Original title: Game intensifies, industry development enters a new pattern

Original author: DaPangDun, crypto researcher

Original source: Mirror

Please note: This article was written by an individual based on market data, personal cognition and logical reasoning. It may not be correct and is for reference only.

1. This bull market is different

Many people should feel that this round of bull market is significantly different from the previous round, mainly manifested in:

The wealth effect is insufficient. There is no general rise in the market like the last round. The choice of the target is very important. If you are not careful, you will lose money. Most currencies cannot outperform BTC.

The trend of value coins is often not as good as Memecoin. Many value coins listed on the stock exchange are always falling.

· The sector is seriously divided, and funds are only transferred within their own ecosystem, and the rotation is not smooth, giving the market the feeling that there is no synergy

The airdrop industry has become very competitive due to the scripted and clustered development, which has led to many impacts.

The narrative led by BTC is not as fast and rough as the previous narrative, and it is relatively cold and quiet. At the same time, DEFI does not seem to be favored in the BTC narrative.

Although Web3 games received a huge amount of financing in the last round, they did not produce any hits.

· ……

After observing these phenomena, I tried to find out the reasons. The last bull market was called water-release bull because the global (mainly the United States) flooded the market with money, and the spillover effect of funds was very obvious. In this round, we can clearly feel that funds are not so sufficient. Is this feeling correct? We can see clues from the following sets of data.

2. Changes in funding

2.1 US M2 Data

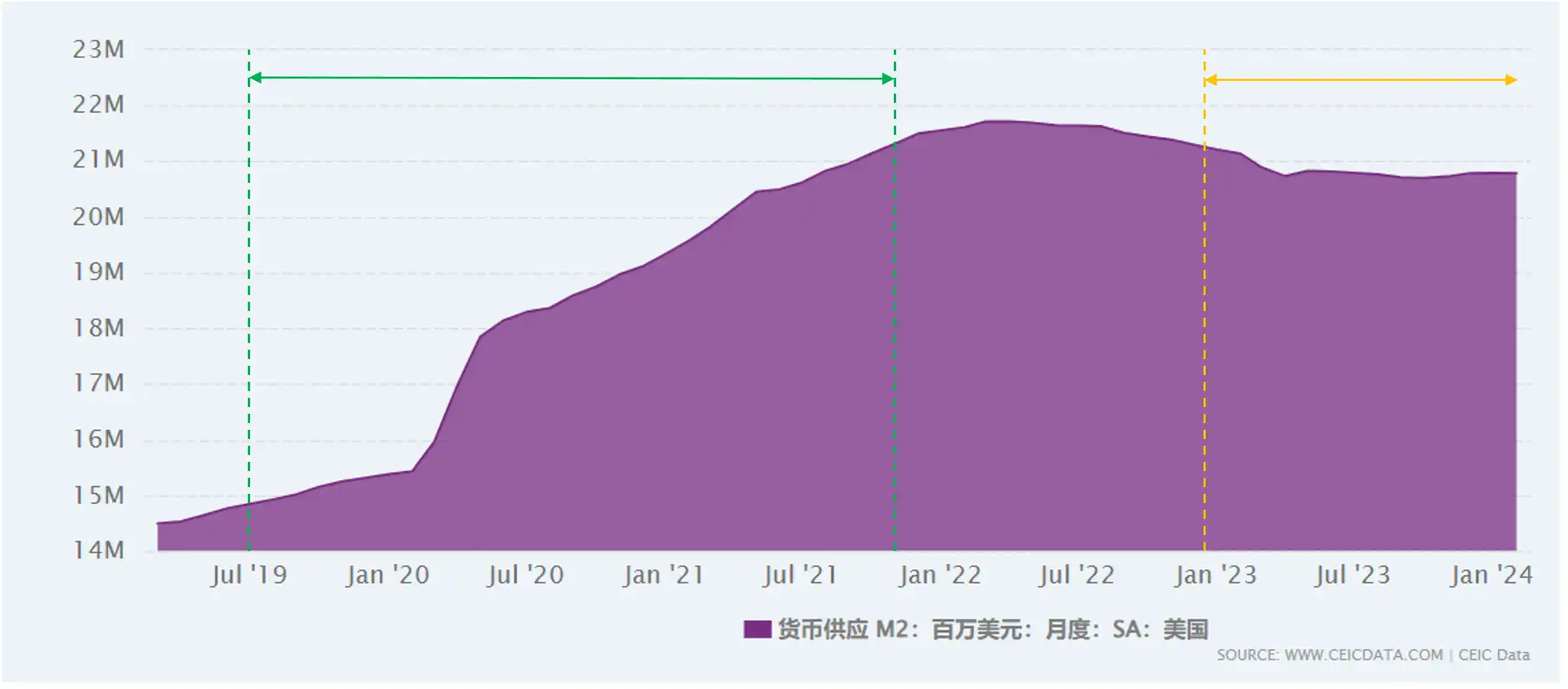

First, let’s look at the U.S. M2 data for the past five years. The green span represents the changes in M2 during the last bull market, and the yellow span represents the changes in M2 during this round.

Kaynak: https://www.ceicdata.com/

Source: https://www.tradingview.com/

Combining the price changes of BTC in the corresponding span, we can see that:

1) During the last bull market, M2 showed a continuous growth trend, and the corresponding BTC price showed a continuous rise (some periodic pullbacks were market corrections and short-term fluctuations). Before the M2 supply approached the top, the market entered a downward channel due to potential exhaustion and gradually entered a bear market;

2) During this round of bull market, M2 has hardly changed, and even showed a downward trend in the early stage. Therefore, this round is indeed not a water-release bull market for the time being, and the funds have not yet shown an increase, so the markets view that funds are insufficient is correct. At present, the BTC price has reached a new high, which in my opinion is more like a process of value return without the market Fomo part.

2.2 Stablecoin Data

Changes in stablecoins usually reflect the inflow and outflow of external funds. At the same time, due to the special attribute of stablecoins, which are active money, when stablecoins continue to grow, it means that they have attracted funds from outside the circle, which will produce a more obvious price effect.

Through Deflama, I retrieved the data from 2021 to date, and we can clearly see that:

The current amount of stablecoins in the circle is only about 10 billion US dollars more than the previous BTC peak, and is still about 28.7 billion US dollars away from the previous high of 187 billion US dollars.

Source: https://defillama.com/stablecoins

Of course, we need to be more rigorous. The SEC approved the BTC ETF on January 11, 2024, which is believed to bring huge incremental funds to Crypto. Therefore, we need to consider this part of the incremental funds that are not reflected in stablecoins because they are real purchasing power.

I counted the holdings of Grayscale Fund GBTC and the total holdings of all current large-scale BTC ETFs, as follows:

Kaynak: https://www.coinglass.com/

Source: https://www.hellobtc.com/etf/

In terms of overall holdings, the increase is approximately 850991-655800 = 195191 BTC. If the holding price is calculated at US$50,000-60,000, the incremental funds are approximately between 9.8 billion and 11.7 billion.

If we also express the incremental purchasing power of ETFs in the form of stablecoins, we can see that the current number of stablecoins in Crypto has not yet reached the peak of the last bull market, but the difference is not that big. Considering that the ETF has only been passed for 4 months, from a long-term perspective, we can indeed maintain a certain degree of optimism.

2.3 Cryto Market Value Data

Crypto market capitalization generally reflects the capital heat of the entire industry, that is, the attention and interest of market funds in the industry.

As can be seen from the figure below: the high point of the previous round was 3.009 T, and the current market value is 2.439 T, accounting for 81%. Although this round of bull market is obviously not over, from a data perspective, the market is still very cautious.

Source: https://www.tradingview.com/

We need to be deeply aware that: although we can have optimistic expectations for future interest rate cuts and money releases and incremental ETF funds, the current on-site funds are indeed insufficient!

In a market with less abundant funds, limited money has to be used to do more things and to allocate to different roles, which will inevitably lead to intensified competition in the market, which is also the internal reason for the various changes we can see. In this scenario, the development status and logic of various parts of the industry have changed, and the industry development will enter a new pattern.

3. Industry Observation

3.1 There is almost no general rise in prices

Although the funds have not reached the high point of the previous round, they are still close. Why do many currencies perform very poorly and there is no obvious general rise in the market?

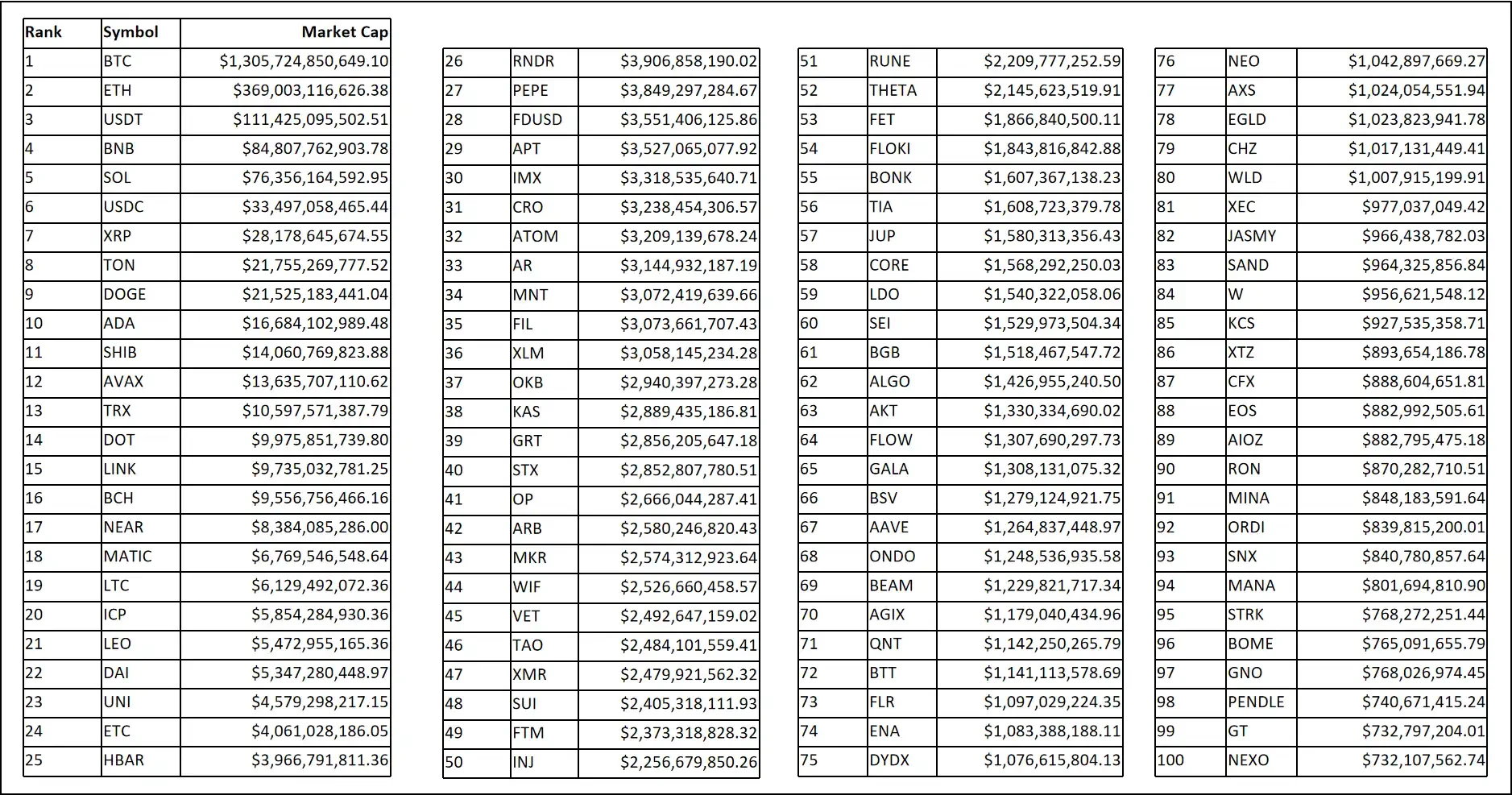

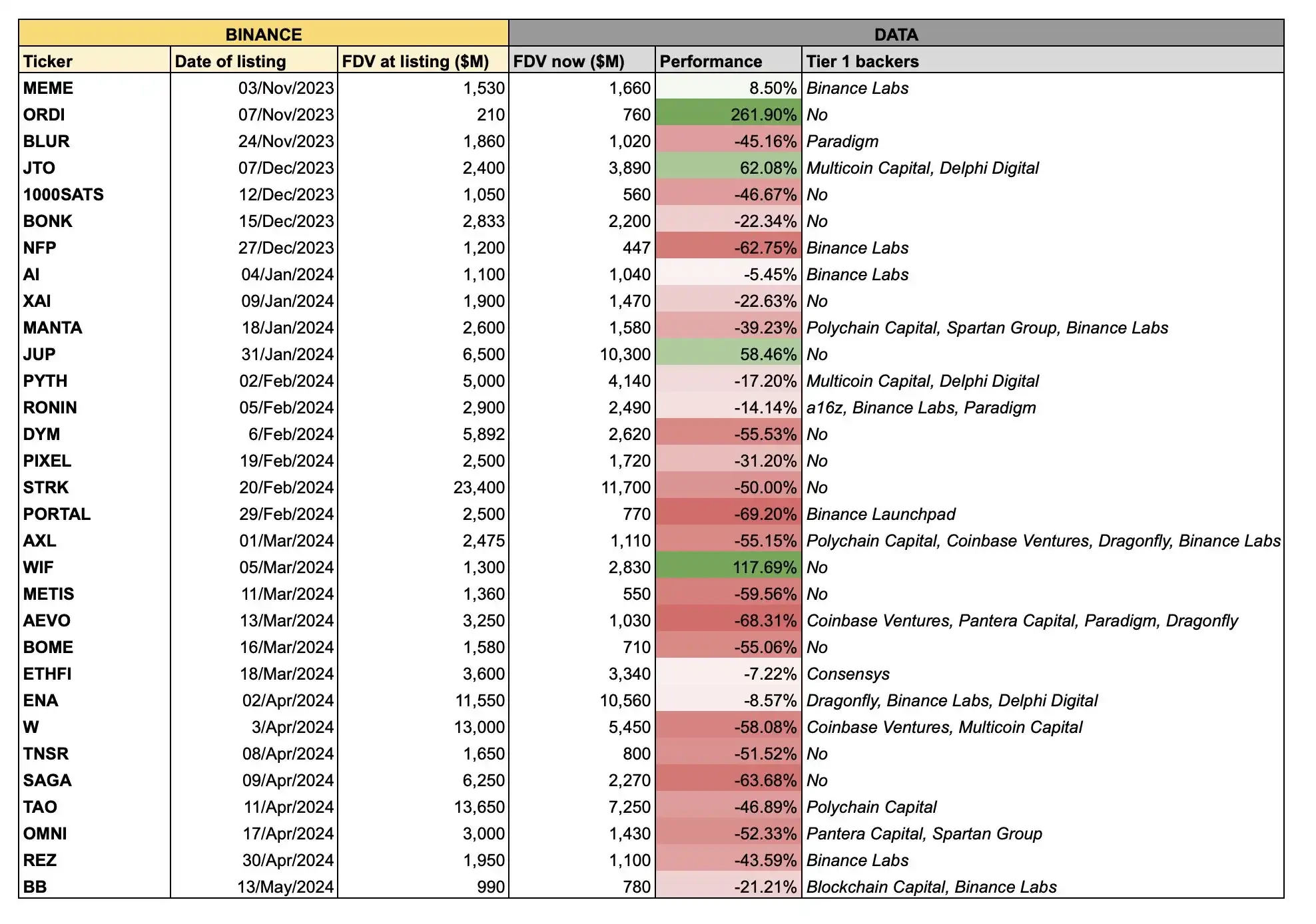

I tried to analyze the market value of each currency at the peak of the previous round (mainly the top 100) and the market value share of this round of currencies, and the data obtained are as follows:

Data source: https://coinmarketcap.com/historical (snapshot data on November 14, 2021)

Data source: https://coinmarketcap.com/historical (snapshot data on May 19, 2024)

According to the corresponding Crypto total market value data at that time, we can make a comparison chart of the percentage data:

Produced by @dapangduncrypto

From the above picture we can see that in this round, the tendency of funds to focus on the head is more obvious.

If we think about it more carefully, we will find that:

① In this round, a number of high-market-cap and low-circulation currencies were added. These currencies diverted funds on the one hand, and increased the bubble of market value on the other hand;

② Many of the previous “old coins” still maintain a high market value under the operation of market makers;

In such a situation, where is the money to create a general rise? ! And because there is no general rise effect, people tend to be conservative in the game and choose more stable top currencies, further exacerbating the lack of funds for other currencies.

New pattern judgment

We need to wait for the sustained growth brought by ETFs to build more consensus within the circle, and we also need to wait for a new era of monetary easing to boost liquidity within the circle.

3.2 No mutual takeover

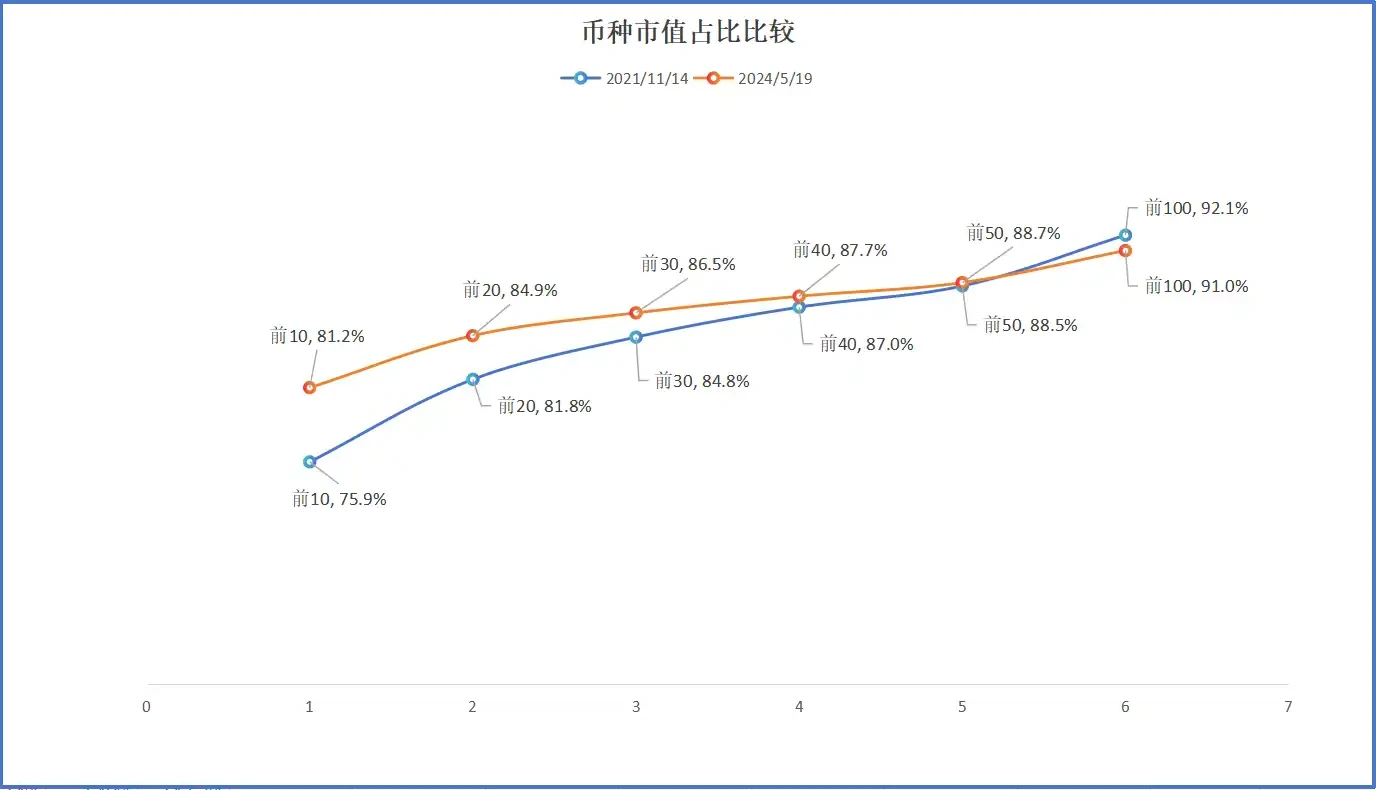

The saying no mutual takeover has been very popular recently. Most of the VC coins have reached their peak when they were listed on the exchange. Binance recently published an article titled Low Float High FDV: How Did We Get Here?, which highlighted:

① Aggressive valuations overdraw potential, leaving little room for retail investors to make profits

②Continuous unlocking makes it almost impossible for the token to rise

This means that retail investors have basically no motivation to take over.

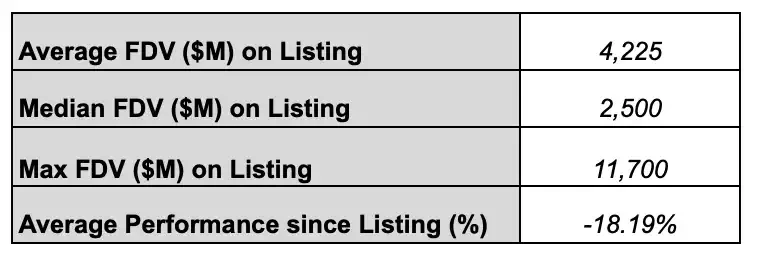

The following figure shows the FDV situation and currency performance of Binance’s recent listed coins:

Source: https://x.com/tradetheflow

From the above table we can get the following data

Source: https://x.com/tradetheflow

The average FDV of the listed currencies is 4.2 billion US dollars, which is far higher than the FDV of Binances listed currencies in the last bull market.

It seems that we have found the reason for not taking over each other, but if we change our perspective and start from the perspective of game, we may be able to see another level of reason for Low Float High FDV.

Among Low Float High FDV, High FDV is the key, and Low Float is just a way to control the market, alleviating short-term selling pressure through long-term continuous unlocking.

For a project token, the parties involved mainly include: project party, VC, exchange, market maker, and secondary market users (I did not include the airdropper part here to simplify the structure).

Think about this question: Who does High FDV benefit?

1) For the project owner, it is obvious that they hope that the FDV is high, which represents the future value and benefits;

2) VCs obviously also want a high FDV, which can generate a sufficient return on investment and an excellent portfolio. Some VCs will sell their investment portion at a discount in an off-market manner to achieve sales. After all, most people are still very interested in discounts, and a high FDV can still make a good profit after the discount.

3) Exchanges are a complex part. From the perspective of transactions, the FDV is not particularly important. However, many exchanges are also investment institutions of projects, especially large exchanges, which can get chips with low valuations at the very early stage of the project. Therefore, they may also hope that the FDV of the project is high, unless this phenomenon has seriously affected its transactions (a large part of the profit source of the exchange is transaction fees);

4) Market makers. Generally speaking, market makers make markets according to a given plan and may not care about the high or low FDV. Their model is to earn profits through quantitative programs, etc.

5) For secondary market users, high FDV is obviously a bad thing. It overdraws future expectations and requires users to bear the risks of continuous unlocking after purchase.

This creates a world where only retail investors are likely to be hurt, so why take over?!

New pattern judgment

Regarding project tokens, it is obviously not a good idea to simply push up the project’s FDV. The project owner needs to have a more reasonable FDV positioning and token release/allocation plan to demonstrate greater vitality.

Exchanges need to save themselves and allocate limited customer resources to higher-quality project tokens to maintain more active trading data and better market performance.

VCs need to have a more reasonable valuation for projects, especially when investigating project tests or participating in data, they need to fully consider the Witch content in the data to achieve a more accurate valuation. (In the future, the witch data analysis service for TO VC projects may be a startup point)

3.3 Memecoin > Value Coin

The lack of mutual support has brought about a series of impacts. Users will change their previous logic of participating in Crypto when investing. For example, instead of choosing value coins (usually what we call high FDV coins), it is better to choose Memecoin. Compared with value coins, Memecoin has three obvious advantages:

①Memes are usually not highly valued and have great potential

②Meme is generally fully circulated, so there is no need to worry about unlocking pressure, so when the market maker pulls it up, there will generally be people following.

③The token distribution of most memes is fair, and ordinary users also have the opportunity to participate in the early stage

However, we also need to realize that:

① Short-term meme fever is not a new thing. There was also a meme fever in the last round, and world-renowned memes such as doge and shib were born. However, most meme coins provide emotional value, which has problems such as fast transfer, large fluctuations, and lack of durability. Most (or 99.9%) memes are short-lived;

② Among the current top 50 currencies, Meme coins occupy 4 seats (DOGE/SHIB/PEPE/WIF), and the vast majority are still firmly controlled by value coins;

New pattern judgment

The popularity of memes is limited. The truly valuable coins will still [return in value] after solving some of their own problems.

3.4 Airdrop Strange Phenomenon

The airdrop industry was not very popular in the last round. After several large airdrops, especially Arb, airdrops began to enter the multi-account era, and the airdrop track became one of the most popular tracks. About 50% of KOLs on Twitter are in this track. After that, the industry changed very rapidly, and specialization, clustering, and automation gradually evolved and matured. There are derivatives such as specialized studios, automatic interaction systems, and interactive services. Due to the special nature of airdrops, it has become the most competitive track.

① Airdrop becomes a necessary skill for users

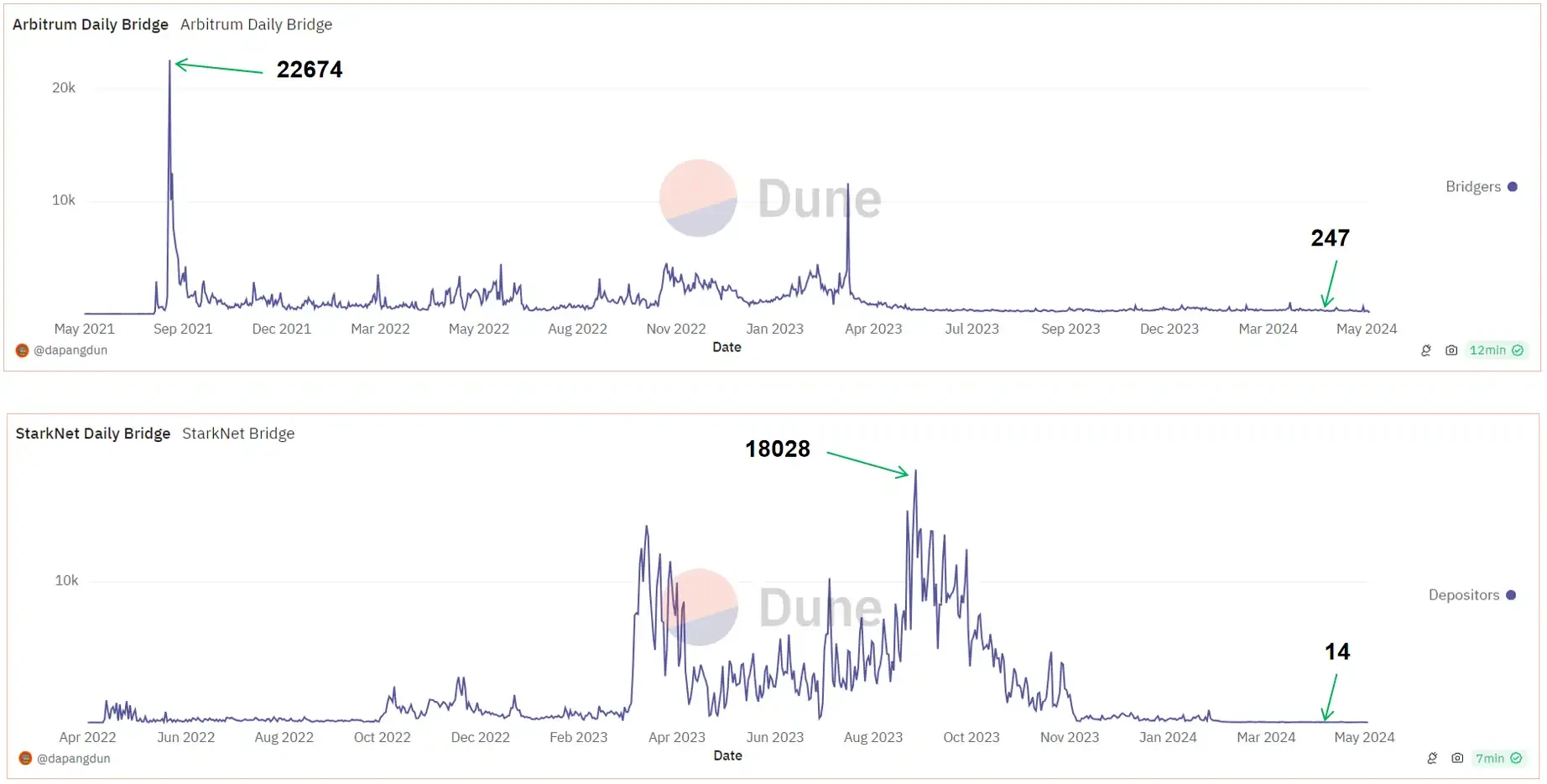

Lets look at a few pictures, respectively: Arb daily new address cross-chain number / Starknet daily new address cross-chain number / L0 daily transaction number / Zksync daily new address cross-chain number

It can be clearly seen that after the project party released a snapshot or suspected of releasing snapshot information, the data dropped significantly, proving that most of the participating addresses participated in the project for the purpose of airdrops. Based on the estimated value of actual active users in Crypto, it is an obvious fact that one person has multiple accounts.

Veri kaynağı: https://dune.com/

Data source: https://dune.com/

②Specialization, automation, and strategy become the mainstream

When there is excess profit in an industry, it will definitely roll. For airdrops, there is always a limit to how many accounts a single person can have, so automation became the first development direction. Automatic clicks, automatic simulation operations, automatic contract interactions, etc. quickly became the focus of development, and a large number of studios were born. Then participants found that blind interactions not only lacked dimensions, but also had low cost-effectiveness, so professional interaction plans and professional dimensional analysis were born. In the meantime, witch became the Sword of Damocles hanging over the heads of every airdrop user, so more in-depth strategic theories such as simulating real users and effective interactions were gradually proposed.

③Game between spear and shield

There are two parties involved in the airdrop track: project owners and users. Users are further divided into “ordinary users” and “clustered users”.

For project owners, they need Farmers to provide good project data to facilitate project financing, but they also hope to incentivize airdrops to real users as much as possible. On the one hand, it is to reward real participants, and on the other hand, it can also reduce the early selling pressure after the airdrop is issued (because clustered users basically sell as soon as they get it and have no faith in the project).

For users, since they have no chance to participate in the primary market, one possible way to get chips is to strive for the projects airdrop. They need to earn income through Farming. Although clustering has a high threshold (some proxy services have greatly lowered this threshold), once successful, they may be able to obtain several times, dozens of times, or even hundreds of times the manual income, so they are motivated to develop clustering.

The emergence of clustered users is disadvantageous to ordinary users, because it leads to the creation of a large number of accounts (you can observe that there are millions of participating addresses in many projects now), and the income of ordinary users is greatly reduced, so they are motivated to see the project party investigate and ban clustered users.

Therefore, the mutual benefit between project parties and users in the low-scale and immature stage has evolved into the love-hate relationship today.

In this process, as the project partys dominant position becomes stronger and stronger, it has an increasingly advantageous position in the game, and many strange phenomena have been born.

① Early projects tend to use standard screening to remove some low-quality interaction addresses and then treat everyone equally to maximize the satisfaction of participants;

②Hop started analyzing “bulk addresses” on Github with great fanfare, ushering in the “Witch Hunting Era”;

③Some project parties adjust the distribution method of airdrops appropriately by increasing airdrops for other dimensions (such as developers and contributors);

④ Project owners are gradually becoming stronger: some projects continue to PUA users but only give extremely low allocations in the end, some projects even take user data for free and break their promises, some projects start community reporting (mobilizing the masses) tactics to solve the witch problem, and some project owners are even unwilling to disclose the screening criteria… Such strange phenomena will continue.

⑤ During this period, the means of data analysis have gradually been upgraded, from manual investigation and standard screening to cluster AI analysis across multiple chains.

The game is still going on, and the airdrop track has entered the deep water zone

New pattern judgment:

Clustering has indeed had a huge impact on this track, and has also made the airdrop industry extremely involuted. It will become increasingly difficult to obtain airdrops. This track will definitely still exist, but the excess returns will gradually decrease until they are close to the industry average.

For project owners, they need to work closely with a truly professional Sybil analysis team (a professional data analysis team is not necessarily a professional Sybil analysis team) to discover clustering traces from multiple dimensions.

For clustered users, it is necessary to deeply study participation strategies while fully considering risks, build small clusters, diversify, and meet the screening criteria;

For ordinary users, it is necessary to do a good job in project research and use limited time/funds to participate in more cost-effective projects. It is necessary to extend the strategy from the companion idea that is deeply bound to the project (community of interests), and to fully explore the blue ocean sub-tracks in the airdrop track.

3.5 The silence of BTC ecosystem narrative

The most important theme of this round is the narrative of the BTC ecosystem, which includes not only ETFs but also the resulting ecological needs. However, it is different from the narrative brought by DEFI+NFT in the previous round: we have seen many BTC-L2s and many projects have made various DAPPs based on BTC, but the narrative of BTC in this round is still relatively cold and quiet, with a feeling of much thunder and little rain. After doing in-depth research, I made the following reasonable reason analysis:

① Different quality. BTC holders are significantly different from ETH holders. They have extremely high demands for security and fund control, which makes them always wary of various L2s and have low recognition. Many people even only recognize BTCs value storage attributes and do not agree that BTC should participate in financial activities. This requires a long education process. For example, Babylons BTC staking solution based on Time-Lock is doing such education.

2) High technical difficulty. Due to the complexity of BTC technology and the lack of scalability of the BTC mainnet, the technical difficulty of developing based on BTC, especially native development, is particularly high. Therefore, the development of many projects cannot be launched quickly or elegantly. There may be various problems in the whole process, and the experience is insufficient.

3) DEFI is path-dependent. Many people believe that as long as DEFI is based on BTC, the grand occasion of the previous round can be reproduced. This is an illusion caused by path dependence. Lets look at a few sets of data:

Source: https://tokenterminal.com/

This is the TVL distribution chart on ETH. We can see that the main part has shifted from MakerDAO+Uniswap+Opensea to Eigenlayer+Lido Finance.

The former is a representation of DEFI+NFT, which are all on-chain activities, generate a lot of transaction fees, and are very active funds, while the latter are all pledged funds and are inactive funds.

We can also verify the activity of funds from the cost, see the following figure:

Source: https://tokenterminal.com/

It is already obvious on ETH that users’ investment preferences have shifted from active to passive investment, so it is unrealistic in the short term to expect that the BTC ecosystem can flourish as long as there is DEFI.

New pattern judgment:

The BTC ecosystem narrative needs time to develop. DEFI is just basic infrastructure, but it may not necessarily lead this round of development.

Activating BTC holders to use BTC is of utmost importance, and the staking and re-staking track will be the key to achieving this step. The native staking solution enables the safe use of BTC, and the yield of Restaking attracts the continuous development of this process.

3.6 Exploration of the gaming industry

Games were a star track in the last round, and received huge amounts of financing. We once thought that they were one of the keys to achieving Web3 mass adoption. However, until now, we have not seen such an effect. Although there are factors such as it takes time to develop good games, in my opinion, the key is that the core problem of Web3 game economics has not been solved.

The most eye-catching game in the last round was the popular running shoes, but its life cycle of only about 2-3 months meant that this economic model was destined not to be a paradigm that could achieve sustained success.

Source: https://coinmarketcap.com/

Of course, we can see a lot of exploration in the game track, such as:

① Start to emphasize the combination of playability + economic efficiency. Excessive pursuit of economic efficiency will inevitably turn the game into a short-lived Ponzi. In addition, Crypto users pay special attention to economic efficiency due to their characteristics. Once the economic efficiency declines, they will move to another position. At the same time, the number of people in the circle is limited after all. Only by attracting more people outside the circle through playability can the game develop in the long run;

② No longer excessively pursuing data, there is a more prudent design for the token economic model. The release and consumption of tokens are controlled through various means within the game to maximize the game cycle.

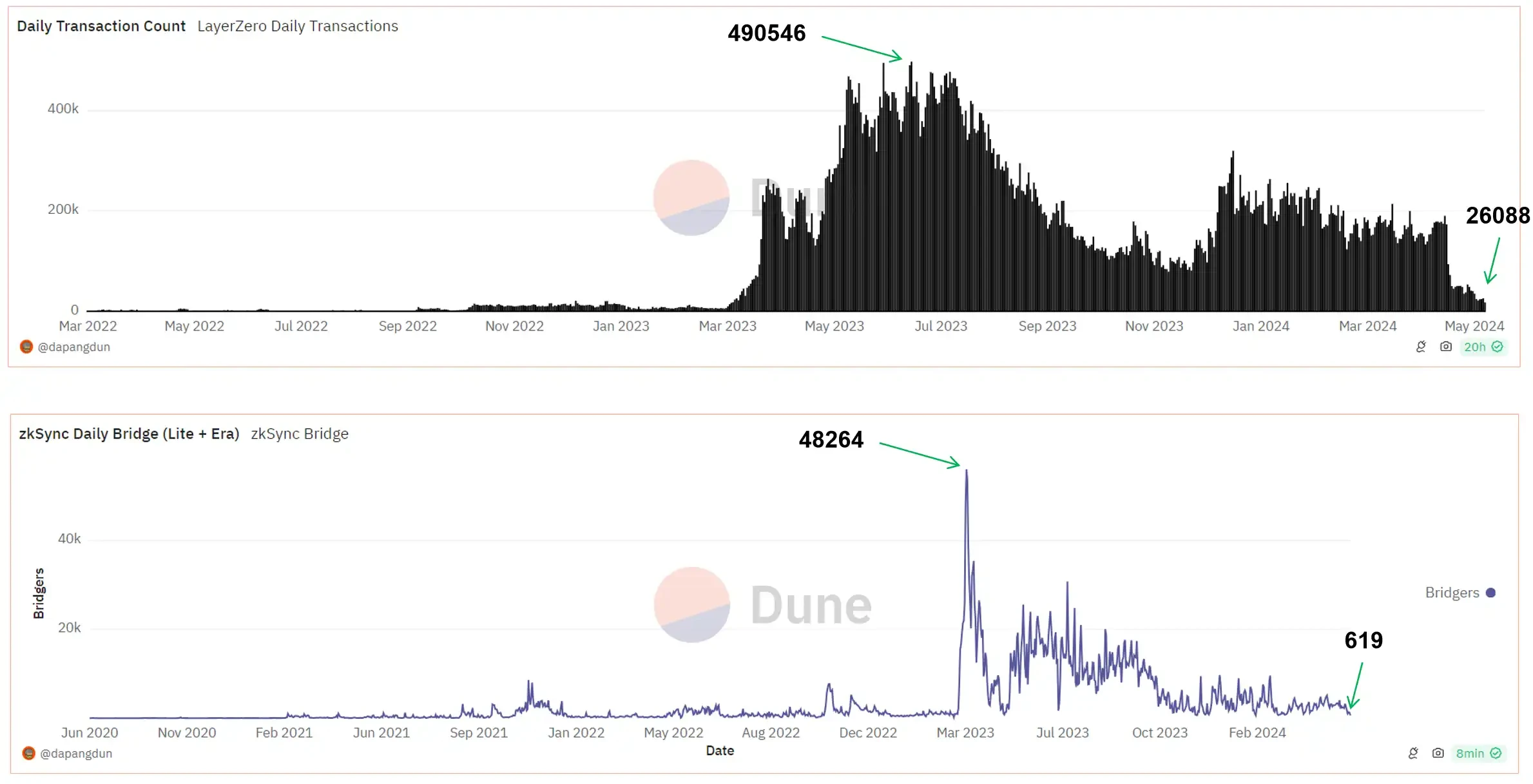

Take Big Time and Pixels as examples. The former has been around for 6 months, and the latter has been around for 3 months. There are still many people participating and making profits.

Kaynak: https://coinmarketcap.com/

Source: https://coinmarketcap.com/

New pattern judgment

The gaming industry is constantly exploring. With many games set to be released into the market in the second half of the year, the gaming sector may see an explosion given the current lack of hot spots in the market.

The simple buy the mother coin strategy is likely to fail in this round, because the game project will focus on maintaining long-term, so it is likely to be a good strategy to let game participants profit during the game, rather than pushing up the token price; but at the same time, the profit margin of the order number will also be greatly compressed, so the studio is likely to have more advantages.

4. Sonuç

In my limited understanding, the fundamentals (main tone) of this round of the industry have changed, and the endogenous logic of many tracks has also undergone tremendous changes. What we can and must do is to adjust our cognition to adapt to the [new pattern of industry development]. Here, we are not only ordinary users like you and me, but also participants with other identities in the industry.

As the industry gradually matures, the degree of game will further intensify. It is meaningless to stand still and complain. Only by considering things from the other side of the game can we find that balance point.

This article is sourced from the internet: Comprehensive interpretation: Why is this bull market so different?

Original | Odaily Planet Daily Author | Nanzhi Yesterday, the TON Foundation announced the latest list of Grant projects to support innovations in social Web3, games, DeFi and other fields. Notcoins listing on Binance and OKX further boosted the popularity of TON ecological projects. Odaily Planet Daily will interpret the business of the 14 Grant projects in this round in this article. GameFi Jump Trade Business: Jump Trade is currently positioned as an NFT trading market , supporting the issuance, trading and auctioning of assets . In terms of asset issuance, it is currently involved in the issuance of ten games, most of which are NFTs with a total of 10,000 units ranging from a few dollars to tens of dollars; in terms of trading, it currently only opens three…