10x Araştırma: ETF sonrası dönemde ETH fiyatları nasıl hareket edecek?

Original: 10x Research

Compiled by: Odaily Planet Daily ( @OdailyChina )

Translator: Azuma ( @azuma_eth )

Editör notu: In the early morning of July 23rd, Beijing time, the U.S. Securities and Exchange Commission (SEC) officially approved the Ethereum spot ETF, allowing multiple ETFs to officially start trading on Tuesday. However, perhaps because the expectation of ETF approval has long been digested by the market, the price of ETH did not fluctuate significantly after the SECs announcement. As of the time of writing, it was temporarily reported at 3442.62 USDT, a 24-hour drop of 1.3%.

At present, one of the issues that the market is most concerned about is undoubtedly the subsequent trend of ETH prices, especially after the ETF is officially opened for trading tomorrow. Can the capital inflow brought by the ETF boost the price of ETH? Will there be a potential trend of good news will lead to bad news? In response to these questions, 10x Research, an investment institution obsessed with market predictions, once again released a market analysis of ETHs future market trends.

The following is the original content of 10x Research, translated by Odaily Planet Daily.

Let us first review the approval process of the Ethereum spot ETF.

On May 20, the SEC unexpectedly asked exchanges to update their 19 b-4 filing materials, which means that the filing progress of the Ethereum spot ETF has made substantial progress. Based on this change, the market has directly increased the probability of approval of the ETF from 25% to 75%.

On May 23, the SEC officially approved the 19 b-4 filing for the Ethereum spot ETF, solving one of the biggest problems before the ETF went public .

In the seven days since then, the size of Ethereums futures open interest has directly increased from US$8.8 billion to US$13 billion, and the price of ETH has also jumped from US$3,065 to a short-term high of US$3,959.

This morning, the SEC has officially completed the final approval of the Ethereum spot ETF, allowing the trading product to start trading tomorrow. We have witnessed similar milestones many times in the past, such as the launch of Bitcoin futures in December 2017, the listing of Coinbase in April 2021, the listing of Bitcoin futures ETF in October 2021, and the listing of Bitcoin spot ETF in January 2024. All of these milestones have been followed by short-term corrections.

Şu anda, traders are asking us if ETH will follow a similar trend…

Although the price of ETH rose to $3,959 at the end of May, it fell below $3,000 in early July. This in itself shows that traders lack confidence in the continued rise in the price of ETH. Although ETH has rebounded to $3,500 before the approval of this ETF, we suspect that many people will choose to sell and take profits as soon as the ETF is launched – or even before it is launched.

Ek olarak, the marketing efforts around the Ethereum spot ETF are relatively low , which may directly lead to low interest in the ETF from retail or institutional investors. BlackRock CEO Larry Fink recently gave a televised speech, but he only promoted Bitcoin instead of Ethereum. This shows that (at least in the early stages) BlackRocks customers have relatively limited interest in ETH.

When the Bitcoin spot ETF was released, the annualized funding rate in the futures market was close to 15%, and it once increased to 70% in February, which attracted the attention of many arbitrage funds – they would buy ETFs and hedge with futures to earn arbitrage profits. This buying action strengthened the bullish sentiment around BTC.

Currently, the annualized funding rate of the Ethereum futures market is only 7-9%, which is not very attractive to arbitrage institutions, especially considering the capital rest cost of at least 5% (federal funds rate). Compared with the situation of Bitcoin spot ETF in February, the Ethereum spot ETF is unlikely to attract too much arbitrage funds, thereby weakening the optimism about ETH.

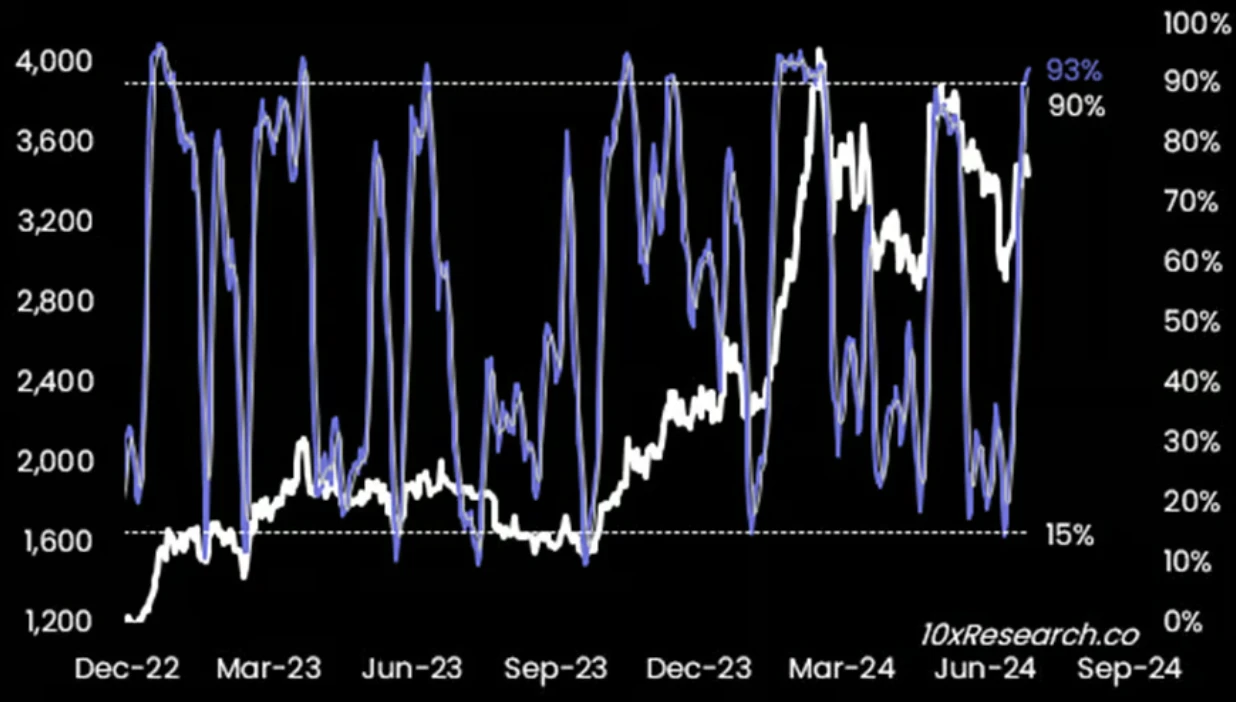

Note: Ethereum Stochastics indicator (greater than 90% means overbought).

From a technical perspective, ETH’s Stochastics indicator has basically peaked, which means that this is a good short opportunity – we will use the recent high of 3560 as the stop loss.

Nispeten konuşursak, we prefer to hedge short ETH while going long on BTC, rather than going short directly. Traders can also sell Ethereum put options and buy Bitcoin call options at the operational level. However, options are relatively expensive, with an implied volatility of 65% expiring on September 27, but a 30-day realized volatility of only 50%, indicating that the implied volatility contains a significant premium.

Judging from the market discussion heat, the discussion about Solana in this cycle is also significantly higher than that of Ethereum. The Solana ecosystem gave birth to the craze of meme tokens, while Ethereum missed this opportunity due to high gas fees. We can cite various data to prove that Solana is more popular than Ethereum. For example, Solana currently has 14.2 million active addresses, while Ethereum only has 7.5 million…

Ethereums market dominance has dropped to 17.0% after reaching a high of 18.4% a month ago . The lack of market interest is also reflected in the gas price, which has never been able to rebound. The Dencun upgrade in March 2024 significantly reduced network fees, but the number of network transactions has stagnated, the number of active addresses is similar to three years ago, and the Ethereum network has hardly grown.

In a trade finance environment with zero interest rates, Ethereum’s staking yield advantage was a key reason for the ecosystem to breed DeFi Summer in 2020 and 2021. Today, Ethereum’s staking yield is only 3.12%, and Coinbase’s Ethereum staking yield is only 2.91%. Although ETFs themselves do not involve staking, from a yield perspective, opportunity cost is a key reason for the low demand for ETH in this cycle.

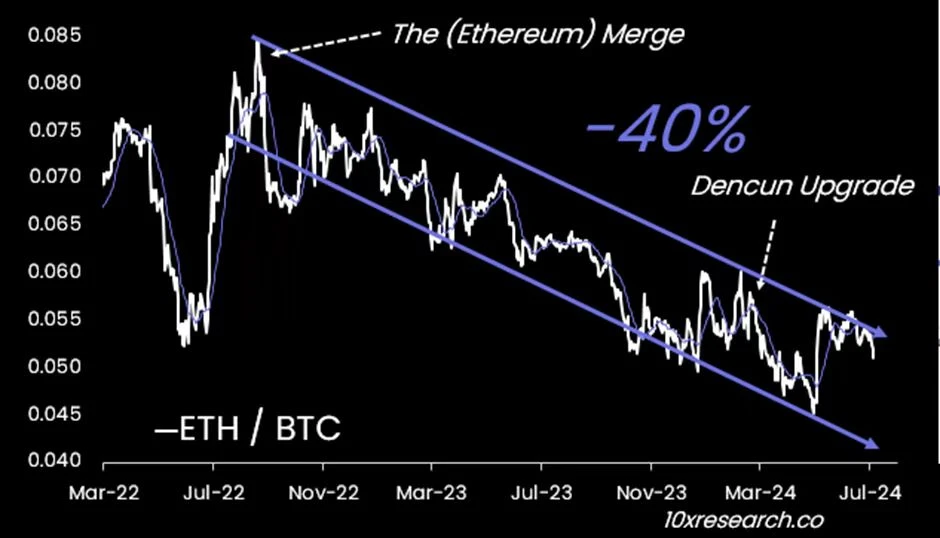

Compared with BTC, the beta coefficient of ETHs rise is also weakening. Since the beginning of this bull market, ETHs performance has been less than ideal. If calculated from October 2022, ETHs performance lags behind BTC by 40%.

Considering the above factors and the fact that the ETF issuer has not yet carried out large-scale marketing activities; coupled with the fact that some traders will choose to close some long positions when the news comes out; in addition, there is also the potential outflow of funds from Grayscale… This can indeed be a reason to be bearish on ETH, at least in the early stages.

This article is sourced from the internet: 10x Research: How will ETH prices move in the post-ETF era?

Headlines US spot Ethereum ETF officially approved The U.S. Securities and Exchange Commission (SEC) has notified at least two of the eight companies that have applied to launch the first U.S. spot Ethereum ETFs that their products can begin trading on Tuesday (July 23). Products from BlackRock, VanEck, and six other companies will begin trading on three different exchanges Tuesday morning: the Chicago Board Options Exchange (CBOE), Nasdaq, and the New York Stock Exchange, which all confirmed that they are ready to start trading. Eric Balchunas, ETF analyst at Bloomberg, said: The spot Ethereum ETF has gone live with the SEC. Form 424(b) is being submitted, which is the last step, meaning everything is ready to start trading at 9:30 a.m. on Tuesday (9:30 p.m. Beijing time tonight). Game on.…