Haftalık Editör Seçimleri, Odaily Planet Daily'nin işlevsel bir köşesidir. Planet Daily her hafta büyük miktarda gerçek zamanlı bilgiyi kapsamanın yanı sıra, çok sayıda yüksek kaliteli derinlemesine analiz içeriği de yayınlar, ancak bunlar bilgi akışında ve sıcak haberlerde gizlenmiş olabilir ve sizi geçebilir.

Bu nedenle, her cumartesi, editöryal departmanımız son 7 günde yayınlanan içeriklerden okumaya ve toplamaya değer, yüksek kaliteli makaleler seçecek ve veri analizi, sektör yargısı ve görüş çıktıları perspektiflerinden kripto dünyasında size yeni ilham kaynağı olacak.

Hadi gelin birlikte okuyalım:

Yatırım ve Girişimcilik

Ürün Olarak Jetonlar: İnsanların İstediği Jetonları Nasıl Yaparsınız?

Token'lar piyasayı bir dereceye kadar tahmin eder, kalabalığın belirli bir yönde hareket eden bir projeye olan ortak ilgisini ve bunun gerçekleşme olasılığını yansıtır. İnsanların bir projeyi, projenin gelecekte bir ihtiyacı karşılayacağına olan inançlarına dayanarak satın almalarını sağlama mekanizması, risk sermayesinin kalbinde yer alır.

Token'ların talihsiz bir dezavantajı vardır, o da piyasa dikkati değiştikçe sermayenin de onunla birlikte akmasıdır. Ekiplerin bu sorunu çözmesinin bir yolu, likidite çekmek için projelerini sürekli olarak en son ve en popüler kripto para değer önerileriyle ilişkilendirmek olan hikaye sörfü yapmaktır; bir diğer yol ise memler kullanmaktır; ayrıca, karar almanın aşırı finansallaştırılmasından kaçınılmalıdır.

Electric Capital: Gelecek çok zincirli, kripto sosyal ve NFT'nin etkisini göz ardı etmeyin

Gelecek çok zincirli; ABD'deki geliştirici payı azalıyor; Bitcoin Layer 2 ve Base geliştiricileri büyüyor; kripto sosyal ve NFT'nin etkisini göz ardı etmeyin.

havadan yardım

Trusta Labs ile Röportaj: Kaos ve Düzen AirdropS

Giderek daha fazla kullanıcı (cadılar dahil) akın ettikçe, airdrop pazarı zaten çok fazla insan ve çok az kaynak durumunda ve hala yoğunlaşmaya devam ediyor. Kullanıcıların yüksek beklentileri ile projenin sağlayabileceği çipler arasında bir uyumsuzluk var.

LayerZeros deneyinin planlanması ve yürütülmesinde bazı sorunlar yaşandı. LayerZero, token ekonomik modelini ve airdrop paylaşım planlamasını önceden açıklığa kavuşturmayı başaramadı ve kendini ifşa etme, tarama ve raporlamanın üç büyük bağlantısının etkinliği de şüpheli. Son zamanlardaki bir diğer yüksek profilli airdrop projesi olan zkSync, LayerZeros listesini tamamen kullanabilir ve nispeten nazik bir şekilde katı cadı taramasını uygulayabilir, böylece ticari marka sorunu kamuoyunda öfkeye neden olduktan sonra topluluk duygusunu tekrar harekete geçirmekten kaçınılabilir.

Mantıklı bir airdrop tasarlamak istiyorsanız, proje ekibinin airdrop için yukarıdan aşağıya bir tasarım fikrine sahip olması ve veri odaklı, şeffaf kurallar, adalet ve kapsayıcılık gibi temel ilkelere uyması gerekir.

Sıradan kullanıcılar için airdropların servet yaratma etkisi giderek azalıyor gibi görünüyor.

meme

Kurumsal Meme coin varlıkları üç katına çıktı; sürekli takaslarda büyük hacimler görüldü; bireysel yatırımcılar yüksek esneklik ve dayanıklılık gösterdi.

Meme coin tüccarı: Satın aldığınız on meme coin'in hepsi benim tarafımdan çıkarılmış olabilir

Olgunlaşmış bir Meme projesini işletmek, bir fili buzdolabına koymaya benzer ve yalnızca üç adım gerektirir: madeni paraların basımının önceden ısıtılması, piyasa değeri yönetimi ve topluluk bakımı. Bu olgun işletme matrisi, kripto endüstrisinin tüm zincirini kapsamaktadır.

İster zengin olmayı başarsınlar ister Meme tarafından engellensinler, her projenin arkasındaki gerçek aktif kişiler her zaman coin çemberinin taban kullanıcılarıdır. Meme coin'lerinin başarısı asla sadece proje sahipleri tarafından yönetilmez, aynı zamanda toplulukların kolektif bilincinin karnavalından da gelir. Meme topluluğu tarafından kurulan bağlantı daha merkezsizdir. İçinde spekülasyon da çılgınca artmaktadır.

Kükreyen Kedi bir kez daha popüler bir konu, işte bununla ilgili en iyi on meme

GME, AMC, Kitty, Superstonk, WSB, DFV, Keith Gill, Ryan Cohen, Melvin.

Ethereum ve Ölçekleme

Aylık milyonlarca dolar kazanan Layer 2'de en çok parayı kim kazanıyor?

Coinbase'in Base'i Mayıs ayında kümülatif zincir içi karlarda $6 milyondan fazla üretirken, onu Blast'ın $1,5 milyonu ve Optimism'in $1,4 milyonu takip etti.

Çoklu ekoloji

Base zinciri ekosistemini keşfetmek: Meme'nin dışında, hangi projelere dikkat edilmeye değer?

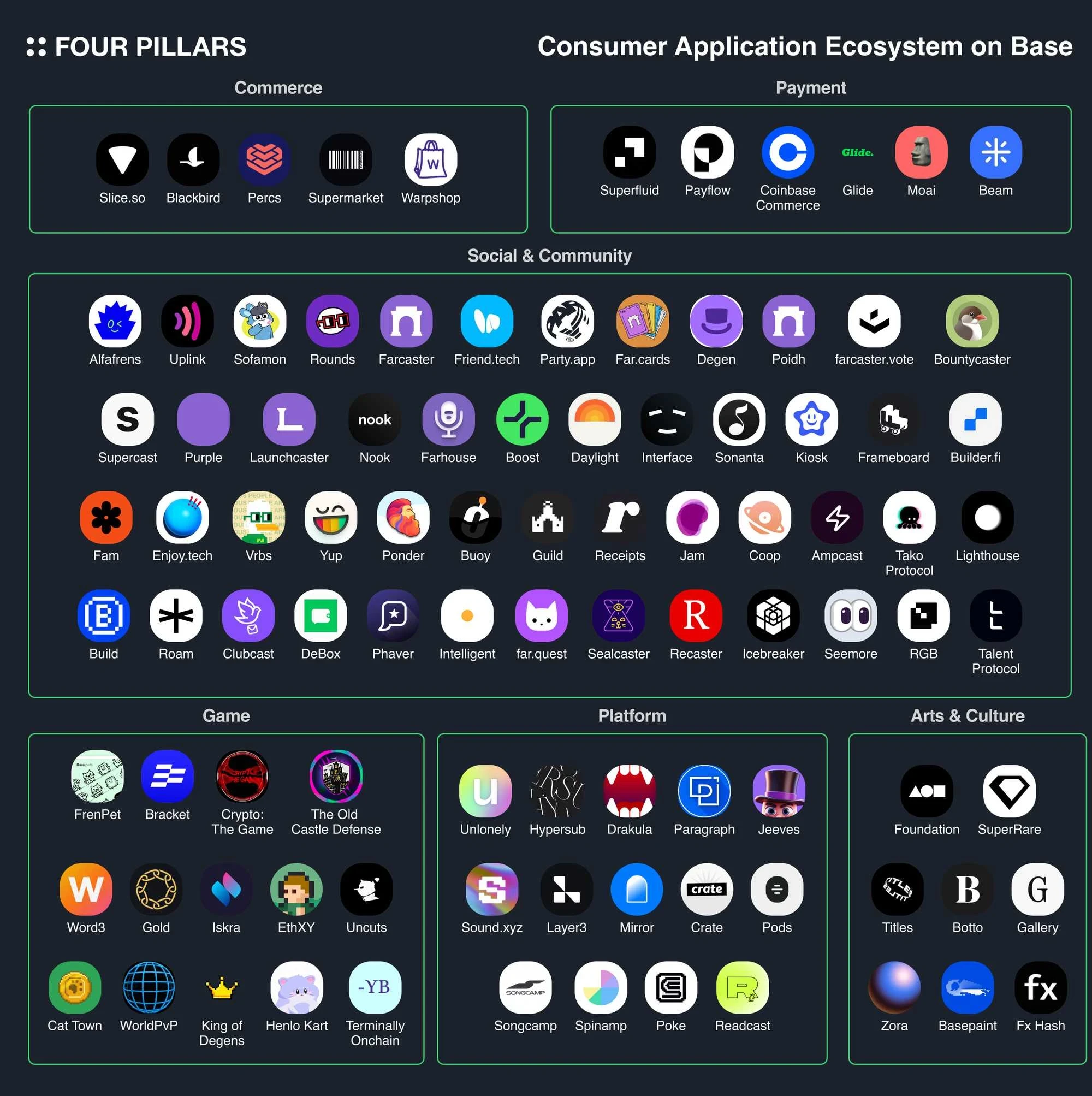

Zincire daha fazla kullanıcı getirme misyonuyla yola çıkan Base, topluluğa, içerik oluşturuculara ve geliştiricilere odaklanan markalaşma ve pazarlama faaliyetleri sayesinde bir yıldan kısa sürede tüketiciye yönelik bir zincir üstü uygulama merkezi haline geldi.

Base, EIP-4844'ün toplama ücretlerini düşürmesi ve Meme çılgınlığı gibi piyasa faktörlerinin yanı sıra Farcaster topluluğunun büyümesi ve zincir üstü uygulamalardaki artış gibi iç faktörler nedeniyle son zamanlarda kullanıcı ve işlem hacminde artış gördü.

Öncelikli olarak DeFi ve altyapıya odaklanan diğer blok zinciri ekosistemlerinin aksine Base, geleneksel Web2 hizmetlerine benzer tüketici odaklı uygulamalar sağlar. Bu, benzersiz topluluğu ve markası tarafından yönlendirilir ve zincir üzerinde daha fazla uygulama getirir.

Şu anda Base ekosistemi, Farcaster merkezli sosyal ve topluluk uygulamalarında en hızlı büyüyenidir. Ancak, içerik, oyunlar ve ticaret dahil olmak üzere zincir üstü uygulamaların yeni kategorileri ortaya çıkmakta ve kullanıcı genişlemesi için geniş bir potansiyel göstermektedir.

Ayrıca şunu da öneriyoruz: Piyasa değeri bir haftada $2 milyar ABD doları arttı, NOT'un büyük ölçekli servet yaratma eylemi gözden geçirildi .

DeFi

Paradigm, mevcut DeFi manzarasını değiştirecek yeni bir mekanizma olan MEV vergisini icat etti

MEV vergisi, uygulamaların blok teklif sahiplerine sızdırmak yerine kendi ürettikleri MEV'i yakalamalarına olanak tanıyan yeni bir mekanizmadır. Bu mekanizma, blok oluşturma sırasında rekabetçi öncelik sıralamasından yararlanır; burada işlemler öncelik ücretlerinin azalan sırasına göre sıralanır ve daha yüksek önceliğe sahip işlemler önce bloklarda paketlenir.

MEV vergi mekanizmasının doğuşu mevcut DeFi ekosistemini etkileyebilir: geleneksel MEV dağıtım yöntemini değiştirmek; uygulamaların gelirini ve kullanıcı deneyimini iyileştirmek; DeFi'deki bazı sorunları çözmek - DEX yönlendirmesini optimize etmek, AMM'nin arbitraj nedeniyle uğradığı kayıpları azaltmak ve cüzdan kullanıcılarının MEV sızıntısını azaltmak gibi.

GameFi, SosyalFi

Blockchain oyunları hakkında: Bir anket yaptım, 62 oyuncuyla konuştum ve 7 sonuca vardım

1. Şu anda Web3 oyuncuları tarafından oynanan blockchain oyunlarının sayısı çok fazla değil, temelde 5'ten az;

2. Web3 oyuncularının blockchain oyun bilgilerine ulaşabilmesinin ana kanalı Twitter'dır;

3. Web3 oyuncularının 90%'si günde 2 saatten fazla zamanını blockchain oyunları oynayarak geçirmiyor ve bunların 57.5%'si ise blockchain oyunlarına 1 saatten az zaman harcıyor;

4. Oyunun popülaritesi, oyuncuların bir blockchain oyununa girip girmemeye karar vermesindeki en önemli faktördür;

5. 30.6% kişi, oyunlaştırma ve Fi ve diğer para kazandırma faktörlerinin cazibesi nedeniyle blockchain oyunları oynuyor. 29% kişi, oyun benzeri ve zengin bir oynanışa sahip olması nedeniyle blockchain oyunları oynuyor; bu da karşılaştırılabilir;

6. 38,7% kişi, oyunlaştırmanın ortadan kalkması veya artık para kazanma cazibesinin olmaması nedeniyle bir blockchain oyunundan vazgeçti ve 38,7% kişi, oynanabilirliğin ortadan kalkması veya eğlenceli olmaması nedeniyle bir blockchain oyunundan vazgeçti;

7. Merakla beklenen blockchain oyunları arasında, oyuncular tarafından en çok bahsedilen ilk 5 blockchain oyunu şunlardır: Xterio Ecological Blockchain Games, MATR1X, Space Nation, Pixels ve BAC Games.

SocialFi fonksiyonel katmanlaması: işlem önceliği mi yoksa sosyal öncelik mi?

Mevcut SocialFi yığını dört temel katmandan oluşur: keşif katmanı – kullanıcıların satın almak istedikleri ürünleri keşfettikleri yer; Uygulama katmanı – varlıkların alınıp satıldığı yer; likidite katmanı – varlıkların depolandığı ve toplandığı yer; ve varlık ihraç katmanı – varlıkların yaratıldığı yer.

SocialFi'de çoğu uygulama iki dikeyleştirme yaklaşımı arasında seçim yapar: işlem odaklı yaklaşım: öncelikle kullanıcıların dikkat çeken varlıklarla (örneğin Memler) ticaret yapabilecekleri bir ticaret platformu veya pazarı oluşturun ve ardından bir sosyal/keşif platformuna dönüştürün; Sosyal/keşif odaklı yaklaşım: Öncelikle bir sosyal platform oluşturun ve ardından yavaş yavaş finansal unsurlar ekleyin; böylece tüketiciler/tüccarlar platformun temel paydaşları haline gelir.

En başarılı uygulamalar, sağlam bir duruş sergileyen, tasarım olarak dikey olarak entegre olan, yeni varlık türleri için likit pazarlar yaratan veya başka şekillerde yeni tüketici davranışlarına ilham veren uygulamalar olacaktır.

Web3

7 Mayıs'ta, dört yeni sosyal uygulama ücret üretimi açısından ilk 15 protokol arasına girdi: Fantezi Üst, Arkadaş Teknolojisi, Pompanokta eğlencesi, YOLO Games. Ve spekülatif ve sosyal unsurları diğerlerinden daha iyi harmanlayan bir tüketici uygulaması var: Polymarket. Yazar ayrıca Farcaster konusunda da iyimser.

GameFi alanında, erken katılımcılar için oynamaya "en değer" olan en iyi 3 Web3 oyunu Nyan Heroes, Metalcore ve Shrapnel'dir.

Aynı zamanda aşırı iyimserliğe kapılmayın; Brave en başarılı tüketici uygulamalarından biri olmasına rağmen, BAT token'ı hala 2017 fiyatlarından işlem görüyor.

Emniyet

Tavsiye edilen Kripto Kendini Koruma Kılavuzu, Milyonlarca Dolar Tasarruf Etmek İçin Bu Püf Noktalarını Öğrenin .

Haftanın Sıcak Konuları

Geçtiğimiz hafta, Nvidia'nın piyasa değeri $3 trilyonu aşarak Apple'ı geride bıraktı;

Ayrıca, politika ve makro piyasalar açısından Biden veto edildi SEC'in kripto varlık muhasebe standardı SAB 121'in yürürlükten kaldırılmasına ilişkin karar; ABD SEC başkanı kripto görüşünü değiştirdi : tüm tokenlar menkul kıymettir ve tokenlar uygun şekilde açıklanmamıştır; Gary Gensler: Ethereum spot ETF ticaretinin başlangıç saati ihraççıların sorulara yanıt verme hızına bağlıdır; Hong Kong Menkul Kıymetler ve Vadeli İşlemler Komisyonu Sanal varlık işlem platformlarının listesi güncellendi ve 11 platformun lisanslı olduğu kabul edildi; CZ Kaliforniya'daki bir federal hapishanede cezasını çekmeye başladı; MikroStrateji ve kurucusu Michael Saylor, vergi kaçırma iddialarına son vermek için $40 milyonluk bir anlaşmaya vardılar; Shenzhen Finans Bürosu Sanal Para Birimi Ticareti Spekülasyonuna İlişkin Risk Uyarısı yayınladı; 00 sonrası bir üniversite öğrencisi bir köpek jetonu çıkardı ve saniyeler içinde likiditeyi geri çekti ve dolandırıcılık suçundan 4 yıl 6 ay hapis cezasına çarptırıldı ve 30.000 yuan para cezasına çarptırıldı;

Görüşler ve sesler açısından, Wall Street Journal: Roaring Kitty olabilir hisse senedi alım satım platformu ETrade'den kaldırıldı ; 10x Araştırma: ETH'de kısa, BTC'de uzun ; Standard Chartered Bank: Bitcoin'in ulaşması bekleniyor $100,000 ABD seçimlerinden önce; Arthur Hayes: Merkez bankalarının faiz indirimi dalgası geliyor ve şimdi en iyi zaman Bitcoin ve altcoinlere yatırım yapmak; Bitfinex: Bitcoin boğa piyasası döngüsü dördüncü çeyrekte zirve ve $120.000'lik bir zirveye ulaştı; Vitalik: Çirkin Ünlülerin Meme paraları çıkarması için para kazanmak için. Kamu refahı hedefleri gibi özelliklere sahiplerse daha fazla saygı görebilirler; Uniswap kurucusu: Meme coin'leri veya ünlü coin'leri hakkında hiçbir fikrim yok ve memler için bir pazar yaratmak harika; Uniswap kurucusu: Solana'nın kurucu ortağının şu görüşüne katılıyorum: DA'nın uzun vadeli değerinin belirsizliği Ethereum'un karşı karşıya olduğu en büyük sorunlardan biri; Shima Capital kurucusu gizli varlık transferlerine karıştığı şüphesiyle güven bunalımı yaratmıştır;

Kurumlar, büyük şirketler ve öncü projeler açısından Ark Yatırım çekildi Ethereum spot ETF yarışması ve 21 Shares ilerlemeye devam edeceğini söyledi; Robinhood, Bitstamp'ı edinin ; Coinbase akıllı bir cüzdan başlattı Bu da işlem imzalarının sayısını azaltacaktır; Starknet Bitcoin uzantı katmanına girdi ve ilgili araştırmaları desteklemek için milyon dolarlık bir fon kurdu; io.net Binance Launchpool'u başlattı; TAİKO airdrop uygulamalarının ilk aşaması açıldı; Ultiverse açıldı ULTI hava atışı uygulamalar; Kutsal alan token ekonomisi ve airdrop detayları duyuruldu; Matter Labs terk edilmiş ZK marka başvurusu; Büyük patlama :DApp'lerin airdrop'ta sayılabilmesi için tüm Altın ve Puanları 25 Haziran'dan önce kullanıcılara tahsis etmesi gerekiyor;

Veri açısından değeri Trumplar kripto para birimi varlıkları bir haftada iki katına çıkarak $20 milyonu aştı; Roaring Kittys'in toplam değeri GEM hisse senedi ve opsiyon pozisyonları yaklaşık $586 milyon idi;

Güvenlik açısından, Japon kripto borsası DMM Bitcoin hacklendi ve 4502,9 BTC çalındı, $305 milyon ABD doları zarara uğradı; Hızlı çekirdek zkSync ve Linea zincirlerinde saldırıya uğradığından şüphelenildi ve tüm likidite tükendi. Velocore: Saldırının temel nedeni tanımlanmış ve taklitçilerin saldırılarını önlemek için önlemler alınmış olup, 10% sağlamaya isteklidir beyaz şapka ödülü hackerlara; Kosinüs Velocore hacklendikten sonra Linea zincirinin askıya alınmasıyla ilgili olarak şu yorumu yaptı: Bu tür kararlar ilk aşamalarda anlaşılabilir, ancak zaman geçtikçe daha az olası hale geliyor; Bir kullanıcı, bu nedenle 1.100.000.000 ABD doları tutarında bir kayba uğradı. kötü amaçlı eklenti Aggr web çerezlerinin bilgisayar korsanları tarafından rehin alınmasına neden oluyor... Eh, inişli çıkışlı bir hafta daha.

Ekli bir portaldır “Haftalık Editörün Seçtikleri” dizisi.

Bir dahaki sefere görüşmek üzere~

Bu makale internetten alınmıştır: Haftalık Editör Seçimleri (0601-0607)

ABD Menkul Kıymetler ve Borsa Komisyonu, 24 Mayıs günü Pekin saatiyle sabah 5:00'te BlackRock, Fidelity ve Grayscale'den olanlar da dahil olmak üzere birden fazla Ethereum spot ETF'sinin 19 b-4 formunu onayladı. Ancak, form onaylanmış olsa da, ETF ihraççılarının işlem yapmaya başlamadan önce S-1 kayıt beyanını yürürlüğe koymaları gerekiyor. Daha önce yayınlanan bir Galaxy Digital raporu, Ethereum spot ETF'sinin Temmuz veya Ağustos'ta borsada listelenebileceğini öngörmüştü. Bloomberg'de bir ETF analisti olan James Seyffart, yakın zamanda Ethereum spot ETF'sinin Haziran ortasında listelenmesinin de mümkün olduğunu söyledi. Ethereum spot ETF'si popüler olmamaktan ve yalnızca 7%'lik bir onay oranına sahip olmaktan bir gecede 75%'lik bir onay oranına geçti ve ETH'nin fiyatı defalarca aştı…