Coinbase 2024 3. Çeyrek Görünümü: Yükseliş eğilimi belirgin ve kripto korelasyonu azalıyor

Orijinal yazar: Kripto, Damıtılmış

Orijinal çeviri: Yerel Blockchain

Coinbase just released its Cryptocurrency Outlook for Q3 2024. It’s a pretty extensive report, and @DistilledCrypto read all 60 pages and summarized the 10 main takeaways you need to know below.

1. MVRV and market trends

When MVRV is above its 365-day average, it indicates that the market is in a strong uptrend.

Pullbacks when MVRV has support are usually buying opportunities.

Currently, MVRV has bounced off the support, which shows that the uptrend is still intact.

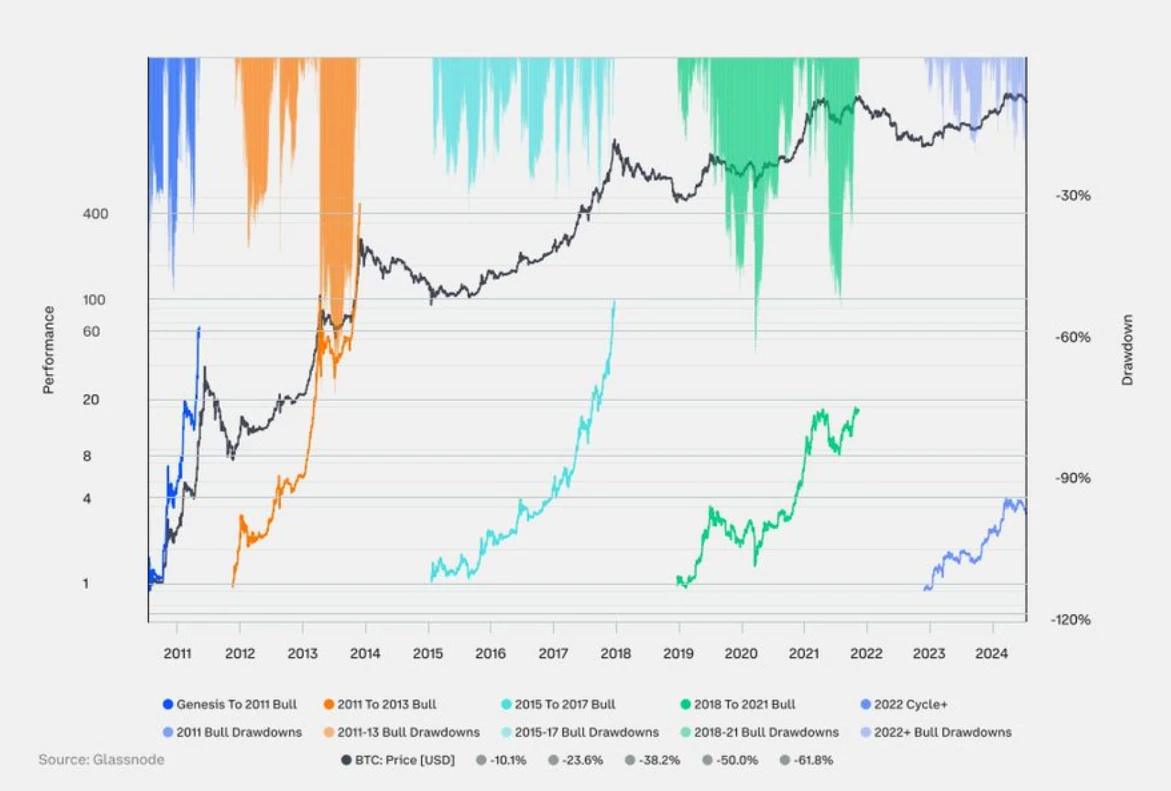

2. Bitcoin’s ROI from Cycle Lows

Bitcoin has completed four market cycles, each with bull and bear phases.

In this cycle, Bitcoin is up about 400% since its November 2022 low.

This cycle is similar to the one from 2018 to 2022, when Bitcoin rose 2,000% from its lows.

3. Smaller callback

Bitcoin bull cycles are usually accompanied by exponential growth and sharp pullbacks.

This cycle was different, showing smaller pullbacks: eight pullbacks between 5%-20%, two between 20%-30%, and no pullbacks exceeding 30%.

4. Cryptocurrency correlation decreases

In the second quarter, correlations among crypto assets declined: Ethereum’s correlation was 0.7, and some altcoins were below 0.5.

This decoupling phenomenon shows that the market has a deeper understanding of the fundamentals of tokens.

With increased regulatory clarity and institutional adoption, correlations are expected to decline further.

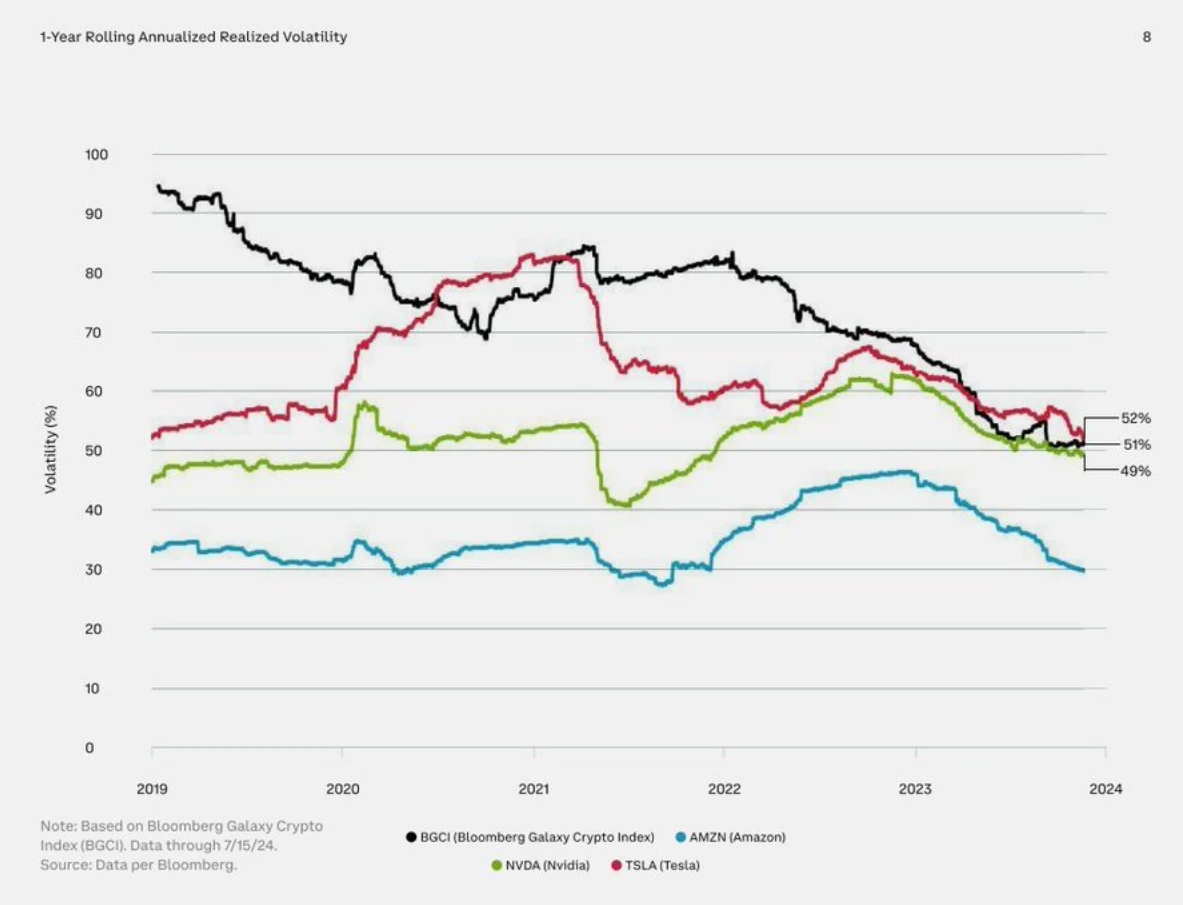

5. Volatility Perception and Reality

Perception: For many investors, the volatility of digital assets is too high.

Reality: The volatility of the cryptocurrency market is comparable to that of some of the largest mainstream technology stocks.

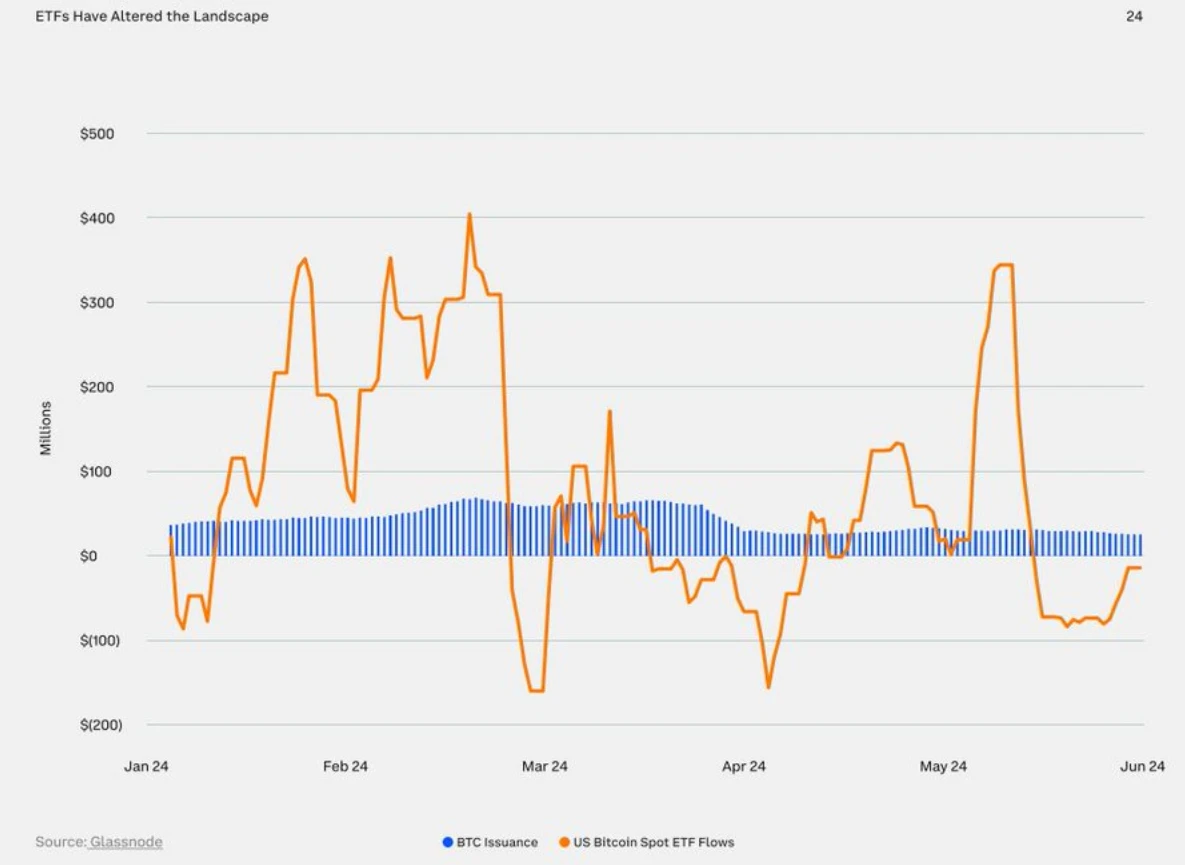

6. Impact of Spot ETFs

Spot ETFs create significant new demand for Bitcoin, while new Bitcoin supply is still limited to miners’ rewards.

Since spot ETFs began trading, demand for ETFs has greatly exceeded the issuance of Bitcoin.

7. Ethereum market cycle

Ethereum has completed two full market cycles.

This cycle started in 2022, and Ethereum has risen by more than 240% since November 2022.

This cycle is similar to the period between 2018 and 2022, when Ethereum rose 6,000% from its lows.

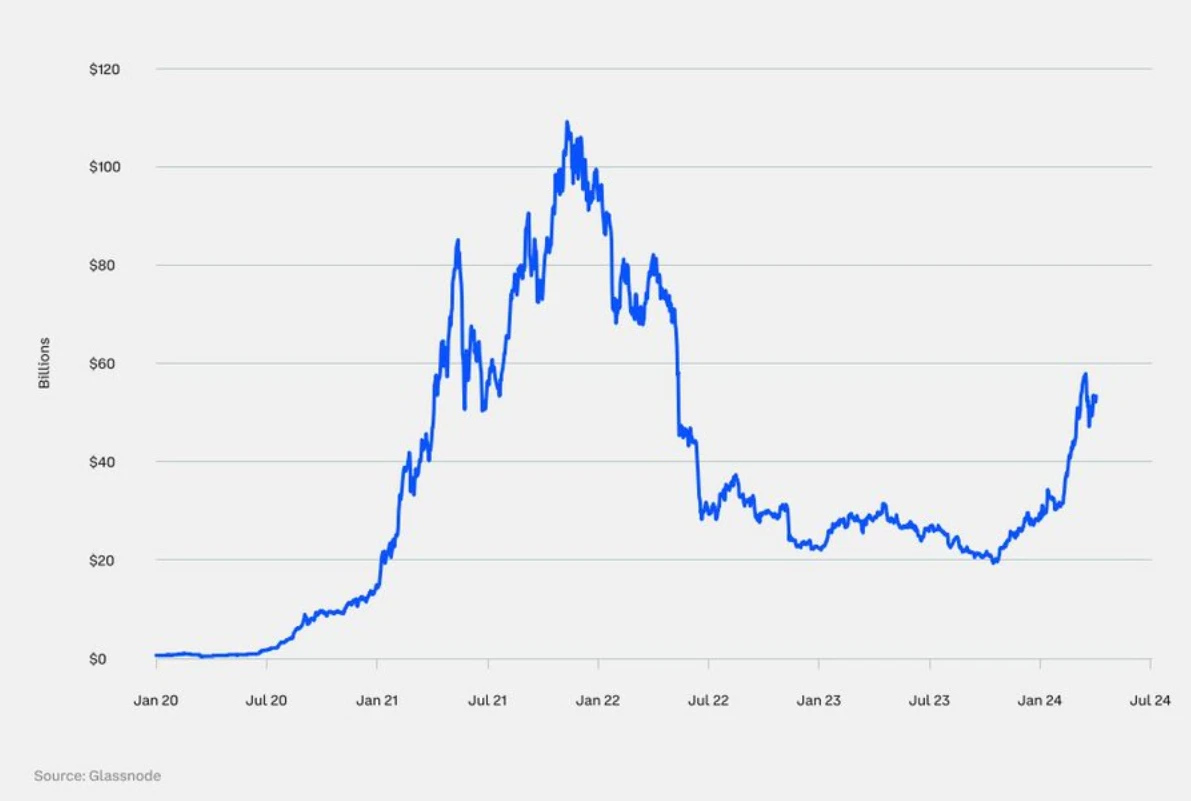

8. Ethereum’s Total Locked Value (TVL)

TVL tracks the value of altcoins and stablecoins in smart contracts and decentralized applications (dApps). It reflects financial activity and liquidity.

In the second quarter, TVL grew by 9%, indicating an increase in activity on the Ethereum blockchain.

9. FTX Cash Distribution

FTX will conduct cash distributions, which could result in large inflows of cryptocurrency if recipients reinvest them.

Key dates: August 16 (trustee vote) and October 7 (court approval deadline).

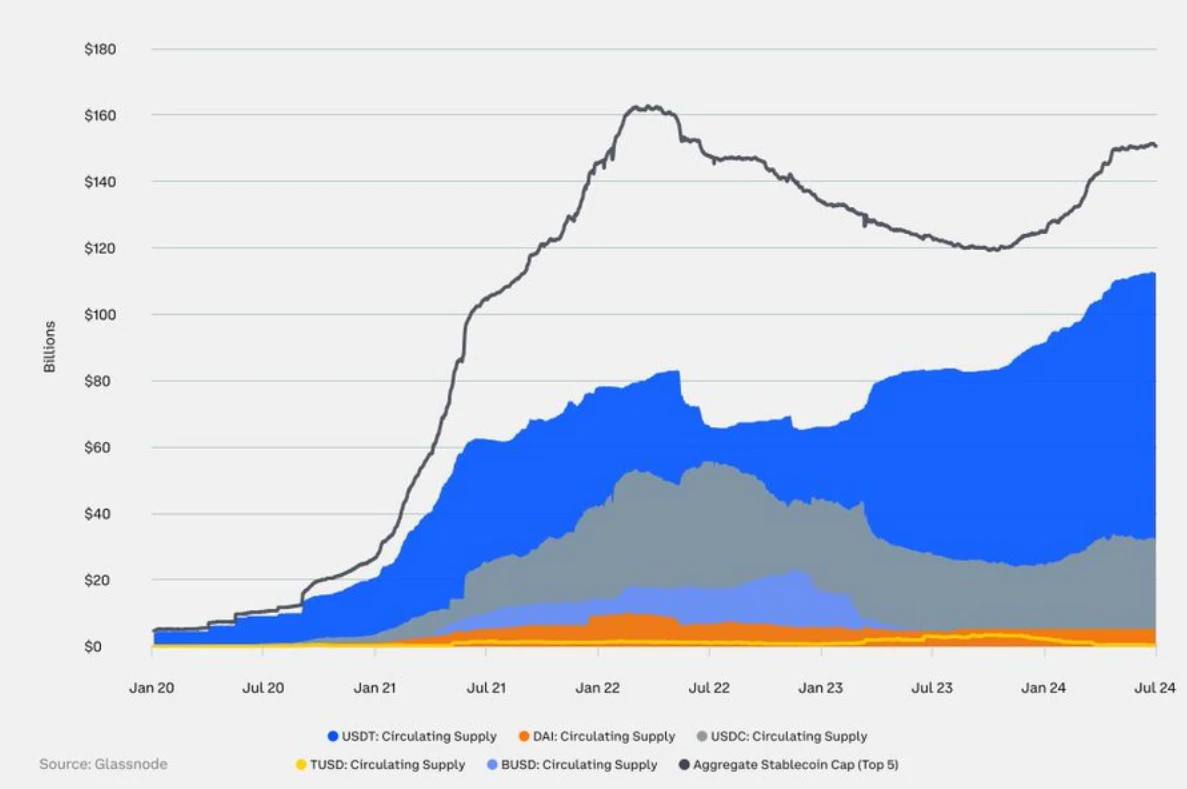

10. Stablecoins

The market capitalization of stablecoins is $162.5 billion, an increase of $2 billion in two weeks, surpassing the level before 3AC.

As a reflection of cryptocurrency liquidity, stablecoins are an important indicator for long-term price prediction.

With capital inflows, it is difficult to support a bearish market outlook.

Finally, thanks to @CoinbaseInsto and @glassnode for their insights! This article is purely educational and does not constitute investment advice.

This article is sourced from the internet: Coinbase 2024 Q3 Outlook: Upward trend is obvious, and crypto correlation is declining

Original source: Followin L2 beat data shows that the Base chain TVL is approximately US$7.27 billion, ranking third in layer 2, second only to OPs US$7.567 billion. Judging from the data growth, there is no doubt that it will surpass OP in the short term. Although the DeFi application of the Base chain is not very good, it is obvious that a large amount of funds are pouring in. Regarding the Base chain, the public has two impressions. One is that social applications are very strong, such as Farcaster, Friend.tech, etc. The other is that it is a MEME coin paradise, second only to Solana. The Base chain team also values MEME. Jesse Pollak, the head of the Base protocol, is the spiritual leader and leader of the Base chain…