition to the limitations of the virtual machine and the TPS cap, most Layer 2s are still focused on how to extract the most value from the main chain through incentives and the DeFi ecosystem, aiming to quickly dominate TVL. This templated approach will only lead to faster, cheaper, but less liquid Ethereum clones that fail to provide a unique user experience.

In contrast, new ecosystems like TON, Solana, and Base are driving real on-chain prosperity by embracing the attention economy. According to Wikipedias definition, the attention economy aims to attract the attention of as many users or consumers as possible and cultivate potential consumer groups to obtain the greatest commercial benefits in the future. In this economic state, the most important resource is neither traditional monetary capital nor information itself, but public attention. Only when the public notices a product can they become consumers and buy it. A key way to attract attention is visual appeal, which is why the attention economy is called the eyeball economy.

In Web2, platforms like YouTube, Twitter, Google, and TikTok are classic examples of the attention economy. A simple question: have you ever paid to use these platforms? Most likely your answer is no. However, you may have noticed that these platforms keep pushing ads for your favorite products to you. This is because someone is buying your attention, and converting traffic into products is one of the main sources of revenue for these platforms, supporting trillion-dollar Internet giants.

In Web3, SocialFi and memes are representatives of the attention economy. We will not discuss memes in detail here, but focus on SocialFi. Whether it is friend.tech or Solanas Blinks, I classify them as SocialFi. Even TON can be regarded as a social application chain. The form of these entities – whether projects, components or blockchains – is not important. Their ultimate goal is to convert public traffic in traditional Web2 social media into private traffic. This is consistent with what I wrote when discussing non-financial applications more than a year ago: the best Web3 non-financial applications should learn from Web2, rather than rebuild applications that have been proven to be ineffective in Web2.

2. TON

1) Architecture

TON was originally designed to enable seamless payments and mini-program operations on Telegram, rather than traditional DeFi applications. This is also the fundamental reason why its TVL is significantly lower than other major blockchains. The choice to build a blockchain instead of embedding mini-programs and payment functions like WeChat stems from the monetary and regulatory consistency challenges faced by Telegrams globally dispersed user base. In this case, the blockchain can effectively serve as a source of trust. The following is a brief overview of the TON architecture:

Multi-chain structure: TON adopts a multi-chain architecture, consisting of a masterchain and multiple workchains. This structure allows different types of transactions and applications to be processed in parallel on different chains, greatly improving the overall throughput.

Mainchain: The mainchain is the core of the TON network, storing the network configuration and the final status of all working chains. It maintains the active list of validators, their stakes, active working chains and related shard chain information.

Workchain: Workchains are customizable blockchains optimized for specific types of transactions or use cases. Each workchain can have its own rules, consensus mechanism, and token economic model.

Shard Chain: Each work chain can be further divided into up to 2 ⁶⁰ shard chains. This extreme sharding capability enables TON to handle a large number of concurrent transactions.

Dynamic Sharding: TON uses dynamic sharding technology to automatically split or merge shard chains according to network load to maintain the optimal scale and efficiency of each shard chain.

Hypercube Routing: TON uses hypercube routing technology to enable efficient communication between shard chains, ensuring smooth transactions within the entire ecosystem.

Validator Network: TON uses the Proof of Stake (PoS) mechanism, and validators participate in network maintenance and transaction verification by staking Toncoin.

TON DNS: TON includes a domain name system that assigns readable names to accounts and smart contracts, improving usability.

TON Storage: Based on technology similar to BitTorrent, TON provides a decentralized file storage solution.

TON Proxy: Provides decentralized VPN and TOR-like services with enhanced user privacy and censorship resistance.

TON Payments: Similar to the Lightning Network, it has a payment channel system that can efficiently process micropayments.

TON Service: Provides a platform for developers to deploy applications and smart contracts.

This complex architecture theoretically allows TON to scale infinitely, processing millions of transactions per second from billions of users, while maintaining high speed, low fees, and decentralization, providing infrastructure for a variety of applications and use cases. However, in addition to the above-mentioned DeFi-unfriendly issues, this architecture also faces challenges of centralization and complexity.

2) Mini Games

The launch of Notcoin on Binance has ignited the craze for Tap-to-Earn mini-games in the TON ecosystem. From the perspective of traffic distribution, Tap-to-Earn is extremely successful. In addition, Binance Labs, in its first investment after nearly six months of silence, also bet on TONs mini-game ecosystem. Although this may be mainly to attract new users to the trading platform, Binance, as the industrys biggest weathervane, at least shows that they are confident that Notcoin will not be the last hit.

So, back to the core question: Is the model of airdrops plus mini-games sustainable? Most people may have encountered a popular WeChat mini-game Sheep Sheep in 2022. The game guides users through an extremely simple first level, but significantly increases the difficulty in the second level. Users frustration, strong sense of competition with friends, and desire for game props and extra lives led to users frantically sharing and watching ads within WeChat. The social spread, coupled with some special factors at the time, made this game the most popular phenomenon of the year, with daily advertising revenue reportedly approaching 5 million RMB.

In short, the monetization path of a successful mini-game should maintain user stickiness through addictive gameplay, and then realize monetization through advertising or in-game purchases, that is, game-advertising/purchase-monetization/exit. Is this easy to achieve in Web3? I think it is very difficult and unsustainable. At present, many projects are purchasing mini-game source code, trying to combine airdrop expectations with this traditional path to form a closed loop, or distributing traffic through trading platform referral codes without advertising, optimistically hoping to get rich through Token. However, my direct impression of most current Tap-to-Earn games is homogenization-studio airdrop brushing-lack of user stickiness-Token issuance and death. Once this model is exposed, only a few high-quality projects will remain, and most projects will not be able to control witch attacks and ultimately fail to recover costs.

From a retail investors perspective, I still think that moderate participation is worth a gamble, and the cost of participation is almost zero. In addition, I personally believe that Binance intends to use its influence to create multiple blockbuster projects similar to STEP. Most projects in the TON ecosystem are highly consistent with the project preferences of major trading platforms-low market capitalization and many users. NotCoin is also the only small project that was launched on both OKX and Binance during this cycle. Its price has almost risen wildly after listing, coupled with Binances current attitude towards TON (recently announced that Binance holders will airdrop Banana Gun). These signals remind me of the early STEP N era. Of course, Binances ultimate goal is to consume a large number of projects to support BNB. As for sustainability, it doesnt matter, as long as it can break out.

3) Mini Programs

Mini Programs have always been one of the most promising directions in my opinion. For Web3, this is an interesting attempt to achieve mass adoption. There is no need to elaborate on the potential of Mini Programs – we can see the answer from WeChat. Simply put, Mini Programs have an advantage over WeChat in terms of coverage and application flexibility. Imagine a simple scenario: a small or medium-sized e-commerce platform wants to expand to multiple countries and needs to provide subsidies to users. Using traditional local social applications will bring huge promotion and time costs. With TON, the platform can effectively track task completion while maintaining transparency and at a much lower cost than traditional methods, fully demonstrating the bottom-up advantages of blockchain.

4) One of the best abstraction layers in Web3

This year, Solanas Meme Summer not only promoted itself, but also made TG BOT (Telegram robot) popular. The daily transaction volume of top BOT can reach billions of dollars. Web3 dapps usually perform poorly in terms of user accessibility, leading to the emergence of many abstraction layer projects. These projects often use chain agnosticism as their slogan, but in fact, the higher the level of abstraction, the more complicated it tends to become, and it is impossible to find a balance between security and usability. In my opinion, there are only three projects that really provide user-friendly access to on-chain activities: OKX Web3 Wallet, UXUY and TON.

The first two projects need no introduction. During the inscription boom, they won the favor of a large number of users with the most user-friendly mobile experience, making a key contribution to the prosperity of the inscription ecosystem. However, TG bot is unique. It is not an officially developed application, but created by an individual project. It supports snapping up and trading platforms with Tokens on major blockchains, and the operation is more convenient and faster than the web version. It is extremely friendly to the mobile experience of both developers and users. This concept can be extended to many ideas, such as introducing the DeFi ecosystem of external chains, and introducing chain games and task platforms in the form of mini-programs. Many projects are exploring this, and there are decentralized implementation methods. Perhaps in the near future, we will achieve true chain independence within TG.

3. Solana Blinks Actions

1) Architecture

From a technical perspective, Blinks and Actions are not overly complex. The motivation for developing these tools stems from Solana’s observation of the huge potential of the attention economy during Meme Summer and the importance of lowering the barrier to entry for users. Similar to TON, Solana aims to use social media as its “second layer”. The following is an excerpt from our previous research report to discuss the architecture of these two components:

A. A ctions( Solana A ctions)

Official definition: Solana Actions are standardized APIs that return transactions on the Solana blockchain that can be previewed, signed, and sent in a variety of contexts, including QR codes, buttons + widgets (user interface elements), and websites.

In simple terms, Actions can be understood as pending transactions. In the Solana network, Actions are an abstract representation of the transaction processing mechanism, covering transaction processing, contract execution, and data operations. Users can use Actions to send transactions, including token transfers and purchases of digital assets. Similarly, developers use Actions to call and execute smart contracts to implement complex on-chain logic.

Solana handles these tasks through transactions, each of which consists of a series of instructions executed between specific accounts. By leveraging parallel processing and the Gulf Stream protocol, Solana forwards transactions to validators in advance, reducing the delay in transaction confirmation. With a fine-grained locking mechanism, Solana is able to process a large number of conflict-free transactions simultaneously, significantly improving system throughput.

Solana uses a runtime to execute transactions and smart contract instructions, ensuring the correctness of inputs, outputs, and states during execution. Transactions wait for block confirmation after initial execution and are considered final once confirmed by a majority of validators. Solana can process thousands of transactions per second with a confirmation time of less than 400 milliseconds. The Pipeline and Gulf Stream mechanisms further improve the throughput and performance of the network.

Actions are not limited to specific tasks or operations; they can be transactions, contract executions, data processing, etc. These actions are similar to transactions or contract calls in other blockchains, but have unique advantages in Solana: due to Solana’s high-performance architecture, Actions are efficient, low-latency, and flexible in performing a variety of complex operations, including smart contract calls and data storage/retrieval (more details in the extended link).

B. B links(B lockchain Links)

Official definition: Blinks can convert any Solana Action into a shareable, metadata-rich link. Blinks enables clients that support Action (browser extension wallets, robots) to display more features to users. On the website, Blinks can immediately trigger a transaction preview in the wallet without navigating to the decentralized application; in Discord, the robot can expand Blinks into a set of interactive buttons. This enables any web interface that displays a URL to achieve on-chain interaction.

Simply put, Solana Blinks can convert Solana Actions into shareable links (similar to http). Supported wallets include Phantom, Backpack, Solflare wallet, etc. It can transform websites and social media into on-chain trading venues, allowing any URL to directly initiate Solana transactions.

The main goal of Actions and Blinks is to “httpify” Solana’s on-chain operations and integrate them into Web2 applications like Twitter.

2) Application Examples

The following are some examples from 33 use cases compiled by @starzqeth:

A. Sending red envelopes on social media Author: @ zen 913

B. Promote memes through Blink Author: @ MeteoraAG

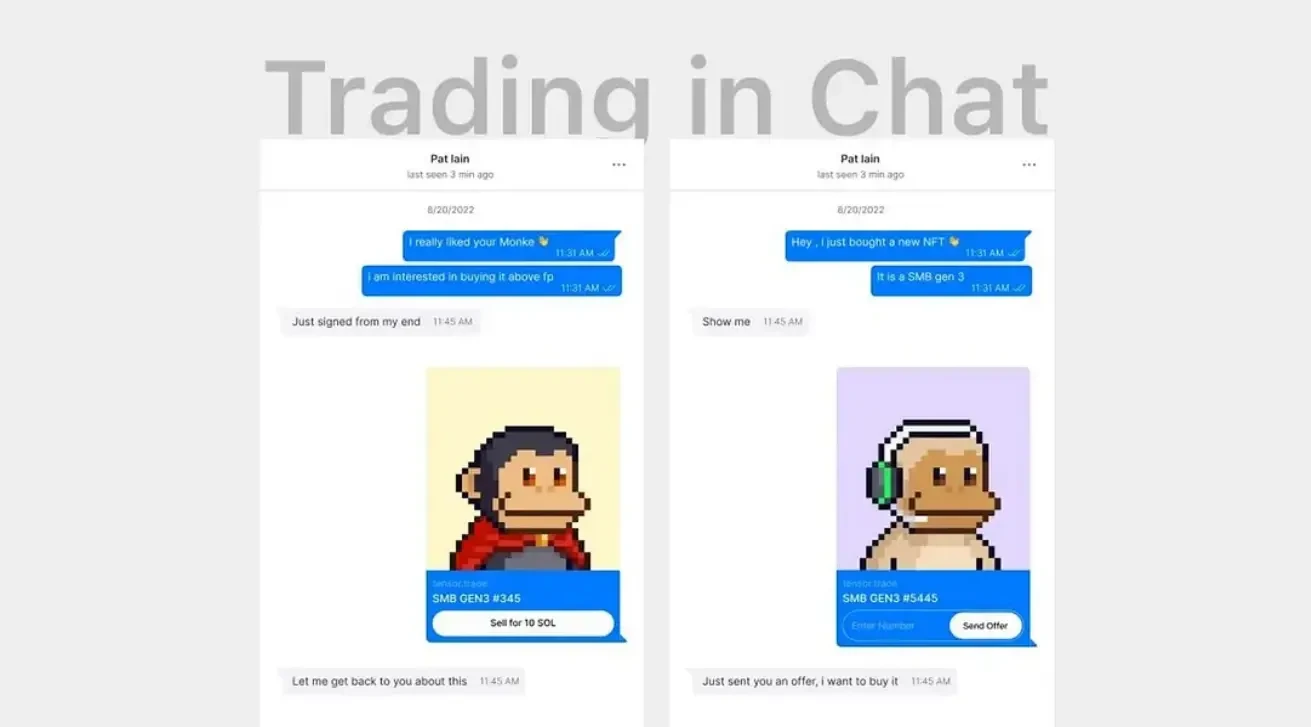

C. Trading in private messages Author: ft. @tensor_hq

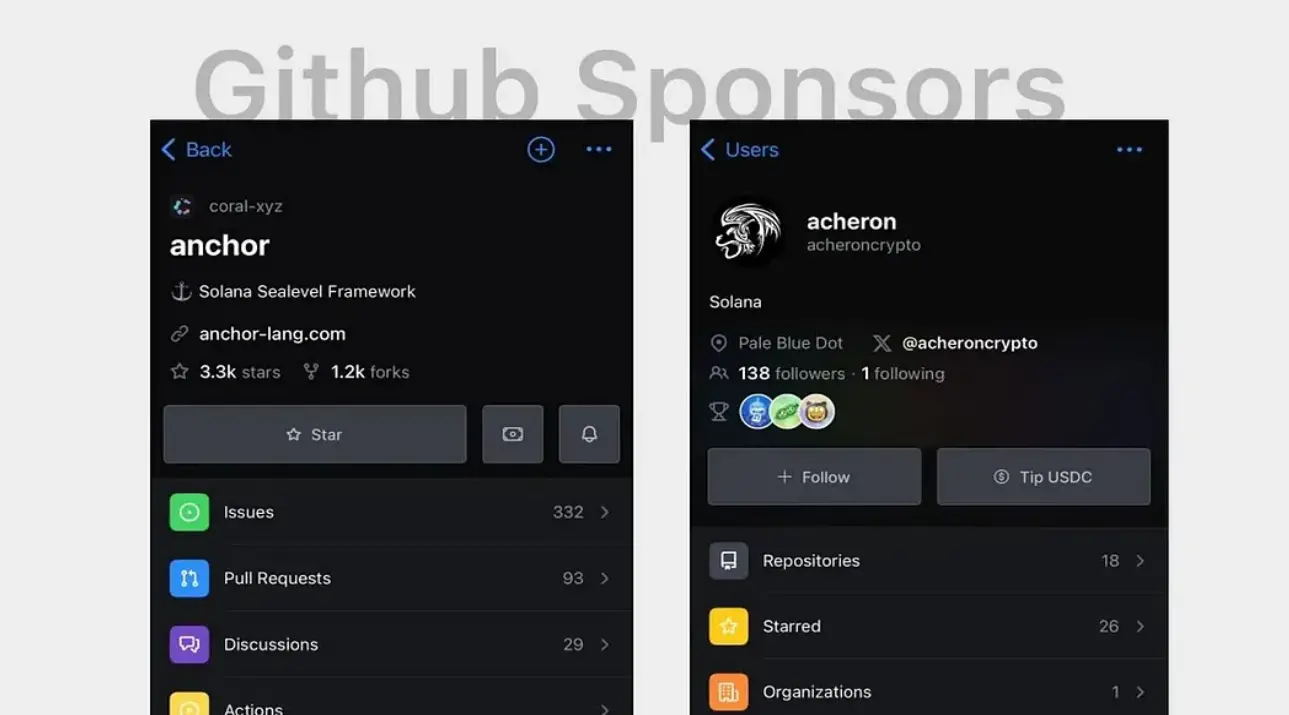

D. Tip the author on social media: @ zen913

3) Security issues

Although Blink looks cool and has gained some attention in the community recently, its actual usability still has a lot of room for improvement. First of all, the feature is not friendly to mobile users. In addition, each operation requires redirecting to a detailed web page to link the wallet and sign the transaction. The tight integration with the wallet significantly increases the risk. Do you dare to sign and complete the transaction through a link posted by a stranger?

Compared with TON, Blinks advantage lies mainly in wider and simpler dissemination, but it lacks the integrated experience of TG + TON. In terms of security, Blink is not just a matter of decentralization; it relies entirely on wallet checks to solve the problem. Therefore, Blink is currently more like an experiment, providing ideas for other blockchains, but there are still many security issues that need to be solved.

4. Base

1) The rise of token-free

The architecture of Base may be familiar to many, so I wont go into detail here. Similar to TON, Base also has a strong backer. Its rise is similar to Solanas current success, relying on memes to start and succeed without token incentives, purely based on the promise of wealth. Initially, Friend.tech attracted a large number of users, and after separating from Friend.tech, Base has its own Farcaster to rely on. Coinbase obviously knows how to operate a blockchain network.

2) Farcaster

Farcaster provides an alternative solution to SocialFi. In short, Farcaster is an open social protocol framework that allows developers to build a variety of social applications, just like the email protocol supports multiple clients. Its outstanding feature is interoperability, which aims to interact seamlessly with other blockchain networks and facilitate the smooth exchange of information and assets between different platforms. This makes it possible to build multiple social media dapps on the Farcaster protocol, such as the popular Twitter-like platform Warpcast.

3) Application Examples

This section refers to the work of Wilson Lee, a core contributor to the Biteye community.

A. Warpcast

Warpcast is the core application under the Farcaster protocol and the first Farcaster client. It was developed by a top engineering team formed by Dan over a period of one year. Its overall architecture is similar to traditional Web2 social software, providing a smooth user experience and currently accounts for 90% of the Farcaster protocol traffic.

The registration process for Warpcast is very simple; the system automatically generates a wallet for the user, all Warpcast accounts are associated with a Farcaster ID, and the generated content is stored in the Farcaster center. This design makes it easy for non-crypto users to enter the on-chain world, greatly reducing the cognitive threshold for new users. Users who are familiar with on-chain interactions can also link their commonly used crypto wallets. These adjustments make Warpcast more user-friendly and promote the growth and acceptance of the Farcaster ecosystem.

B. Jam

Jam is a creator economy platform based on Farcaster that allows users to convert each tweet on Warpcast into an NFT asset similar to Friend.tech Key. Users can buy and sell each tweet, and the price is determined by the bonding curve below.

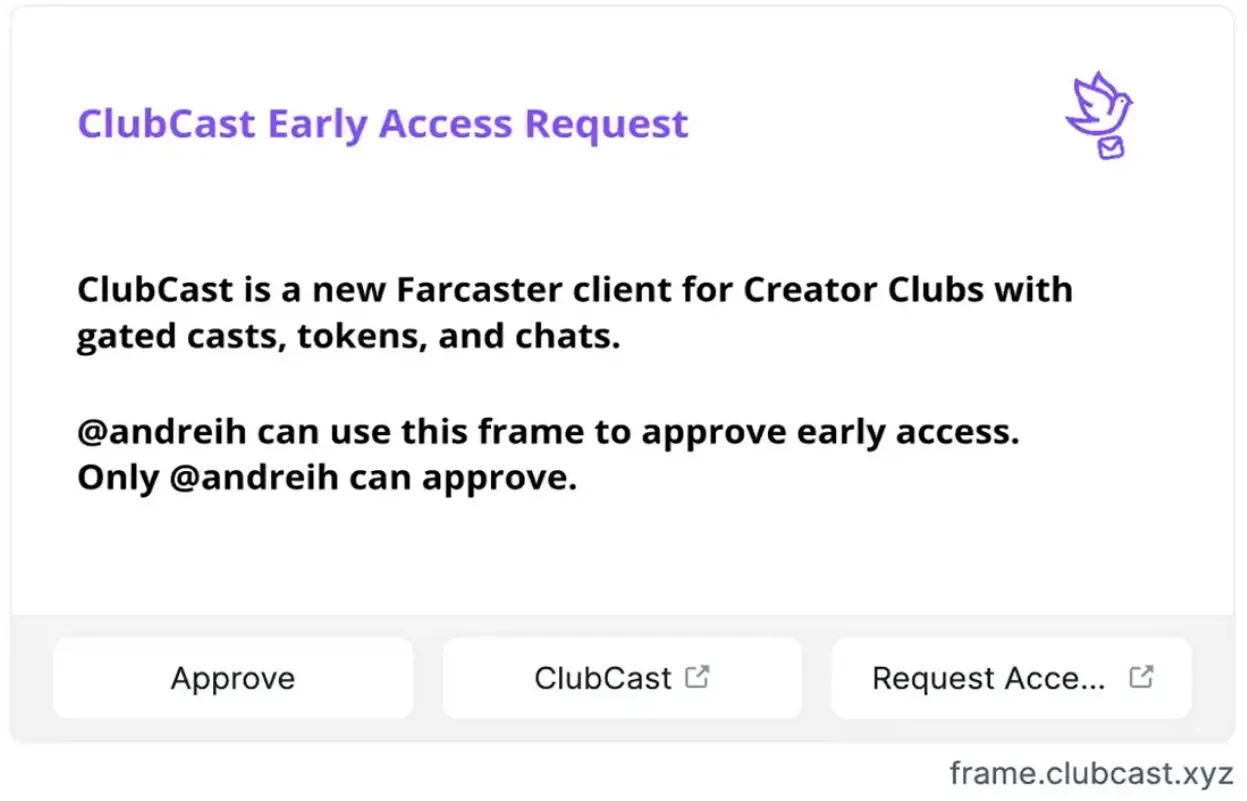

C. Club cast

Club cast is an application on Farcaster, similar to the knowledge sharing platform Zhihu, which has launched the Token-Gated Casts feature. Users must pay to purchase other users Club Tokens to unlock hidden content on clubcast.xyz or Frame. Currently, developer permissions are required to use this feature.

4) The best economic model may be no economic model

Base aims to consolidate itself through the various Social Fi applications provided by Farcaster. Unlike TON and Blinks, which mainly attract users from Web2 and convert them, Farcaster is a more traditional Web3 social protocol. The protocol includes lightweight applications that enhance the functionality of Web2, as well as more complex applications designed to rebuild social interactions. These two types of applications are more closely related to Fi, which means that they first need to solve the problems of content pricing and economic model design. Complex applications also face the challenges of content scarcity and user scarcity.

We have discussed the problem of complex applications at the beginning of this article, so how should we think about the problem of economic model design? From Friend.tech to Pump.fun, the best economic model may be no economic model at all, allowing content to develop freely without presetting pricing curves. At the peak of Friend.tech, there was a lot of discussion about the Key pricing model. Once something can be accurately calculated, its life cycle and upper limit become limited, which is exactly the case with Friend.tech.

This article is sourced from the internet: Embracing the Attention Economy: An Overview of the Ecosystem Layout of TON, Solana, and Base

Original author: Huo Huo On August 5, the Bank of Japans interest rate hike triggered a violent shock in the global financial market. Japanese and US stocks collapsed, the Bitcoin panic index in the crypto market soared by nearly 70%, and many stock markets in various countries were circuit-breakers. Even European and emerging market stock markets also suffered a significant blow. Under the huge market pressure, people began to seek a good way to alleviate the situation and called on the Federal Reserve to cut interest rates to save the market. The Feds interest rate hike may come soon, which means that a bigger rate hike than the Bank of Japan is coming. Can it pull Bitcoin back to the bull market? Why does the Federal Reserve have such a…