Orijinal yazar: Frank, PANews

Sui has been very popular on social media recently. Many people compare Sui to the Solana killer and make many analyses of Suis network performance and the K-line trend of the SUI token. A bullish sentiment on SUI seems to be spreading. But is this statement really tenable? How is Suis ecological development?

The identity behind the millions of big Vs who are bullish is the director of Sui Foundation

The earliest comment on the bullishness of SUI came from Raoul Pal, founder and CEO of Real Vision, who has millions of followers on Twitter. On August 9, he sent a series of tweets on Twitter. After comparing the trend charts of SUI tokens with the governance tokens of several other mainstream public chains, he concluded that: $SUI is starting to become very interesting from a price perspective. Although it is still early and unconfirmed, it has shown signs of a breakthrough compared to most tokens.

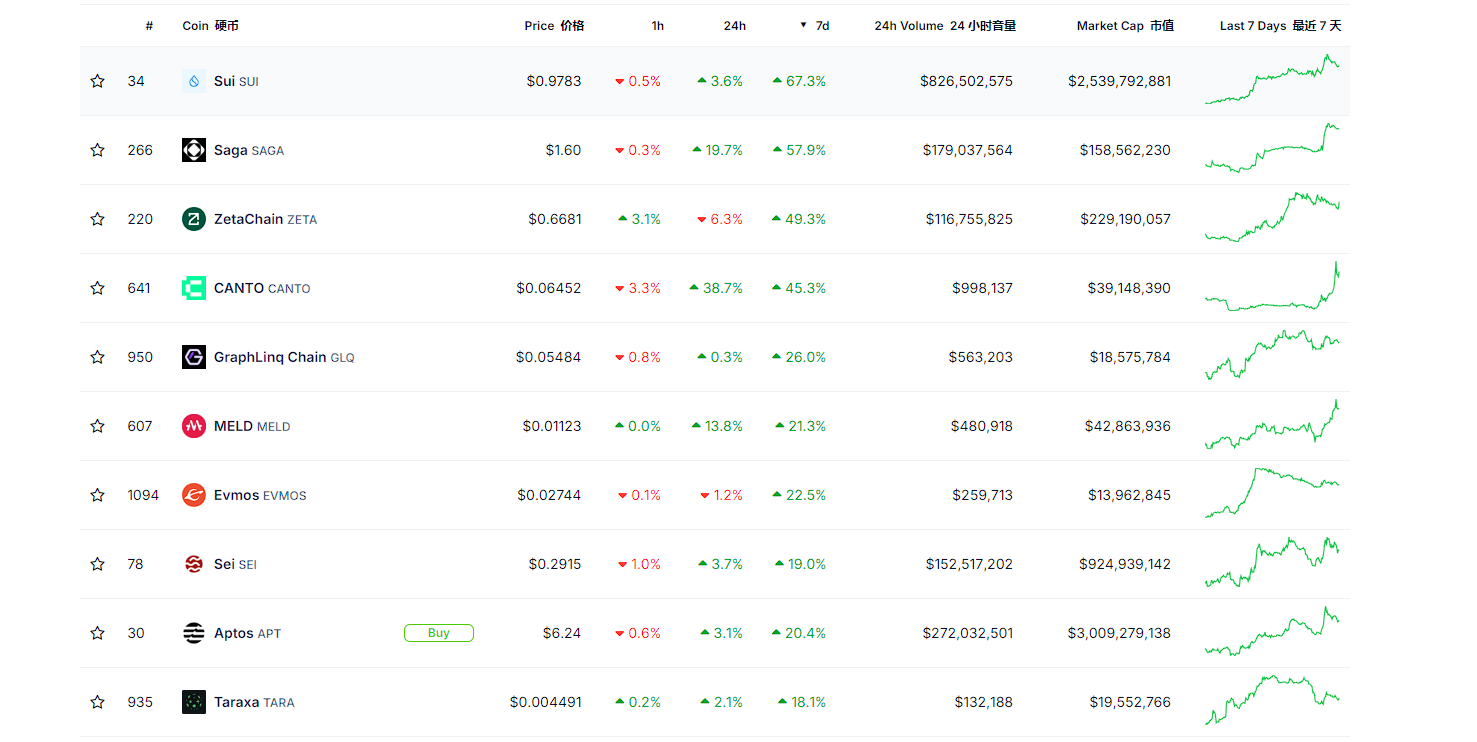

The price trend of SUI has indeed performed well recently. Since it hit a recent low of $0.4625 on August 5, it has rebounded strongly. Data on August 12 showed that the price of SUI reached a maximum of $1.1174. The increase in one week exceeded 141%. It has the highest increase among the tokens of mainstream public chains. However, this price is still far from the high of $2.18 created in March this year. Previously, the SUI token had fallen all the way since it rose to $2.18 on March 27, 2024, and fell to a minimum of $0.46. The decline in half a year exceeded 78.8%.

SUIs outstanding performance may be recognized by Grayscale. On August 7, Grayscale announced the launch of two new crypto investment products, trust products for SUI tokens. Rayhaneh Sharif-Askary, head of product and research at Grayscale, said in a statement: We are pleased to add Bittensor and Sui to our product suite and believe that Bittensor is at the core of the development of decentralized AI, while Sui is redefining smart contract blockchains. Influenced by this news, the price of SUI soared 42% on August 8, setting a recent single-day high.

Grayscale currently has 18 crypto investment products, mainly including mainstream public chain projects such as Solana and Litecoin.

Raoul Pal said on Twitter, “I’m looking for the next major token for a SOL-type opportunity, and SUI is one of them.” However, Raoul Pal’s call also raised some questions, and he himself stated that he is a director of the Sui Foundation and has an interest in the Sui ecosystem.

Andrew Kang, co-founder of Mechanism Capital, listed five reasons for Suis recent rise on Twitter, including support from Raoul Pal, a large amount of over-the-counter demand, strong holders after large-scale unlocking, no pullback in SUI price trend, and Mysiceti performance upgrade. However, regarding the argument that SUI will surpass Solana, Andrew Kang said, I dont think SUIs market value will be the same as SOL, but its market value is 3.5% of SOL.

In addition to the bullish comments from many KOLs, there have been some recent developments in the Sui ecosystem. On August 9, Suis ecological domain name service SuiNS announced its reorganization into a decentralized protocol, which will allow users to govern through the protocol token NS. It also plans to airdrop 10% of the tokens to the community. On August 13, CoinList launched a staking fund, which first supported five crypto assets, including ETH, SOL, NEAR, SUI, and MINA.

The data comparison is far less than Solana and is on par with TON

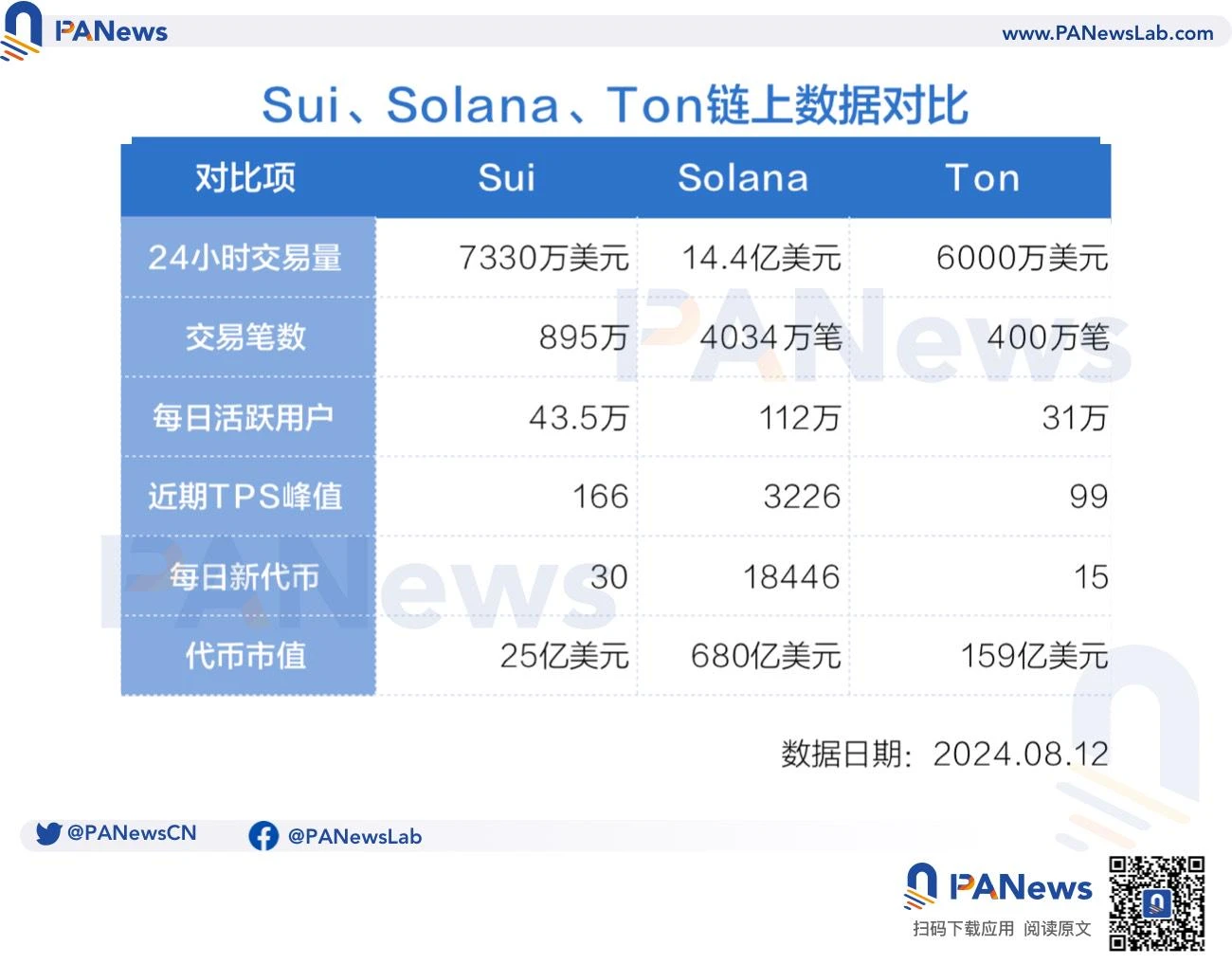

However, has the Sui ecosystem made rapid progress recently, or is the bullish outlook just a smokescreen? PANews compared several indicators of Sui, Solana, and TON (data collection was on August 12).

In terms of transaction volume and number of transactions, there is still a big gap between SUI and Solana, especially the 24-hour transaction volume is only about 5% of Solana. Given that TONs ecological performance and secondary market price were relatively outstanding some time ago (it was also once called the Solana killer), it can be seen that Suis overall data performance is closer to TONs performance, and even Sui seems to be slightly ahead in many aspects. However, SUI is quite different from TON in terms of circulating market value. SUIs circulating market value is only US$2.5 billion, while TONs circulating market value is about US$15.9 billion, a difference of 6.4 times. Catching up with TONs market value may be SUIs upside. But considering that TON is backed by Telegrams 900 million users, it has more premium space than other public chains.

Large-scale unlocking is interpreted as a positive thing?

The unlocking of SUI tokens has also become a reason for many KOLs to be bullish. On August 1, SUI unlocked 53.89 million tokens, accounting for 2.56% of the liquidity, worth about 50.6 million US dollars. Those who are bullish on SUI believe that the market has not ushered in huge selling pressure after these tokens are unlocked, which is the reason for the market to improve. Those who hold opposing views believe that SUI tokens will not only be unlocked in August, but will be unlocked every month thereafter. This is just a way for the main force to create momentum before shipment to raise expectations. Some users also questioned that the Sui Foundation recently attracted KOLs to promote SUI tokens in a paid manner.

In addition, it is worth noting that since August 5, the contract holdings of SUI have seen a large increase. Taking the Binance perpetual contract trading pair as an example, the contract holdings of SUI were 28.46 million on August 5, and rose to 100 million on August 12. At the same time, the funding rate remained negative. This data phenomenon shows that a large number of short positions are paying fees to hold positions.

Judging from the data on the chain, Sui has indeed made great progress in the past six months, especially in May, when the number of daily transactions exceeded 70 million through the SPAM (spam) model, surpassing all public chains such as Solana. Although the data has since declined to around 7 million, it is still much higher than the hundreds of thousands before May. Similarly, the number of active addresses has also seen a significant increase. However, the overall magnitude is still quite different from Solana, especially the number of newly issued tokens per day, which represents the activity within the ecosystem, is only about 30, while Solanas data is around 20,000.

On the whole, it is still too early for Sui to become the Solana killer, and TON may be Suis real direct competitor.

This article is sourced from the internet: Surge of 141% in a week, can SUI become the Solana Killer?

İlgili: WeChat'ten Telegram'a, Mini APP neden Web2 ve Web3 arasında en iyi köprüdür?

1. İletişim yazılımlarının benzersiz avantajı: bağlantı İletişim yazılımlarının en büyük cazibesi, bizi arkadaşlarımız ve ailemizle sorunsuz bir şekilde bağlayabilmeleridir. Tıpkı arkadaşlarınız kullandığı için belirli bir yazılımı kullanmaya başlamanız gibi, doğal olarak onların saflarına katılırsınız. WeChat bunun tipik bir örneğidir. WeChat, 2009'daki lansmanından bu yana Çin'deki en popüler iletişim araçlarından biri haline geldi. İstatistiklere göre, 2023'ün sonunda WeChat'in aylık aktif kullanıcıları 1,2 milyarı aştı. Bu bağlantı etkisi WeChat'i hızla popüler hale getirdi ve hayatlarımızın vazgeçilmez bir parçası haline getirdi. Ancak dünyada kripto para kullanan yalnızca 1 milyardan fazla insan olduğunu biliyorsunuz. WeChat kullanan insanların ⅓'ü kripto paraya katılıyorsa, Bitcoin'in şu anki…