Original post by @DistilledCrypto

Original translation: Tech Flow

When will liquidity flow into the market?

More money coming in generally means higher cryptocurrency prices thanks to liquidity.

However, the current market remains dry, with no sign of the 2021 “uptick”.

I consulted the insights of macro expert CG ( @pakpakchicken ) for some clues.

Affected by policies

@pakpakchicken spends hours every day tracking policy changes, Policies drive liquidity, liquidity drives assets, assets drive GDP… etc.

His conclusion : The biggest risk is on the upside.

@CryptoHayes Ve @RaoulGM agree.

An overlooked insight

@pakpakchicken points out that there is little discussion about the prospect of a weaker USD.

He predicted a coordinated move to devalue the dollar in the future, a move that could increase liquidity.

As background for the story, let’s review the events of 1985

The policy context around 1985 will help understand the mindset of policymakers:

→ Tight monetary policy

→ High long-term interest rates

→ Strong US Dollar (Exploring the “Milkshake Theory”)

→ High Deficit

Unprecedented volatility

As volatility season approaches, @pakpakchicken predicts extreme volatility.

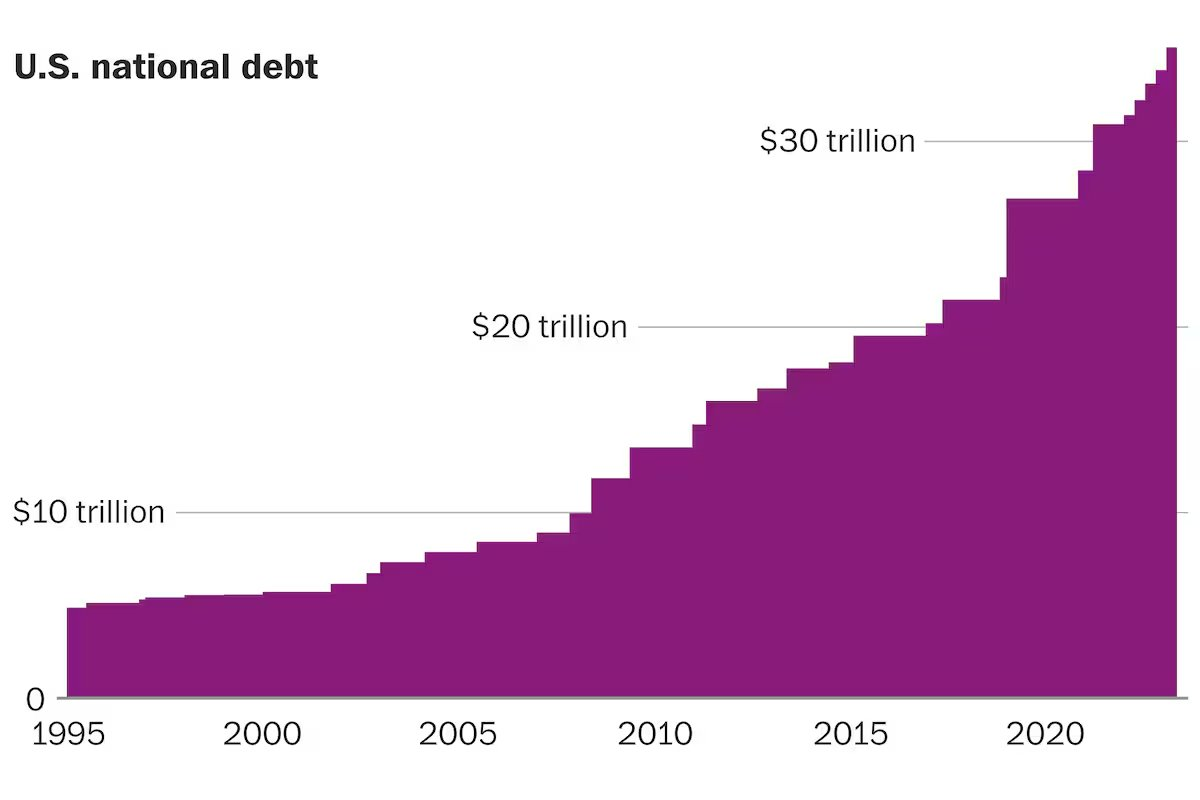

This will be driven by the need for the US to service its $35 trillion debt.

Why volatility is a good thing

@pakpakchicken argues that volatility is not a flaw, but a desirable feature of profitability.

A lot of money is made in short-term bursts.

Sideways trading will throw ordinary investors out, and the market will rise just when you give up.

The impact of debt on cryptocurrencies

To manage its massive debt, the U.S. may increase liquidity to devalue its currency.

This will ensure that debt rollovers are manageable, without which yields could spiral out of control.

Larry Finks opinion

BlackRock CEO Larry Fink said of the national debt :

No matter how the United States increases taxes or cuts debt, these measures are not enough to solve the national debt problem. Therefore, he emphasized that building new infrastructure is crucial. He believes that by building new infrastructure, it can not only promote economic growth, but also lay the foundation for future development.

CG ( @pakpakchicken ) believes that as long as the U.S. dollar continues to maintain its value, institutions will tokenize all assets.

CGs macro update (late Q2)

At the end of the second quarter, weekly US liquidity support was up to $2 billion per operation, and QT was reduced from $6 billion to $2.5 billion per month.

US policies increase the issuance of short-term bills, while the Chinese yuan may depreciate.

The growth of trillions of yuan in liquidity in China could be a boon to cryptocurrencies, and the looming currency devaluation as the value of goods, services, and assets deflates, all factors that point to a potentially bullish second half of the year.

U.S. Treasury bond repurchase

Weekly liquidity-backed repo surged to $2 billion starting May 29 with the start of U.S. Treasury repo , an injection of liquidity that could amplify cryptocurrency prices during a chaotic election season.

CG ( @pakpakchicken ) believes that there may be an upward momentum in the second half of 2024.

Exponential Summer

@pakpakchicken is committed to crypto as a leading asset class However, he stressed: “Markets can remain irrational longer than you can remain solvent.” A future of surging global liquidity is on the way…

Narrative fatigue

CG ( @pakpakchicken ) emphasizes that narrative comprehension is key.

Narratives drive markets until the value of the narrative is exhausted.

The CPI/inflation narrative is waning; recent reports lack impact.

The next mainstream focus

With bank reserves faltering, employment is in focus and rate cuts are coming sooner than expected.

TLDR: Hold for the long term

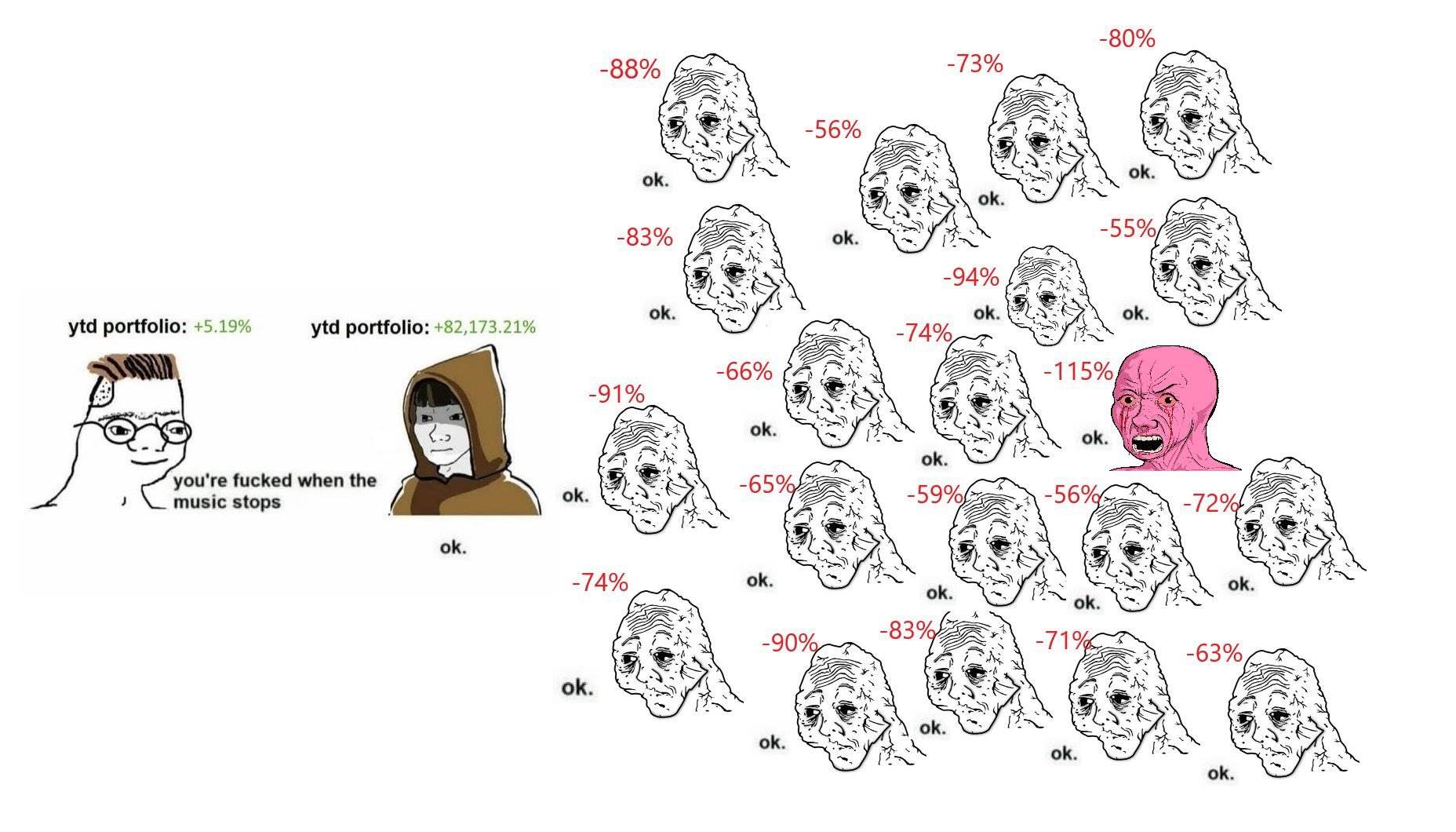

The most painful market trend

As macro forces converge, according to market rules, CG expects the most painful market trend to occur.

PS: The most painful market trend is a concept in the financial market, literally translated as greatest pain. It refers to the price change path taken by the market in a certain period of time. This path usually brings the greatest pain and distress to most investors.

The logic behind this concept is that the market tends to choose price trends that magnify losses for most investors. The driving forces behind this market behavior include market manipulation, institutional investors strategies, and the markets inherent supply and demand relationships.

What are the signs before heading towards the most painful market trend?

-

Retail not ready for upturn

-

Many influential people say the market has peaked

-

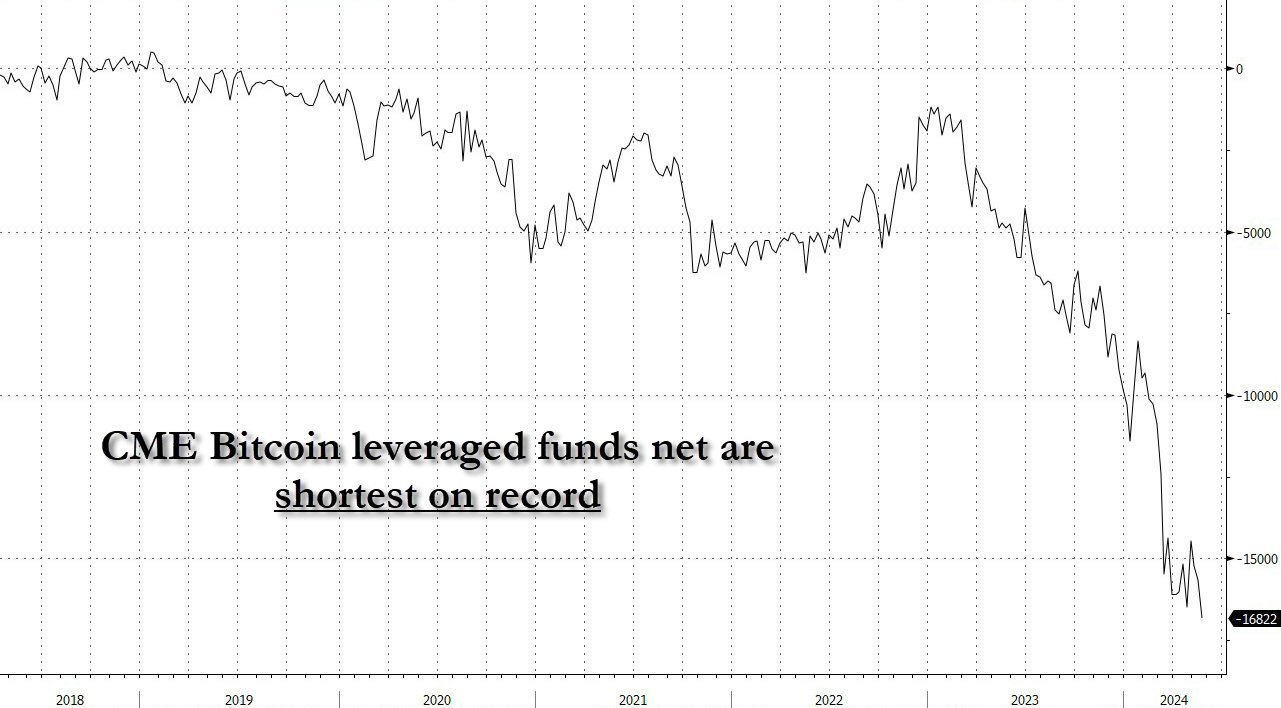

Market Makers Go Short

-

Overwhelming bearish positioning

The end result is likely to be a sharp rise.

Stake $ETH

CG ( @pakpakchicken ) believes that $ETH will stand out in the up cycle .

As Larry Fink points out, debt is unsustainable in the long run.

While the dollar has value, everything will transition and tokenize.

Only one L1 has stood the test of time and has the highest adoption rate to date — $ETH

Respect for probability

While CG ( @pakpakchicken ) is leaning towards the upside, further downside is not out of the question. Macro expert @fejau_inc sees slowing economic growth as a fundamental factor and believes there is a risk of a major downside surprise not seen since 2019.

This article is sourced from the internet: Market liquidity is still dry, when will the upward tide come?

İlgili: SignalPlus Volatilite Sütunu (20240426): Makro veriler beklentileri aştı

Dün (25 Nisan), ABD'nin birinci çeyrekteki GSYİH'si beklenenden önemli ölçüde düşüktü, PCE fiyat endeksi ise 3,7%'ye sert bir şekilde sıçradı ve bu gece açıklanacak PCE enflasyon endeksinin piyasaların önceki tahmininden daha yüksek olma ihtimalinin yüksek olduğunu gösterdi. Zayıf ekonomik çıktı ve yükselen fiyatlar risk algısını etkiledi ve üç büyük endeks düştü. Faiz oranı politikasına duyarlı olan iki yıllık ABD Hazine tahvili getirisi bir kez 5,016%'ye sıçradı ve gün içinde kademeli olarak 5,0%'nin altına düştü. Fed'den Goolsbee, beklenenden yüksek enflasyon verilerinden sonra Fed'in yeniden ayarlama yapması ve bekleyip görmesi gerektiğini söyledi. Kaynak: TradingView Dijital para birimi açısından, BTC ile ABD hisse senetleri arasındaki korelasyon son zamanlarda güçlendi. Para biriminin fiyatı bir kez…