Kripto Piyasası Duygu Araştırma Raporu (2024.06.07-06.14): TÜFE beklentilerden düşük, faiz oranı toplantısı devam ediyor

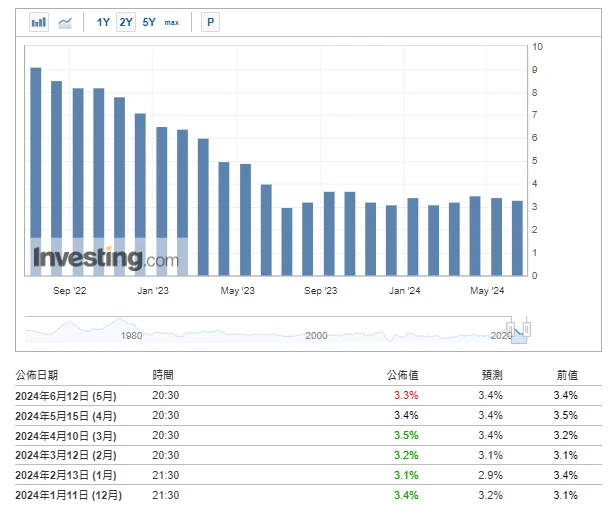

CPI is lower than expected, interest rate meeting maintains interest rate

At 20:30 on June 12 (Beijing time), the US CPI was lower than expected. After the data was released, Bitcoin rose from $68,000 to $70,000 in a short period of time, up 3%. After the Fed鈥檚 interest rate meeting at 02:00 on June 13 (Beijing time), the price of Bitcoin fell from $70,000 to $67,000, down -4.3%. Chairman Powell clearly released a message at the subsequent press conference: it is very inappropriate to cut interest rates in a short period of time. Only when the Fed sees more encouraging data and is more confident that inflation can sustainably move closer to the 2% target, can interest rate cuts be put on the agenda.

There are about 45 days until the next Federal Reserve interest rate meeting (2024.08.01)

https://hk.investing.com/economic-calendar/interest-rate-decision-168

Piyasa teknik ve duyarlılık ortamı analizi

Duygu Analizi Bileşenleri

Teknik göstergeler

Fiyat eğilimi

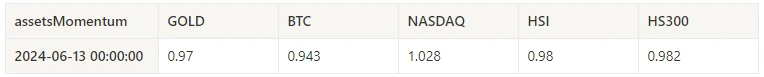

BTC price fell -5.69% and ETH price fell -9.02% in the past week.

Yukarıdaki resim BTC'nin geçen haftaki fiyat tablosudur.

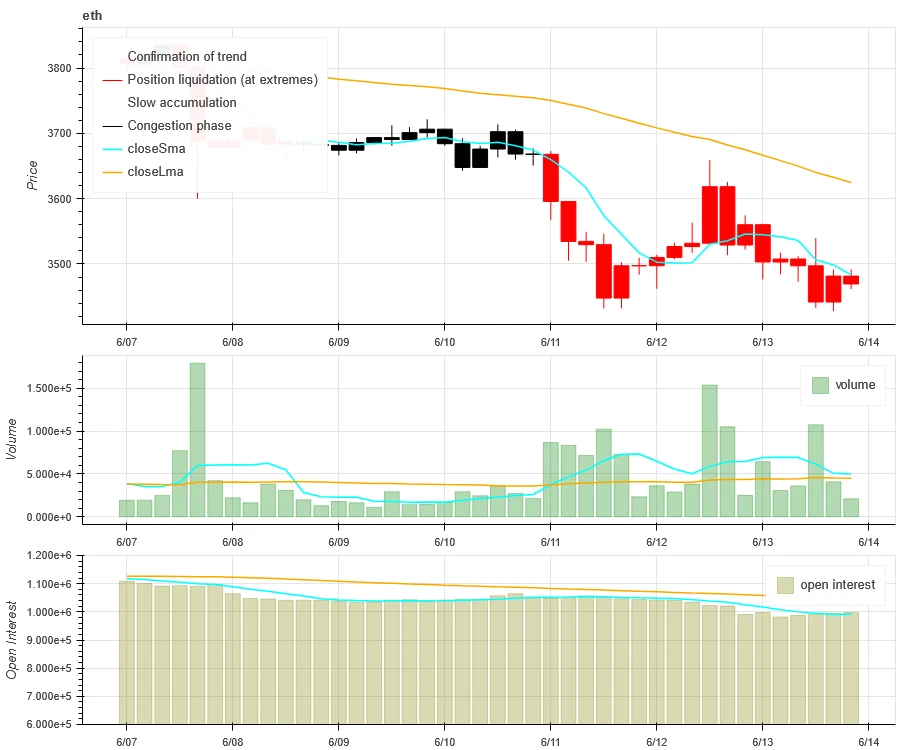

Yukarıdaki resim ETH'nin geçen haftaki fiyat tablosudur.

Tabloda geçtiğimiz haftadaki fiyat değişim oranları gösterilmektedir.

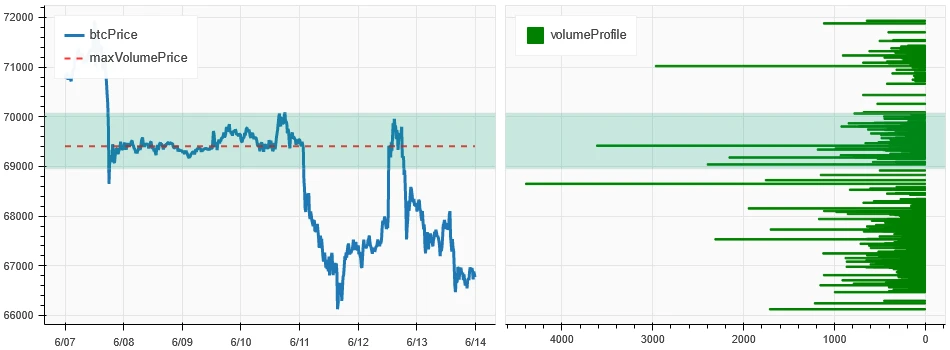

Fiyat Hacim Dağılım Grafiği (Destek ve Direnç)

In the past week, BTC and ETH broke down from the dense trading area and fluctuated at a low level.

Yukarıdaki resim, geçtiğimiz hafta BTC'lerin yoğun işlem alanlarının dağılımını göstermektedir.

Yukarıdaki resim, geçtiğimiz hafta ETH'lerin yoğun işlem alanlarının dağılımını gösteriyor.

Tablo, geçen hafta BTC ve ETH'nin haftalık yoğun işlem aralığını gösteriyor.

Hacim ve Açık Faiz

In the past week, BTC and ETH had the largest trading volume when they fell on June 7, followed by the CPI and FOMC events on June 12. The open interest of BTC and ETH both decreased.

Yukarıdaki resmin üst kısmı BTC'nin fiyat eğilimini, ortası işlem hacmini, alt kısmı açık pozisyonları, açık mavi 1 günlük ortalamayı, turuncu ise 7 günlük ortalamayı göstermektedir. K çizgisinin rengi mevcut durumu temsil eder, yeşil fiyat artışının işlem hacmi tarafından desteklendiğini, kırmızı pozisyonların kapatıldığını, sarı yavaş yavaş biriken pozisyonları, siyah ise kalabalık durumu ifade eder.

Yukarıdaki resmin üst kısmı ETH'nin fiyat eğilimini, ortası işlem hacmini, alt kısmı açık pozisyonları, açık mavi 1 günlük ortalamayı ve turuncu ise 7 günlük ortalamayı göstermektedir. K çizgisinin rengi mevcut durumu temsil eder, yeşil fiyat artışının işlem hacmi tarafından desteklendiğini, kırmızı pozisyonların kapandığını, sarı yavaş yavaş pozisyonların toplandığını ve siyah ise kalabalık olduğunu gösterir.

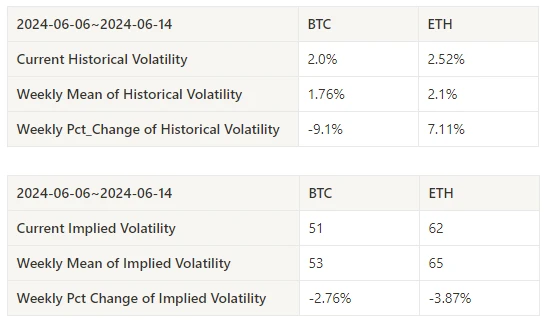

Tarihsel Volatilite ve İma Edilen Volatilite

In the past week, the historical volatility of BTC and ETH was the highest when the data was released on June 12; the implied volatility of BTC and ETH has declined.

Sarı çizgi tarihsel oynaklığı, mavi çizgi ima edilen oynaklığı, kırmızı nokta ise 7 günlük ortalamayı gösteriyor.

Olay odaklı

In terms of events, at 20:30 on June 12 (Beijing time), the US CPI was lower than expected. After the data was released, Bitcoin rose from US$68,000 to US$70,000 in a short period of time, an increase of 3%. Subsequently, at 02:00 on June 13 (Beijing time), the Federal Reserve announced that it would maintain interest rates at its interest rate meeting. The price of Bitcoin fell from US$70,000 to US$67,000, a decrease of -4.3%.

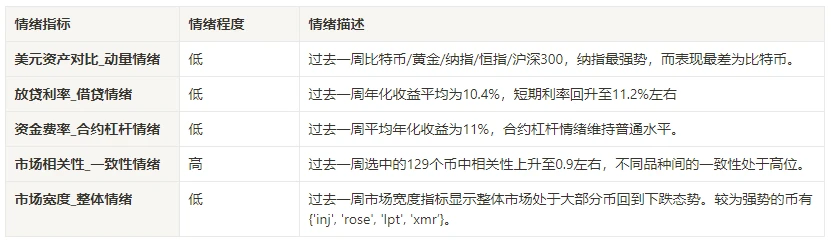

Duygu Göstergeleri

Momentum Duyarlılığı

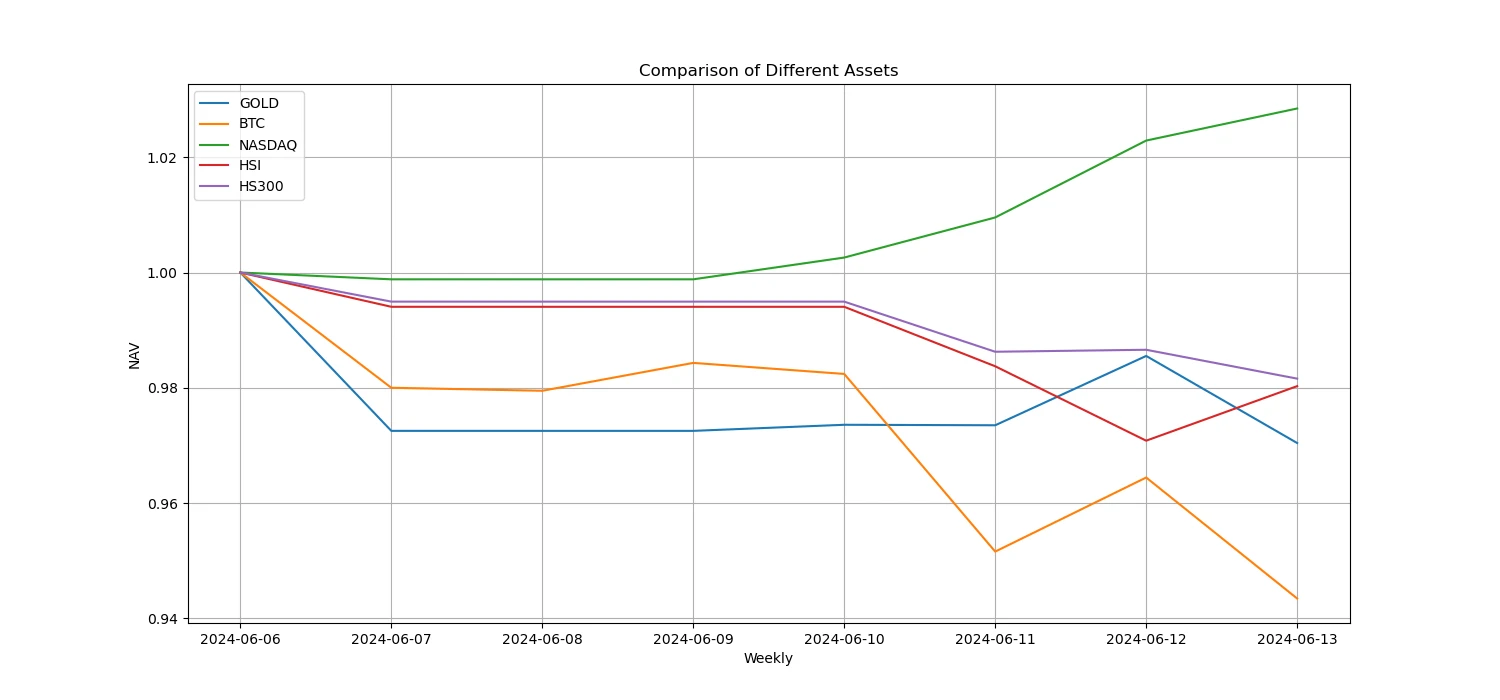

In the past week, among Bitcoin/Gold/Nasdaq/Hang Seng Index/SSE 300, Nasdaq was the strongest, while Bitcoin performed the worst.

Yukarıdaki resim farklı varlıkların geçen haftaki eğilimini göstermektedir.

Borç Verme Oranı_Kredi Verme Duyarlılığı

The average annualized return on USD lending over the past week was 10.4%, and short-term interest rates rebounded to around 11.2%.

Sarı çizgi USD faiz oranının en yüksek fiyatı, mavi çizgi en yüksek fiyat olan 75%, kırmızı çizgi ise en yüksek fiyat olan 75%'nin 7 günlük ortalamasıdır.

Tablo, geçmişteki farklı elde tutma günleri için USD faiz oranlarının ortalama getirisini göstermektedir

Fonlama Oranı_Sözleşme Kaldıraç Duyarlılığı

The average annualized return on BTC fees in the past week was 11%, and contract leverage sentiment remained at a normal level.

Mavi çizgi BTC'nin Binance'teki fonlama oranı, kırmızı çizgi ise 7 günlük ortalamasıdır

Tablo, geçmişteki farklı tutma günleri için BTC ücretlerinin ortalama getirisini göstermektedir.

Piyasa Korelasyonu_Konsensüs Duyarlılığı

The correlation among the 129 coins selected in the past week rose to around 0.9, and the consistency between different varieties was at a high level.

Yukarıdaki şekilde mavi çizgi Bitcoin fiyatı, yeşil çizgi ise [1000 floki, 1000 lunc, 1000 pepe, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, algo, ankr, ant, maymun, apt, arb, ar, astr, atom, ses, avax, axs, bal, grup, yarasa, bch, bigtime, bulanıklık, bnb, btc, celo, cfx, chz, ckb, comp, crv, cvx, cyber, tire, doge, nokta, dydx, egld, enj, ens, eos, vb, eth, fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot, icp, icx, imx, inj, iost, iotx, jasmy, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic, mana, matic, meme, mina, mkr, near, neo, ocean, one, ont , op, pendle, qnt, qtum, rndr, rose, rune, rvn, sand, sei, sfp, skl, snx, sol, ssv, stg, storj, stx, sui, suşi, sxp, theta, tia, trx, t , uma, uni, veteriner, wave, wld, woo, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx] genel korelasyon

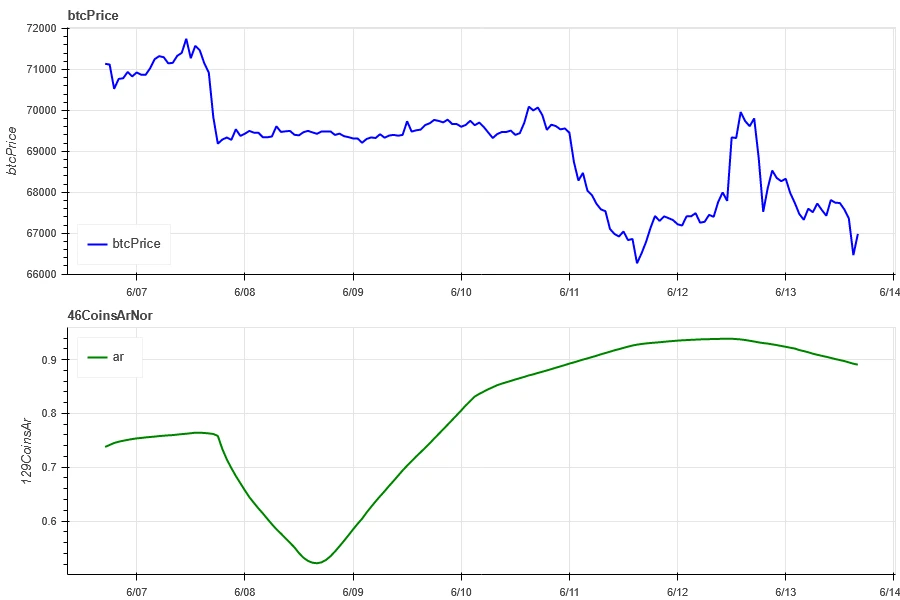

Pazar Genişliği_Genel Duygu

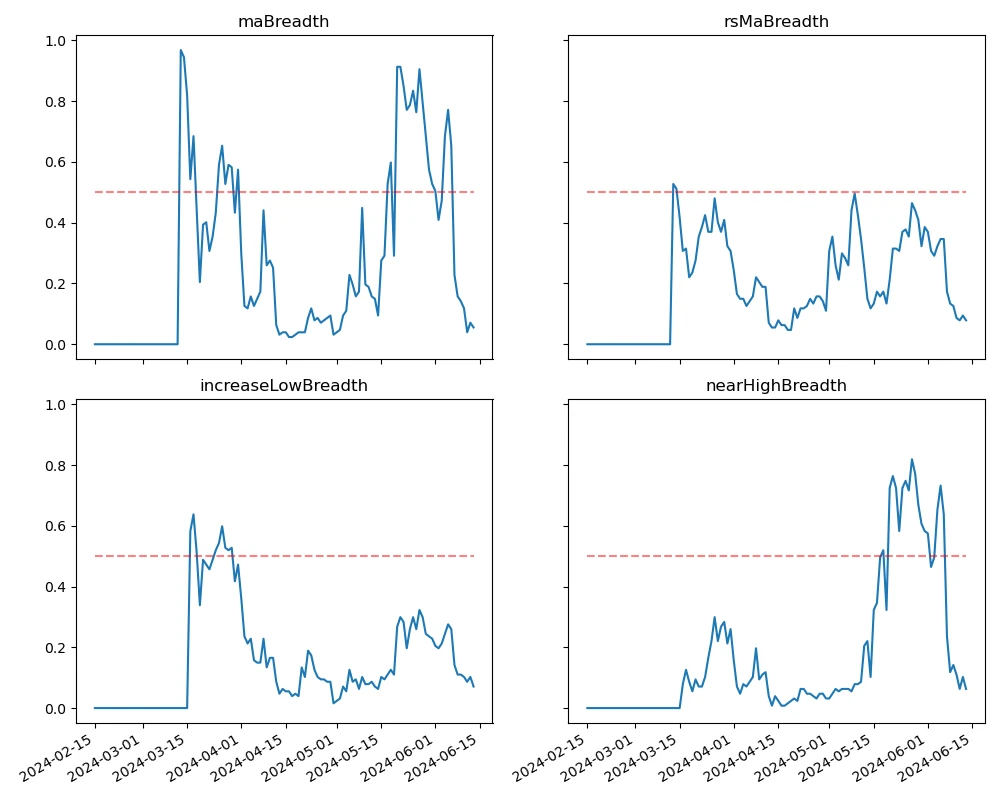

Among the 129 coins selected in the past week, 5.5% of the coins were priced above the 30-day moving average, 7.8% of the coins were priced above the 30-day moving average relative to BTC, 7% of the coins were more than 20% away from the lowest price in the past 30 days, and 6.3% of the coins were less than 10% away from the highest price in the past 30 days. The market breadth indicator in the past week showed that the overall market was in a downward trend with most coins returning to a downtrend.

Yukarıdaki resim [bnb, btc, sol, eth, 1000 floki, 1000 lunc, 1000 pepe, 1000 sats, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, ai, algo, alt, ankr, ape, apt, arb, ar, astr, atom, avax, axs, bal, band, bat, bch, bigtime, blur, cake, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos, vb., fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot, icp, icx, idu, imx, inj, iost, iotx, jasmy, jto, jup, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic, mana, manta, mask, matic, meme, mina, mkr, near, neo, nfp, ocean, one, ont, op, ordi, pendle, pyth, qnt, qtum, rndr, robin, rose, rune, rvn, sand, sei, sfp, skl, snx, ssv, stg, storj, stx, sui, suşi, sxp, theta, tia, trx, t, uma, uni, veteriner, dalgalar, wif, wld, woo,xai, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx ] Her genişlik göstergesinin 30 günlük oranı

Özetle

In the past week, both Bitcoin (BTC) and Ethereum (ETH) experienced two price declines, and volatility reached an all-time high when the data was released on June 12. Bitcoin and Ethereums trading volume reached its highest level during the decline on June 7, and then there was a large volume when the data was released on June 12. The open interest of Bitcoin and Ethereum has dropped slightly, and the implied volatility has also dropped. In addition, Bitcoins funding rate remains at an average level, and the market breadth indicator shows that most currencies have returned to a downward trend. In terms of events, the prices of mainstream currencies rose after the release of US CPI data, and then fell again after the Feds interest rate meeting.

Twitter: @ https://x.com/CTA_ChannelCmt

İnternet sitesi: kanalcmt.com

This article is sourced from the internet: Crypto Market Sentiment Research Report (2024.06.07-06.14): CPI is lower than expected, interest rate meeting maintains interest rate

Related: Movement Labs Announces Battle of Olympus Hackathon

On June 13, San Francisco-based blockchain development team Movement Labs announced the launch of Battle of Olympus, an innovative hackathon event designed to drive growth and adoption of Movement, a modular blockchain network based on Move. The hackathon marks the first phase of the Movement Labs testnet, will provide developers with early access, and will run from July 17 to September 17, 2024. 280 Capital and other partners will serve as judges, provide guidance, and advise the teams. Battle of Olympus is an important part of Movement Labs’ broader “Road to Parthenon” initiative, a community project designed to foster the development of a strong and thriving ecosystem for Movement Labs’ eventual mainnet. The hackathon will bring together talented developers and enthusiasts to innovate and build breakthrough applications on the Movement…