Kripto Piyasası Duygu Araştırma Raporu (2-9 Ağustos 2024): Durgunluk geldi mi? Temmuz ayında ABD tarım dışı istihdam bordroları düştü

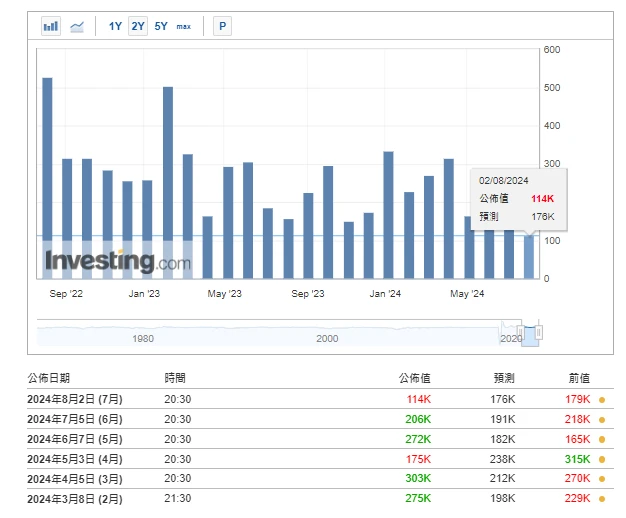

Recession has arrived? US non-farm payrolls in July fell far short of expectations

Resim kaynağı: https://hk.investing.com/economic-calendar/nonfarm-payrolls-227

The US non-farm payrolls report for July surprised the market, with the number of new jobs hitting a three-and-a-half-year low and the unemployment rate rising to a three-year high, triggering the Sams Rule, a recession indicator with 100% accuracy. Panic spread rapidly, and traders began to bet on the possibility of a 50 basis point rate cut in September, and predicted that the rate cut this year would exceed 110 basis points. This week, both US stocks and Bitcoin rebounded after a significant decline.

-

The Sahm Rule is an indicator proposed by economist Claudia Sahm to predict economic recessions. The rule is based on changes in the unemployment rate and has a trigger condition: if the three-month moving average employment rate is 0.5 percentage points lower than the highest employment rate in the past 12 months, then the indicator is triggered, indicating that the economy may be about to or has entered a recession.

There are about 40 days until the next Federal Reserve interest rate meeting (September 19, 2024)

https://hk.investing.com/economic-calendar/interest-rate-decision-168

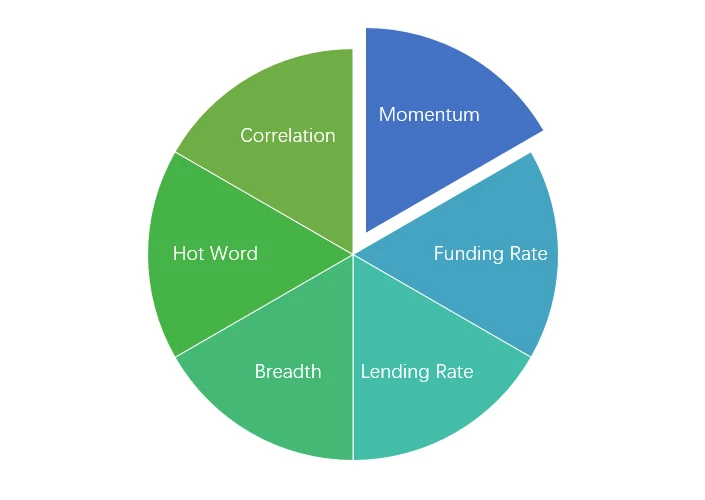

Piyasa teknik ve duyarlılık ortamı analizi

Duygu Analizi Bileşenleri

Teknik göstergeler

Price Trends

BTC price fell -5.61% and ETH price fell -16.26% in the past week.

Yukarıdaki resim BTC'nin geçen haftaki fiyat tablosudur.

Yukarıdaki resim ETH'nin geçen haftaki fiyat tablosudur.

Tabloda geçtiğimiz haftadaki fiyat değişim oranları gösterilmektedir.

Fiyat Hacim Dağılım Grafiği (Destek ve Direnç)

In the past week, BTC and ETH fell to a low level and formed a new dense trading area before rebounding.

Yukarıdaki resim, geçtiğimiz hafta BTC'lerin yoğun işlem alanlarının dağılımını göstermektedir.

Yukarıdaki resim, geçtiğimiz hafta ETH'lerin yoğun işlem alanlarının dağılımını gösteriyor.

Tablo, geçen hafta BTC ve ETH'nin haftalık yoğun işlem aralığını gösteriyor.

Hacim ve Açık Faiz

In the past week, both BTC and ETH had the largest trading volume when they fell to 8.5; the open interest of BTC and ETH both fell sharply.

Yukarıdaki resmin üst kısmı BTC'nin fiyat eğilimini, ortası işlem hacmini, alt kısmı açık pozisyonları, açık mavi 1 günlük ortalamayı, turuncu ise 7 günlük ortalamayı göstermektedir. K çizgisinin rengi mevcut durumu temsil eder, yeşil fiyat artışının işlem hacmi tarafından desteklendiğini, kırmızı pozisyonların kapatıldığını, sarı yavaş yavaş biriken pozisyonları, siyah ise kalabalık durumu ifade eder.

Yukarıdaki resmin üst kısmı ETH'nin fiyat eğilimini, ortası işlem hacmini, alt kısmı açık pozisyonları, açık mavi 1 günlük ortalamayı ve turuncu ise 7 günlük ortalamayı göstermektedir. K çizgisinin rengi mevcut durumu temsil eder, yeşil fiyat artışının işlem hacmi tarafından desteklendiğini, kırmızı pozisyonların kapandığını, sarı yavaş yavaş pozisyonların toplandığını ve siyah ise kalabalık olduğunu gösterir.

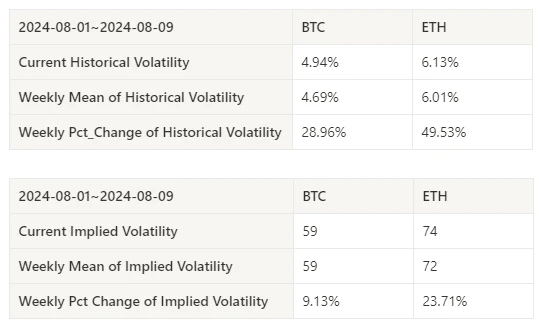

Tarihsel Volatilite ve İma Edilen Volatilite

This past week, historical volatility for BTC and ETH was highest at 8.5, while implied volatility for both BTC and ETH increased.

Sarı çizgi tarihsel oynaklığı, mavi çizgi ima edilen oynaklığı, kırmızı nokta ise 7 günlük ortalamayı gösteriyor.

Olay odaklı

The non-farm data of the past week was significantly lower than expected, which pushed the mainstream currencies to continue to decline for several days after the data was released.

Duygu Göstergeleri

Momentum Duyarlılığı

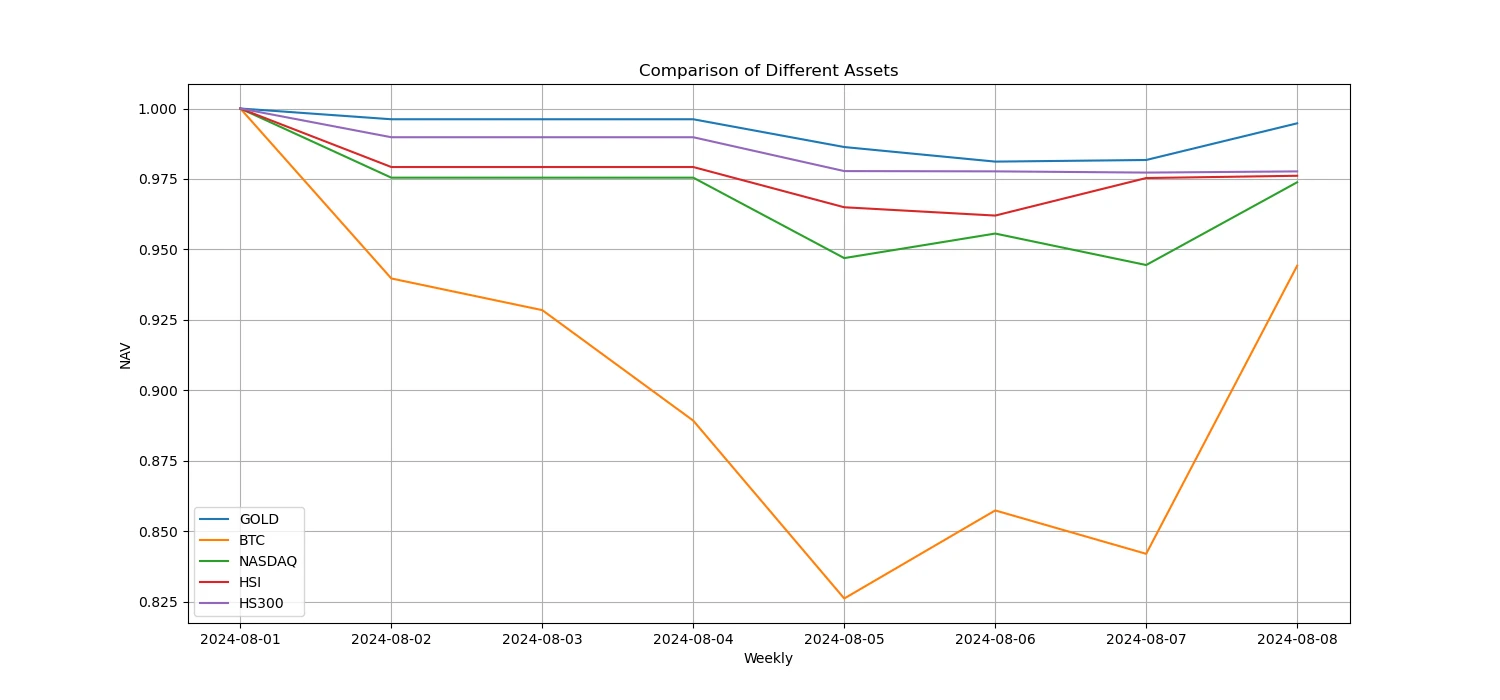

In the past week, among Bitcoin/Gold/Nasdaq/Hang Seng Index/SSE 300, gold was the strongest, while Bitcoin performed the worst.

Yukarıdaki resim farklı varlıkların geçen haftaki eğilimini göstermektedir.

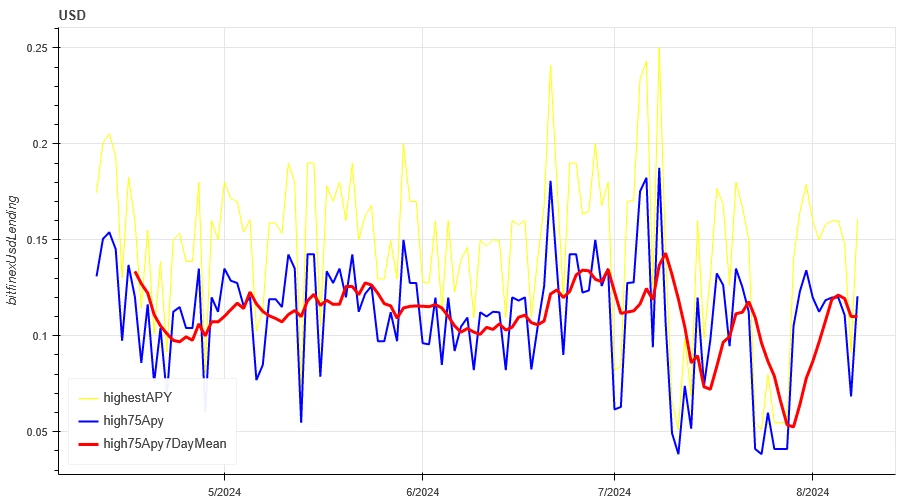

Borç Verme Oranı_Kredi Verme Duyarlılığı

The average annualized return on USD lending over the past week was 11.1%, and short-term interest rates remained at 12.1%.

Sarı çizgi USD faiz oranının en yüksek fiyatı, mavi çizgi en yüksek fiyat olan 75%, kırmızı çizgi ise en yüksek fiyat olan 75%'nin 7 günlük ortalamasıdır.

Tablo, geçmişteki farklı elde tutma günleri için USD faiz oranlarının ortalama getirisini göstermektedir

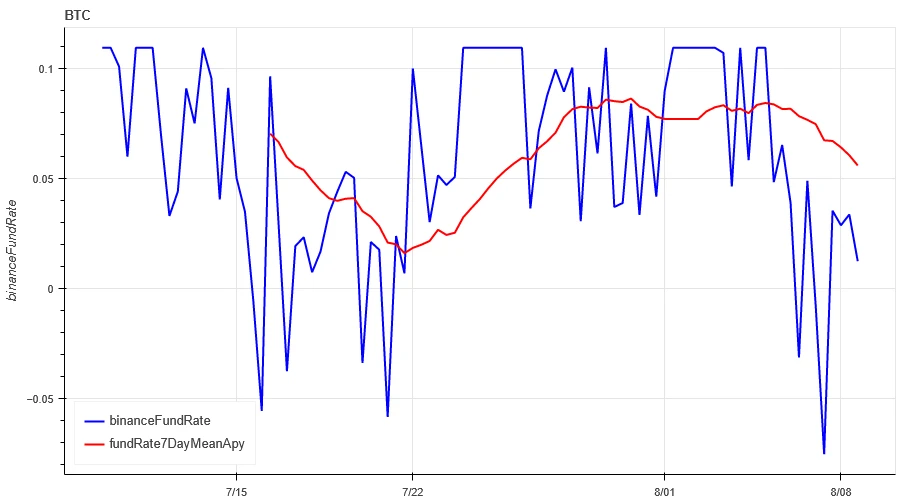

Fonlama Oranı_Sözleşme Kaldıraç Duyarlılığı

The average annualized return on BTC fees in the past week was 5.8%, and contract leverage sentiment was gradually declining.

Mavi çizgi BTC'nin Binance'teki fonlama oranı, kırmızı çizgi ise 7 günlük ortalamasıdır

Tablo, geçmişteki farklı tutma günleri için BTC ücretlerinin ortalama getirisini göstermektedir.

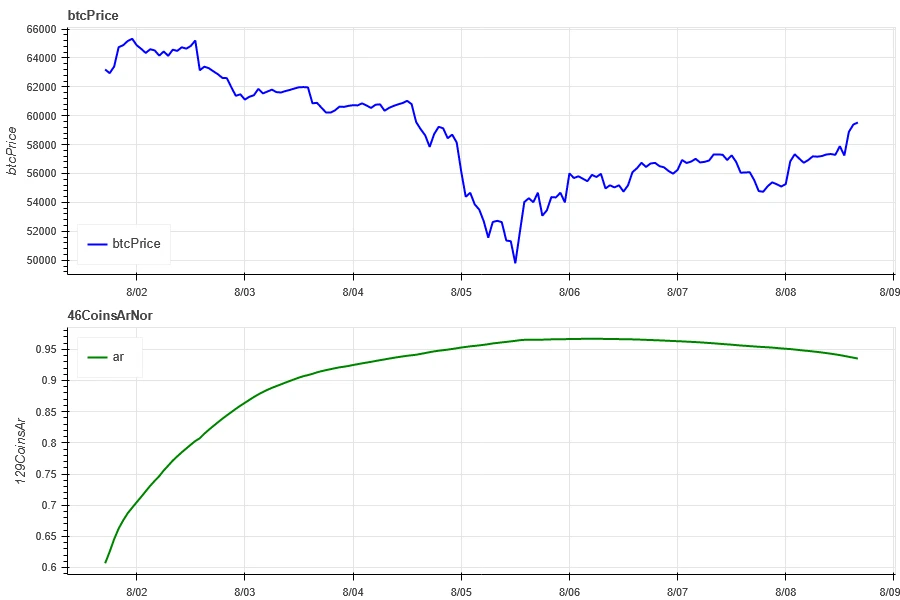

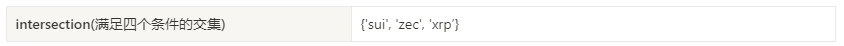

Piyasa Korelasyonu_Konsensüs Duyarlılığı

The correlation among the 129 coins selected in the past week was around 0.95, and the consistency between different varieties rose to a high level.

In the above picture, the blue line is the price of Bitcoin, and the green line is [1000 floki, 1000 lunc, 1000 pepe, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, algo, ankr, ant, ape, apt, arb, ar, astr, atom, audio, avax, axs, bal, band, bat, bch, bigtime, blur, bnb, btc, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos,etc, eth, fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot, icp, icx , imx, inj, iost, iotx, jasmy, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic, mana, matic, meme, mina, mkr, near, neo, ocean, one, ont, op, pendle, qnt, qtum, rndr, rose, rune, rvn, sand, sei, sfp, skl, snx , sol, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni, vet, waves, wld, woo, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx] overall correlation

Pazar Genişliği_Genel Duygu

Among the 129 coins selected in the past week, 6.3% of them were priced above the 30-day moving average, 12% were priced above the 30-day moving average relative to BTC, 9% were more than 20% away from the lowest price in the past 30 days, and 10% were less than 10% from the highest price in the past 30 days. The market breadth indicator in the past week showed that most coins in the overall market maintained a downward trend.

The picture above is [bnb, btc, sol, eth, 1000 floki, 1000 lunc, 1000 pepe, 1000 sats, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, ai, algo, alt, ankr, ape, apt, arb, ar, astr, atom, avax, axs, bal, band, bat, bch, bigtime, blur, cake, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos,etc, fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot , icp, icx, idu, imx, inj, iost, iotx, jasmy, jto, jup, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic, mana, manta, mask, matic, meme, mina, mkr, near, neo, nfp, ocean, one, ont, op, ordi, pendle, pyth, qnt, qtum, rndr, robin, rose, rune, rvn, sand, sei, sfp, skl, snx, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni, vet, waves, wif, wld, woo,xai, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx ] 30-day proportion of each width indicator

Özetle

In the past week, the prices of Bitcoin (BTC) and Ethereum (ETH) fell sharply on August 5, when the volatility and trading volume of these two cryptocurrencies reached a peak. The volume of open contracts decreased significantly, while the implied volatility increased simultaneously. Bitcoins funding rate continued to decline, which may reflect the weakening interest of market participants in its leveraged trading. Market breadth indicators show that the prices of most cryptocurrencies fell, and the entire market continued to be under pressure. In addition, the non-agricultural data was significantly lower than expected, which pushed the mainstream currencies to continue to decline for several days after the data was released.

Twitter: @ https://x.com/CTA_ChannelCmt

İnternet sitesi: kanalcmt.com

This article is sourced from the internet: Crypto Market Sentiment Research Report (August 2–9, 2024): Has recession arrived? U.S. non-farm payrolls in July fell far short of expectations

Related: Must-read guide: Play with the TON ecosystem and seize early dividends

Original author: Biteye core contributor Viee Original editor: Biteye core contributor Crush Have you started to FOMO TON? These past two days, I have been crazy about posting black and white dog MEMEs and showing off my points. I thought the bull market was back. Today, Biteye will teach you how to play in the TON ecosystem and seize potential airdrop opportunities. We have organized this thread into a mind map, please take it if you need it. 01 Wallet Introduction The first step to participate in the TON ecosystem is to use a wallet. Currently, there are 49 wallets that support the TON chain. Here are two of the most popular ones: Wallet and TON Space Wallet Wallet is Telegrams native centralized custodian wallet, similar to WeChat Wallet, which…