Orijinal makalenin yazarı: Decentralised.Co

Orijinal çeviri: TechFlow

Is L2 plundering the interests of L1?

L2 uses L1 for settlement while providing cheaper transaction services to users. They act as intermediaries between L1 and users and capture part of the value by charging fees (including MEV). So, are they paying enough for using L1s valuable block space? Lets analyze the impact of L2 on Ethereum through four charts.

1. How does L2 help the Ethereum ecosystem?

Without talking about L2 tokens, let’s look at their contribution to the entire Ethereum ecosystem. One way to measure this is to look at the increase in ETH market value from L2 tokens.

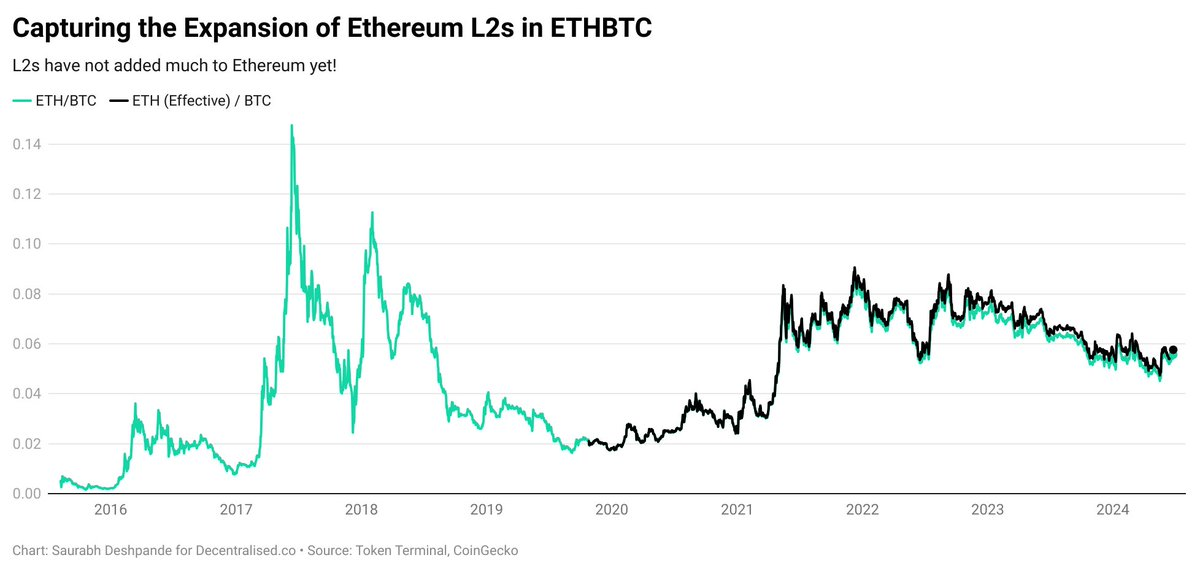

For comparison, I use the ETHBTC ratio as a benchmark of how the Ethereum ecosystem is trending relative to Bitcoin.

To capture the value of Ethereum as a whole, I added the top 10 L2 tokens by market cap to ETH and considered that as “effective ETH” or the value of the entire Ethereum ecosystem.

Currently, the top 10 L2s have little impact on the ETHBTC ratio. As Bitcoin’s market dominance exceeds 50%, the chart below shows that L2s have not significantly increased the ETH(effective)/BTC ratio (see black line vs. green line).

2. So, where does value capture happen?

In simple terms, value capture can be measured by two metrics: revenue and market capitalization. If value is generated, it will be reflected in the price.

a. Where is revenue captured? Ethereum regularly captures ~90% of the total Ethereum ecosystem revenue. In Q2 2024, Base has been the leading L2 by revenue, followed by Blast.

b. In terms of market capitalization, ETH still accounts for more than 95% of the top 10 L2 market capitalization.

3.How much revenue does L2 pass to Ethereum?

L2 incurs costs for storing data on Ethereum. This is the operating cost of L2. This cost needs to be balanced. If the cost is too high, L2 operations will become difficult; if the cost is too low, although Ethereum provides key settlement services, it will not earn much revenue from L2.

Ethereum’s 4844 upgrade (also known as Proto Danksharding) reduces the operating costs of L2. The reduction in the cost of L2 data storage has reduced L2’s contribution to Ethereum’s revenue from about 10% to about 2%. While this may seem like a setback, it makes L2 ready for more users because transaction costs are reduced.

So far, blobs seem like a bad idea from Ethereum’s perspective. So what’s the end goal? Scaling.

In one week in 2024, Ethereum supported 7.1 million transactions with $10.6 million in revenue. The cost per transaction for users was about $1.5. Meanwhile, five L2s (Arbitrum, Base, Blast, Optimism, and Polygon) supported over 70 million transactions with $2.75 million in fees. The cost per transaction was just $0.03.

We can discuss the quality of transactions, whether they are bots or their value, etc. But the fact is that Ethereum cannot support that many transactions.

In general, by building L2 and lowering transaction costs on L2 by providing them with cheaper data storage options on L1, this is good for users, but not so good for Ethereum (L1). If most users choose to transact on L2, more data will be pushed to L1. As L2 pushes more data and competes with each other for L1s block space, L1s base fee will increase, thereby increasing Ethereums revenue. Therefore, when more people start using L2, it can be a win-win for Ethereum and users.

This article is sourced from the internet: Opinion: L2 is the savior of users, but the predator of L1

Original author: Crypto, Distilled Original translation: TechFlow When will the consolidation end? Despite the general pessimism and anger, $BTC is only 15% below its high. Famous trader @BobLoukas offers hope: The darkness before dawn, mid-cycle reaccumulation, and the emergence of cycle highs Here are his main points. Monthly chart: We reached the all-time high of the previous cycle in month 16, while the previous cycle took more than two years. We are now in the third month of sideways trading. Historically, $BTC has paused after reaching its all-time high before reaching its final cycle peak. A longer period of sideways movement means the next rally will be healthier and stronger. Weekly chart: It is now in a 14-week consolidation following the ETF news, down 12% from its highs. This volatility…