Bitget Araştırma Enstitüsü: BTC 63.000'in altına düştü ve duygu donma noktasına ulaştı, sadece birkaç meme serveti etkiliyor

Geçtiğimiz 24 saat içinde piyasada pek çok yeni sıcak para birimi ve konu ortaya çıktı ve bunların para kazanmak için bir sonraki fırsat olma ihtimali çok yüksek.

-

The sectors with relatively strong wealth-creating effects are: TON ecology;

-

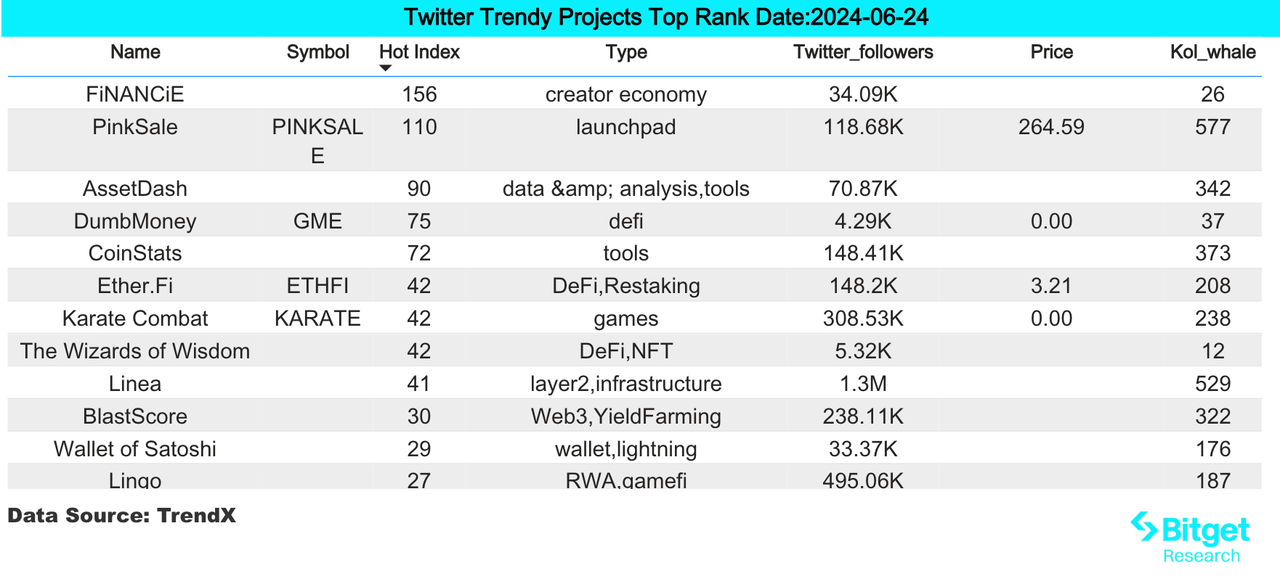

Hot search tokens and topics among users are: REVOX, Linea, RWA;

-

Potential airdrop opportunities include: LayerN, LIFI;

Data statistics time: June 24, 2024 4: 00 (UTC + 0)

1. Pazar ortamı

In the past two weeks, the BTC spot ETF has shown a continuous net outflow trend. BTC fell below $63,000, ETH on-chain gas fell to 1-2 gwei, and market sentiment dropped to freezing point. High-market-cap new coins ZRO and ZK led the decline of altcoins, and their prices have fallen by 30%-50% from the price at the time of TGE. The market value performance is far below pre-market expectations.

The performance of Ton ecosystem tokens was relatively resilient, with TON only falling 8% in the past 7 days. The TVL of the two leading DEXs DeDust and STON.fi in the ecosystem grew by 12% and 3% respectively in the past 7 days. The number of users of high-traffic Telegram Mini App Catizen and Hamster Kombat continued to soar, and continued to attract market attention.

2. Zenginlik yaratan sektör

1) The sector that needs to be focused on in the future: Ton Ecosystem

Asıl sebep:

-

As the broader market continued to fall and altcoins plummeted, TON tokens and Ton ecosystem tokens performed relatively well.

-

The two leading DEXs in the Ton ecosystem are also the two protocols with the highest TVL: DeDust and STON.fi, whose TVLs have bucked the trend and increased by 12% and 3% respectively in the past 7 days.

-

The number of users of Ton ecosystems high-traffic Telegram Mini App Catizen and Hamster Kombat continues to soar, attracting market attention. The total number of users on the Catizen chain has exceeded 1.25 million, and the number of Hamster Kombat users has exceeded 150 million, becoming one of the few hot spots in the recent cryptocurrency market.

-

Pantera Capital is raising money for a new fund dedicated to investing in TON tokens. The fund, called Pantera TON Investment Opportunities, aims to raise funds to buy more TON tokens, with a minimum investment of $250,000 per backer.

Specific project list: TON, NOT, STON, Catizen, Hamster Kombat, etc.

3. Kullanıcıların Sıcak Aramaları

1) Popüler Dapp’ler

REVOX(ReadON):

REVOX is the first Read-FI program for ordinary users. REVOX was formerly the decentralized content distribution platform ReadON, which aims to build a modular AI Agent network and distributed applications. It has now opened an airdrop points claiming activity, and users can use the Web3 GPT tool lense.revox.ai to obtain airdrop points.

2) Twitter'da

Linea:

Linea public chain is an efficient, secure and decentralized blockchain platform designed to provide powerful infrastructure for developers and users. It uses an advanced consensus mechanism to support high-throughput transaction processing and ensure the security and reliability of the platform. Linea also supports smart contracts and cross-chain interoperability, allowing developers to build and deploy decentralized applications (DApps) and achieve the free flow of assets and information between different blockchains. Rich development tools and friendly documentation further lower the development threshold and lay the foundation for the prosperity of the ecosystem.

3) Google Arama Bölgesi

Küresel bir perspektiften bakıldığında:

Why is crashing: All kinds of tokens in the crypto industry have generally fallen, causing a global search for the reason for the fall. This is mainly due to global macroeconomic uncertainty, countries strengthening regulation of cryptocurrencies, market sentiment fluctuations, technical issues, and concentrated selling by large holders. These factors have jointly led to a decline in investor confidence and a drop in market prices.

Her bölgedeki sıcak aramalardan:

(1) In the hot searches in Asia, MEME and RWA projects are the most prominent. In this round of crypto cycle, MEME and RWA each have their own unique narratives. MEME is the core narrative of resistance to VC and is generally considered to be a money-making opportunity that retail investors can participate in; RWA is considered to be the core narrative of institutions in this round of crypto cycle, and traditional finance has extensive layout and participation.

(2) The areas of focus in Europe, America, English, and CIS are different. They are mainly some recent large airdrop projects and ton and its ecosystem, including Monad, FLOKI, RWA, etc., which have made it to the hot search list. There is no obvious trend of unified topics.

Potansiyel Airdrop Fırsatlar

LayerN

Layer N is a high-performance rollup network designed to scale financial applications on Ethereum. It consists of ultra-high-performance and customized modular rollups with best-in-class scalability and a shared communication layer for unified liquidity.

Layer N completed a $5 million seed round of financing, led by Founders Fund and dao 5.

How to participate: Log in to the project website, connect your wallet, bind your social media account, go to http://nord.layern.com, connect your wallet and trade ETH, repeat 4-8 times. Go to https://app.galxe.com/quest/layern/GCdcmthdaA…

Connect your wallet to complete the simplest task ever to receive points

LI.FI

LI.FI is a multi-chain liquidity aggregation protocol that supports the exchange between any two assets by aggregating bridges and DEX aggregators from more than 20 networks including Ethereum, Arbitrum, Optimism, Solana, Polygon, Base, etc.

Cross-chain infrastructure protocol LI.FI completed a US$17.5 million Series A financing round, led by CoinFund and Superscrypt, with participation from Bloccelerate, L1 Digital, Circle, Factor, Perridon, Theta Capital, Three Point Capital, Abra and nearly 20 angel investors.

How to participate: Log in to the project website, conduct cross-chain swaps between multiple chains, maintain the activity of the wallet address and the transfer scale, and you can get potential airdrop opportunities.

Orijinal bağlantı: https://www.bitget.com/zh-CN/research/articles/12560603811594

【Feragatname】Piyasa risklidir, bu nedenle yatırım yaparken dikkatli olun. Bu makale yatırım tavsiyesi niteliğinde değildir ve kullanıcılar bu makaledeki herhangi bir fikir, görüş veya sonucun kendi özel koşullarına uygun olup olmadığını düşünmelidir. Bu bilgilere dayanarak yatırım yapmanın riski size aittir.

This article is sourced from the internet: Bitget Research Institute: BTC falls below 63,000 and sentiment reaches freezing point, only a few memes have wealth effect

Related: Matrixport Investment Research: Declining U.S. inflation may push up Bitcoin prices

According to the latest report from Matrixport Research Institute, the recent market highlights are: CPI has been lower than market expectations for two consecutive months, which is good for the venture capital market The Fed does not rule out providing incentives at the end of the year, which is good for BTC prices The Feds hawkish stance is eye-catching, and there is a possibility of a slight shift to a dovish stance by the end of the year This week is a big macro week. The US CPI, PPI and economic data released by the Federal Reserve meeting are relatively favorable to the venture capital market . However, the crypto market has not responded well, which is in sharp contrast to the US stock market. The lower inflation data and…