Federal Rezerv'in görünmez teşviki geliyor ve kripto para piyasası daha fazla likidite enjekte edebilir

Orijinal yazar: Tomas

Orijinal çeviri: TechFlow

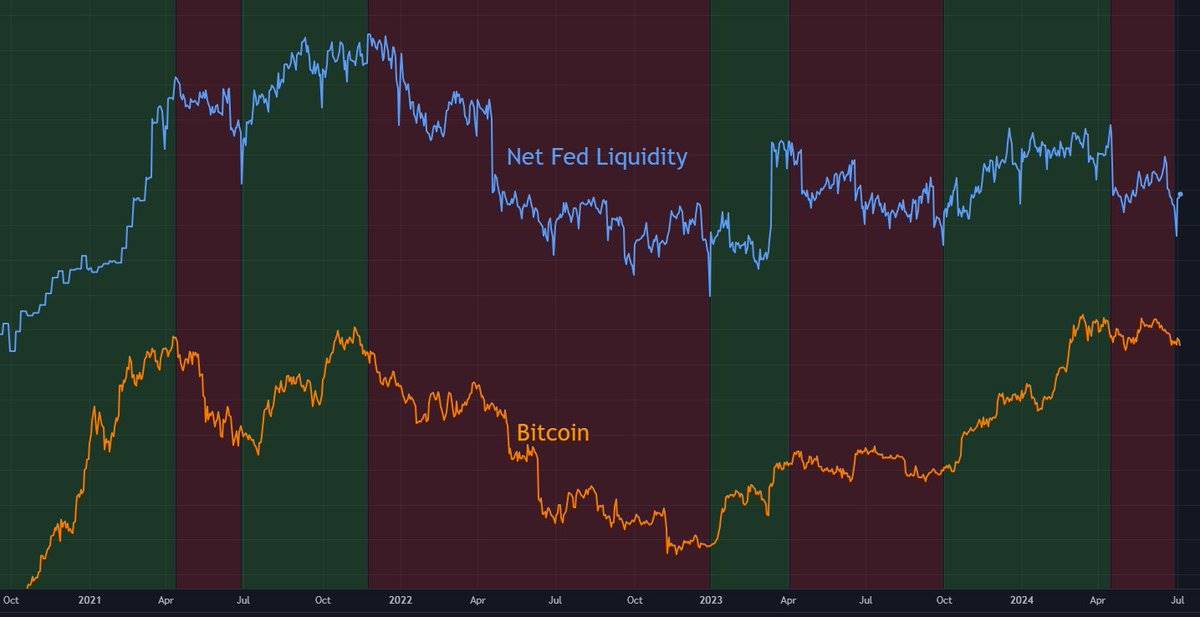

Net Fed liquidity will rise in the coming months. This could be bullish for stocks, gold, and Bitcoin prices. Let me explain why.

Net Fed liquidity measures the total liquidity entering the market directly from the Fed sources. It can be considered as a stealth stimulus measure for the US and can be influenced not only by the Fed but more importantly by the US Treasury.

Since the beginning of 2022, the Fed has officially been tightening policy by shrinking its balance sheet. But in reality, nearly $1 trillion of liquidity was injected into the market from December 2022 to March 2024. This is what caught many people off guard when the market rebounded at the end of 2022.

Net Fed liquidity is broadly correlated with most asset markets. It fell in 2022 (along with asset prices) but bottomed out in late 2022 (along with asset prices) [Chart 1]. The correlation with Bitcoin in particular is strong [Chart 2], while the correlation with stocks has been weak in recent months.

[Figure 1]

[Figure 2]

My measure of net Fed liquidity consists of the following five components:

-

Discount Window

-

Bank Term Financing Scheme

-

Balance Sheet

-

Treasury General Account

-

Reverse repo

At any given time, these five components are either injecting liquidity into the market or drawing liquidity from the market. The different components are essentially pulling in opposite directions, like a tug-of-war.

Net Fed liquidity measures which side has the upper hand in the tug-of-war.

The important thing about net Fed liquidity is that its overall future direction can sometimes be predicted with relative accuracy.

Bu yüzden what happens to net Fed liquidity in the third quarter of 2024? Let’s look at the five components and how they might perform in the third quarter.

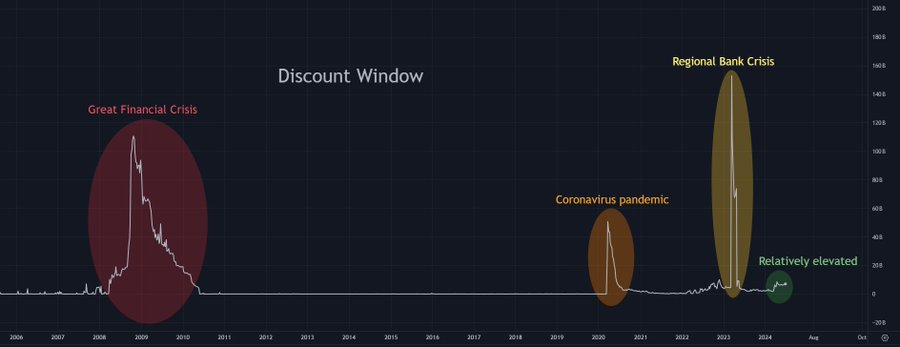

1. Discount Window – No significant changes

The Federal Reserves discount window is the banking industrys last straw in an emergency.

Banks can borrow through the discount window, which is equivalent to injecting liquidity into the market. Although the discount window is not important most of the time, it will rise sharply in times of banking distress (such as the 2008 global financial crisis, the 2020 epidemic, and the 2023 regional banking crisis).

Discount window usage is relatively high right now ($7 billion), but nowhere near historical “panic levels” or high enough to have a significant impact on the market. Most of the time it’s largely unworthy of consideration — and I think that will be true in Q3 2024 as well. So we can ignore the discount window for now.

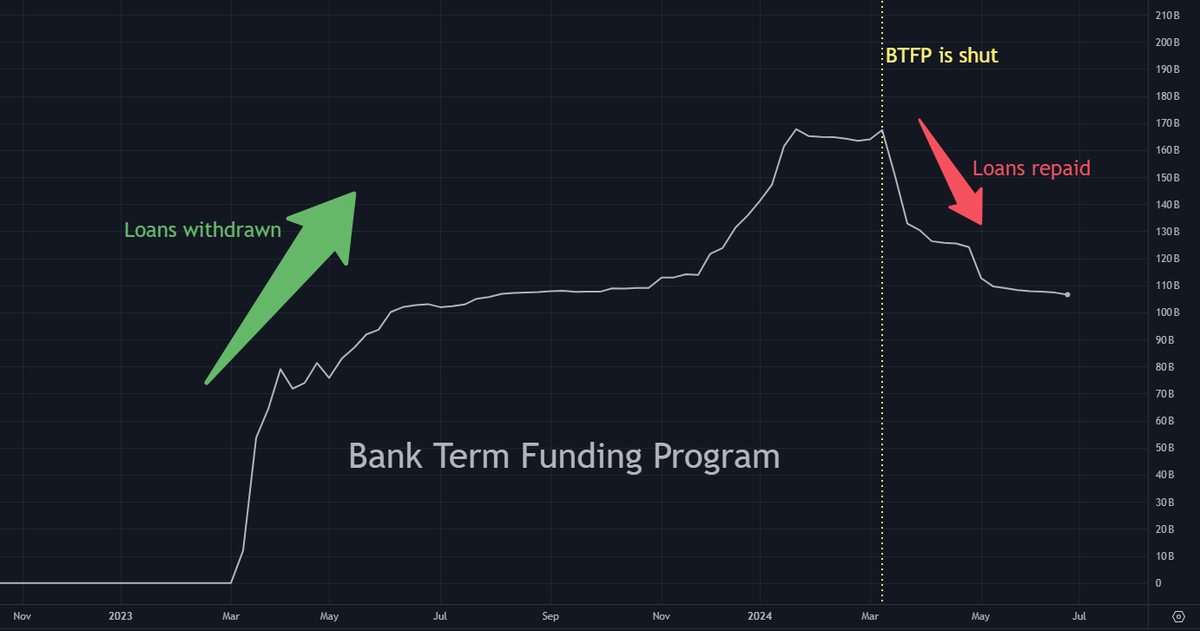

2. Bank term funding schemes – little change

The Bank Term Funding Program (BTFP) is an emergency bank rescue measure launched by the Federal Reserve in March 2023.

During and after the regional banking crisis (e.g., the collapse of Silicon Valley Bank), banks borrowed approximately $165 billion from BTFP, which at the time served as a liquidity injection .

However, BTFP was closed by the Fed in March 2024 and now these loans need to be repaid within 12 months, which removes liquidity from the market when these loans are repaid.

I do not expect much change in banks term funding plans in the third quarter, and if there is any change, it may be less than $20 billion. To simplify the analysis, we can also temporarily ignore this factor.

3. Balance Sheet – $75 billion in liquidity withdrawal

The Fed is currently engaging in quantitative tightening (QT), which is reducing the size of its large balance sheet by selling its large holdings of U.S. government bonds and mortgage-backed securities (MBS). Quantitative tightening is a liquidity extraction because when these assets are sold by the Fed, they need to be absorbed by the market, and these funds could have been used elsewhere.

This is the easiest to predict because it is essentially a systematic process. The Feds balance sheet will be reduced by about $25 billion per month in the third quarter, so quantitative tightening will withdraw a total of $75 billion in liquidity in the third quarter.

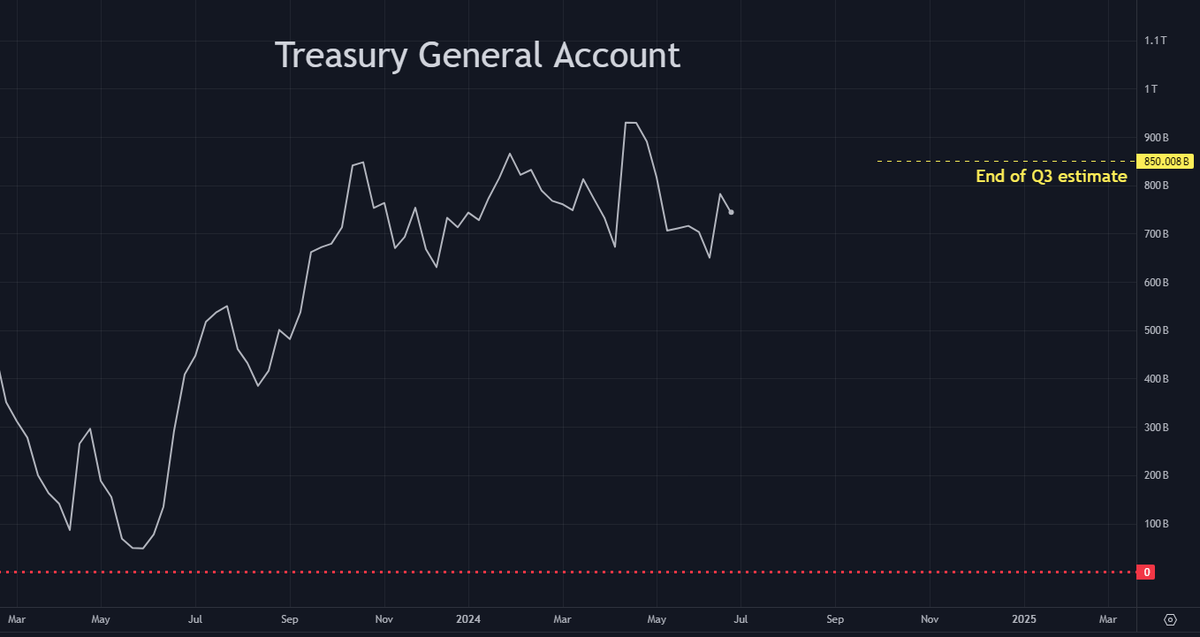

4. Treasury General Account – $100 billion liquidity withdrawal

The Treasury General Account (TGA) is the governments bank account at the Federal Reserve.

When cash sits idle in the Treasury’s general account, it is effectively “dormant” and removed from the market, thus representing a liquidity withdrawal.

Conversely, when money in the Treasurys general account is spent, it re-enters the market, injecting liquidity.

Currently, the Treasury General Account balance is about $750 billion. In the latest quarterly refunding announcement, the Treasury projected that the Treasury General Account balance would reach $850 billion by the end of the third quarter. We trust the Treasurys forecast for now. This means that the Treasury General Account will further increase (extract liquidity from the market), with an estimated increase of about $100 billion. Therefore, together with the $75 billion in liquidity withdrawals from quantitative tightening (QT), the increase in the Treasury General Account will bring the total liquidity withdrawal to $175 billion.

5. Reverse repo – liquidity injection of $200 billion to $400 billion

Reverse repo (RRP) is a tool of the Federal Reserve where financial institutions parked cash to earn fixed income during the easy money era of 2020 and 2021. By the end of 2022, about $2.5 trillion was deposited in reverse repo. Since reverse repo and U.S. government Treasury bills (T-bills) are both short-term assets with no credit risk, they are almost perfect substitutes.

To finance its huge deficit, the US government has issued a large number of T-bills over the past 18 months. T-bills offer slightly higher returns than reverse repo, thus attracting about $2 trillion to be withdrawn from reverse repo to purchase newly issued T-bills [Figure 3]. This cash is transferred from the Fed’s “frozen” state back to the money market, thus being a liquidity injection .

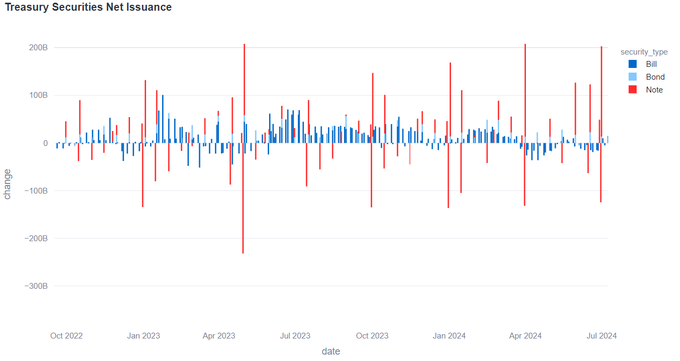

However, reverse repos stopped draining liquidity in the second quarter of 2024 [Chart 4] as the U.S. government temporarily stopped issuing large amounts of T-bills. This slowdown can be seen in a chart from @dharmatrade [Chart 5]. The chart shows that net T-bills issuance in 2023 and early 2024 exceeded historical levels by a wide margin, then turned negative in the second quarter of 2024.

But this temporary slowdown in T-bills issuance will end in the third quarter of 2024. As the government tries to plug the “gap” of its massive deficit, a flood of T-bills will be issued again. As a result of this coming flood of T-bills, I expect $200 billion to $400 billion to be withdrawn from reverse repos in the third quarter (I know that’s a pretty broad range), which will be a liquidity injection .

[Figure 3]

[Figure 4]

[Figure 5]

therefore:

-

$200 billion to $400 billion in liquidity injections (reverse repo)

-

$175 billion in liquidity withdrawals (quantitative tightening and Treasury general account)

-

Net liquidity injection between $25 billion and $225 billion

Further Discussion on the General Account of the Ministry of Finance

Lets go back to the Treasury General Account (TGA). So far, our calculations show that there will be a net liquidity injection in the third quarter. But this assumes that the Treasury General Account balance in the third quarter is $850 billion.

I have mentioned before that these Treasury General Account balance “estimates” should not be taken too seriously. Since Janet Yellen became Treasury Secretary, estimates of the Treasury General Account have often been too high (sometimes by a lot).

As a result, the Treasurys general account balance is likely to be less than $850 billion at the end of the third quarter.

We already have a range of $25 billion to $225 billion for Q3 net liquidity injections assuming a Treasury General Account balance of $850 billion. Any deviation from a Treasury General Account balance below $850 billion would shift this range upward.

predict

Taking all factors into account, here is the likely range of net Fed liquidity through the end of the third quarter, with an added buffer in case the Treasury general account balance estimate is wrong again:

the last point:

This analysis assumes that conditions do not change during the third quarter.

But there are still small probability events that may force the Fed to respond to certain problems in the financial system or sudden black swan events. This may include reopening the Bank Term Funding Program (BTFP), launching another similar rescue facility, stopping quantitative tightening, restarting quantitative easing, or taking any other measures that can quickly inject more liquidity into the market.

This article is sourced from the internet: The Federal Reserves invisible stimulus is coming, and the crypto market may inject more liquidity

Related: So overnight, Blinks turned the X platform into Solana L2?

Original | Odaily Planet Daily Author | Nanzhi Last night, a number of projects in the Solana ecosystem announced support for Solana鈥檚 latest feature Blinks on the X platform, including the wallet Phantom, DEX Jupiter, NFT platform Tensor, and dozens of other projects. What is Blinks? It allows various interactive operations on Solana to be converted into a button on the X platform, such as Mint, Swap, etc. Why was Blinks born? It carries Solanas vision of achieving Mass Adoption. Jon Wong, the engineering director of the Solana Foundation, said: How do we promote blockchain to a billion people? Our answer is simple: we must reach users where they are – their favorite apps and websites. Odaily will introduce the functions, features and usage of Blinks in this article. Blinks…