Cycle Capital Haftalık Piyasa Yorumu (7.29): Ekonomik veriler iyimser, ikinci çeyrek kazançları cesaret verici ve

Market Overview

-

In the past two weeks, digital assets (especially Bitcoin) have performed well. The second largest digital currency Ethereum has given up its previous gains after the ETF was launched, which is similar to the trend after the BTC ETF was launched.

-

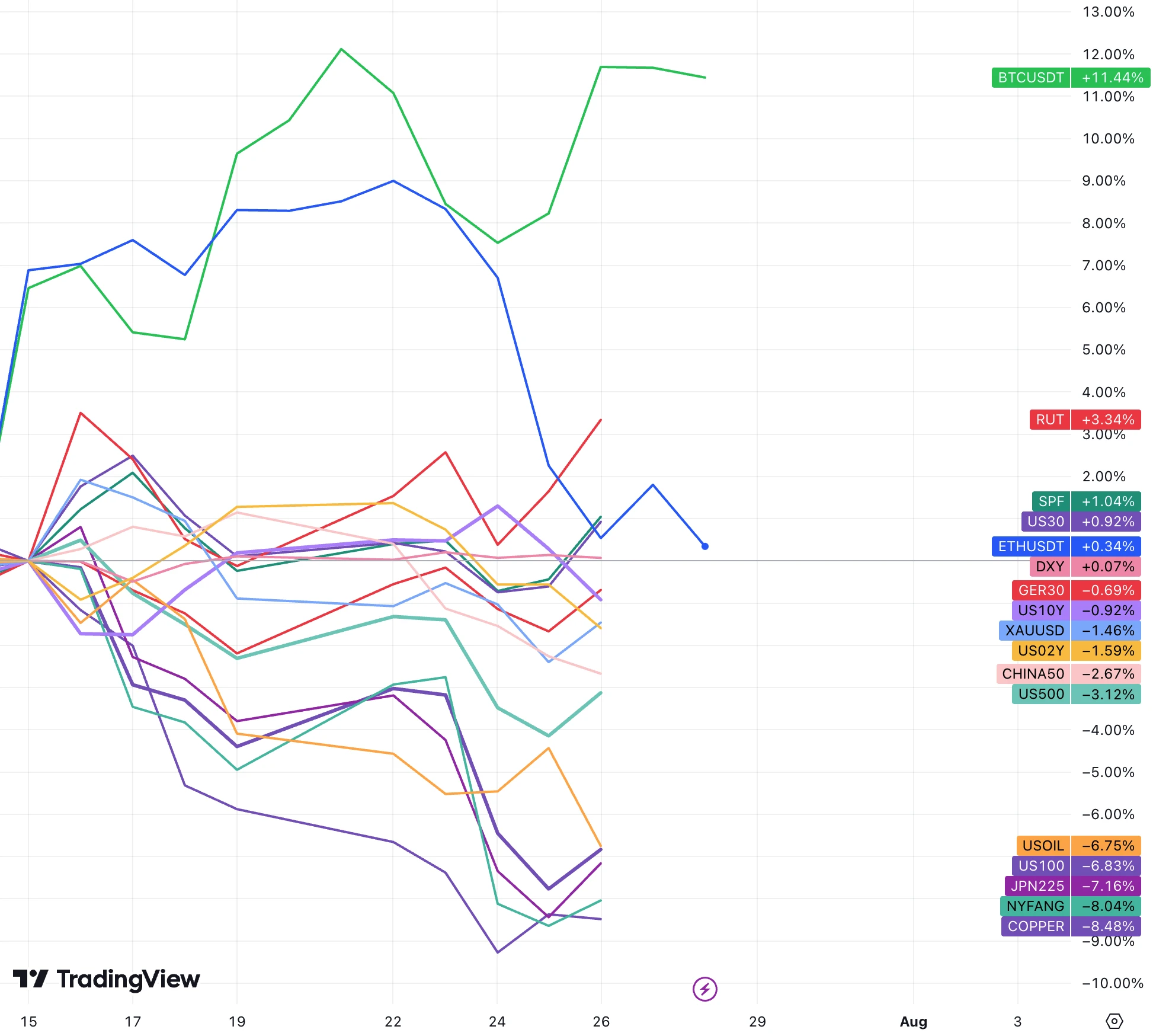

As we reminded at the meeting two weeks ago, the market showed a clear style switch: large-to-small, cyclical-to-defensive. In the US stock market, small-cap stocks withstood the pressure of the large market, RUT rose 3.3% against the trend, traditional large-cap stocks performed steadily, the Dow Jones 30 rose 1%, the financial stock index SPF rose 1%, and the utilities and healthcare industries were also relatively strong (Goldman Sachs continues to be optimistic about the financial sector, with more upside potential than downside). Technology stocks performed the worst, with the NYFANG+ (top ten technology stocks) index falling 8%, the Nasdaq 100 falling 6.8%, and the SPX, which has a slightly lower technology content, falling 3%.

-

The decline in Treasury yields reflects market concerns about the economic outlook and rising expectations for rate cuts. US 10 Y is already less than 4.2%, while 02 Y is at 4.385%. The spread between the two hit a two-year low last week.

-

Commodities that are also representative of the cyclical sector (such as crude oil and copper) fell sharply.

-

The dollar index was mostly flat, but yen shorts (the most popular FX carry trade) retreated sharply. Trump recently said in an interview that the strength of the dollar has a negative impact on the competitiveness of US exports, specifically pointing to the weakness of the yen and the yuan. A weaker dollar could accompany Trump trades.

-

From the perspective of U.S. stock fund style preferences, although big technology stocks fell, small caps rose. The market is not completely risk-averse, and the decline in yields is also a good thing for the cryptocurrency circle.

Over the past two weeks, long-standing popular trades have suddenly reversed, with the worlds most crowded trades beginning to liquidate due to changes in interest rates (expectations of rate cuts have increased), the economic outlook (commodity prices confirm poor expectations for global economic demand) and political factors (Trumps victory).

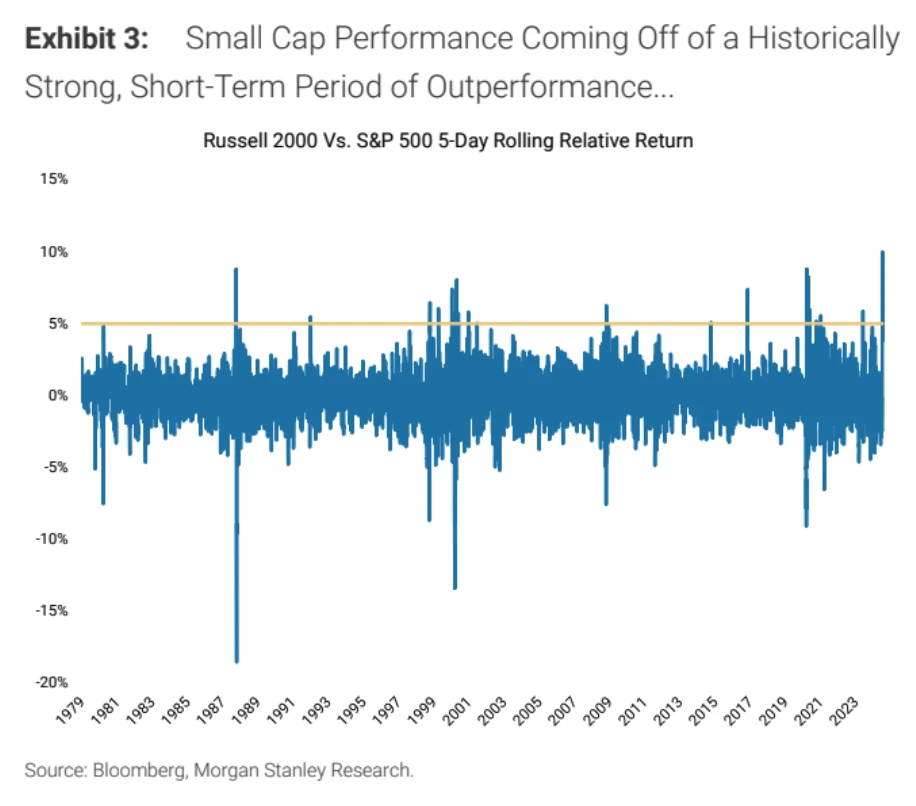

The weak CPI data on July 11 and the rising chances of Trumps victory triggered a rotation into small-cap stocks, as small-cap stocks are more sensitive to lower borrowing costs and have greater marginal benefits from the policy environment promised by Trump, such as tax cuts and increased tariffs. In addition, a large number of shorts have also covered their positions in the recent trend, leading to a sharp rise in the small-cap market.

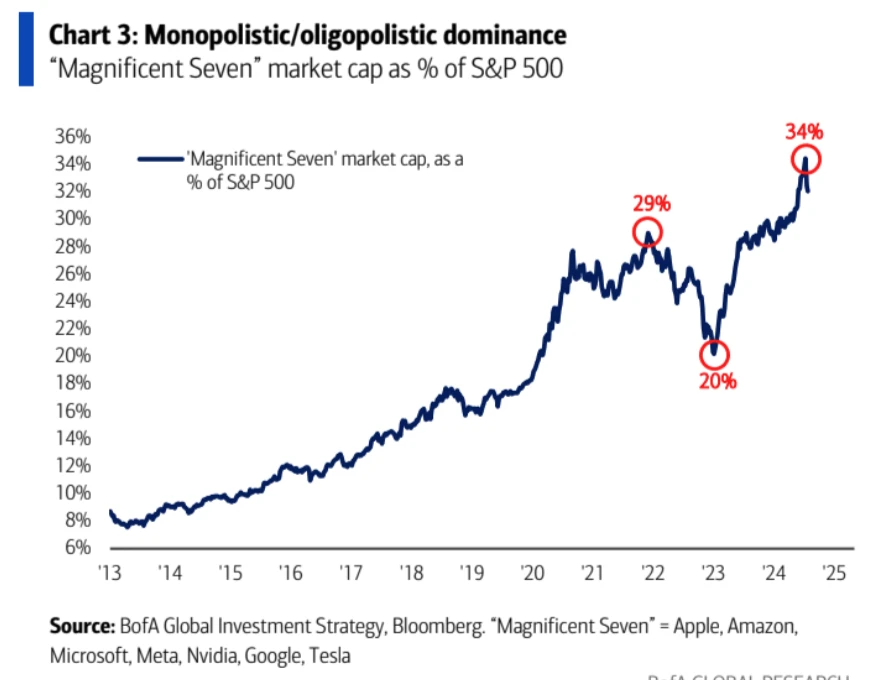

Figure: The last time the market switched, the share of big tech fell by nearly 1/3

The relative strength of small-cap stocks has hit an all-time high, considering that this rotation may lack lasting support from fundamentals and macro levels

, the rotation of large and small stocks will not last long, and short covering has pushed the market to overextend:

Judging from the pace of Trumps transactions around 2016, small-cap stocks peaked after the November election:

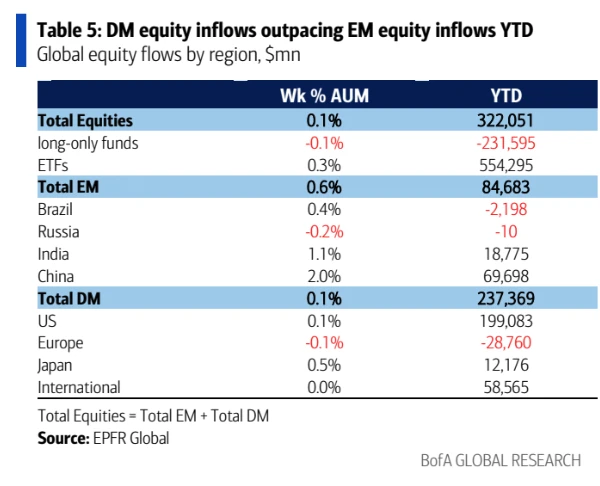

The market currently expects that even if the Fed does not cut interest rates this week, it will definitely cut interest rates in September. According to EPFR data, equity funds inflows last week were $22.2 billion, and emerging market stocks + $11.1 billion (the largest inflow since February).

China +$8.3 billion (largest inflow since February), bonds +$16.1 billion, gold +$1.3 billion, crypto inflows of $1.2 billion, and cash outflows of $42.3 billion (largest outflow in three months), showing that investors are starting to rush in ahead of the upcoming rate cut.

The second quarter report is progressing well

41% of SP 500 companies have announced their actual second quarter results, which are almost all better than Q1:

-

78% of companies reported positive EPS surprises, up from 76% in Q1

-

60% of companies reported positive revenue surprises, down from 62% in Q1

-

Q2 earnings growth was 9.8%, the highest growth rate since Q4 2021 (31.4%), vs Q1 +6.5%

-

Q2 revenue increased by 5% vs. Q1 by 4.2%

-

Profit margin 12.1% vs 11.8%

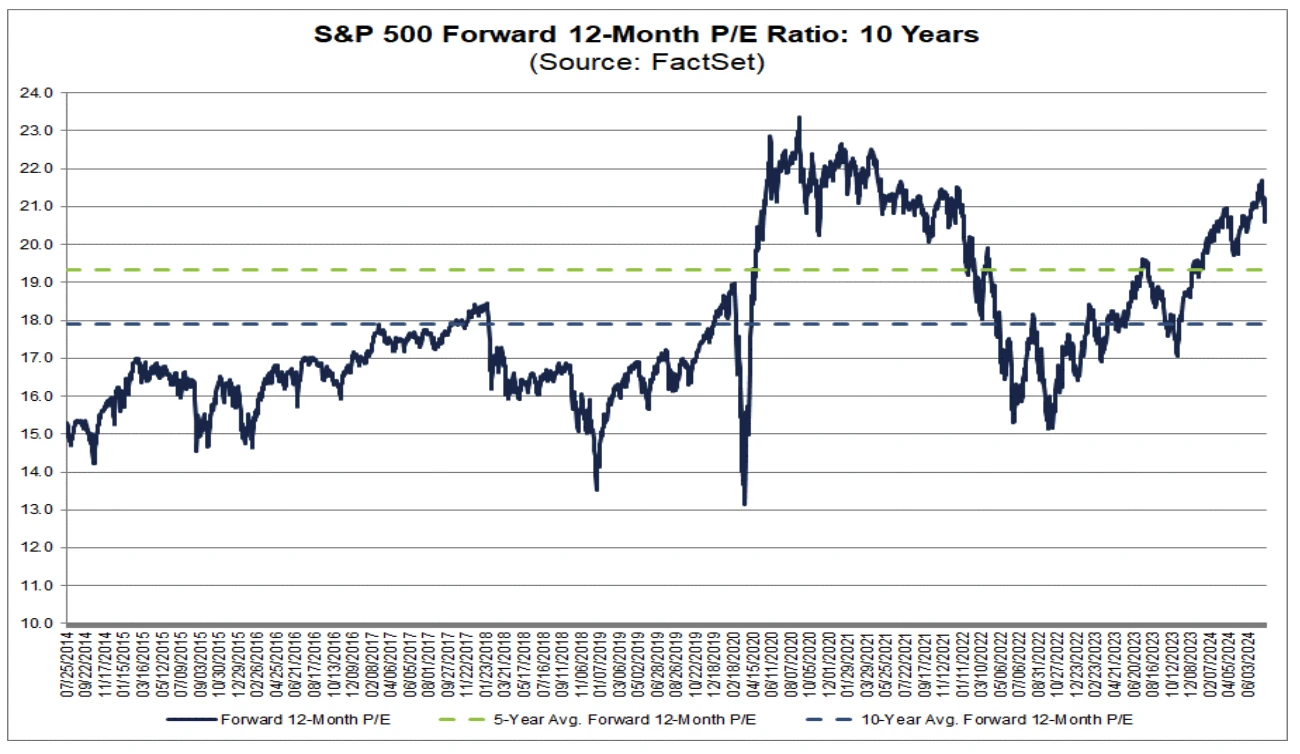

After the recent correction, the SP 500 12-month forward P/E ratio has fallen back to 20.6, but is still above its 5-year average of 19.3 and its 10-year average of 17.9:

Since most tech giants have not yet reported their earnings, the market is not sure about the optimistic data so far. The seven major companies that will release their earnings next week include Microsoft (MSFT) (Tuesday), Meta (META) (Wednesday), Apple (AAPL) and Amazon (AMZN) (Thursday). Nvidia (NVDA) is expected to release its earnings report on August 28. Whether it can remain optimistic or pessimistic should be determined this week.

Economic data is optimistic

Overall, we continue to see a favorable environment for stock and crypto investors. Economic growth is cooling but showing a positive trend, and inflation has eased, supporting the Federal Reserve to lower interest rates in the second half of this year.

-

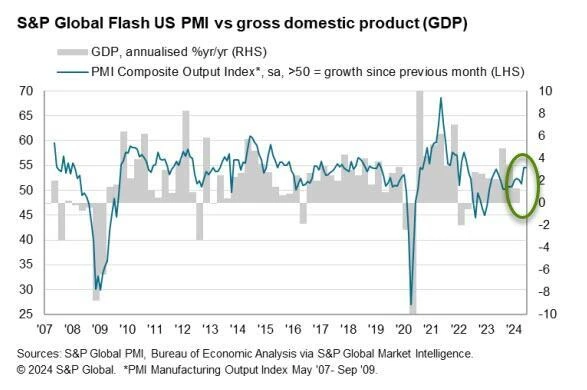

Data released by SP Global showed that although the US Markit manufacturing PMI fell into contraction in July, hitting a 7-month low, the service industry PMI hit a 28-month high, causing the composite PMI to rise to 55, a more than two-year high. Moreover, the report pointed out that part of the decline in manufacturing output was related to employee shortages, so it may be temporary.

-

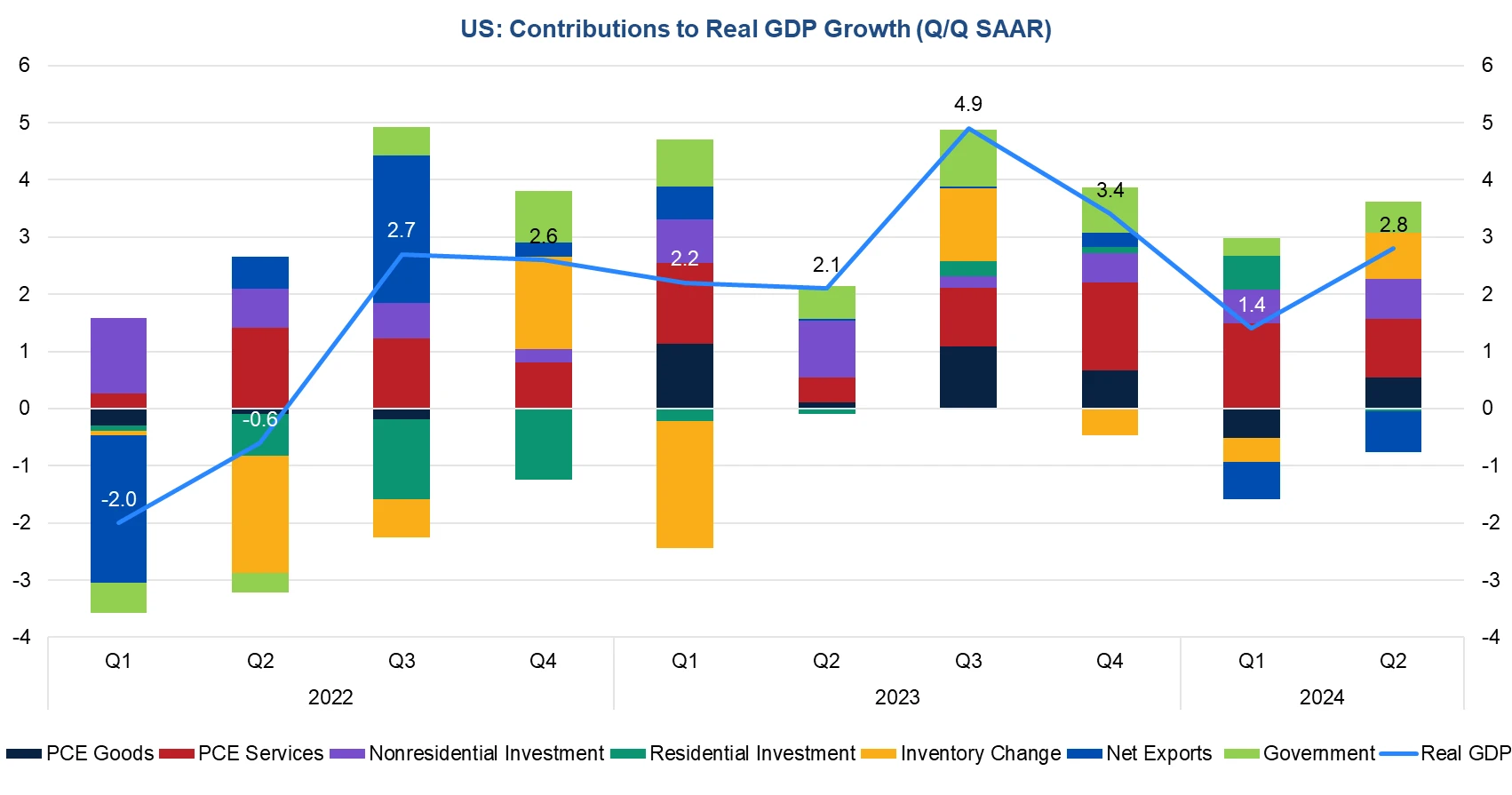

The U.S. GDP for the second quarter of 2024 released on Thursday grew by 2.8% year-on-year, 2.0% higher than expected and a significant rebound from 1.4% in the first quarter. The sub-item data showed that the increase in GDP this time was relatively widespread, with significant contributions from consumption, investment, inventory replenishment and the government, and a slowdown in service consumption, indicating that the U.S. recovery momentum in the second quarter was strong and healthy. After the GDP was released, the U.S. dollar and U.S. bond interest rates rebounded, and U.S. stocks rebounded after a brief decline. The market currently expects that the U.S. economic growth rate will still reach 2.3% in 2024, with the second quarter being the highest point of the year, and economic domestic demand slowing down in the third and fourth quarters.

-

As the economy grew, inflationary pressure eased. The year-on-year growth rate of the U.S. PCE price index in June fell from 2.6% in the previous month to 2.5%, the lowest level in five months, higher than the expected 2.4%; the year-on-year growth rate of the core PCE price index was 2.6%, the same as the previous value, the lowest level since March 2021.

-

Consumer spending also showed a certain degree of recovery. Personal consumption in the second quarter increased by 2.3% month-on-month, in line with expectations and slightly higher than 1.5% in the first quarter. The growth in consumer spending was mainly reflected in durable consumer goods and service consumption, while non-durable consumer goods declined slightly.

Popular Companies

Tesla reported lower-than-expected second-quarter earnings on Tuesday, with electric vehicle sales falling for the second consecutive quarter and profit margins falling to the lowest in more than five years, reflecting the impact of price cuts to boost demand and increased investment in AI programs. Q2 was a turbulent period for Tesla, with Musk shelving the development of a new, more affordable car model and focusing on building self-driving taxis, and the launch conference was postponed from August to October.

Q2 overall revenue increased by 2% YoY to $24.93 billion; net profit dropped by 45% to $1.48 billion, with adjusted earnings per share of 52 cents, lower than Wall Streets expectation of 62 cents and much lower than 91 cents in the same period last year. As a result, the stock price plummeted by 10% last week:

In addition, Teslas second quarter report showed that it has 9,720 bitcoins, with an acquisition cost of approximately US$337 million. Currently, there are US$640 million worth of bitcoins that have not been sold.

Alphabets second-quarter revenue and earnings per share exceeded expectations, and YouTube advertising revenue fell short of expectations, but cloud business and core advertising business grew year-on-year, showing a steady improvement trend as the main source of revenue. The market is concerned about the role of AI technology in driving the companys business and the impact of AI investment costs on profit margins.

Google’s stock price fell 7.5% last week, possibly because it has not yet seen the return prospects of its huge investment in AI, and OpenAI launched its competing product search GPT. Despite its good financial performance and the expectation of dividends and buybacks of tens of billions of dollars, Google’s stock price still fell 7.5% last week. However, Google’s forward PE in 2025 is 21 times, which is still attractive among large technology stocks. Wall Street’s consensus rating for Alphabet is still “strong buy”, with 33 analysts recommending “buy”, 6 rating “hold”, and no one recommending “sell”. The average target price has risen to $202.88, indicating a potential increase of 11%.

LVMH released financial data for the first half of this year, showing that operating income in the second quarter of 2024 was 20.98 billion euros, a year-on-year decrease of about 1.1%. Analysts expected a year-on-year increase of 0.9% to 21.41 billion euros. Regionally, in the second quarter, LVMHs organic sales in the three major markets of the United States, Japan and Europe increased by 2%, 57% and 4% respectively, but sales in Asia outside Japan, including China, fell by 14%.

LVMH shares fell 4.3% last week, continuing their decline since March:

The Democratic Party of the United States changes its leadership at the last minute

From June 27, when Biden performed poorly in the debate, which led to his decline in the polls, to calls within the Democratic Party to replace the candidate, to Trumps assassination attempt, to Bidens formal withdrawal from the race last week, many major events have occurred in the political situation.

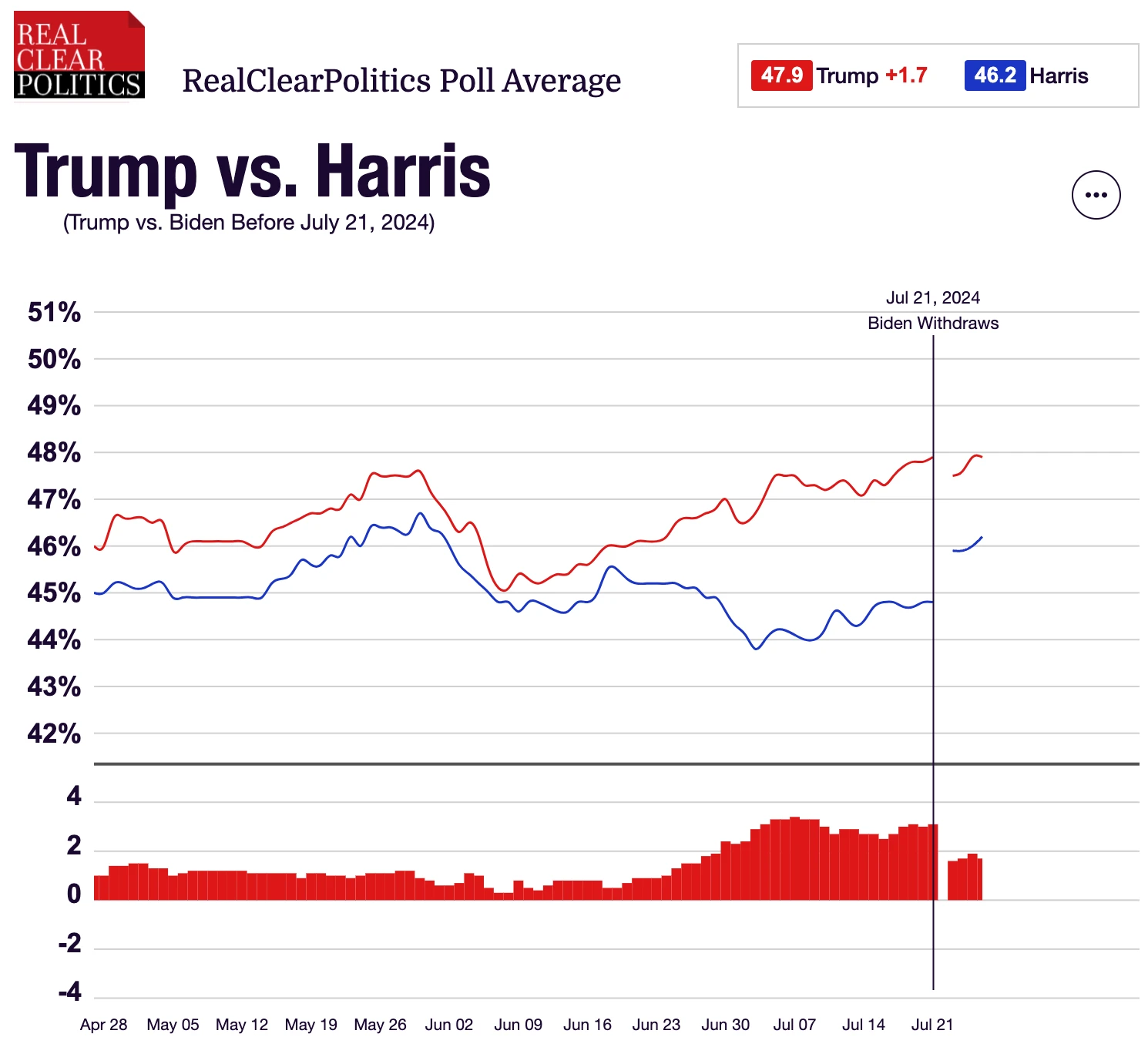

As we expected in the video we released on Monday, after the Democratic Party changed to a younger candidate, its support rate rose sharply and surpassed Biden. Comprehensive polls show that Harris is currently only 1 to 2 percentage points behind Trump, which makes the election results unpredictable and brings uncertainty to the outlook for economic policy:

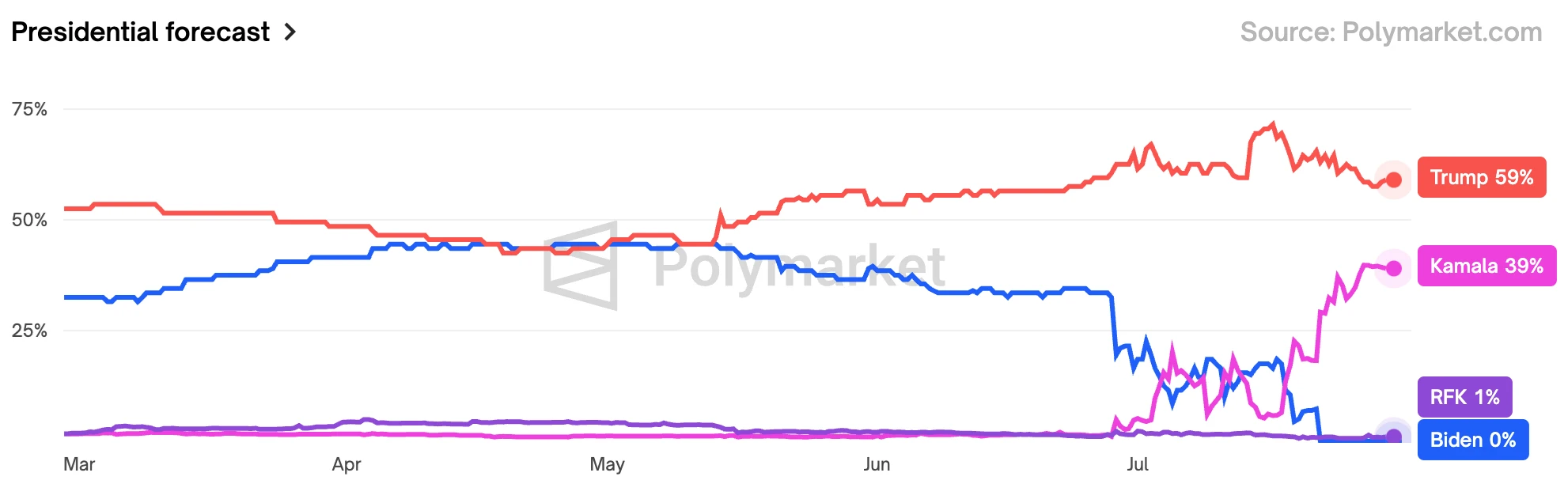

Prediction markets show Trumps chances of winning have fallen from nearly 75% to 60%, and the probability of a complete Republican victory has dropped from more than 50% to 35%.

There is no discussion about another Democrat challenging Harris for the nomination. Reuters polls show that a slight majority of Americans (52%) think she should be the Democratic nominee, while the figure for Democrats is 86%. About 80% of Democratic voters say they have a favorable impression of Biden, while 91% also have a favorable impression of Harris. It seems that the Democratic Party will most likely unite closely around Harris, and a split is unlikely. The next two key events are Harriss selection of a running mate from August 19 to 22, the Democratic National Convention, and the next presidential debate, which may be held in mid-September.

The stock markets reaction to election uncertainty increases, on average, from August to September and settles two weeks before the election:

Republican rule may lead to repeated inflation. In the 1980s, when faced with high inflation in the United States, the Reagan administration significantly cut taxes, reduced government spending, and relaxed regulations, which actually brought down inflation. However, this requires a strong contractionary monetary policy + open international trade, and then tax cuts to stimulate production, investment and consumption will be effective.

Yen reversal

More and more people believe that the turning point of Japanese and US monetary policies is coming soon. The carry trade of the yen seems to be unwinding. USDJPY fell from nearly 162 to a low of 152. The turning point was the weaker-than-expected CPI on July 11. Cryptocurrency also rebounded from that moment (BTC 57,000-68,000 ). Technology stocks also began to weaken from then on. It can be seen that institutions chose to start selling facts on big technology, which has already made a lot of profits.

If the yen continues to appreciate, it could lead to cross-asset liquidations, including selling of U.S. dollar assets, which is closely linked to the weakening of U.S. stocks.

However, I personally believe that the possibility of continued appreciation of the yen is limited, unless there is a risk of recession in the United States and the Federal Reserve is willing to further cut interest rates. Even if the Bank of Japan decides to raise interest rates and reduce purchases of Japanese government bonds next week, this may bring further downward pressure on USD/JPY, but the impact will be short-lived. Because the interest rate gap between the two countries is still large enough, it does not support large-scale capital flows back to Japan for the time being. Despite the long-term bearish US dollar, friends who invest in the yen need to have enough patience.

Regarding the monetary policy of the Bank of Japan, more and more opinions in the market believe that the time to raise the benchmark interest rate is approaching. This is because the Japanese government and relevant people of the ruling party have successively expressed their support for the Bank of Japan to shift to normal monetary policy. Like the Federal Reserve, Japan will hold its July monetary policy meeting on July 30-31. The market expects that the plan to reduce the purchase of government bonds will be announced at this meeting. If nothing unexpected happens, it will avoid announcing an interest rate hike at the same time to avoid market confusion.

PBOC unexpectedly cuts interest rates

On Thursday, the PBOC cut the one-year lending rate for commercial banks to 2.3% from 2.5%. This was the largest rate cut since a similar cut in April 2020, at the beginning of the coronavirus outbreak. The rate cut surprised the market because the central bank generally reviews the one-year lending rate on the 15th of each month. It also followed a cut in the open market seven-day reverse repurchase operation rate from 1.8% to 1.7% on Monday, as well as a 10 basis point reduction in both the one-year and five-year loan prime rates (LPR). The two rate cuts in a week came on the heels of the szqh meeting to discuss economic policy. This meeting did not introduce a strategy for broad adjustments or strong stimulus to the economy as many economists have suggested, and the stock market performed poorly. (Szqhs attitude remains to use advanced manufacturing to promote economic growth, and tolerance for a period of moderate economic slowdown remains)

Data released by the National Bureau of Statistics on Monday showed that the economic growth rate slowed to 4.7% in the second quarter, which was not only lower than market expectations, but also the worst performance in five quarters. Although the government continued to introduce measures to promote consumption and stabilize the property market, the growth rate of total retail sales of consumer goods in June still fell to the lowest level in a year and a half, and the price of new houses recorded the largest drop in nine years during the same period, highlighting the weak recovery of the demand side.

If the economic heat (supply and demand) does not improve, continued easing may not directly benefit the risk asset market.

Kripto Piyasası

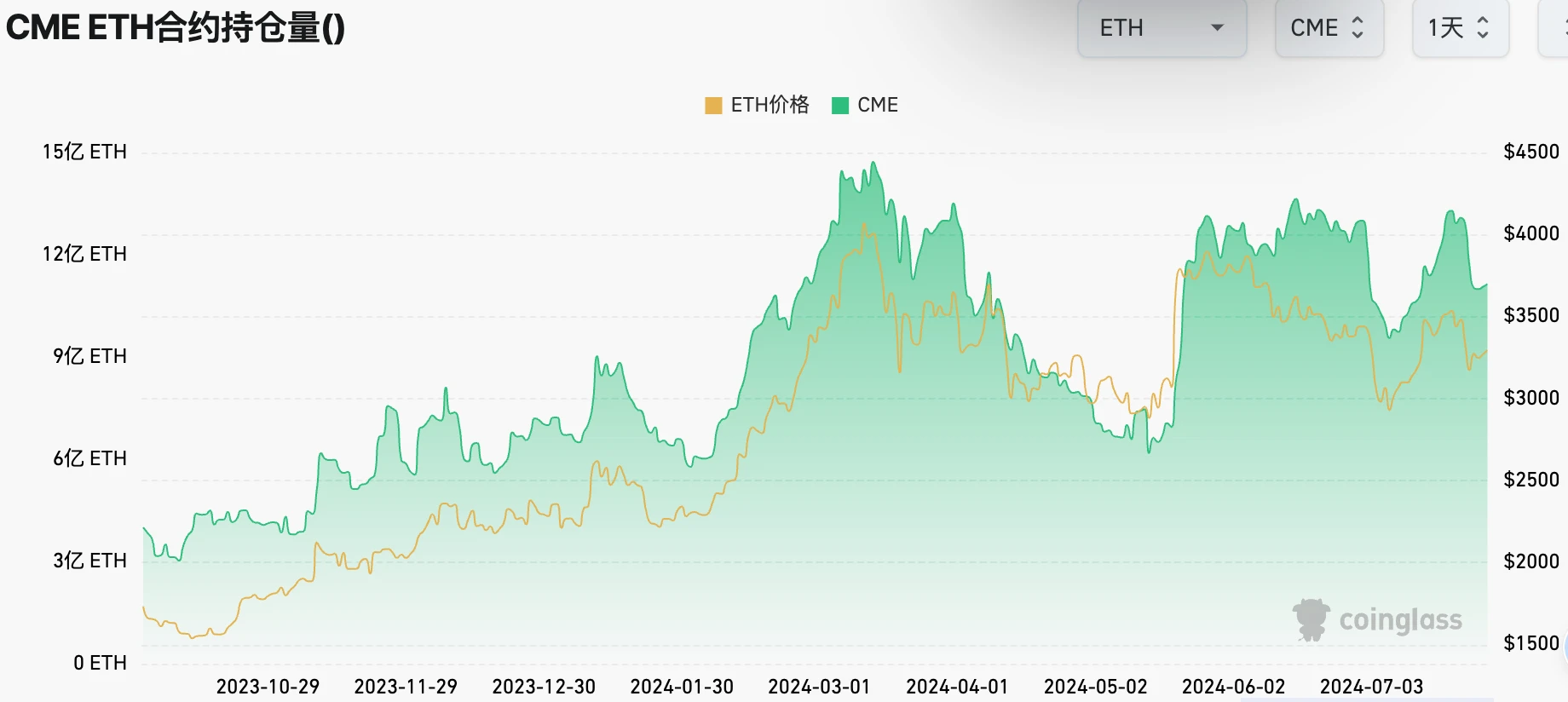

The response to the ETH ETF listing on July 23 was relatively flat. In the first four days of listing, the total net outflow of these nine ETFs was $163 million. This was mainly due to the large outflow of $1.5 billion from Grayscales ETHE. However, on the other hand, Grayscales Mini ETH ETF has continuously inflowed $164 million. Since the outflow may be mainly driven by high fees (2.5% vs. 0.2%), the demand for other ETFs except ETHE continues, so the basic market of ETH is still relatively optimistic. From the perspective of market performance, ETH peaked after the unexpected approval of 19 b-4 at the end of May, and has not been able to break through the previous high so far. The market chose to start selling the fact when the ETF was confirmed to be listed two months ago. This is different from BTC, which continued to rise until the day the ETF was listed. In addition, the outflow of ETH ETFs was much larger than that of BTC in the early stage in terms of market value ratio, so overall it seems that ETH is an accelerated version of BTC ETFs before and after its listing. Will it also follow the rise of BTC in advance? (After the ETF, BTC rose from more than 40,000 to more than 70,000).

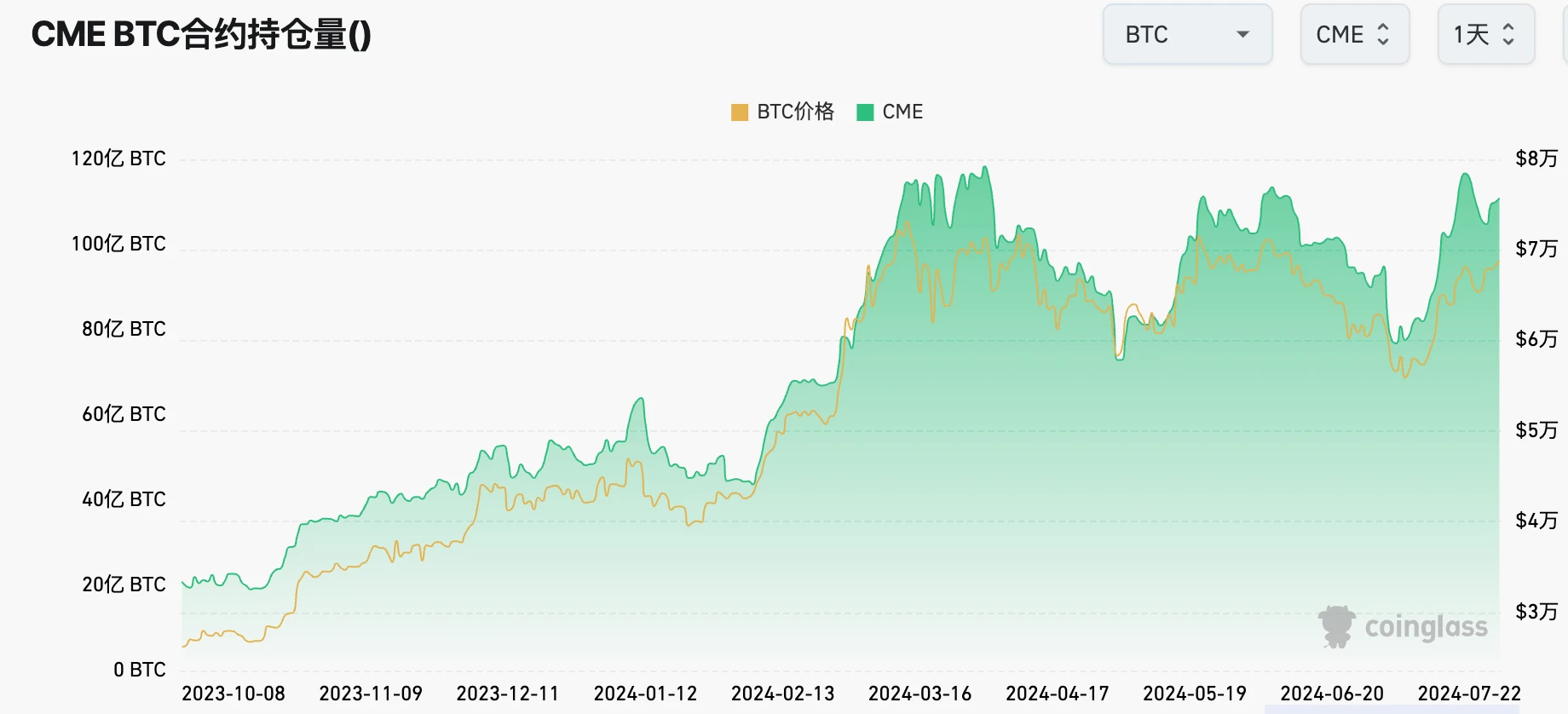

Wall Street futures open interest remains high, reflecting the continued enthusiasm for encryption:

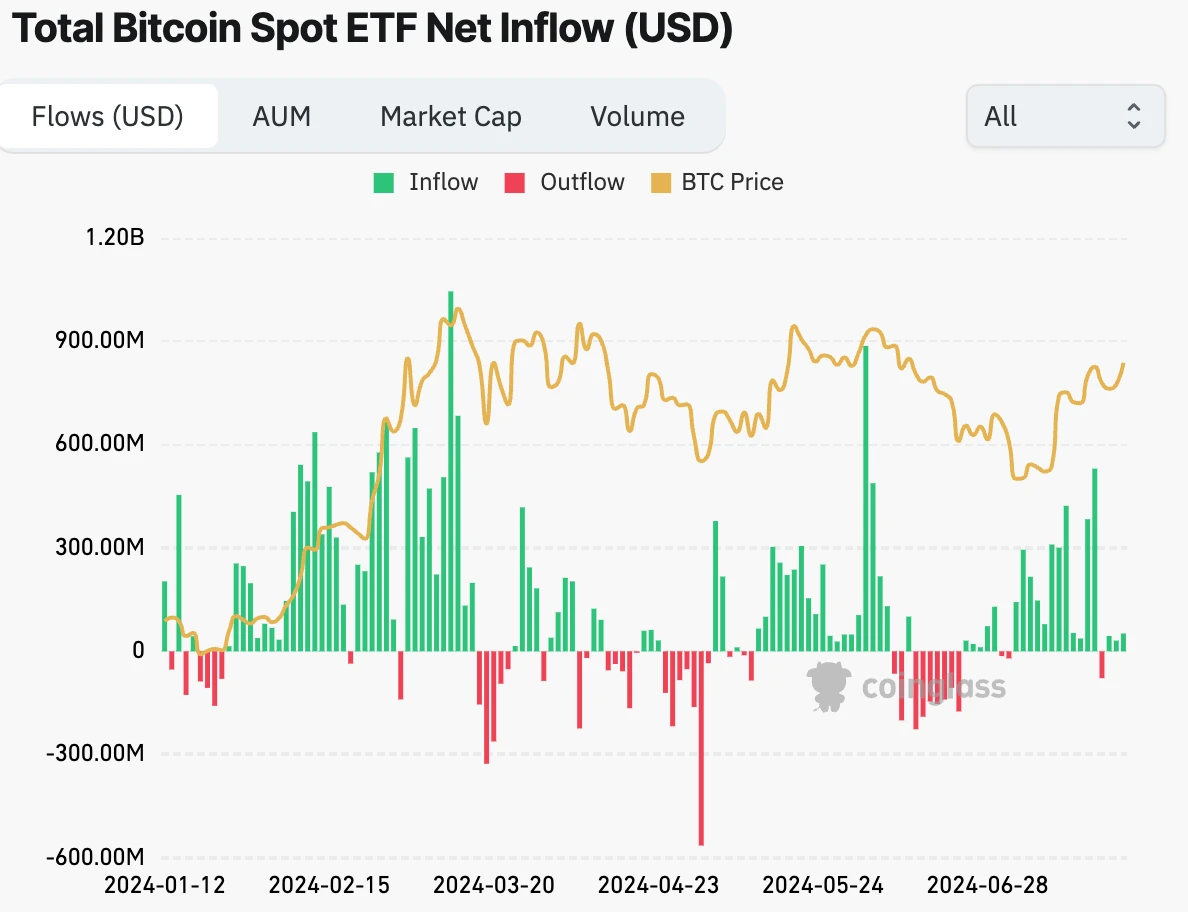

ETFs maintained net inflows for most of July, with only three days of net outflows, and net inflows of $3 billion were the best monthly performance since March:

Crypto Trump deal?

Like China and the United States, the overall housing market is weak but luxury homes are hot

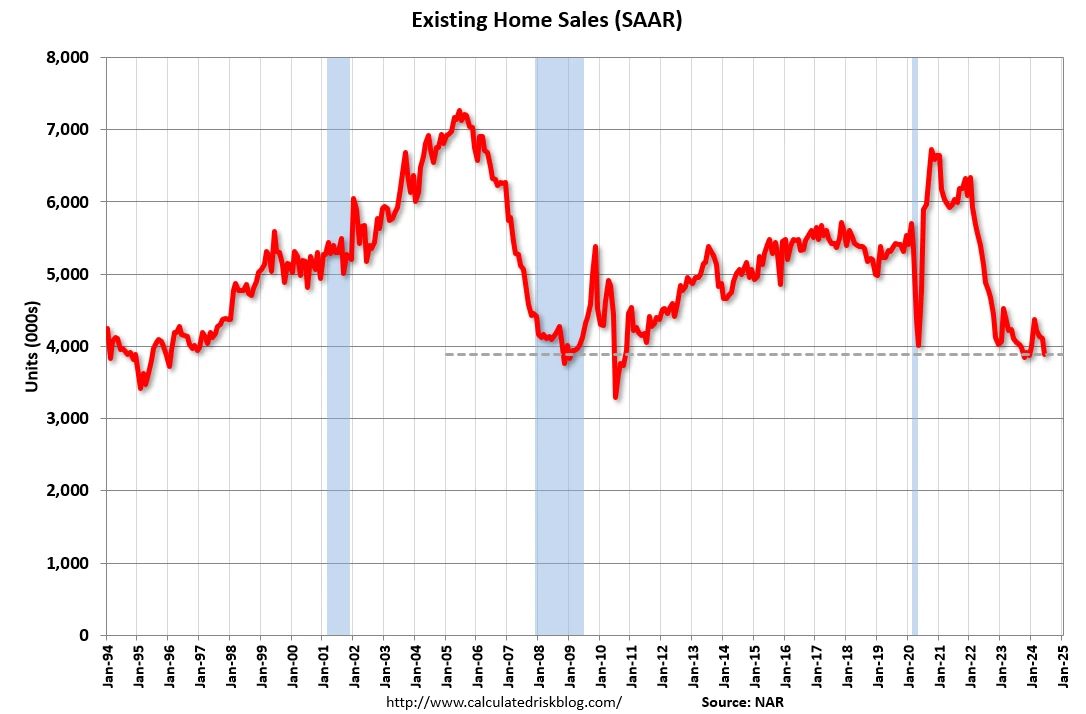

Due to high house prices and high interest rates, the total number of existing home sales in the United States in June, released on Tuesday, hit the lowest annualized rate since 2010, but the median house price hit a new record.

-

Luxury real estate market rebounds, in stark contrast to the sluggish general real estate market

-

Sales of luxury homes priced at $100 million are expected to double this year, with more than 4,000 homes sold in the United States for more than $5 million through June, up 13% year-over-year.

-

Reasons: High interest rates and the wealth effect of the stock market, as well as the death of the older generation of wealthy people in recent years, have caused the younger generation to inherit a large amount of wealth from their families.

Professional investors bottom-fished last week

By observing funding spreads, we can understand professional investors demand for financial derivatives such as futures, swaps and options, especially their demand for leverage.

June 25: Funding spreads peak, indicating that demand for leveraged instruments from professional investors was very high during this period.

July 10: Funding spreads fell to a low, indicating a reduction in long demand, and the SPX peaked during this period.

July 24: Funding spreads hit a new high again, indicating a renewed rise in long demand.

The current funding spread level shows that professional investors are still actively participating in the market even under the current high stock valuations, which is a bullish signal for the stock market.

Combined with the fact that there was no slowdown in inflows into stock and cryptocurrency ETFs last week, it can be felt that the markets willingness to buy at low prices remains strong.

FOMC Outlook

After the PCE data that met expectations last week, the market further confirmed the Feds expectation of a rate cut in September. The CME futures market predicts a 90% chance of a 25 basis point cut in September. The expected interest rate level at the end of the year is between 4.5% and 4.75%, 60 to 75 bp away from the current level, which means that the Fed is expected to cut interest rates 2.5 times, higher than the 1 time previously expected by Fed officials.

The recent positive news on inflation and the further rise in unemployment are expected to cause Fed officials to adjust their views. It is expected that the FOMC will not cut interest rates, but may revise its statement, including Powells possible relaxation at the press conference, hinting at a rate cut in September and the possibility of more than one rate cut this year. Some voices, including the former third-in-command of the Federal Reserve, have called on the Federal Reserve to cut interest rates in July, laying the foundation for expectations of more rate cuts this year.

This article is sourced from the internet: Cycle Capital Weekly Market Commentary (7.29): Economic data is optimistic, second quarter earnings are encouraging, and style switching is excessive

Related: The SECs investigation into ETF 2.0 just ended, but lawyers are arguing

Original|Odaily Planet Daily Author: jk On June 18, the U.S. Securities and Exchange Commission (SEC) announced the end of its investigation into Ethereum 2.0 and would not take enforcement action against Consensys. This is undoubtedly a milestone victory for Ethereum developers, technology providers, and the Ethereum ecosystem. A week has passed since the discussion on this matter, and many people in the legal community have written detailed legal opinions on this matter. However, there are different opinions on the interpretation of this decision. Some lawyers believe that the end of this investigation means that all topics related to Ethereum as a security (except staking) will no longer be investigated in the future, while other lawyers believe that this is just a temporary truce against Consensys. This article will summarize the…