Haftanın Finansmanı | 30 projeye yatırım yapıldı, açıklanan toplam finansman tutarı yaklaşık

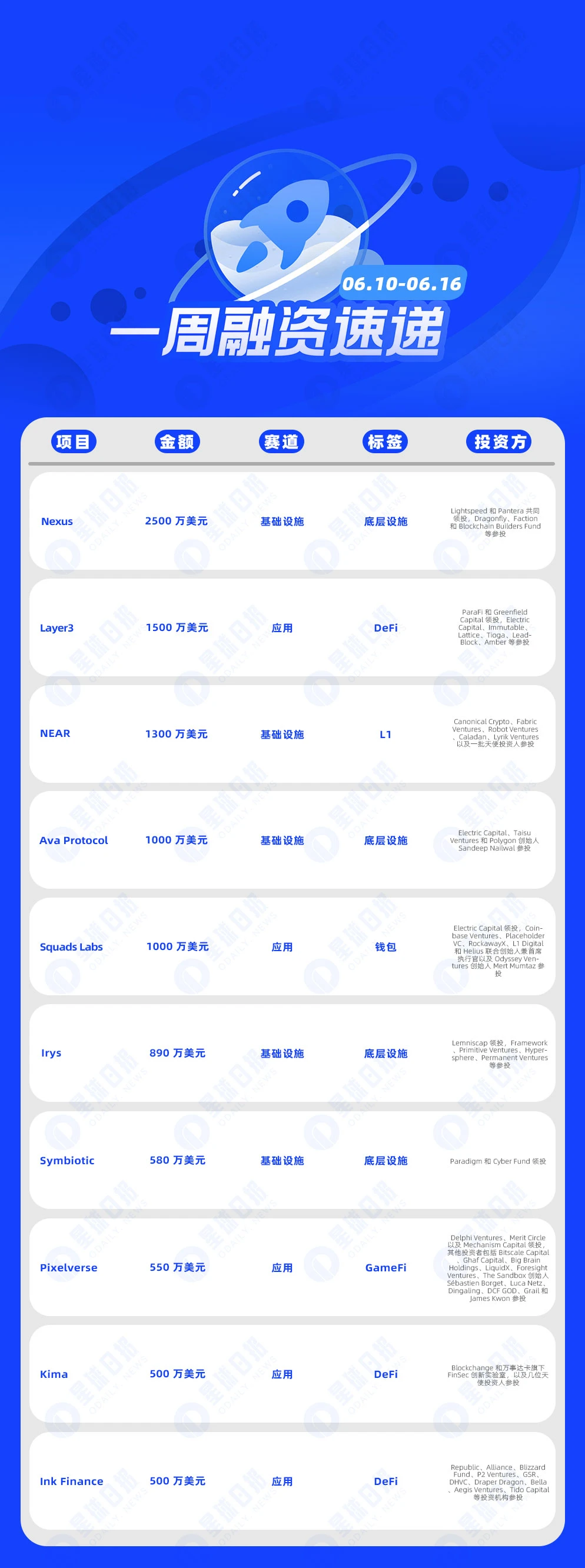

According to incomplete statistics from Odaily Planet Daily, there were 30 blockchain financing events at home and abroad announced from June 10 to June 16, which was a decrease from last weeks data (23). The total amount of financing disclosed was approximately US$125 million, which was an increase from last weeks data (US$234 million).

Last week, the project that received the most investment was the modular zkVM project Nexus ($25 million); followed closely by the token distribution protocol Layer 3 ($15 million).

Aşağıda belirli finansman etkinlikleri listelenmiştir (Not: 1. Açıklanan para miktarına göre sıralayın; 2. Fon toplama ve MA etkinlikleri hariç; 3. * işareti, işi blockchain ile ilgili olan geleneksel bir şirketi gösterir):

Nexus announces $25 million Series A funding round led by Lightspeed and Pantera

On June 11, the modular zkVM project Nexus announced the completion of a $25 million Series A financing round, led by Lightspeed and Pantera, with participation from Dragonfly, Faction, and Blockchain Builders Fund.

Layer 3 Completes $15 Million Series A Funding, Led by ParaFi and Greenfield Capital

On June 12, token distribution protocol Layer 3 announced the completion of a $15 million Series A financing round, led by ParaFi and Greenfield Capital, with participation from Electric Capital, Immutable, Lattice, Tioga, LeadBlock, Amber and others. Layer 3 will soon launch its tokens and conduct airdrops in the summer.

On June 13, NEAR Foundation’s newly established independent entity Nuffle Labs completed a $13 million financing, with Canonical Crypto, Fabric Ventures, Robot Ventures, Caladan, Lyrik Ventures and a group of angel investors participating. NEAR Foundation is the non-profit manager of the blockchain ecosystem of the same name. The spin-off aims to promote the modularization of NEAR and bring more decentralized development to the ecosystem. Nuffle Labs will provide aggregation through NEAR’s data availability (NESR DA) and fast final layer (NFFL) products.

Ava Protocol Completes $10 Million Seed Round, Polygon Founder and Others Participate

On June 13, Ava Protocol (formerly OAK Network) completed a $10 million seed round of financing, with participation from Electric Capital, Taisu Ventures and Polygon founder Sandeep Nailwal. The new funds will be used to develop its Eigenlayer AVS for private autonomous transactions on Ethereum.

On June 13, Squads Labs, the developer of Solanas multi-signature protocol Squads, announced the completion of a $10 million Series A financing round led by Electric Capital, with participation from Coinbase Ventures, Placeholder VC, RockawayX, L1 Digital and Helius co-founder and CEO and Odyssey Ventures founder Mert Mumtaz. Squads Labs also announced the launch of its retail-focused iOS wallet application Fuse on public TestFlight.

On-chain data developer Irys completes $8.9 million in financing, led by Lemniscap

On June 12, on-chain data developer Irys completed a $8.9 million financing round led by Lemniscap, with participation from Framework, Primitive Ventures, Hypersphere, Permanent Ventures, etc. Irys develops scalable on-chain storage and has infrastructure that can help track and verify digital information.

Symbiotic, a re-staking project, completes $5.8 million seed round, led by Paradigm

On June 11, the re-staking project Symbiotic announced on the X platform that it had completed a $5.8 million seed round of financing, led by Paradigm and Cyber Fund. Symbiotic is a shared security protocol that acts as a thin coordination layer, enabling network builders to control and adjust their own re-staking implementations in a permissionless manner.

On June 12, the startup entertainment studio and gaming ecosystem Pixelverse announced the completion of a new round of financing of US$5.5 million, led by Delphi Ventures, Merit Circle and Mechanism Capital. Other investors included Bitscale Capital, Ghaf Capital, Big Brain Holdings, LiquidX, Foresight Ventures, The Sandbox founder Sébastien Borget, Luca Netz, Dingaling, DCF GOD, Grail and James Kwon.

On June 12, the settlement protocol Kima announced the completion of a $5 million financing, with participation from Blockchange and Mastercards FinSec Innovation Lab, as well as several angel investors. Kima has established a settlement protocol that connects traditional financial services such as legal bank accounts and credit cards with decentralized financial instruments.

On June 11, Ink Finance, a decentralized DAO financial governance platform supported by Republic Capital, Defi Alliance, Avalanche Ecological Fund, Polygon Ecological Fund, etc., announced the completion of a new round of financing of US$5 million. Investment institutions such as Republic, Alliance, Blizzard Fund, P2 Ventures, GSR, DHVC, Draper Dragon, Bella, Aegis Ventures, and Tido Capital participated in the investment, and the valuation information has not been disclosed. It is reported that the new funds will be used to expand Web3 financial management, provide support for reputable DAOs and protocols in DeFi, and bridge the gap between DeFi and TradFi, and develop more efficient, fair and inclusive financial infrastructure.

On June 11, well-known market maker Sandstorm has recently guaranteed $4 million in financing to innovative cryptocurrency trading platform Upbots. The funds are intended to facilitate the integration of Upbots with Sandstorms advanced market making capabilities. The funds will be used by Upbots in the next two years to ensure its long-term financial stability and help Upbots improve its trading platform and provide new features and services to customers. Upbots automatic robots, social trading functions and advanced analysis functions are expected to be improved.

On June 12, the Web3 gaming social metaverse platform Yuliverse completed a $4 million Pre-A round of financing, led by LIF Capital, with participation from Spyre Capital, Presto Labs, DWF Labs, Sending Labs, 2 Punk Capital, G20, CSP DAO, 071 Labs, Titans Ventures, Ultiverse, HC Capital and others, with a total financing of more than $6 million.

Unite Completes $3 Million Seed Extension Round, Led by SuperLayer

On June 12, Unite, a mobile gaming L3 blockchain solution, completed a $3 million seed extension round of financing, led by SuperLayer, with participation from Coinbase Ventures, OKX Ventures, Solana Ventures, Kraken Ventures, Gemini Frontier Fund, Formless Capital, HTX Ventures, and CoinDCX Ventures. Unite plans to use the funds to accelerate its strategic transformation and become a Layer 3 blockchain solution for mass-market mobile games.

Data protocol codatta completes $2.5 million seed round of financing, led by OKX Ventures

On June 12, codatta announced the successful completion of a $2.5 million seed round of financing. This round of financing was led by OKX Ventures, with participation from Comma 3 Ventures, Mask Network, OGV, Paramita Venture, Web3Port, CGV, Fibo Partners, CatcherVC, BlockAI Venture, and angel investors from former Coinbase and Pinterest executives. GoPlus and zCloak Network also participated in the strategic investment.

On June 14, Web3 music platform Stage completed a financing of US$2.4 million, with participation from RR 2 Capital, Moonrock Ventures, Cogitent, and Kraken US CEO. It is reported that Stage will soon launch the STAGE token on BNB Chain.

On June 12, the Web3 gaming, entertainment and social ecosystem Skytopia announced that it had raised a total of $2.4 million in seed round funding, led by Vertex Capital and SuperChain Capital, with participation from Boyaa and Initiate Capital.

On June 11, native account abstraction layer Zyfi announced on the X platform that it had completed a $2 million private equity financing, with participation from Tenzor Capital, Everstake Capital, ZBS Capital and others.

On June 14, Qiro Finance, a DeFi credit service company headquartered in Singapore, announced the completion of a US$1.2 million Pre-Seed round of financing, led by Alliance, with participation from Druid Ventures, Escape Velocity (E V3), Trident Digital and CMT Digital. The specific valuation information has not been disclosed yet.

On June 13, Web3 game startup D-Drops completed a 500,000 euro Pre-Seed round of financing, with ROM Utrecht participating. The funds will support the launch of a location-based treasure hunt game.

On June 13, Honeypot Finance, a Berachain ecosystem project, announced on the X platform that it had completed a strategic round of financing, with a valuation of $20 million. The total amount of funds raised by the project in the seed round, seed round and strategic round financing has now reached $1.3 million. This round of financing was led by TKX CAPITAL, CSP DAO, AQUANOW, Web3Port, EnigmaValidator and other institutions.

On June 11, K 3 Labs, the Web3 infrastructure service provider of the Eigenlayer ecosystem, announced the completion of its Pre-Seed round of financing. Institutions such as Finality Capital Partners, Blockchain Founders Fund, and Aztlan Capital participated in the investment, but the specific amount has not been disclosed.

On June 12, HTX Ventures announced a strategic investment in Avail. Avail is a modular blockchain solution designed to unify Web3 and optimize data availability (DA) to support scalable and customizable applications. It is reported that Avail DAs data availability layer is combined with cross-chain interoperability and the strong security provided by Avail Nexus and Avail Fusion. Avail is building a unified layer for Web3. HTX Ventures, together with Founders Fund, Dragonfly and other institutions, completed Avails $43 million Series A financing. After this round of financing, Avails total financing has reached $75 million, and Avail will be launched on the mainnet in the next few weeks.

On June 13, AI Layer 2 project Optopia.ai announced the completion of its seed round of financing, with participation from G·Ventures, Kucoin Ventures, JRR Capital, KKP International Limited, ZenTrading, Klein Labs, MCS Capital and well-known KOL MrBlock.

The funds will be used to accelerate the continuous upgrade and optimization of Optopias infrastructure, enhance AI capabilities, build decentralized technology, and increase community engagement.

On June 13, the modular AI network REVOX (revox.ai) announced the completion of a strategic round of financing. This round of financing was participated by a number of angel investors in the fields of AI and Web3, including SevenX Ventures, Arweave SCP Ventures, Cointelegraph Acceleration, Skyland Ventures, Taisu Ventures, 0x Consulting, 7 upDAO and other institutions.

Web3 Talent Marketplace Bondex Completes Strategic Round of Financing, Animoca Brands Participates

On June 14, Web3 talent market Bondex announced the completion of a strategic round of financing, with Animoca Brands participating in the investment. The specific amount has not been disclosed. It is reported that Bondex mainly provides gamified experience and tokenized rewards, enabling participants to improve their careers, build reputations and receive rewards through recommendations and skill verification.

Leveraged trading protocol Particle completes a new round of strategic financing

On June 14, the permissionless leveraged trading protocol Particle announced the completion of a new round of strategic financing, with participation from Spirit DAO, XDeGods, dingaling and others. The specific amount has not been disclosed yet.

On June 14, the decentralized AI protocol PrivateAI announced the completion of a strategic round of financing, with participation from Charlie Hu of Bitlayer, DAO Maker, Gains Associates, Dextools Ventures, Connectico Capital, DOGE.ORG, Stone Block Association, 32 Ventures, Lunar Digital Assets, Pinnacle VC, Samara Asset Group, Snova Capital and Meezan Ventures. The specific amount of financing has not yet been disclosed. It is reported that PrivateAI has also launched its AI-native distributed data platform, which aims to build the worlds first domain-specific large language model (LLM) for the longevity industry.

On June 14, Orbital 7, a modular Web3 development kit based on Runes, BRC 20 and Bitcoin, announced the completion of a private round of financing, with Castrum Istanbul participating. The specific amount of financing and valuation data have not been disclosed. Orbital 7 aims to utilize and enhance Level 0 technology, promote the integration of various blockchain networks into a compatible ecosystem, unify the user and developer experience on different platforms, achieve seamless asset transfer, smart contract execution and decentralized application use, and solve interoperability issues.

Web3 oyun yayıncısı Sidus Heroes yeni finansman turunu tamamladı, DWF Labs yatırıma katıldı

On June 16, Web3 game publisher Sidus Heroes announced the completion of a new round of financing. Crypto trading market maker DWF Labs participated in the investment and reached a partnership with it. The specific amount of financing has not been disclosed yet.

DeFi ticaret platformu Reposwap, QCP Capital liderliğindeki tohum turu finansmanını tamamladı

On June 16, DeFi trading platform Reposwap announced the completion of its seed round of financing, led by QCP Capital and participated by ZK Prime Capital, XLink Ventures and other investment institutions. The specific amount of financing and valuation have not been disclosed yet.

This article is sourced from the internet: Financing Express of the Week | 30 projects received investment, with a total disclosed financing amount of approximately US$125 million (June 10-June 16)

Related: PUMP.FUN Protocol Insights: From Bonding Curve Calculation to Profit Strategy Construction

Original author: @malloyberac 3 Mentor: @CryptoScott_ETH introduction Bitcoin has laid the foundation for the value of cryptocurrency because it cannot be issued in large quantities. Ethereum has triggered an ICO craze through smart contracts, and Inscription and Memecoin have attracted massive amounts of funds due to fair distribution. The replacement of new technologies has continuously expanded the audience of crypto applications; and the differences in the issuance mechanisms of emerging tokens further reflect the changes in the audiences investment value concepts. Different from the old meme coins such as $DOGE $SHIB $FLOKI that try to combine practical applications, the Memecoin market has shown a new form of business under the leadership of $BOME $SLERF since the beginning of this year. From issuance to trading, around the upstream, midstream and downstream…