Let鈥檚 start with the Bitcoin shutdown price

Recently, as Mt. Gox began to pay out Bitcoin and the German government frequently sold Bitcoin, the price of Bitcoin once fell below $54,000 (it has now risen back above $60,000), reaching the shutdown price of some Bitcoin mining machines.

According to a survey, if Bitcoin reaches 54,000, only ASIC mining machines with an efficiency of more than 23 W/T can make a profit, and only 5 models of mining machines can barely support it. This means that if the price of Bitcoin falls below the shutdown price, some miners with smaller risk resistance will seek to exit and stop losses. When these miners exit, they often sell Bitcoin for cash and sell mining machines at a lower price, causing the price of Bitcoin to fall further. This phenomenon is called Miner Capitulation.

The so-called shutdown price is actually the cost price of Bitcoin mining machines. So how is this cost price calculated? In order to answer this question, we must first understand Bitcoins economic model and PoW mechanism.

Bitcoin is pre-programmed with a total supply of 21 million, and a block is mined approximately every 10 minutes, rewarding miners with a number of bitcoins. The amount of rewards was 50 bitcoins per block at the beginning of Bitcoin, and then the rewards will be halved every 210,000 blocks (approximately every four years). The most recent halving event occurred on April 23, 2024, when the block height was 840,000, and the reward dropped to 3.125 bitcoins per block. In addition to the block reward, miners will also charge a fee for packaging transactions, and the fee for each transaction is generally between 0.0001 and 0.0005 bitcoins. The fee is regulated by the market. The more users use Bitcoin to transfer money, the busier the miners will be. If the transaction fee is set too low, the transaction will be ignored by the miners.

When transactions occur in the Bitcoin network, they are placed in the memory pool (mempool). Then, miners select a group of transactions from the memory pool and try to form a new block. To do this, miners need to find a specific value in the random number and combine this specific value with the block data to generate a hash value that meets the network difficulty target. This process is called mining. Whoever calculates the qualified hash value first obtains the right to record the account, which means that the mining is successful. The difficulty target is a dynamic value that is adjusted every 2016 blocks (approximately every two weeks) to keep the average block time of Bitcoin at about 10 minutes. Therefore, the greater the computing power of the entire network, the greater the difficulty target will be.

The computing power mentioned above is the ability of Bitcoin mining machines to mine, that is, how many hash collisions can be made per second. The current computing power unit is generally TH/s, that is, 10 ^ 12 hashes per second. The computing power of the entire network is about 630 EH/s, that is, 6.310 ^ 20 hashes per second. Therefore, each T computing power can theoretically mine 810 ^(-7) Bitcoins per day. For miners, in addition to the purchase of mining machines and the operation and management costs of mining farms, the main expenditure is the electricity cost of mining. Taking the Ant S 19 pro mining machine as an example, the rated computing power is 110 T and the rated power consumption is 3250 W. It can be inferred that the daily power consumption of each T computing power is 0.709 kW. The electricity costs in different countries and regions vary greatly. According to 0.055 u/kw, the cost of one Bitcoin is about 50,000 US dollars. The figure below is the Bitcoin mining data of F 2 Pool, which is basically consistent with the authors estimate.

The above premise is based on the fact that the total network computing power is 630 EH/s. Once miners surrender, the total network computing power will drop, and the cost of mining one Bitcoin will also drop. Similarly, if the price of Bitcoin rises, miners will be profitable, the total network computing power will increase, and the cost of mining one Bitcoin will also increase.

Therefore, Bitcoins shutdown price is actually the result of market regulation and miners game, and all of this is based on Bitcoins simple and effective economic model.

Economic Model under PoS

In the economic model of PoW public chains represented by Bitcoin, miners are the most important participants. However, in PoS public chains (such as Ethereum and Solana), there is no role of miners. So what is their economic model like?

First of all, we need to know that the biggest difference between the PoS mechanism and the PoW mechanism is that under PoS, there is an access mechanism for nodes participating in consensus and block generation, which is usually implemented by staking. In this mechanism, nodes need to stake a certain amount of platform tokens to be eligible to participate in network consensus; at the same time, the platform will issue platform tokens to these nodes as block rewards to encourage them to contribute to network stability. Under PoS, nodes that participate in network consensus through staking are generally called validators.

Secondly, if the platform token is issued indefinitely (such as Ethereum and Solana), the inflation of the platform token also needs to be considered. The issuance of platform tokens is usually achieved through validator block rewards, and the destruction is generally carried out in the form of transaction fees to recover liquidity, such as returning it to the project treasury, burning it within the protocol, etc. There needs to be a balance between issuance and recovery, allowing inflation or deflation for some time, but not long-term inflation or deflation to maintain economic stability.

Finally, there is the function of platform tokens. Unlike Bitcoin, which can only be used as transaction fees, PoS platform tokens have the function of generating interest due to the existence of pledged block rewards. Therefore, some platforms will also have a design of delegated pledge, which can reduce the circulation of platform tokens in the market and maintain economic stability. The liquidity pledge we often talk about is usually a third-party protocol designed based on delegated pledge, and the APR comes from the pledged block rewards (and MEV).

Ethereum

The Ethereum network had an initial supply of 72 million, of which 60 million were distributed to people who purchased ETH in a crowdfunding campaign held in July and August 2014 (at an average price of about $0.3 per ETH), and the remaining 12 million were distributed half to 83 early contributors to the protocol when the network was launched in 2015, and the other half was left to the Ethereum Foundation. The current total supply of the Ethereum network is about 120 million.

In September 2022, Ethereum switched from PoW to PoS (The Merge) and launched the beacon chain. The inflation design of the Ethereum network is divided into two stages based on this boundary: before Ethereum switched to PoS, about 4.84 million ETH were issued each year, with an inflation rate of about 4%; after Ethereum switched to PoS, about 3.01 million ETH were issued each year, with an inflation rate of about 2.5%. In fact, since Ethereum switched to POS, since EIP-1559 stipulates that each transaction will burn a part of ETH as the basic fee of the network, ETH has been deflationary most of the time, with an average deflation rate of 1.4%.

In the Ethereum network, if a node wants to become a validator of the beacon chain, it needs to stake 32 ETH. More than 32 ETH will not increase the weight of the validator on the network. Each epoch in the beacon chain has 32 slots, each slot is about 12 seconds, and a block is generated. Ethereum issues rewards by epoch, and the amount is calculated from the base reward. The base reward represents the average reward of each validator under the best conditions in each epoch. The proposer of the block can take 1/8 of the base reward, and the rest of the rewards will be distributed to voters (provided that the vote is consistent with the majority of other validators) and participants in the synchronization committee. The reward distribution is related to the validators effective balance and the total number of active validators. For details on validator rewards, readers can learn about Ethereums Gaper consensus, which is also one of the most complex designs of the Ethereum protocol.

Since Ethereum staking requires at least 32 ETH, it does not support delegating ETH to other validators for staking, and the ETH that is staked has a 27-hour unlocking period. These rules are certain obstacles for stakers. Therefore, in order to provide users with a more convenient staking environment, the Liquid Staking Token (LST) protocol has emerged in the market. The principle is to pool ETH together to bypass the minimum requirement of 32 ETH. Each user does not need to operate his own validator. The staking pool will handle the corresponding operations and provide users with corresponding staking certificates to participate in other DeFi applications and improve capital utilization.

stETH, launched by Lido, the industry leader in Ethereum liquidity staking, has occupied most of the market share of the Ethereum LST track. Lido allows ordinary users to stake any amount of ETH through the Lido platform. The staked ETH becomes stETH and can be exchanged for ETH at any time, solving the pain points of native staking. Currently, the staked ETH in the Ethereum network is 32.54 million, accounting for 27% of the total supply, of which Lido contributed 9.8 million, and stETH accounts for 30% of the staked ETH.

Solana

The initial supply of the Solana network is 500 million, of which 38% goes to the community reserve fund, 12.5% to team members, 12.5% to the Solana Foundation, and the remaining 37% to investors. The current total supply of the Solana network is about 580 million, with 460 million in circulation, and a circulation rate of about 80%. The remaining 20% of SOL is locked in the hands of investors and the team, and the most significant unlocking will occur in March 2025, about 45 million pieces.

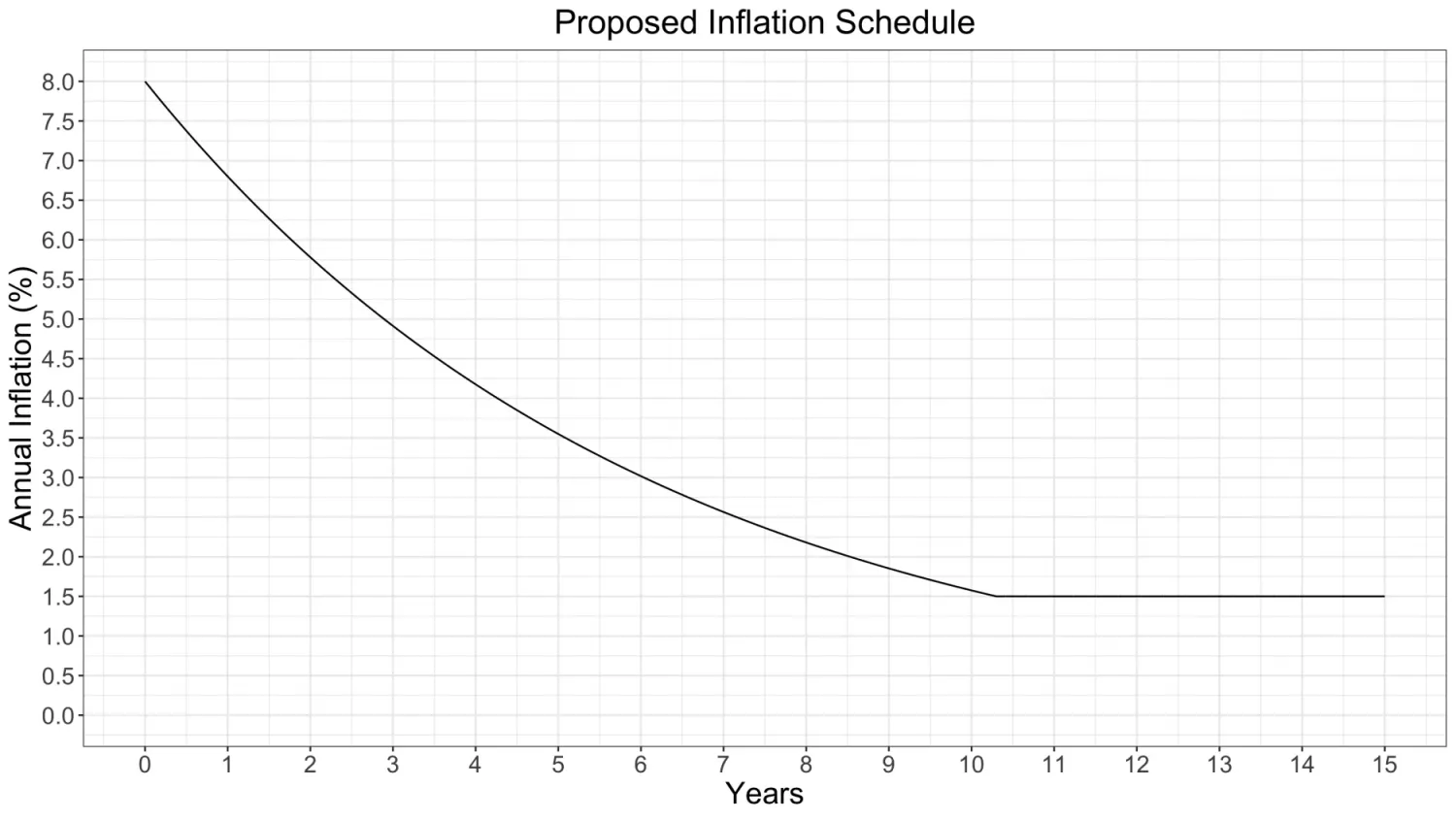

Solana鈥檚 initial inflation rate is 8%, with an annual reduction rate of -15%, and a long-term inflation rate of 1.5%.

The Solana network does not require a minimum staking amount for validators, but the voting power and staking rewards of validators will be distributed in proportion to their staking amount. The Solana network supports delegated staking, where users stake their SOL to existing validators to share the benefits. Delegated staking does not mean that SOL is delegated to the validator, and SOL remains in the users wallet, which makes it as safe as holding them. There are currently 1,500 validation nodes, with an average APR of around 7%.

Validators perform the work of verifying transactions and proposing blocks: every time a validator submits a correct and successful vote (which is itself a transaction, and the validator pays the transaction fee), they will receive points; there are no additional points for proposing a block, the block reward only includes the transaction fees included in the block, and only 50% of the fees flow to the validator as a block reward, and the other 50% will be destroyed. During a period, validators will accumulate these points, and then they can exchange a certain proportion of SOL rewards at the end of the period. The exchange of points to rewards is calculated by equity weighting, that is, the percentage of the total points (the sum of the points of all validators) that the validator accounts for will receive the corresponding SOL.

The current status of LST on the Solana network is significantly different from that of Ethereum. The proportion of SOL in circulation in the Solana network is staked at over 80%, which is much higher than Ethereums 27%. However, LST only accounts for 6% of the staked supply (compared to over 40% on Ethereum). The main reason is that the Solana network natively supports delegated staking, and the DeFi protocol ecosystem is still in its early stages. The problems that Lido and its peers are trying to solve on Ethereum do not exist on Solana. Jito is the leader of LST on the Solana network. Jito entrusts users SOL to validator nodes that support MEV (Jito-Solana validator client) to become JitoSOL, where MEV income is distributed to stakers as additional income. Therefore, the APR of the Jito platform is higher than that of delegated staking, currently reaching 7.92%, and JitoSOL accounts for 3% of the staked SOL.

Özetle

The economic model is the most important design of a blockchain that aims to run long-term. Compared with the simple and effective economic model of the PoW public chain represented by Bitcoin, the economic model design of the PoS public chain represented by Ethereum and Solana is usually very complex – it is necessary to consider the pledge mechanism, incentive mechanism, inflation parameters, and token functions.

Judging from the economic model of new public chains, most of them adopt the PoS rather than the PoW consensus mechanism. The reason is that in addition to PoS being more energy-efficient, it also has better throughput and transaction confirmation time, and can process more transactions per second. Performance is the cornerstone of blockchains large-scale adoption.

At the same cost, PoS is also more secure and easier to recover from attacks. Because validators are stakeholders, honest validators will be rewarded and malicious validators will be punished – of course, the largest stakeholders will get the most rewards, which will also cause wealth concentration problems.

This article is sourced from the internet: What do we talk about when we talk about economic models?

Recently, Movement, an Ethereum Layer 2 solution based on the Move language, received $38 million in financing led by Polychain. Movement introduces the Move language into EVM, allowing Ethereum developers to seamlessly migrate and deploy applications to the Movement network, while also enabling cross-chain asset and data transfer with the Sui and Aptos networks developed based on the Move language. It seems that Movement is a Layer 2 that will bring a diverse future to Ethereum, and the huge amount of financing also shows that the market is optimistic about the future development of Movement. TechFlow takes stock of some of the applications that are being or will be deployed in the Movement ecosystem in the future to help readers further understand the current development status of the Movement ecosystem.…