VC perspektifi: Yüksek FDV'li, düşük dolaşımlı token'ların düşüşünün gerçek nedeni nedir?

Orijinal makale: Haseeb Qureshi, Yönetici Ortak, Dragonfly

Derleyen: Odaily Planet Daily Azuma

Editör notu: Bu makale, Dragonfly'ın yönetici ortağı Haseeb Qureshi'nin, şu anda toplulukta hararetle tartışılan yüksek FDV, düşük float token'larının genel düşüşü fenomeni üzerine kişisel bir analizidir. Haseeb, makalede, topluluk tarafından genel olarak spekülasyon yapılan düşüşün üç nedenini çürütmüştür; VC ve KOL'un piyasayı boşaltması, perakende yatırımcıların satın almaması, sadece memleri sevmesi ve düşük dolaşım oranının kusurlu değer keşfine yol açması gibi. Veri analizine dayanarak ve IC0'a dönüş, tek seferlik tam kilit açma, airdrop oranını artırma ve adil lansmanı benimseme gibi birden fazla pazarda yaygın olarak tartışılan çözümleri analiz etmiştir.

Haseeb'in bu makalenin kendi kişisel görüşü olduğunu ve Dragonfly'ı temsil etmediğini belirtmesi önemlidir. Aslında, Haseeb'in görüşleri çok radikal olduğu için, Dragonfly'daki birçok kişi onun görüşlerine katılmıyor.

Aşağıda Odaily Planet Daily'nin çevirdiği Haseeb'in orijinal içeriği yer almaktadır.

Piyasa yapısı bozuldu mu? Girişim sermayedarları çok mu açgözlü? Bu, perakende yatırımcıları hedef alan bir piyasa manipülasyon oyunu mu?

Yukarıdaki sorularla ilgili olarak, son zamanlarda birçok teori gördüm, ancak ne yazık ki, neredeyse her teori yanlış görünüyor. Her şeyi göstermek için veri kullanacağım.

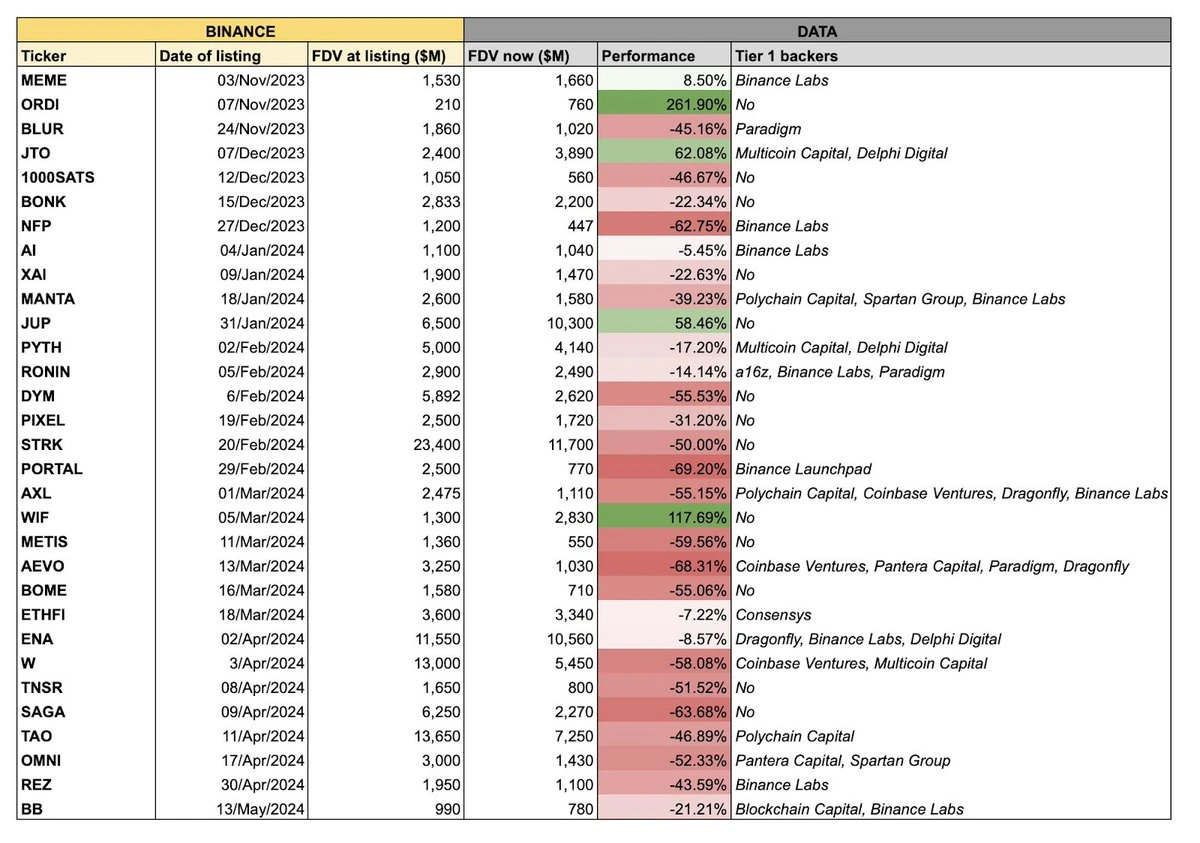

Yukarıdaki grafik son zamanlarda piyasada yaygın olarak dolaşıyor. Grafiğin teması, yakın zamanda Binance'de listelenen bir token grubunun genel olarak kötü performans göstermesi ve bu temsilci grubunun genellikle büyük arz, küçük dolaşım ortak özelliklerine sahip olmasıdır - bu, tam dolaşım değerlemelerinin yüksek olduğu, ancak açılışın başlangıcındaki dolaşım arzının nispeten düşük olduğu anlamına gelir.

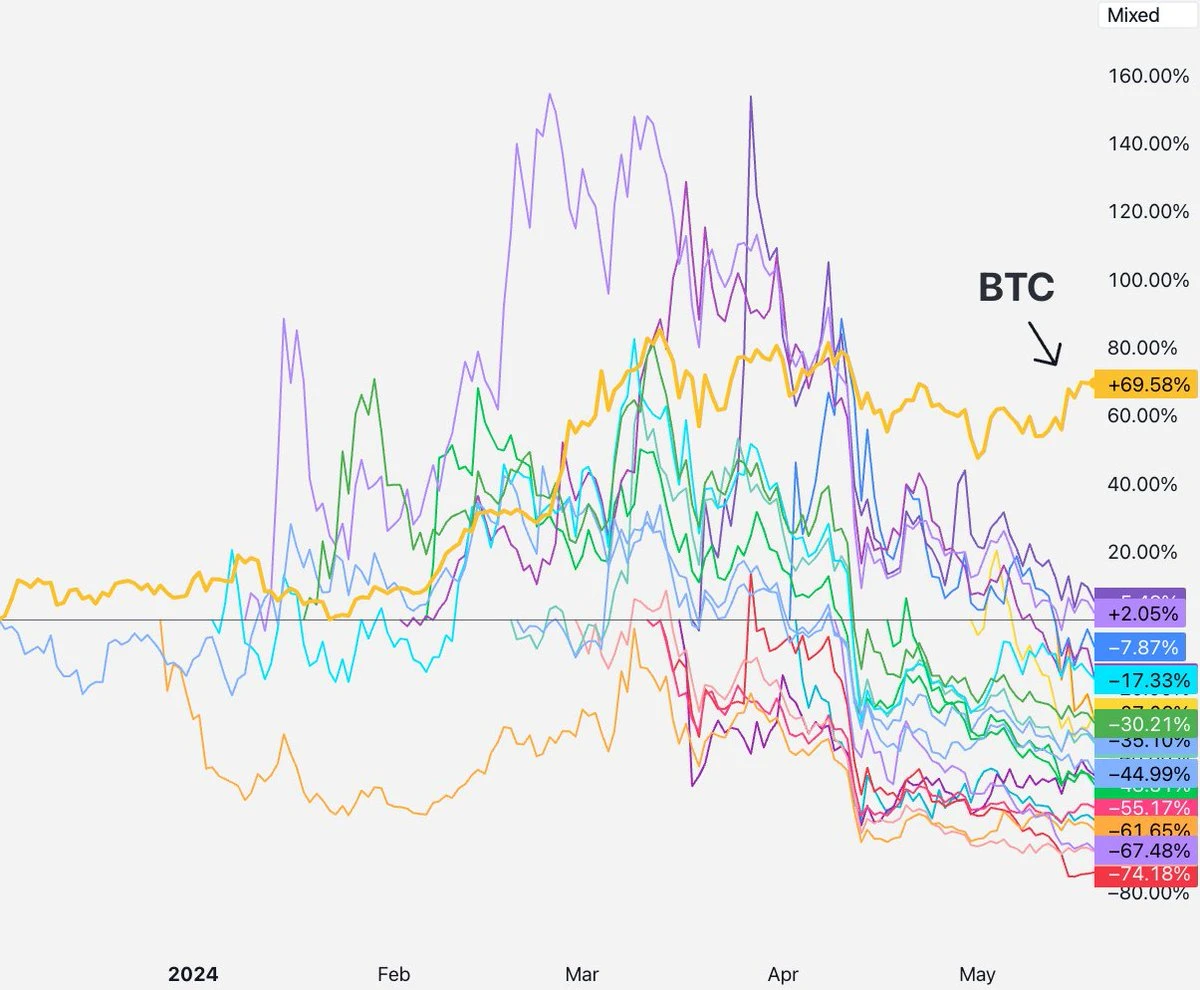

Tüm bu token'ların verilerini sıraladım ve meme token'ları ve Binance listelenmeden önce var olanlar (RON, AXL, vb.) gibi bazı "gürültü faktörlerini" hariç tuttum ve sonunda aşağıdaki dinamik grafiği elde ettim.

Şekilde görüldüğü gibi, bu büyük tedarik, küçük sirkülasyon token'ların neredeyse tamamı Binance'de listelendikten sonra düştü. Bu nasıl açıklanabilir? Bu soru için herkesin kendi tercih ettiği açıklaması var. Piyasadaki en popüler üç açıklama şunlardır:

-

Girişim sermayedarları ve KOL'lar hisse senetlerini satıyor;

-

Bireysel yatırımcıların bu tokenlara ilgisi yok ve bunun yerine meme tokenlara yatırım yapıyorlar;

-

Dolaşım hızı çok düşük ve fiyat tespiti başarısız;

Bu spekülasyonların hepsi makul görünüyor. Şimdi, bunların doğru olup olmadığına bakalım. Burada, tüm token'lar için daha derin bir piyasa yapısı sorunu olmadığı varsayımı var.

Tahmin 1: Girişim sermayedarları ve KOL'lar hisse senetlerini satıyor

Eğer durum böyleyse piyasanın görünümü nasıl olmalı? Daha kısa kilitlenme sürelerine sahip olan tokenların daha hızlı düştüğünü görebiliriz, ancak daha uzun kilitlenme süreleri ile veya KOL katılımı olmayan projelerin iyi performans göstermesi gerekir.

Peki gerçek piyasa durumu nasıl? Token'ların piyasaya sürülmesinden nisan ayının başına kadar geçen sürede tüm token'ların performansı temelde iyiydi. Daha önce hiçbir VC veya KOL'un piyasayı boşaltmadığı görülüyordu.

Sonra nisan ortasında, tüm projeler bir araya gelmeye başladı. Bu projelerin TGE zamanı farklıdır ve yatırımcıların geçmişi de farklıdır. Hepsi nisan ortasında kilit açma dalgasını başlattılar mı ve sonra satılmaya devam ettiler mi?

İtiraf etmem gerek ki Ben aynı zamanda bir VC yatırımcısıyım ve VC'ler bazen perakende yatırımcılara satış yaparlar – bazı VC'lerin kilitleme kısıtlamaları yoktur, bazıları korunma amaçlı bunu yapmak zorundadır ve bazıları da temerrüt halinde bile satar. Ancak genel olarak konuşursak, yalnızca ikinci kademe VC'ler bu kadar hamdır ve yatırım yaptıkları projelerin en iyi borsalarda yer alması genellikle zordur.

Gerçek şu ki Aklınıza gelebilecek her büyük VC'nin en az bir yıllık bir kilitlenme süresine ve token almadan önce çok yıllık bir serbest bırakma sürecine tabi olduğu. SEC'lere göre 144a Kural olarak, SEC tarafından düzenlenen her kurum için en az bir yıllık bir kilitleme süresi zorunludur.

Bu nedenle, VC veya KOL'un piyasayı boşalttığı yönündeki spekülasyonlara karşı koymak zor olacaktır. , çünkü yukarıda belirtilen token'lar TGE'ye bir yıldan az bir süre kala, bu da VC'lerin genellikle hala kilit kısıtlama döneminde olduğu ve hiç satamayacağı anlamına geliyor. Belki de küçük projelere yatırım yapan bazı ikincil VC'lerin projelerin TGE'sinin erken aşamasında satacakları coin'leri olacaktır, ancak mevcut durum, en iyi VC'ler tarafından yatırılan ve kilit kısıtlamaları olanlar da dahil olmak üzere tüm token'ların düşüşte olmasıdır.

Başka bir deyişle, bazı token'lar VC'ler veya KOL'lar tarafından satış baskısı altında olsa da, tüm token'lar aynı anda düşüyorsa, yukarıdaki spekülasyon bu olguyu açıklayamaz.

Bir sonrakine bakalım.

Tahmin 2: Perakende yatırımcılar artık bu fikre inanmıyor, sadece memleri seviyorlar

Eğer bu doğruysa, nasıl bir piyasa eğilimi beklemeliyiz? Yeni token'lar listelendikten hemen sonra düşecek ve perakende yatırımcıların fonları meme token sektörüne akacak.

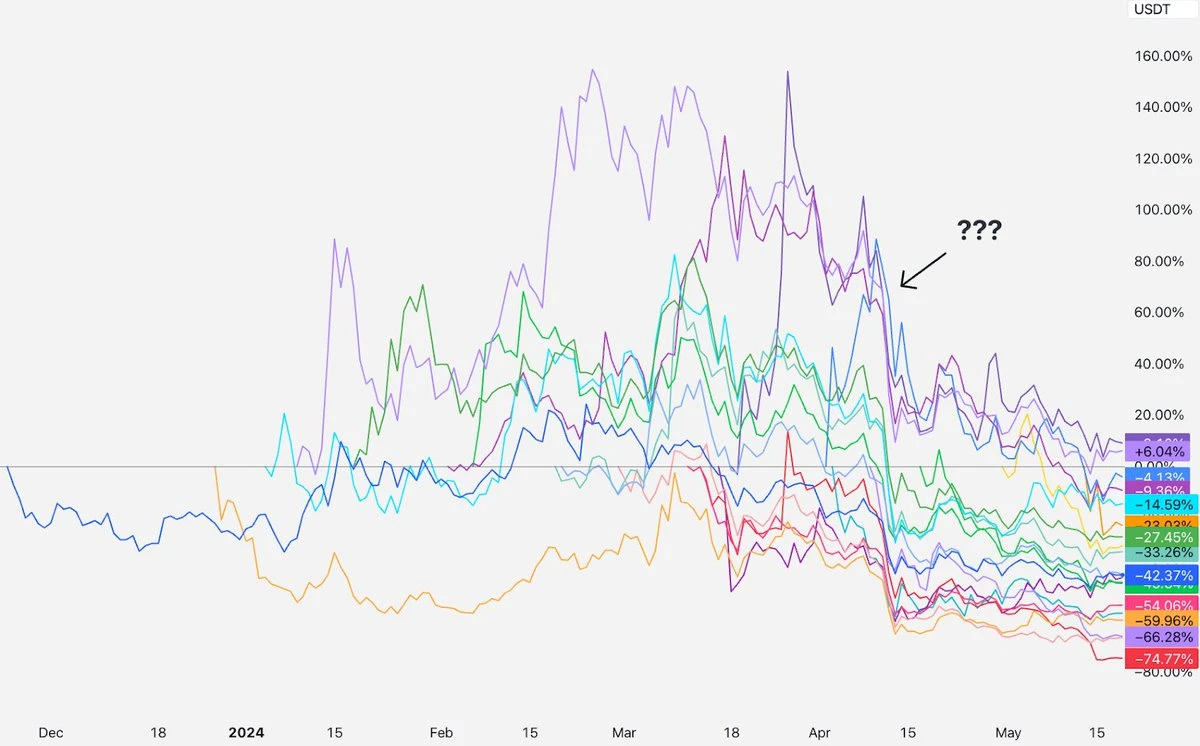

Peki gerçek durum nedir? SHIB ile bu token grubunun işlem hacmi değişimlerini karşılaştırdım ve zamanların uyuşmadığını gördüm; meme token çılgınlığı Mart ayının başlarında başlamıştı ancak bu token'ların hacmi, bir buçuk ay arayla Nisan ayına kadar keskin bir düşüş göstermedi.

Solana DEX'teki işlem hacmindeki değişikliklere bir göz atalım, sonuç aynı: Meme token'ların işlem hacmi, nisan ortasından çok daha önce, mart ayının başlarında artmaya başladı.

Dolayısıyla bu veriler ikinci hipoteze uymamaktadır. Yukarıdaki token'ların değeri düştükten sonra, fonlar meme token sektörüne geniş çapta akmadı. İnsanlar meme token'ları alıp satıyor, ancak aynı zamanda bu yeni token'ları da alıp satıyorlar ve işlem hacmi herhangi bir net trend sinyali göstermiyor.

Bazıları sorunun hacim değil, varlığın fiyatı olduğunu ileri sürebilir. Birçok kişi perakendenin şu fikri aktarmaya çalışıyor: yatırımcılar "gerçek projelerden" hayal kırıklığına uğradılar ve bunun yerine meme token'lara ilgi duyuyorlar.

Coingecko'da Binance'deki en iyi 50 token'a baktım ve Binance'deki hacmin yaklaşık 14.3%'sinin kripto para piyasasının hala küçük bir parçası olan meme token çiftlerinden geldiğini gördüm. Finansal nihilizm gerçekten var ve kripto para alanında daha belirgin, ancak çoğu insan hâlâ belirli bir teknik anlatıya inanma fikriyle token satın alıyor, bu inancın doğru veya yanlış olmasına bakmaksızın.

Yani gerçek durum, perakende yatırımcıların VC token'larından meme token'lara geçiş yapması olmayabilir.

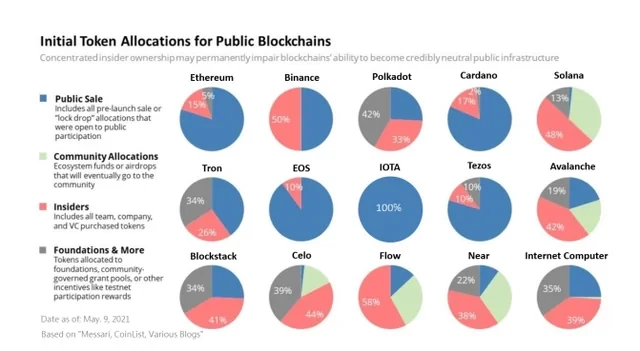

Perakende yatırımcıların öfkelenmesinin sebebinin, bu token'ların tamamının VC'ler tarafından yapılan dolandırıcılıklar olduğunu aniden fark etmeleri olduğunu söyleyen bir söz de var; çünkü VC ekibi ve VC genellikle token arzının 30%-50%'sini elinde tutuyor. Bu hikaye kulağa çok canlı geliyor, ancak ne yazık ki ben uzun süredir VC sektöründe çalışıyorum ve yaşanan hikayelere aşinayım. İşte 2017'den 2020'ye ana akım token'ların dağılımına genel bir bakış. Kırmızı kısım ise içeridekilerin (ekip + yatırımcılar) payını ifade ediyor, SOL 48%, AVAX 42%, BNB 50%, STX 41%, NEAR 38%…

Durum bugün de benzerdir. Bu nedenle, önceki tokenların VC token olmadığını söylemek istiyorsanız, bu açıkça doğru değildir. Sermaye yoğun projeler, hangi döngüde olursa olsun, ihraçlarının başlangıcından itibaren ekiplerden ve yatırımcılardan satış baskısıyla karşı karşıya kalacaklardır, ancak bu erken VC token'ları, tamamen kilitleri açıldıktan sonra bile birbiri ardına başarıya ulaşmışlardır.

Genel olarak konuşursak, işaret ettiğiniz şey son döngüde gerçekleştiyse, şu anda gerçekleşen benzersiz olguyu açıklamaz. Dolayısıyla perakende yatırımcıların artık bu memeye inanmadığı hikayesi kulağa hoş geliyor, ancak veriler tarafından desteklenmiyor.

Hadi, bir sonrakine geçelim.

Tahmin 3: Dolaşım oranı çok düşük ve fiyat keşfi başarısız oluyor

Bu gördüğüm en yaygın görüş. kulağa doğru geliyor çünkü objektif ve çok sansasyonel görünmüyor. Binance Research bu konuyu örneklendirmek için bir rapor bile yayınladı.

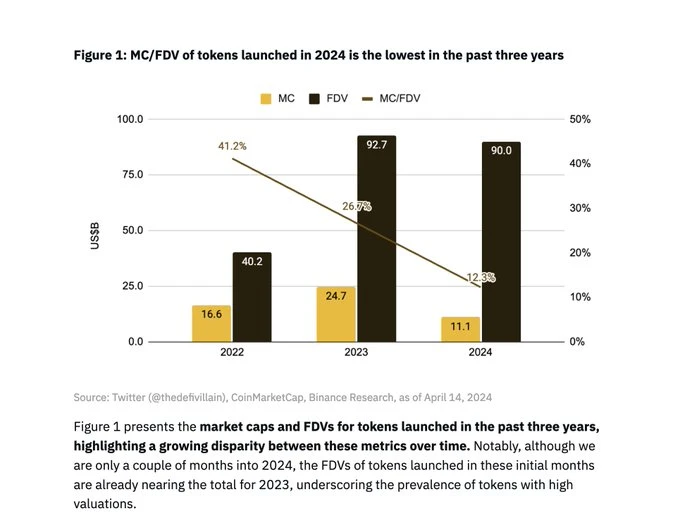

Binance Research tarafından sağlanan yukarıdaki grafikten görebiliriz ki Bu döngüde yeni çıkarılan tokenların ortalama ilk dolaşım oranı yaklaşık olarak 13% Peki bu rakam gerçekten bir önceki döngüye göre çok mu düşük?

Ambient'in kurucusu Doug Colkitt verileri sıraladı. Son döngüde, TGE sırasında ana akım token'ların ortalama ilk dolaşım oranı da 13% idi.

şunu belirtmekte yarar var Binance Research raporunda ayrıca yaygın olarak dolaşan bir grafik de yer alıyor ve bu grafikte 2022 yılında token'ların ortalama ilk dolaşım oranının 41% olduğu gösteriliyor.

Bu çok saçma! 2022 yılındaki piyasa koşullarının gayet farkındayım ve o dönemde 41% başlangıç tirajıyla projeler başlatılmadı.

Binance'in 2022'de listelenecek coin'leri listesine baktım: OSMO, MAGIC, APT, GMX, STG, OP, LDO, MOB, NEXO, GAL, BSW, APE, KDA, GMT, ASTR, ALPINE, WOO, ANC, ACA, API 3, LOKA, GLMR, ACH, IMX.

Basit bir nokta kontrolünden sonra, IMX, OP, APE, vb. gibi bazı tokenların bu döngünün tokenlarına benzer başlangıç dolaşım oranlarına sahip olduğunu göreceksiniz. IMX'in ilk gün dolaşım oranı 10%, APE'nin ilk gün dolaşım oranı 27% (ancak bunların 10%'si hazineye aitti, bu nedenle gerçek dolaşım oranı 17% idi) ve OP'nin ilk gün dolaşım oranı 5% idi.

Ayrıca LDO (55%) ve OSMO (46%) her ikisi de Binance'de listelendiklerinde daha yüksek dolaşım oranlarına sahipti, ancak bu token'lar bir yıldan uzun süredir dolaşımda olduğundan, listelenmenin ilk günü ile TGE'nin ilk gününü karşılaştıramazsınız. Bu, Binance Research'ün 41% rakamının temel nedeni olabilir; ancak bu, TGE'nin gerçek eğilimini değil, yalnızca Binance'in listeleme seçiminin eğilimini temsil ediyor.

Bazıları şunu iddia edebilir: 13%'lik bir ilk dalgalanma geçmiş döngülere benzese bile, etkili fiyat keşfine izin vermek için çok küçüktür. Bu argümana karşı en iyi karşıtlık, hisse senedi piyasasının mevcut durumudur; burada 2023 yılında halka arz edilen şirketlerin ortalama serbest dolaşım miktarı 12,8% oldu.

Son derece düşük ilk dolaşım oranı kesinlikle bir sorundur. WLD, dolaşım arzının yalnızca 2%'si ile çok ciddi bir durumdur. FIL ve ICP de lansmanlarının başlangıcında son derece düşük dolaşım oranlarına sahipti ve bu da çok çirkin performanslarına yol açtı. Ancak, Binance tarafından yakın zamanda piyasaya sürülen yeni token grubu için durum böyle değil. İlk dolaşım oranlarının hepsi normal aralıkta.

Ayrıca, "düşük tiraj, kırık fiyat keşfi" hipotezi doğruysa, daha düşük tirajlı coin'lerin daha kötü, daha yüksek tirajlı coin'lerin daha iyi performans gösterdiğini görmelisiniz, ancak güçlü bir korelasyon görmüyoruz. Aslında, hepsi düşüyor.

Dolayısıyla bu tahmin kulağa en makul gelen tahmin gibi gelse de, verileri analiz ettikten sonra buna katılamıyorum.

Çözüm nedir? Akranlarım ne diyor? Ben ne diyorum?

Herkes "çok arz, az dolaşım" madeni paraların azalmasından şikayetçi ama aynı zamanda pratik çözümler üretmeye çalışan birkaç kişi de var.

Birçok kişi İlk Para Arzlarının (ICO) yeniden başlatılmasını öneriyor. Katılmıyorum. ICO token'larının listelendikten sonra fiyatının keskin bir şekilde düştüğü ve perakende yatırımcıların ağır kayıplar yaşamasına neden olduğu tarihi dersi hatırlamıyor musunuz? Ciddi şekilde etkilendiler mi? Ayrıca, ICO'lar neredeyse her yerde yasadışıdır, bu yüzden bunun ciddi bir öneri olduğunu düşünmüyorum.

Multicoin Capital kurucusu Kyle Samani, yatırımcıların ve ekiplerin 100% hissesinin kilidini TGE tokeninde hemen açmaları gerektiğine inanıyor , ama yüzünden Kuralın varlığı 144a Bu durum ABD'li yatırımcılar için imkansızdır.

Girişim sermayesi şirketi Arca, token ihraçlarının geleneksel halka arzlarda olduğu gibi teminat altına alma rolleriyle donatılması gerektiğine inanıyor. Bunun mümkün olduğunu söyleyebilirim, ancak token ihracı daha çok doğrudan listelemeye benzer, bu da yalnızca bir borsada listelemeyi ve bazı hizmet sağlayıcılarından destek almayı içerir. Ben şahsen daha basit bir listeleme yapısını ve daha az aracı rolü tercih ediyorum.

Lattice'in kurucu ortağı Regan Bozman, projelerin token'ları daha düşük bir fiyattan çıkarması gerektiğini öne sürdü perakende yatırımcıların daha erken satın almalarına ve biraz kazanç elde etmelerine olanak sağlamak. Fikri anlıyorum, ancak işe yarayacağını düşünmüyorum. Fiyatı yapay olarak piyasanın beklenen fiyatının altına ayarlamak, herhangi birinin token'ın Binance'de listelenmesinin ilk dakikasında bu fiyat farkını yakalayabileceği anlamına gelir, ancak bu yalnızca emirlerini ilk 10 dakika içinde hızla dolduran birkaç yatırımcıya fayda sağlayacaktır. NFT ve IDO'ların basımında bunun birçok kez gerçekleştiğini gördük.

Bazıları adil lansman modeline geri dönülmesini öneriyor. Adil lansman kulağa ideal gelse de, pratikte sorunsuz olmaz çünkü ekipler pes edecektir. İnanın bana, birçok proje DeFi Summer'da çok şey denedi, ancak Yearn dışında, son yıllarda meme olmayan token'ların başka başarılı örneklerini gördünüz mü?

Birçok kişi ekibin airdrop oranını artırmasını önerdi. Bu girişimin makul olduğunu düşünüyorum. Genellikle ekipleri daha iyi merkeziyetsizlik ve fiyat keşfi elde etmek için ilk gün dolaşım oranını maksimize etmeye teşvik ediyoruz, ancak sadece dolaşım oranını artırmak için abartılı büyüklükte bir airdrop yapmanın akıllıca olmadığını düşünüyorum. TGE'den sonra projenin hala yapması gereken çok şey var. Sadece dolaşım oranını artırmak için, bir seferde çok fazla airdrop yayınlamak, proje partisini gelecekteki bağışlar ve fonlama planları konusunda daha fazla mali baskı altına sokacaktır.

Peki bir VC olarak ne görmek istiyoruz? İnanın ya da inanmayın, token'larımızın fiyatının lansmandan sonraki ilk yıl içinde gerçek değeri yansıtmasını istiyoruz. VC'ler "markup'lardan" değil, ROI'den para kazanırlar, bu da sonunda token'larımızı tasfiye etmemiz gerektiği anlamına gelir. Hiçbir kağıt kazancı elde etmeyiz ve kilidi açılmış token'larımızı piyasa fiyatlarında değerlendirmeyiz (bunu yapan herkes delirmiştir). Aslında bir VC için değerlemelerin yükselip sonra çökmesi kötü bir imajdır, bu da LP'lerin yatırım yaptığınız varlık sınıfında bir sorun olduğunu düşünmesine neden olur. Bunu istemiyoruz. Varlığın fiyatının kademeli ve istikrarlı bir şekilde artmasını tercih ediyoruz, ki bu çoğu insanın istediği şeydir.

Peki, büyük arz, küçük dolaşım olgusu devam edecek mi? Bilmiyorum. ETH, SOL, NEAR, AVAX vb. tokenların ilk listelendikleri yıllardaki fiyatlarıyla karşılaştırıldığında, bu tokenların mevcut fiyat rakamları açıkça şaşırtıcı, ancak aynı zamanda, kripto para piyasasının ölçeği artık çok daha büyük hale geldi ve başarılı projelerin piyasa potansiyeli geçmişe göre önemli ölçüde daha büyük.

Ambient'in kurucusu Doug Colkitt , harika bir noktaya değindi – Bu döngüdeki yeni token'ların FDV'sini, önceki döngüdeki ETH cinsinden eski token'ların FDV'siyle karşılaştırırsanız, sayıların birbirine çok yakın olduğunu göreceksiniz. Ünlü KOL Cobie de son yazısında buna değindi. Layer 1'in $40 milyon FDV olarak değerlendirildiği günlere asla geri dönmeyeceğiz, çünkü herkes şu anki pazar büyüklüğünün ne kadar büyük olduğunu gördü.

Özetle, kripto paralar son beş yılda önemli ölçüde arttı ve yeni projelerin değerleme fiyatlandırması genellikle mevcut projelerle karşılaştırmayı gerektiriyor, bu nedenle elde edeceğiniz rakamlar çok büyük olacak.

Bazı insanlar başkalarının fikirlerini kötülediğimi fark etmiş olabilir, peki gerçek çözüm ne olmalı?

Cevap şudur: Çözüm yoktur.

Serbest piyasa bu sorunları çözecektir. Bu tokenların fiyatı düşerse; diğer tokenların da fiyatı düşecektir; borsalar takımları daha düşük FDV'lerde listelemeye zorlayacaktır; zarar gören yatırımcılar daha düşük fiyatlardan satın alacaktır, VC'ler bunu proje kurucularına iletecektir – B Serisi fiyatlandırması daha düşük kamu piyasası beklentileri nedeniyle düşecektir, A Serisi yatırımcılar uyanık olmaya başlayacaktır ve sonunda tohum yatırımcılar etkilenecektir. Fiyat sinyalleri her zaman iletilecektir.

Gerçek bir piyasa başarısızlığı olduğunda, akıllıca bir müdahaleye ihtiyaç duyabilirsiniz; ancak, yalnızca bir fiyatlandırma hatası olduğunda, serbest piyasa bunu kendi kendine çözebilir; sadece fiyatı değiştirebilir. Hem kurumsal hem de perakende para kaybedenler bu dersi içselleştirmiş ve bu token'lar için daha düşük fiyatlar ödemeye razı olmuşlardır. Bu yüzden tüm bu token'lar daha düşük FDV'lerde işlem görmektedir ve bu da gelecekteki token'lar için fiyat değişikliklerini de beraberinde getirecektir.

Bu daha önce de birçok kez yaşandı, piyasaya biraz daha zaman vermek gerekiyor.

Açığa çıkarma anı

Şimdi bir açıklama yapmanın zamanı geldi. Nisan ayında neler oldu ve tüm para birimleri neden düştü?

Ben asıl suçlunun Ortadoğu'daki durum olduğunu düşünüyorum.

İlk birkaç ay boyunca, bu "büyük arz, küçük dolaşım" token'ları, listelemenin ilk günlerinde, durum aniden değişene kadar, yaklaşık olarak sabit işlem görüyordu. İran ve İsrail arasındaki gerginlikler yoğunlaştı ve savaş olasılığını artırdı. Piyasa çöktü ve Bitcoin kademeli olarak toparlanırken, bu token'lar toparlanmadı.

Bu token'lar neden hala düşüşte? Benim açıklamam, bu yeni token'ların psikolojik olarak yüksek riskli yeni coin'ler olarak sınıflandırılmasıdır. Nisan ayındaki olaylar, piyasaların yüksek riskli yeni coin'lere olan ilgisinin azalmasına neden oldu ve henüz toparlanmadı, bu yüzden piyasa bu yeni coin'leri şimdilik geri almamaya karar verdi.

Piyasalar zaman zaman dalgalı olabilir, ancak bu token'lar bu zaman diliminde 50% düşmek yerine 50% yükselmiş olsaydı, token piyasasının yapısının bozulacağından mı bahsediyor olurdunuz? Bu da yanlış fiyatlandırma olurdu, sadece ters yönde.

Yanlış fiyatlandırma yanlış fiyatlandırmadır ve piyasa eninde sonunda kendini düzeltecektir.

Peki şimdi ne yapılabilir?

İnsanlar para kaybettiklerinde kimi suçlayacaklarını bilmek isterler. Kurucuyu mu? VC'yi mi? KOL'u mu? Borsayı mı? Piyasa yapıcıyı mı? Tüccar mı?

Bence en iyi cevap, hiç kimsenin sorumlu olmadığıdır (herkesin sorumlu olduğunu kabul ediyorum), ancak farklı roller tamamen yeni bir pazar ortamında daha iyi performans gösterebilir.

Girişim sermayedarları olarak yapmamız gereken şey, piyasanın sesini daha fazla dinlemek ve hızı yavaşlatmak; ayrıca daha iyi bir fiyat disiplini göstermemiz ve kuruculara değerlemede daha gerçekçi olmalarını söylememiz gerekiyor; ayrıca, kilitli token'ları asla piyasa fiyatlarından fiyatlandırmayın (tanıdığım hemen hemen tüm büyük girişim sermayedarları kilitli token'ları önemli bir indirimle fiyatlandırıyor); eğer kendinizi bu anlaşmada para kaybedemem diye düşünürken bulursanız, büyük ihtimalle anlaşmadan pişman olacaksınız.

Borsalar için, token'ları daha düşük bir fiyattan listelemeniz ve son risk sermayesi değerleme turuna göre değil, ilk günkü halka açık açık artırmalara göre fiyatlandırmayı göz önünde bulundurmanız gerekir; lütfen token kilitleme süresini belirlemeden token'ları listelemeyin; perakende yatırımcılara yeni listelenen token'ların kilidini açma ve FDV durumunu daha net verilerle gösterin.

Proje sahipleri için, TGE'nin ilk gününde daha fazla token çıkarmanız gerekir. 10%'nin altındaki bir dolaşım oranı çok düşüktür. Kapsamlı ve sağlıklı airdrop planı. Listelemenin ilk gününde düşük bir FDV'den korkmayın. İdeal bir topluluk oluşturmak için en iyi fiyat eğilimi her zaman kademeli bir artıştır. Jetonunuz düşüyorsa, yalnız hissetmeyin. Unutmayın ki AVAX, borsaya kote olduktan sonraki iki ayda yaklaşık 24% düşüş yaşadı; SOL, listelemeden sonraki iki ayda yaklaşık 35% düştü; NEAR, listelendikten sonraki iki ayda yaklaşık 47% düştü… Takdirde Gurur duyabileceğiniz bir şey inşa etmeye odaklanırsanız, piyasa sonunda değerinizi keşfedecektir.

Milyonlarca sıradan insana gelince, tüm iddialara ve abartılı ifadelere karşı dikkatli olmanızı umuyorum. Piyasalar karmaşıktır, düşüşler normaldir, nedenleri bildiğini güvenle iddia eden, kendi araştırmanızı yapan ve karşılayabileceğinizden fazla para yatırmayan herkese şüpheyle yaklaşmalısınız.

Bu makale internetten alınmıştır: Girişim sermayedarlarının bakış açısı: Yüksek FDV'li, düşük tirajlı token'ların düşüşünün gerçek nedeni nedir?

Orijinal yazar: Haotian Vitalik'in FHE (Tam Homomorfik Şifreleme) hakkındaki makalesi, bir kez daha herkesin yeni şifreleme teknolojilerini keşfetmesine ve hayal etmesine ilham verdi. Bana göre, FHE, hayal gücü açısından ZKP teknolojisinden gerçekten bir adım öndedir ve AI+Crypto'nun daha fazla uygulama senaryosunda uygulanmasına yardımcı olabilir. Bunu nasıl anlamalıyız? 1) Tanım: FHE tam homomorfik şifreleme, verileri ve gizliliği ifşa etme konusunda endişelenmeden şifrelenmiş verilerin belirli bir biçimde çalışmasını gerçekleştirebilir. Buna karşılık, ZKP yalnızca şifrelenmiş bir durumda verilerin tutarlı bir şekilde iletilmesi sorununu çözebilir. Veri alan taraf yalnızca veri tarafı tarafından gönderilen verilerin gerçek olduğunu doğrulayabilir. Bu, noktadan noktaya şifreleme iletim şemasıdır; tam homomorfik şifreleme ise kapsamı sınırlamaz…