TVL 50 milyar ABD dolarını aştı, likidite staking yolunun performansına ilişkin kapsamlı bir inceleme

Original author: OurNetwork

Orijinal çeviri: TechFlow

Likidite Stakingi

Sanctum, Lido, Marinade, Tonstakers and Stader

Over $50 billion locked in liquidity staking protocols

-

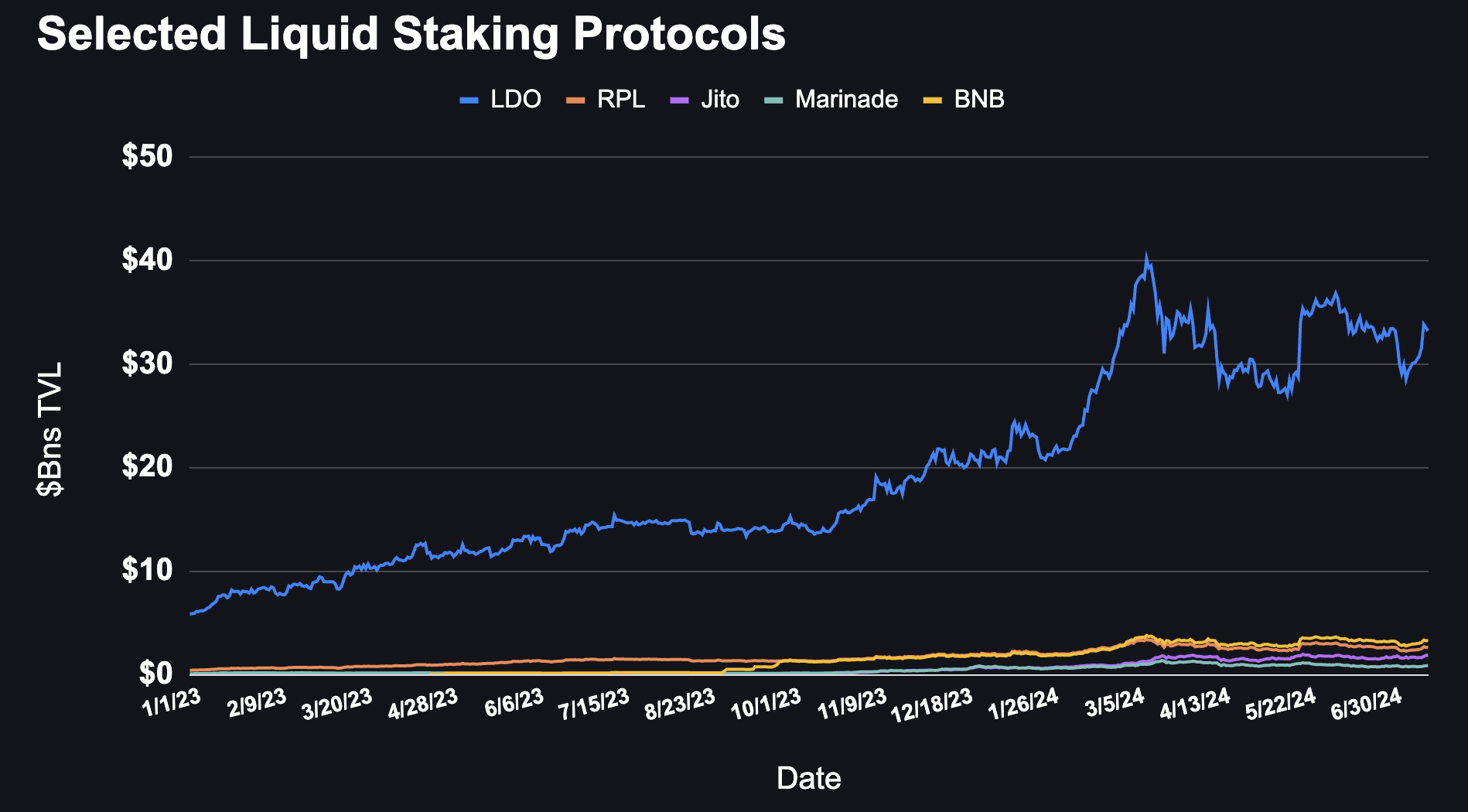

Liquidity staking is one of the most used features in cryptocurrencies, allowing users to unlock DeFi options. As more proof-of-stake blockchains launch, liquidity staking solutions emerge almost immediately, offering users flexibility in how they stake. The total value locked (TVL) in the liquidity staking market has exceeded $50 billion, thanks to new chain launches, rising ETH prices, and more users using Liquidity Staking Tokens (LSTs). Liquidity staking traffic has increased significantly on Solana, TON, and Ethereum over the past year.

DeFi Llama

-

Lido remains the dominant liquidity staking protocol, with a staggering $33 billion TVL. Its size is more than 8 times that of the second largest protocol, Rocket Pool, and the liquidity staking market still exhibits a power-law distribution. Solana has two protocols in the top ten, with Jito accumulating $1.8 billion in TVL and Marinade Finance about $850 million.

Artemis Analytics DeFi Llama

-

Outside of Ethereum, penetration of liquidity staking providers remains low, with plenty of room for growth. TONstakers stake almost 6% of all TON, indicating significant demand for TON staking products. Solana staking products have seen significant inflows over the past year, but the total staked percentage remains low.

stakingrewards.com

① Sanctum

h 4 awk | Web sitesi | Dashboard

Sanctum’s Wonderland Increases Liquidity Staking Token (LST) Trading Volume on Solana by 25%, Currently Over 25 Million SOL

-

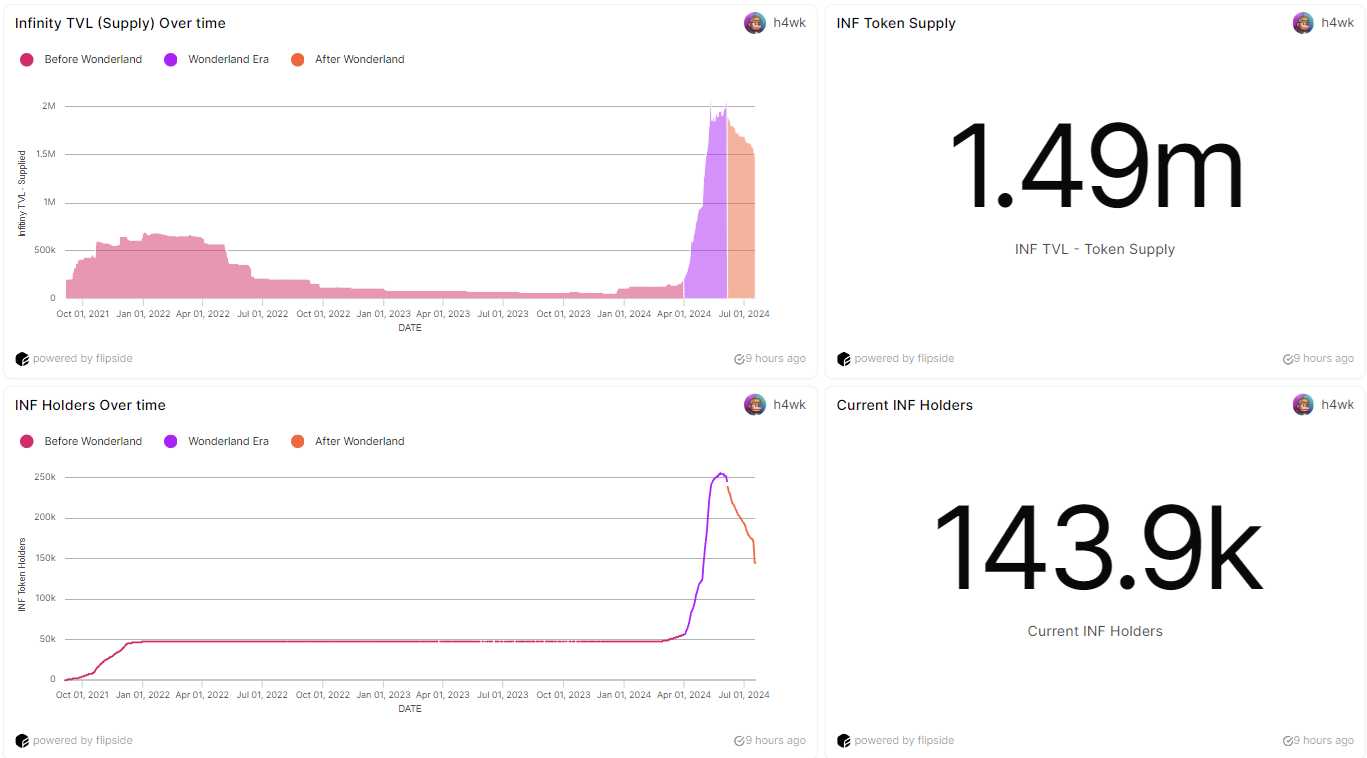

Sanctum’s Infinity is the only liquidity pool that can natively support millions of different LSTs. Wonderland allows users to hold LST to gain pet experience (points) and contribute to the CLOUD airdrop protocol on July 18, 2024. The event boosted Solana’s LST trading volume, increasing its share from 5.2% to 6.5%, with a total trading volume of over 25 million SOL.

Flipside – @h 4 wk

-

Even though the campaign has ended, INF tokens remain popular among Sanctum users. Currently, the supply of INF remains at around 1.5 million, with over 140,000 holders. Both figures have dropped slightly after the end of Season 1. The announcement of Wonderland Season 2 suggests that it will be released later this year.

Flipside – @h 4 wk

-

Before CLOUD launched, 5,000 investors subscribed to the CLOUD Alpha Vault for 30 million USDC, which was 400% oversubscribed. 60% of the trading volume came from the last hour, which shows that the project is very popular and traders are looking forward to it.

Flipside – @marqu

② Lido

Steakhouse Financial | Web sitesi | Dashboard

stETH price is highly correlated with CME ETH futures price

-

Steakhouse analyzed the suitability of stETH as an asset to back Ethereum collateralized ETFs and found that stETH prices are highly correlated with CME ETH futures prices and that its bid-ask spread is narrow relative to market capitalization. We analyzed three questions: Can stETH be traded fairly and provide an efficient redemption and subscription market? Can stETH be traded without being controlled by a few individuals or entities? What is the total return profile provided by stETH as an ETP underlying asset?

Dune Analytics – @steakhouse

-

For stETH data, Steakhouse uses TradingView’s API to fetch data from centralized exchanges (CEX) for stETH/USD. For ETH commodity futures data, we rely on CME’s tick-by-tick historical data. For ETH spot prices, we rely on data provided by Coinbase via the TradingView API. Our Python notebooks are available on github . We explored long-term correlation trends, timeframes since withdrawals were opened, and timeframes of immediate and detailed market reactions.

Steakhouse Financials economic analysis of stETHs performance in ETFs

③ Marinade

Turşu | Web sitesi | Dashboard

Marinade’s total stake increased by 26% year-on-year

-

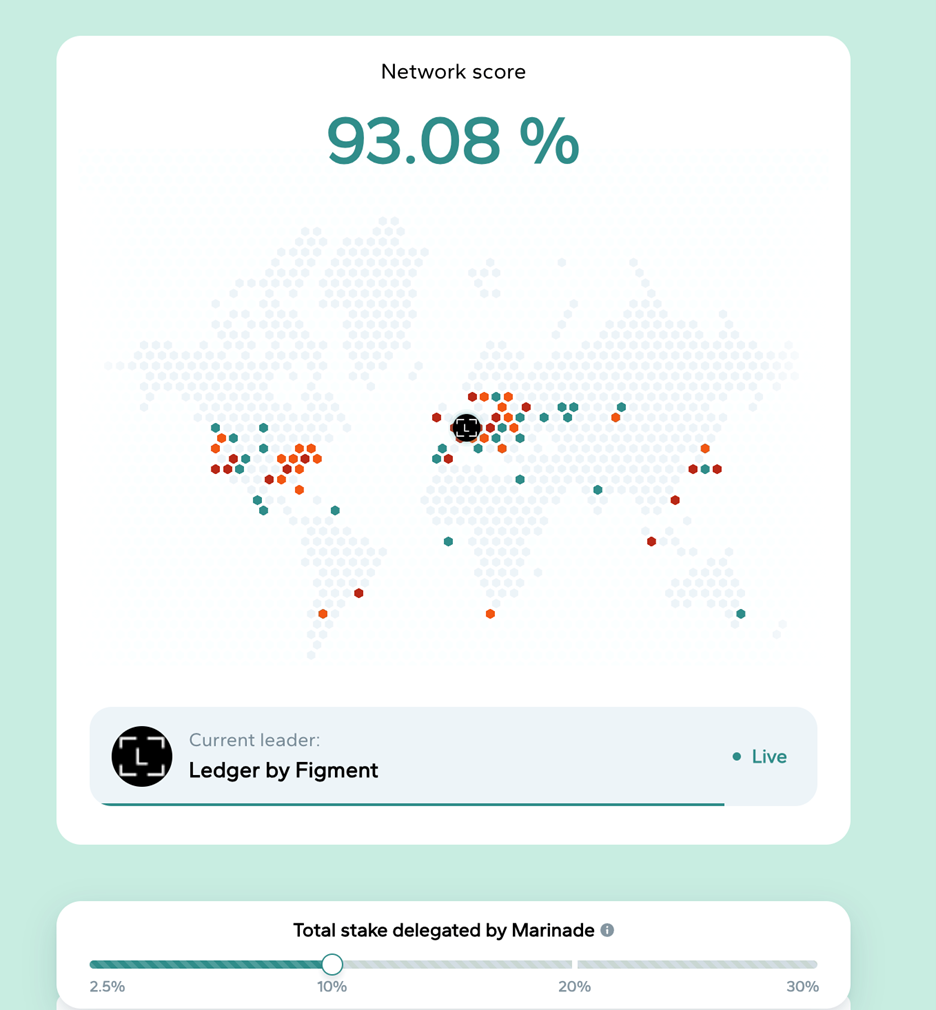

The Stake Auction Marketplace (SAM) is an important feature of Marinade v2 , which creates an open auction platform for staking between validators. This allows stakers on Marinade to receive priority fees, such as MEV tips and transaction fees, which were previously only available to validators.

Twitter – @MarinadeFinan

-

Solana’s network growth is accelerating. As usage of the Solana network increases, validators earn more revenue from MEV and transaction fees. This makes staking more valuable and provides an opportunity for Marinade to create an on-chain market to redistribute the maximum rewards to stakers.

Blok

-

Marinade will soon update its delegation strategy with the goal of increasing the decentralization of Solana security. Starting August 14, 90% of stake will be delegated based on SAM results, 10% based on MNDE votes, and the rebalancing cap per epoch will be increased from 2% to 5%. Currently, about 2% of SOL stake is delegated through Marinade. If this proportion increases to 10%, the performance of validators will increase from 72% to 93%, which will have a positive impact on decentralization.

-

Transaction-Level Alpha: Last month, a user deposited 30,000 SOL (over $4.1 million at the time) into Marinade liquidity stake in a single transaction. Overall, the total amount of SOL staked in Marinade has increased by approximately 2.85 million over the past 15 months, a 57% increase.

④ Tonstakers

Maksim Ratnikov | Web sitesi | Dashboard

The first liquidity staking protocol on TON, with a TVL of over $250 million and over 70,000 daily active users

-

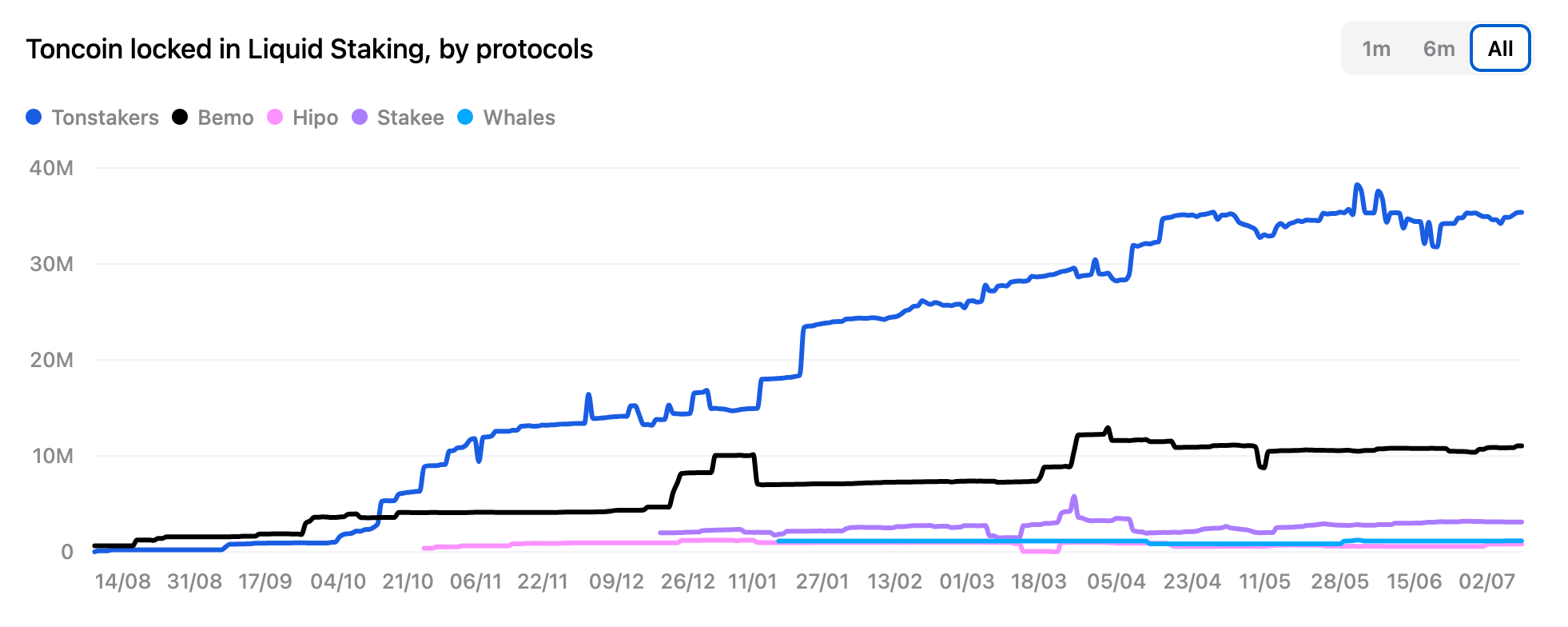

Tonstakers holds 69% of the total locked value (TVL) of liquidity staking tokens (LST) on TON. Tonstakers is a liquidity staking protocol in the TON (The Open Network) ecosystem. Tonstakers uses a clever liquidity staking mechanism that compounds interest every approximately 18 hours to maximize annual percentage yield (APY) and protect users from slashing losses. The value of deposits denominated in US dollars increased by 12,400% year-on-year (from $2 million to over $250 million) throughout the year. In 2024, Tonstakers reached 1 million subscribers on its Telegram channel, and daily active users (DAU) grew from approximately 20,000 to over 75,000, a 700% year-on-year increase.

TON Stat

-

In early 2024, Tonstakers passed a comprehensive security audit by Certik Security, scoring 94 out of 100 (AAA). This makes Tonstakers the most secure project on the TON blockchain, and it has maintained a record of zero security incidents during its operation.

skynet.certik.com

-

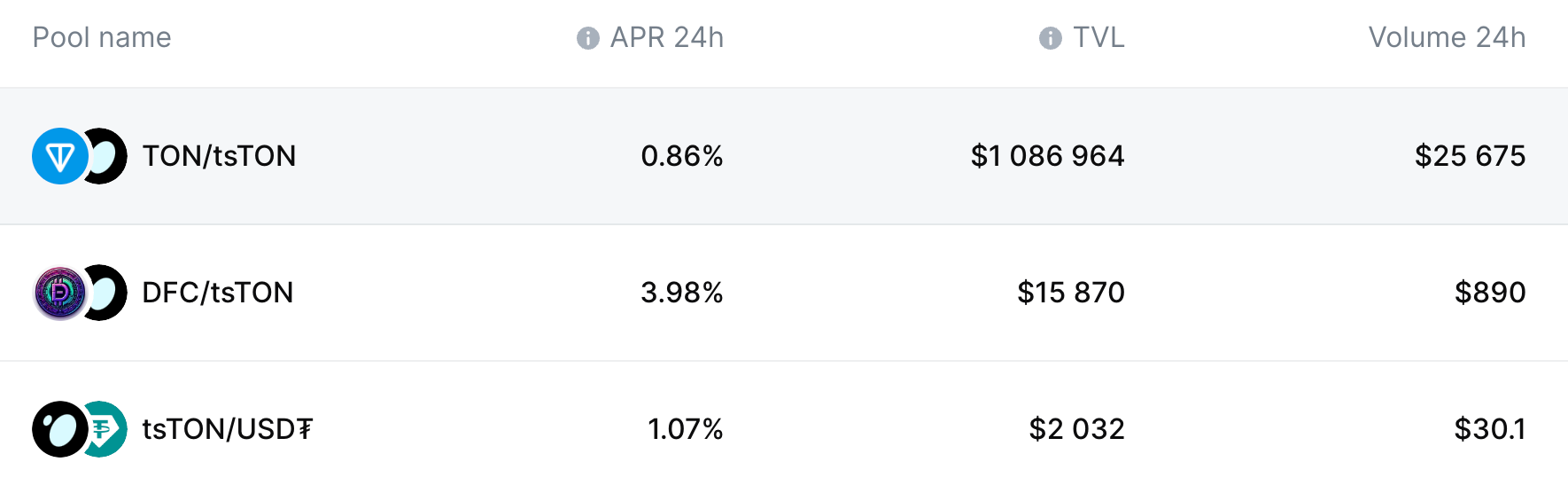

Tonstakers users learn how the protocol’s LST tsTON can unlock their liquidity: leverage tsTON in EVAA loans, earn higher rewards through DFC, mint stablecoins on Aqua Protocol, etc. In addition, Tonstakers is developing a unique jetton staking that allows users and projects to stake fungible tokens risk-free.

app.ston.fi

⑤ Stader

Mayhem 10 r | Web sitesi | Dashboard

Total locked value (TVL) on ETHx, Polygon, BSC, and Hedera exceeds $600 million, with rewards exceeding $25 million

-

ETHx TVL and deposits: Stader Labs is a non-custodial staking platform that provides liquidity and security to users on multiple Proof-of-Stake networks. Stader Labs has a total TVL of Ξ125,293 (~$386M) on ETHx and Ξ135,872 deposited on the beacon chain (including 9,000+ ETH deposits from node operators). This large-scale participation reflects the strong confidence of institutions and users in Stader’s staking solution, driven by a combination of permissionless and permissioned TVL.

Dune – Stader Labs

-

MaticX TVL, Rewards and Revenue: Stader Labs is the leading Liquid Staking Token (LST) on Polygon with a TVL of over 154M Matic. It has distributed $6,128,781 in rewards to users. These rewards are managed through an ETH contract, and Stader received a 10% share ($680,976). Stader has been showing consistent growth since July 2022.

Dune – Stader Labs

-

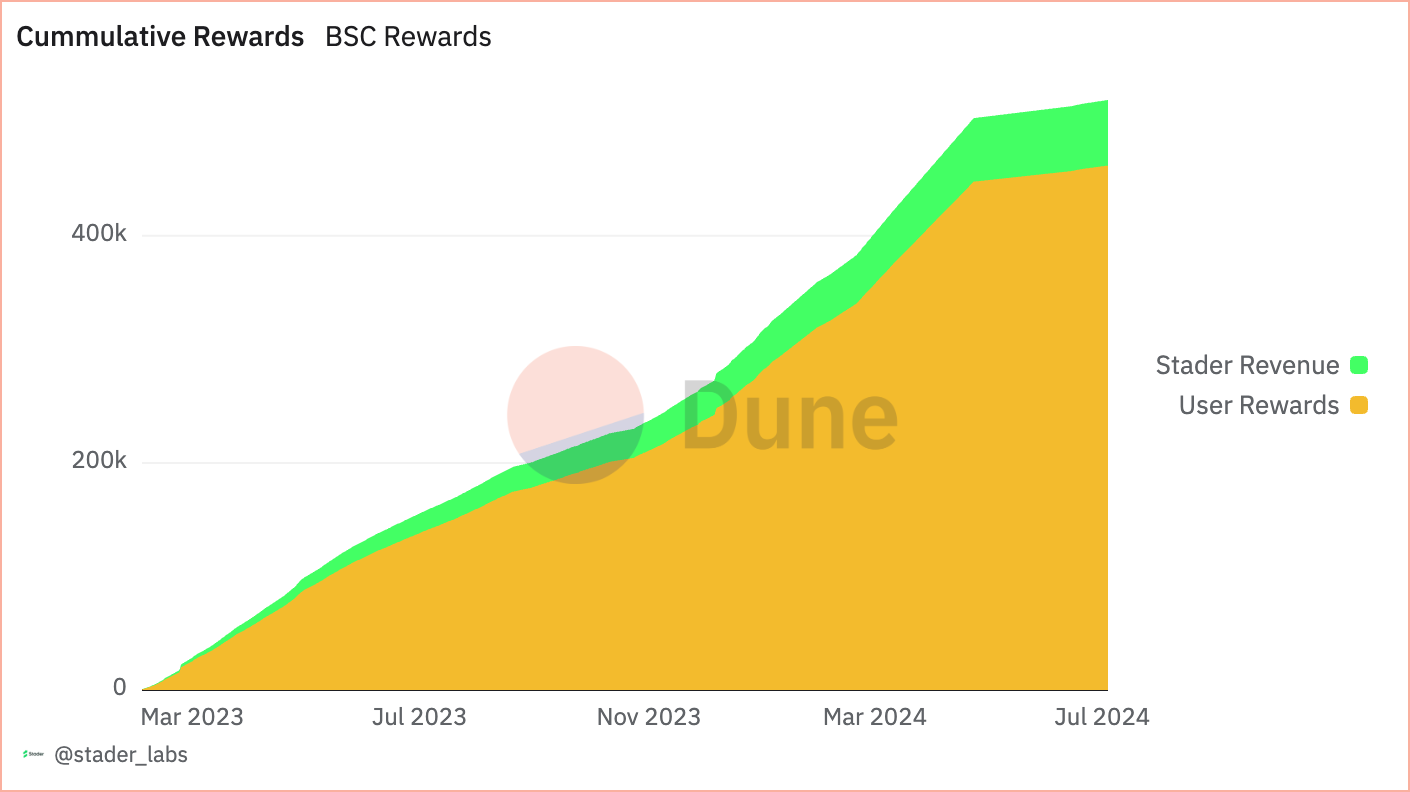

BNBx Rewards and Revenue: On the BNB blockchain, Stader Labs distributed $461,818 in rewards to users and generated $57,727 in revenue. Reward distribution occurs automatically with each auto-compounding, ensuring continued growth and user engagement in the staking ecosystem.

Dune – Stader Labs

This article is sourced from the internet: TVL exceeds 50 billion US dollars, a comprehensive review of the performance of the liquidity staking track

Related: A brief analysis of the liquidity war in the re-pledge market

Original author: Larry Sukernik, Myles ONeil Original translation: Frost, BlockBeats At Reverie, we spend a lot of time researching restaking protocols. It’s an exciting investment category for us because everything is fuzzy (opportunities exist in fuzzy markets) and there’s a lot happening (dozens of projects will launch in the restaking space in the next 12 months). In our work studying re-pledge mechanisms, we have gained some insights, so we wanted to predict how the re-pledge market will develop in the next few years. A lot of this is new, so what works today may not work tomorrow. Nonetheless, we wanted to share some initial observations about the business dynamics of the re-pledge market. LRT as a leverage point Today, LRTs like Etherfi and Renzo hold a powerful position in the…