Ethereum spot ETF'si onaylandı ancak büyük bir artış görmedi. Sektör içeriden kişiler ne düşünüyor?

24 Mayıs'ta Pekin saatiyle sabah 5:00'te, ABD Menkul Kıymetler ve Borsa Komisyonu, BlackRock, Fidelity ve Grayscale'den olanlar da dahil olmak üzere birden fazla Ethereum spot ETF'sinin 19 b-4 formunu onayladı. Ancak, form onaylanmış olsa da, ETF ihraççılarının işlem yapmaya başlamadan önce S-1 kayıt beyanını yürürlüğe koymaları gerekiyor.

Daha önce yayınlanan bir Galaxy Digital raporunda Ethereum spot ETF'sinin Temmuz veya Ağustos'ta borsada listelenebileceği öngörülmüştü. Bloomberg'de bir ETF analisti olan James Seyffart, yakın zamanda Ethereum spot ETF'sinin Haziran ortasında listelenmesinin de mümkün olduğunu söyledi.

Ethereum spot ETF'si popüler olmamaktan ve sadece 7%'lik bir onay oranına sahip olmaktan bir gecede 75%'lik bir onay oranına geçti ve ETH'nin fiyatı defalarca $3.800 sınırını aştı. Belki de hiç kimse Ethereum ETF'sinin Bitcoin ETF'sinin onaylanmasından sadece dört ay sonra onaylanacağını beklemiyordu. Rüzgar yönündeki ani değişimin nedenleri hala tartışmalı olsa da, piyasa gözlemcileri ve kıdemli kripto para uygulayıcıları genellikle düzenleyicilerin onayının Ethereum ve diğer kripto paralar üzerinde farklı derecelerde etki yaratacağına inanıyor.

Ethereum spot ETF'si bugün onaylandıktan sonra, fiyat sadece sabah 5'te $3.900'ü kısa süreliğine aştı ve ardından $3.700-3.850'de kaldı. ETH beklenen büyük artışı neden başlatmadı? Bunun arkasındaki sebep nedir? Kripto KOL'larının analizlerini ve görüşlerini dinleyelim:

BITWU.ETH (Kripto KOL)

Ethereum spot ETF'si onaylandıktan sonra neden bir artış görmedi? Sanırım birçok kişi bu soruyu tam olarak anlamıyor. İşte iki belge arasındaki farka dair kısa bir giriş:

ABD Menkul Kıymetler ve Borsa Komisyonu (SEC), dün gece, ETF'lerin borsalarda işlem görmesine izin veren kural değişikliklerini SEC'e bildirmek için kullanılan bir form olan sekiz Ethereum spot ETF'si için 19 b-4 belgesini onayladı.

Örneğin, yeni ürünler sunmak, ticaret mekanizmalarını veya diğer ilgili borsa politikalarını değiştirmek. SEC, gönderildikten sonra teklifi inceleyecek ve onaylayıp onaylamamaya karar vermeden önce kamuoyunun yorumlarını isteyecektir.

Ancak 19 b-4 belgesinin onaylanması, ETF'nin onaylandığı anlamına gelmez. Resmen listelenmek için, ETF ihraççısının ayrıca SEC tarafından onaylanan S-1 belgesini alması gerekir.

S-1 başvurusu, bir şirketin ilk halka arz (IPO) veya bir ETF'nin listelenmesi de dahil olmak üzere diğer menkul kıymet teklifleri için SEC'ye sunduğu bir kayıt beyanıdır.

S-1 başvurusu son adım değil, ancak ABD SEC'in gözetimi altında çok kritik bir adım!

SEC'in S-1 belgesine ilişkin incelemesini tamamlayıp onaylamasının ardından S-1 belgesi yürürlüğe girecek ve fon yöneticileri, listeleme tarihini belirlemek ve pazarlama yapmak da dahil olmak üzere ETF'nin resmi listelenmesine hazırlanmaya devam edebilecekler.

Genel olarak, 19 b-4'ün onayı projenin uygulanabilir olduğu anlamına gelir; ancak S-1'in onayından sonra tamamlanmış bir anlaşma olarak kabul edilebilir. Şu anda, bu süreç birkaç haftadan birkaç aya kadar sürüyor, bu nedenle fiyat kısa bir süre içinde fırlamayacak.

DTCC web sitesinde birden fazla spot Ethereum ETF'sinin listelenmiş olması gerçeğiyle birleştiğinde, bunun #Bitcoin spot ETF'sinin senaryosu olabileceği çok açık!

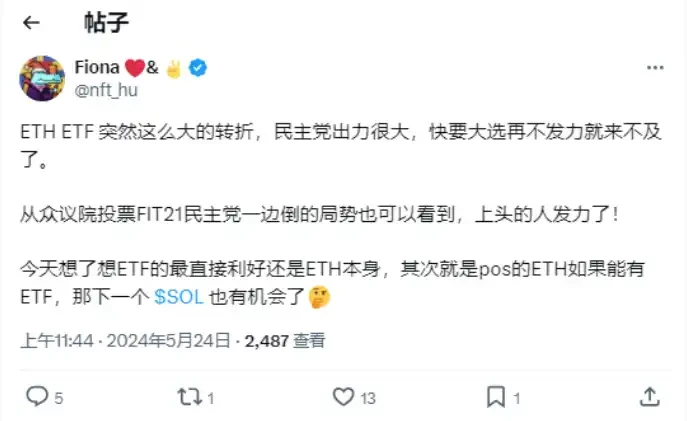

Fiona (Kripto KOL)

ETH ETF'si aniden çok büyük bir dönüş yaptı. Demokrat Parti büyük çabalar sarf etti. Seçim yaklaşırken çaba sarf etmezlerse çok geç olacak.

Demokrat Parti'nin Temsilciler Meclisi'ndeki FIT 21 oylamasındaki tek taraflı durumundan da anlaşılacağı üzere, tepedekiler güçlerini sonuna kadar kullanmışlar!

Bugün ETF'nin en doğrudan faydasının ETH'nin kendisi olduğunu ve ikincisinin POS ETH olduğunu düşündüm. Bir ETF varsa, bir sonraki $SOL'un da bir şansı olacak.

Lianyanshe (kripto KOL):

SEC, BlackRock, Fidelity ve Grayscale'den ETF'ler de dahil olmak üzere aynı anda sekiz spot Ethereum ETF'sini onayladı. Form onaylanmış olsa da.

Ancak, listeleme işlemi için hala ihraççının planladığı S-1 formunun onayı gerekiyor ve bunun tamamlanmasının birkaç haftadan üç aya kadar sürmesi bekleniyor.

Önceki tahminlerden farklı olarak SEC'in tek bir onay vermek yerine hepsini birden onaylaması, yani bu sefer ETH'nin Grayscale'in yaklaşık 10 milyar dolarlık Ethereum satış baskısını yine deneyimlemesi gerekecek.

Grayscales GBTC o sırada 21 milyar ABD doları satış baskısına sahipti ve ETHE'nin elindekiler 10 milyar ABD dolarından azdı. Bitcoin spot ETF'sinin listelemenin ilk günündeki girişi 300 milyon ABD dolarıydı. Ethereum spot ETF'sinin girişi ne kadar olacak? Grayscale geri ödemeyi başlattıktan sonra, ETH'nin kendi alımları bu kadar büyük bir satış baskısına dayanamayabilir.

Bu nedenle, $ETH pozisyonlarımın çoğunda kar elde etmeyi ve işlem resmi olarak başlatılmadan önce bunları BTC, BNB ve SOL'a geçirmeyi seçeceğim.

Kay Capital(Kripto KOL)

ETH ETF'si onaylanırsa ne olur?

ETH'nin antik dev boğası.

BTC ETF'si onaylanmadan önce, tüm piyasa ilk kez ETF onayıyla karşı karşıyaydı ve genel olarak üç senaryo vardı:

1. Tarihte her zaman olduğu gibi, zirve büyük bir olayın gerçekleştiği zamandır (kısa vadeli kısa)

2. ETF Inflow'un (uzun) getirdiği küçük ve yavaş boğa piyasası

3. ETF'ler bulanıklaşarak erken balinalar, özellikle GBTC (uzun vadeli kısa) için benzeri görülmemiş likidite ve teslimat fırsatları sağlıyor

Beklentiler oldukça tutarsızdı ve yaklaşık 20%'lik bir düşüş yaşandı, ardından 38.000'den neredeyse iki katına çıkan bir boğa koşusu yaşandı.

ETH ETF'si onaylanırsa, çoğu kişi önce düşen ve sonra yükselen BTC ETF'sini taklit etmesini bekleyecektir. Bu nedenle, bu beklentinin bir ön koşusu olması muhtemeldir, yani doğrudan yukarı çekilecektir.

1. ETH'nin bu seferki artışı o kadar da fazla değil. ETH ETF'sinin daha hızlı geçebileceği beklentisi ancak bu hafta ortaya çıktı ve artış 20%'den fazla değildi, BTC'nin iki katına çıkmasından çok daha düşüktü.

2. ETH'nin fiyatı uzun süredir baskı altında ve döviz kuru tarihsel olarak yoğun işlem bölgesinde.

3. Eğer geçerse, geleneksel ETH zincir üstü aktivitesi daha az aktif olacak mı? Bu ETH turunda efsanevi bir anlatı mı eksik?

4.ETHE'nin satış baskısı GBTC'ninkinden çok daha az

Mevcut makro durum:

1. Dört büyük ABD hisse senedi endeksi yükselişte

2. Nvidia'nın kazanç çağrısı beklentileri aştı ve hisse senedini böldü

3. VIX bir yıllık düşük seviyeye düştü. ABD doları ve ABD tahvillerinin kısa vadede güçlenmeye devam etmesi zor.

4. FIT 21'in kabulü ve seçim bağışları gerekli

Başka bir deyişle, piyasadaki en az dirençli yön yukarı doğru olan ETH'dir! Duruma göre oynamayı öğrenmeliyiz!

Bu, geleneksel aptal para için öncümüzdür, fırsatı değerlendirin.

Peki ya diğer coinler?

Önceki “Kripto Endüstrisi, Bir Sonraki Büyük Katalizör Nedir?” başlıklı yazımda şunları paylaşmıştım:

"Sadece ABD ETH ETF'si onaylanırsa kripto para dünyasına özel bir karnaval, destansı bir altcoin sezonu ve sayısız aptal para ve coşkulu zamanlar getirebilir.

Çok basit bir mantık. Shitcoin ETF'sinin onaylanması tıpkı aile içi şiddet/travestilik/prostat masajı gibidir. Sadece 0 kez ve sayısız kez vardır."

ETH ETF onaylandıktan sonra, insanlar SOL/AVAX/PEPE/DOGE ETF'nin onaylanması hakkında fanteziler kurmaya başlayacak. SOL, SEC tarafından bir menkul kıymet olarak belirlenmiş olsa bile, önemli değil. Duygu ve ivme olduğu sürece, sorun olmayacaktır.

Bilişsel işlemlere göre, bir öngörü yapıldığında, bilgi ve eylemin bütünleştirilmesi gerekir.

Pozisyonla ilgili

70% ETH, 30% PEPE, büyük bir ivmeyle uzun boğa piyasasını karşılamaya hazır.

Eski Japonya Başbakanı Shinzo Abe, 2016 ABD başkanlık seçimleri öncesinde Hillary Clinton ile görüştü, ancak Başkan Trump seçildikten sonra Abe'nin tutumu 180 derece değişti. Başkan Trump ile görüşmek üzere hemen Amerika Birleşik Devletleri'ne uçtu ve Değişim Kitabı'ndan alıntı yaptı: Büyük bir adam kaplan gibi değişir, bir beyefendi ise dış dünyanın ona karşı tutum değişikliğine yanıt vermek için leopar gibi değişir.

Büyük güçler, tıpkı bir kaplanın çizgilerinin mevsimlere göre değişmesi gibi, durumdaki değişiklikleri kavrarlar. Diğer ülkeler de leoparlar gibi olmalı, durumdaki değişiklikleri sezmeli ve ayarlamalar yapmalı, böylece tehlikeli ve sürekli değişen uluslararası politik ve ekonomik durumda hayatta kalabilmelidirler.

Dovey Wan (Kurucusu, Primitive Ventures):

kısa vadeli:

Azalan marjinal pompalanabilirlik + 11 B toplam ETHE artı 2.5% ücret artı (staking ödüllerini kaçırmanın gizli maliyeti) ile onaylanan ETF

uzun:

BlackRock ve benzeri kuruluşların kripto endeks ürünleri çıkarmasıyla birlikte piyasaya daha fazla ETF ve diğer yapıların girdiğini görmeye başlayacağız. Ortalama bir kişi için çok daha erişilebilir olan bir hibrit SP 500 95% BTC 5% endeks ETF'si veya bir 50% altın 50% BTCETF veya bir 50% FAANG 50 hibrit BTC/ETH/SOL coin'i hayal edin. İnsanlar bir düğmeye tıklayıp 401k'larından satın alabilecekler.

Uzun vadede bunun da tıpkı CME vadeli işlemlerinin 2017 boğa koşusunda başlatılması, ancak bu boğa koşusu sırasında hacim olarak sadece Binance vadeli işlemlerini geçmesi gibi, birden fazla döngü alacağını düşünüyorum.

Bu makale internetten alınmıştır: Ethereum spot ETF'si onaylandı ancak büyük bir artış görmedi. Sektör içeriden kişiler ne düşünüyor?

İlgili: En iyi KOL yatırım listesini ortadan kaldırın ve yeni Alfa bulun

Orijinal|Odaily Planet Daily Yazar: Wenser Nisan 2024'te, Web3 varlık veri platformu RootData, son altı ayda KOL'lerin proje finansmanına katılımına ilişkin istatistikleri yayınladı. Dingaling 21 proje finansmanıyla birinci sırada, GmoneyNFT ve DCF GOD ikinci ve üçüncü sırada yer aldı. Bugün, Odaily Planet Daily, KOL'lerin yatırım stratejilerini bu tablodan ayırmak ve yeni Alfa bulmak için sizinle birlikte çalışacak. https://x.com/RootDataLabs/status/1779848819364245812 Popüler parçalar: Oyunlar, BTC L2, Sosyal Yukarıdaki tablo bilgilerine ve Rootdata resmi web sitesi bilgilerine göre, birçok KOL'ün ana yatırım hedefleri oyunlar, sosyal ağlar ve BTC L2 ağı gibi popüler parçalarda yoğunlaşmıştır. Bunlar arasında, aşağıdaki projeler KOL'lerden daha fazla tanınma ve yatırım almıştır: EESee'ye yatırım yapan 7 KOL vardır. Merkezi olmayan bir toplama ticaret ve piyango platformudur…