Grayscale raporu: ETH fiyatının daha fazla artış için sınırlı alanı var, Solana pazar payını ele geçirebilir

Orijinal yazar: Gri Tonlamalı Araştırma

Orijinal çeviri: Felix, PANews

-

The potential launch of a spot Ethereum ETF will expose more investors to the concepts of smart contracts and decentralized applications, thereby making them understand the potential of public blockchains to transform digital commerce.

-

Ethereum is the largest blockchain network in terms of users and applications, and is expanding with a modular design concept, with more activities taking place on the Layer 2 network in the future. To maintain its dominance in a highly competitive market segment, Ethereum needs to attract more users and increase fee income.

-

Based on international precedent, the demand for US spot Ethereum ETFs is expected to be about 25%-30% of the demand for spot Bitcoin ETFs. It is unlikely that a large portion of Ethereum supply (such as staked ETH) will be used for ETFs.

-

Given the high initial valuations, further price gains may be limited compared to a Bitcoin ETF launching in January 2024, but Grayscale Research remains optimistic about the prospects for both assets.

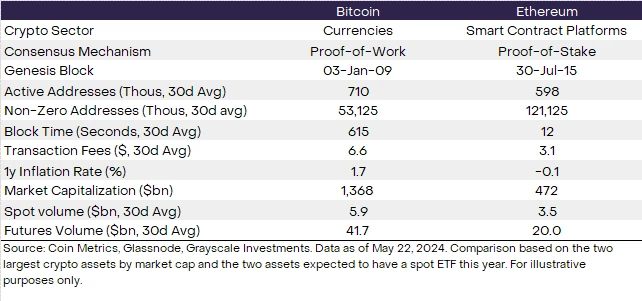

Last week, the U.S. Securities and Exchange Commission (SEC) approved several issuers’ Form 19 b-4 filings for spot Ethereum ETFs, a notable step toward listing these products on U.S. exchanges. Similar to the spot Bitcoin ETFs that were listed in January, these new products will allow a broader range of investors to gain exposure to crypto assets. While both assets are based on the same public blockchain technology, Ethereum is a separate network with different use cases (Table 1), while Bitcoin primarily serves as a store of value and digital alternative to gold. Ethereum is a decentralized computing platform with a rich ecosystem of applications that is often likened to a decentralized app store. New investors interested in exploring this asset may want to consider Ethereum’s unique fundamentals, competitive positioning, and potential role in the growth of blockchain-based digital commerce.

Figure 1: Ethereum is a smart contract platform blockchain

Smart Contract Basics

Ethereum expanded on the original vision of Bitcoin by adding smart contracts. A smart contract is a pre-programmed, self-executing computer code. When a user engages a smart contract, a predefined action is performed without any additional input. Its like a vending machine: the user inserts a coin and the vending machine dispenses an item. When using a smart contract, the user inserts a digital token and the software can perform some type of action, such as trading tokens, issuing loans, and verifying the users digital identity.

Smart contracts operate through the mechanisms of the Ethereum blockchain. In addition to recording ownership of assets, the blockchains block-by-block updates can also record any changes in state (note: a computer science term meaning the state of data in a database). In this way, coupled with smart contracts, public blockchains can actually operate like computers (software computers rather than hardware computers). With this, Ethereum and other smart contract platform blockchains can host almost any type of application and serve as core infrastructure for the emerging digital economy.

Asset Returns and Fundamentals

Since the beginning of 2023, ETH has performed roughly in line with the overall smart contract platform token segment (Table 2). However, ETH has underperformed BTC and Solana. Since the beginning of 2023, ETH, like BTC, has outperformed certain traditional asset classes on a risk-adjusted basis. Over the long term, both BTC and ETH have achieved risk-adjusted returns comparable to traditional asset classes, despite significantly higher volatility.

Figure 2: ETH’s performance has been consistent with the cryptocurrency sector

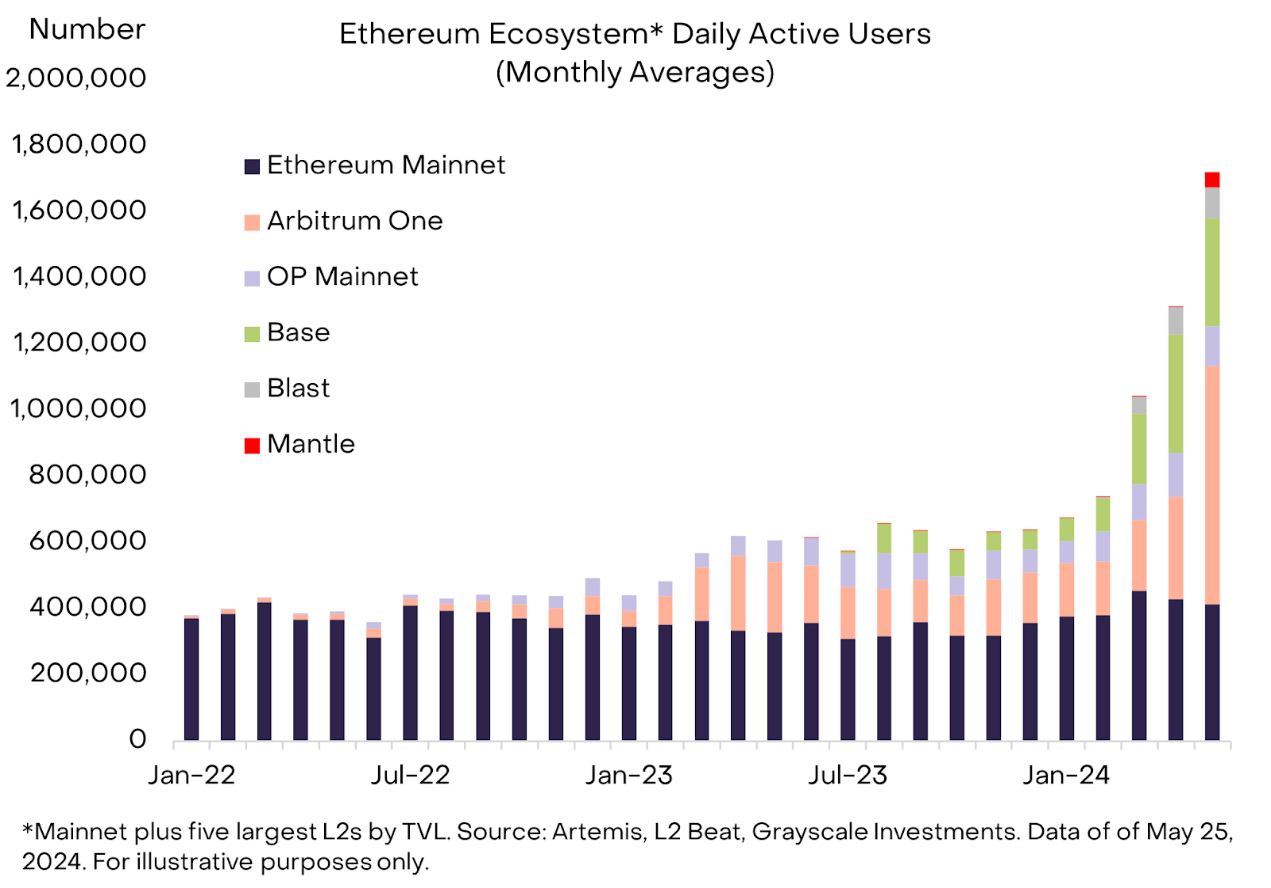

Through Ethereum’s modular design, different types of blockchain infrastructure work together to provide a great experience for end users. In particular, the ecosystem expands as activity on the Ethereum Layer 2 network increases. Layer 2 periodically settles and publishes its transaction records to Layer 1, benefiting from its network security and decentralization. This approach contrasts with single-layer design-philosophy blockchains such as Solana, where all key operations (execution, settlement, consensus, and data availability) occur in Layer 1.

In March 2024, Ethereum underwent a major upgrade that is expected to facilitate its transition to a modular network architecture. From the perspective of blockchain activity, the upgrade was successful: the number of active addresses on the Layer 2 network increased significantly, accounting for about two-thirds of the total activity in the Ethereum ecosystem (Figure 3).

Figure 3: Ethereum Layer 2 activity has grown significantly

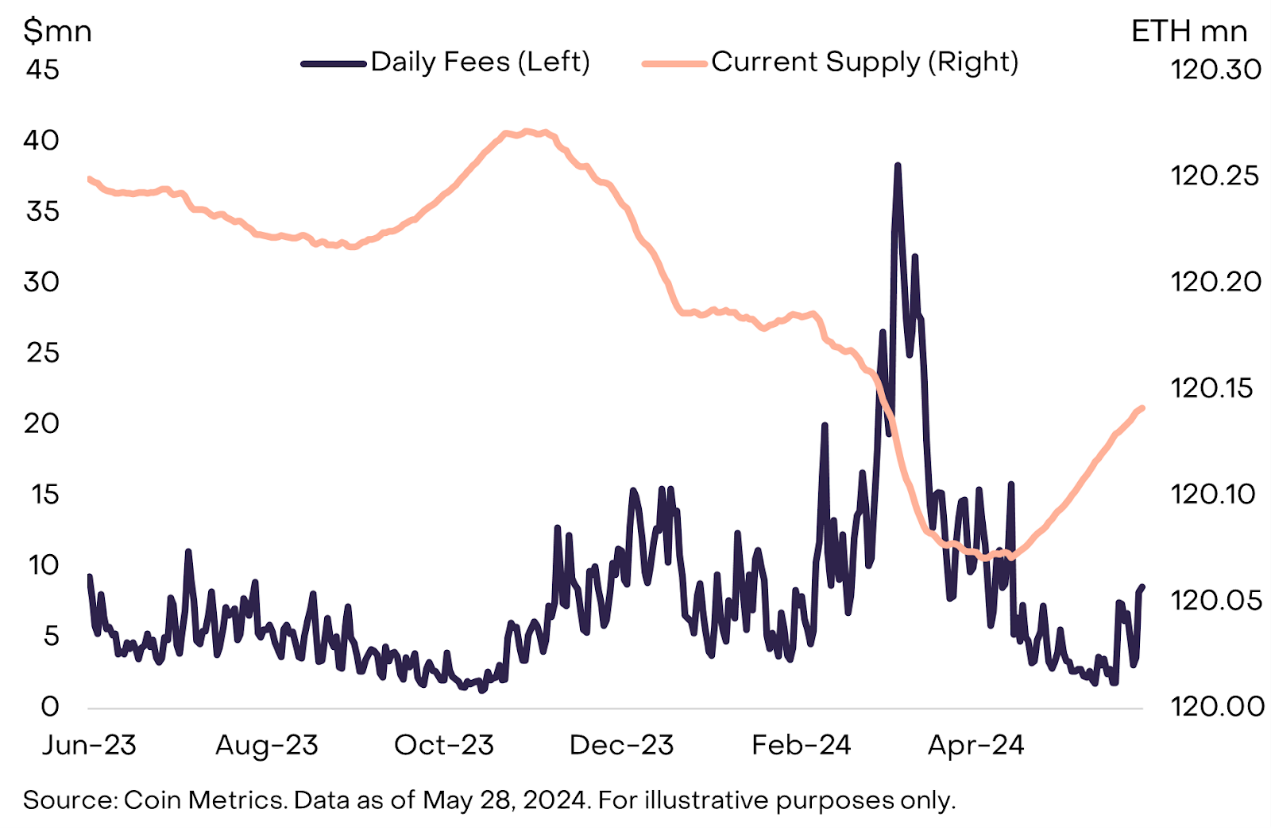

At the same time, the shift to Layer 2 networks has also affected the token economics of ETH, at least in the short term. Smart contract platform blockchains accumulate value primarily through transaction fees, which are typically paid to validators or used to shrink the token supply. In the Ethereum network, base transaction fees are burned (removed from circulation), while priority fees (tips) are paid to validators. When Ethereums transaction revenue was relatively high, the number of tokens destroyed exceeded the rate of new issuance, and the total ETH supply fell (deflation). However, as network activity transitioned to Layer 2, fee revenue on the Ethereum mainnet fell, and ETH supply began to increase again (Figure 4). Although Layer 2 networks also pay fees to publish their data to Layer 1 (so-called blob fees, as well as other transaction fees), the amounts tend to be relatively low.

Figure 4: ETH supply has increased recently due to lower mainnet fees

In order for ETH to increase in value over time, the Ethereum mainnet will likely need to increase fee revenue. This could happen in two ways:

-

Moderately increase Layer 1 activity, paying higher transaction fees

-

Significantly increase Layer 2 activity, paying lower transaction fees

Grayscale Research predicts that a combination of the two approaches is more likely.

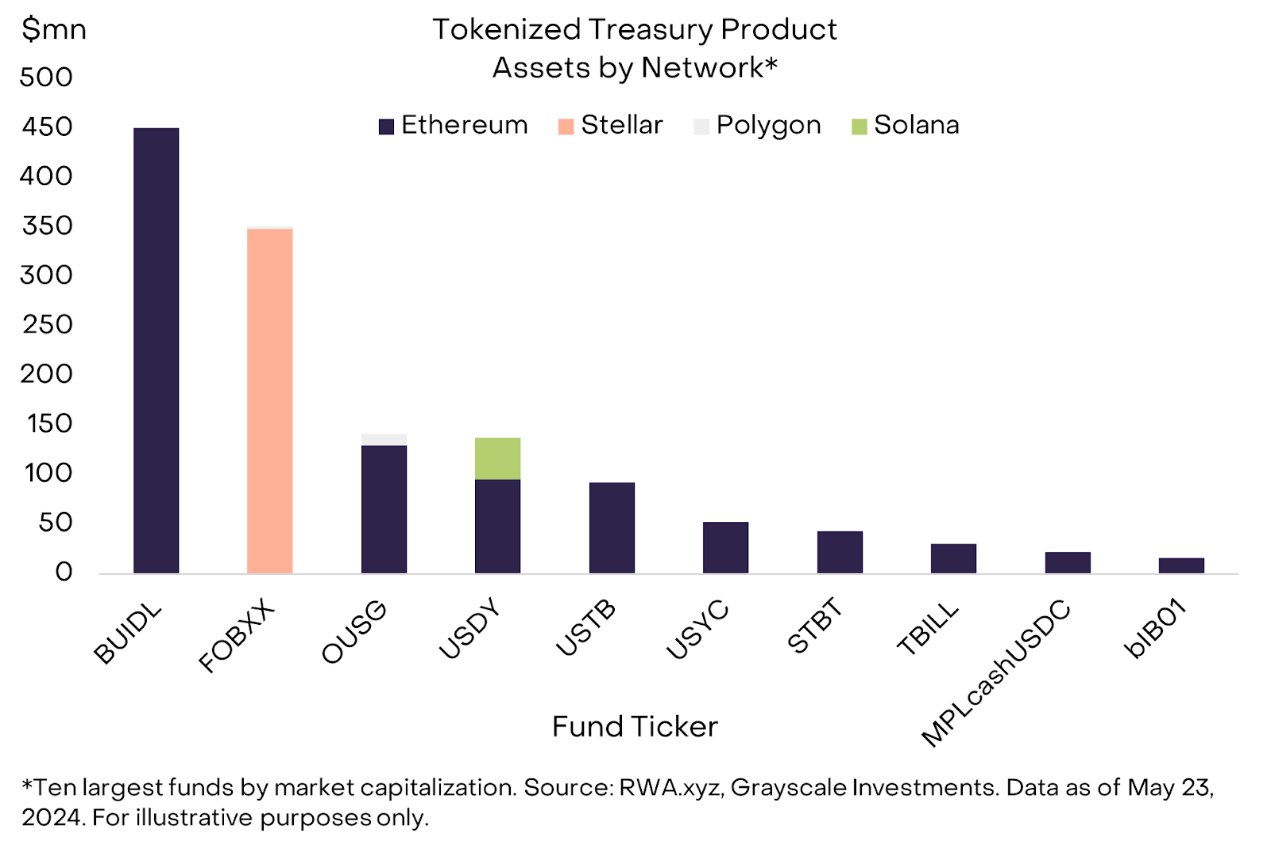

Grayscale believes that the growth of Layer 1 activity is most likely to come from low-frequency and high-value transactions, as well as any transactions that require a high degree of decentralization (at least until the Layer 2 network is sufficiently decentralized). This may include many types of tokenized projects, where transaction costs may be relatively low compared to the dollar value of the transaction. Currently, about 70% of tokenized U.S. Treasuries are on the Ethereum blockchain (Table 5). In Grayscales view, relatively high-value NFTs may also remain on the Ethereum mainnet because they benefit from its high security and decentralization and change hands less frequently (for similar reasons, Bitcoin NFTs are expected to continue to grow).

Figure 5: Ethereum hosts the majority of tokenized Treasury securities

In contrast, relatively high-frequency and/or low-value transactions will occur more on Ethereums various Layer 2 networks. For example, social media applications, recent success stories on Ethereum Layer 2, include friend.tech (Base), Farcaster (OP Mainnet), and Fantasy Top (Blast). In Grayscales view, both games and retail payments may require very low transaction costs and are more likely to migrate to Layer 2 networks. However, it is important to note that given the low transaction costs, these applications need to attract a large number of users to significantly increase the fee income of the Ethereum mainnet.

Potential Impact of US Spot Ethereum ETF

In the long term, ETHs market capitalization should reflect its fee income, as well as other fundamentals. But in the short term, ETHs market price may be affected by changes in supply and demand. While progress has been made in the approval of spot Ethereum ETFs in the United States, ETF issuers still need to wait for the S-1 registration statement to become effective before they can begin trading. Full approval and launch of trading in these products could bring new demand as the assets will be available to a wider range of investors. Given the supply and demand dynamics, Grayscale Research expects that access to Ethereum and the Ethereum protocol will increase through ETF wrappers, which will help drive increased demand and, in turn, the price of the token.

Outside the United States, both Bitcoin and Ethereum exchange-traded products (ETPs) are listed, with assets in Ethereum ETPs accounting for about 25%-30% of Bitcoin ETP assets (Table 6). On this basis, Grayscale Researchs forecast is that net inflows into U.S.-listed spot Ethereum ETFs will reach 25%-30% of net inflows into spot Bitcoin ETFs to date; or about $3.5 billion to $4 billion in inflows in the first four months or so (accounting for 25%-30% of the $13.7 billion net inflows into spot Bitcoin ETFs since January). Ethereums market capitalization is about one-third of Bitcoins market capitalization (33%), so Grayscales assumption means that Ethereum net inflows may account for a slightly smaller share of market capitalization. But this is just an assumption, and there is uncertainty about higher and lower net inflows into U.S.-listed spot Ethereum ETFs. It is worth mentioning that in the U.S. market, ETH futures ETFs only account for about 5% of BTC futures ETF assets, although this does not represent the possible demand for spot ETH ETFs.

Figure 6: Outside the United States, Ethereum ETP assets under management account for 25%-30% of Bitcoin ETP assets under management

In terms of ETH supply, Grayscale Research believes that about 17% of ETH can be classified as idle or relatively illiquid. According to data from Allium, a data analysis platform, about 6% of the ETH supply has not moved for more than five years, and about 11% of the ETH supply is locked in various smart contracts (e.g., bridges, wrapped ETH, and various other applications). In addition, 27% of the ETH supply is pledged. Recently, issuers of spot Ethereum ETFs, including Grayscale, have removed references to pledges from public documents, indicating that the U.S. SEC may allow ETFs to trade without pledges. Therefore, this part of the supply is unlikely to be available for ETF purchases.

Outside of these categories, $2.8 billion worth of ETH is used for network transactions each year. At current ETH prices, this represents an additional 0.6% of supply. There are also protocols that hold large amounts of ETH in their treasuries, including the Ethereum Foundation ($1.2 billion worth of ETH), Mantle (~$879 million ETH), and Golem ($995 million ETH). Overall, ETH in protocol treasuries accounts for about 0.7% of supply. Finally, about 4 million ETH, or 3% of the total supply, is held in ETH ETPs.

Collectively, these categories account for approximately 50% of ETH supply, although there is some overlap (e.g., ETH in protocol libraries may be staked) (Figure 7). Grayscale believes that net purchases of ETH are more likely to come from the remaining circulating supply. Because existing usage limits the available supply for new spot ETF products, any increase in demand is likely to have a larger impact on prices.

Figure 7: A significant portion of ETH supply is unable to enter new spot ETFs

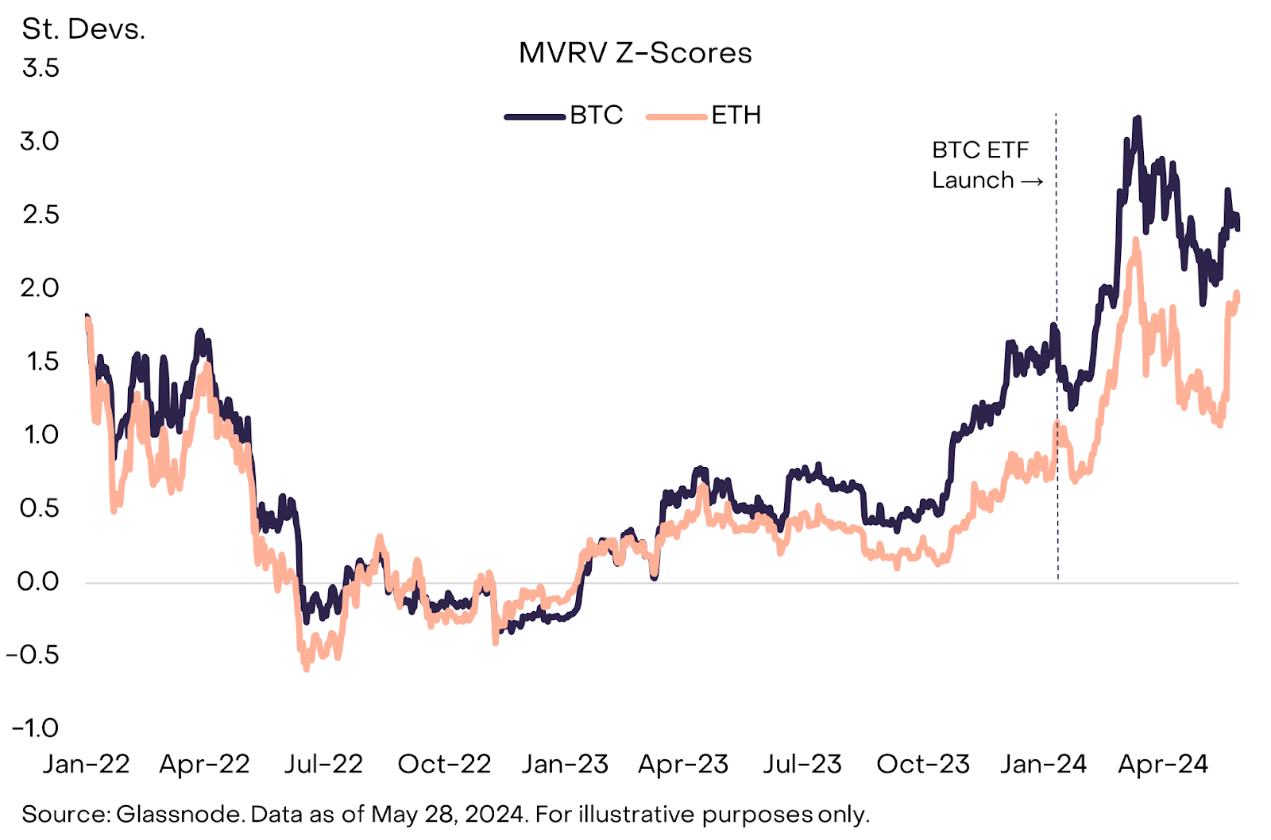

From a valuation perspective, Ethereum is arguably more highly valued than Bitcoin was when the spot Bitcoin ETF launched in January. For example, one popular valuation metric is the MVRV z-score. This metric is based on the ratio of a token’s total market capitalization to its “realized value”: the market capitalization based on the price at which the token last moved on-chain (as opposed to the price at which it trades on an exchange). When the spot Bitcoin ETF launched in January, its MVRV z-score was relatively low, indicating a modest valuation and potentially more room for price appreciation. Since then, the crypto market has appreciated, and the MVRV ratios of both Bitcoin and Ethereum have increased (Table 8). This may indicate that there is less room for price appreciation following the approval of the spot ETH ETF in the United States compared to January when the spot Bitcoin ETF was approved.

Figure 8: When the spot Bitcoin ETF was launched, ETHs valuation indicators were higher than BTC

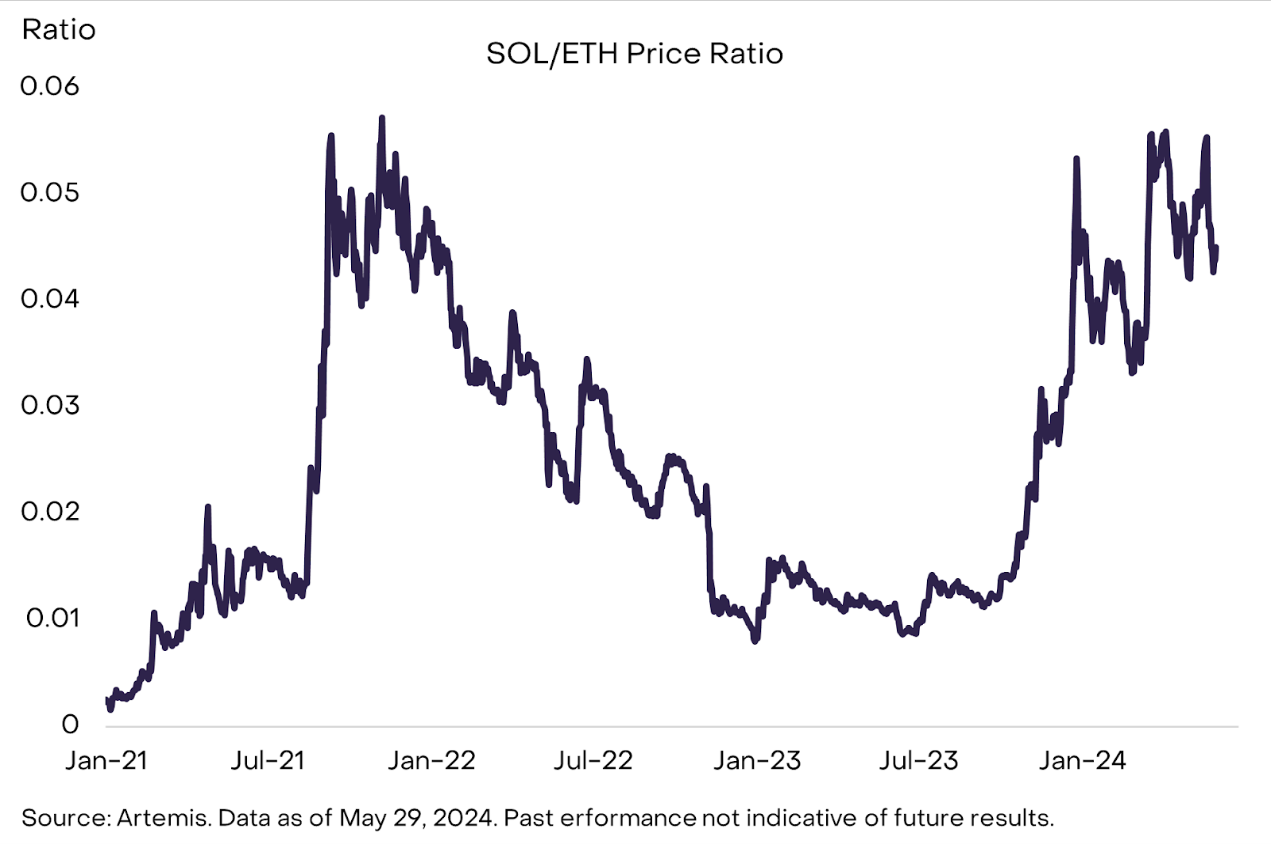

Finally, native crypto investors may be interested in the impact of a spot Ethereum ETF on smart contract platform tokens, specifically the SOL/ETH price ratio. Solana is the second largest asset in this segment (by market cap). Grayscale Research believes that Solana is currently most likely to take market share from Ethereum in the long run. Solana has significantly outperformed Ethereum over the past year, with the SOL/ETH price ratio now close to the peak of the last crypto bull run (Figure 9). This may be partly due to the fact that despite Solana being affected by the FTX incident (in terms of token ownership and development activity), the user and developer community of the Solana network continues to grow the ecosystem. More importantly, Solana has also driven increased trading activity and fee income through a silky user experience. In the short term, Grayscale expects the SOL/ETH price ratio to stabilize as inflows from the Ethereum ETF will support the price of ETH. However, in the long run, the SOL/ETH price ratio is likely to be determined by the fee income of both chains.

Figure 9: SOL/ETH price ratio close to previous cycle high

İleriye bakmak

While the launch of a spot ETH ETF in the U.S. market could have an immediate impact on ETH valuations, the impact of regulatory approval goes far beyond price. Ethereum provides an alternative framework for digital commerce based on decentralized networks. While the traditional online experience is quite good, public blockchains may offer more possibilities, including near-instant cross-border payments, true digital ownership, and interoperable applications. While other smart contract platforms can also provide such practical functions, the Ethereum ecosystem has the most users, the most decentralized applications, and the deepest pool of funds. Grayscale Research expects that the new spot ETF can popularize this transformative technology to a wider range of investors and other observers and help accelerate the adoption of public blockchains.

This article is sourced from the internet: Grayscale report: ETH price has limited room for further increase, Solana may seize market share

Related: Market Interpretation: Macroeconomic Liquidity Summer May Come

Original author: Raoul Pal Original translation: TechFlow Some people are talking about the banana zone (referring to the price starting to rise after passing the inflection point, like an upright banana with a curved bottom and a vertical top), so let me clarify it. The macroeconomic summer and autumn are driven by the global liquidity cycle. Since 2008, the global liquidity cycle has shown a clear cyclical nature. Why choose to start the analysis from 2008? This year, many countries around the world reset their interest payments to zero and adjusted their debt maturities to 3 to 4 years, creating a perfect macro cycle. In the Institute for Industrial Supply Management index (ISM) we can observe the perfect cyclicality of the business cycle, which is one of the best indicators…