Polygon (MATIC) เคลื่อนไหวในแนวราบมาหลายวันแล้ว และกำลังรอตัวกระตุ้นที่จะช่วยให้ altcoin หนีจากการรวมตัวกันได้

แต่จากการดูแล้ว นักลงทุน MATIC อาจจะต้องรอนานกว่านี้ เนื่องจากมีแรงต้านสำคัญที่ขัดขวางการฟื้นตัว

Polygon กำลังสังเกตเห็นสัญญาณขาลง

ราคาของ MATIC กำลังทดสอบขีดจำกัดบนและล่างของช่วงการรวมตัวที่มันติดอยู่มาสักระยะแล้ว สัญญาณตลาดที่กว้างขึ้นไม่ได้ช่วย altcoin มากนัก เนื่องจาก Relative Strength Index อยู่ในโซนขาลง

RSI คือออสซิลเลเตอร์โมเมนตัมที่ใช้วัดความเร็วและการเปลี่ยนแปลงของการเคลื่อนไหวของราคา โดยมีค่าตั้งแต่ 0 ถึง 100 และโดยทั่วไปจะใช้เพื่อระบุสภาวะซื้อมากเกินไปหรือขายมากเกินไปในตลาด

แม้ว่าโทเค็นดั้งเดิมของ Polygon จะยังไม่ถูกขายมากเกินไปในขณะนี้ แต่ก็สังเกตเห็นถึงภาวะขาลงอย่างมาก โดยอยู่ต่ำกว่าเส้นกลางที่ 50.0

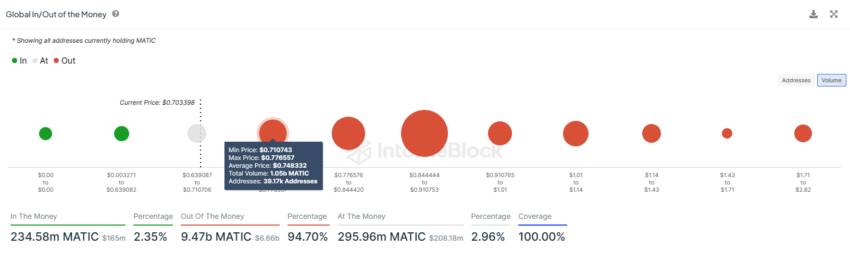

อย่างไรก็ตาม แม้ว่า MATIC จะเห็นสัญญาณขาขึ้น แต่ก็อาจพบกับแรงต้านจากนักลงทุน ตามตัวบ่งชี้ Global In/Out of the Money (GIOM) MATIC ประมาณ 1.05 พันล้าน มูลค่า $735 ล้าน ซึ่งซื้อในราคา $0.71 ถึง $0.77 กำลังรอผลกำไร

เนื่องจากขีดจำกัดบนของการรวมตัวอยู่ที่ $0.74 MATIC ยังคงต้องสร้างกราฟขึ้นอีกเพื่อให้อุปทานนี้มีกำไร

อ่านเพิ่มเติม: วิธีซื้อรูปหลายเหลี่ยม (MATIC) และทุกสิ่งที่คุณต้องการรู้

ความล้มเหลวในการทำเช่นนั้นอาจทำให้ altcoin ยังคงแข็งแกร่ง ซึ่งเป็นผลลัพธ์ที่เป็นไปได้

การคาดการณ์ราคา MATIC: มีแนวโน้มลดลง

ราคาซื้อขายของ MATIC ที่ $0.70 ล้มเหลว โดยทะลุแนวต้านที่ $0.74 ได้เป็นครั้งที่สี่ในช่วงสามสัปดาห์ที่ผ่านมา มีแนวโน้มสูงที่ altcoin นี้จะมีการลดลงอีกครั้ง เนื่องจากกำลังเผชิญกับแนวต้านอย่างมาก ดังที่กล่าวไว้ข้างต้น

สิ่งนี้อาจส่งผลให้ MATIC เริ่มปรับตัวขึ้นในอีกไม่กี่วันข้างหน้าและปรับตัวลดลงมาอยู่ที่แนวรับ $0.64 อย่างไรก็ตาม หากแนวโน้มขาลงยังคงเพิ่มขึ้น ราคาของ MATIC อาจลดลงมาแตะแนวรับนี้และตกลงมาแตะจุดต่ำสุดที่ $0.60

อ่านเพิ่มเติม: การทำนายราคารูปหลายเหลี่ยม (MATIC) ปี 2024/2025/2030

ในทางกลับกัน หากแนวโน้มเป็นขาขึ้น ราคาของ MATIC อาจหลุดจากการรวมตัวได้ ซึ่งจะช่วยให้ MATIC มีแรงหนุนในการพยายามรักษาระดับ $0.80 ไว้เป็นแนวรับ

ด้วยเหตุนี้ จึงทำให้อุปทาน MATIC มูลค่า 1.05 พันล้านเหรียญมีกำไรด้วย ผลลัพธ์ก็คือทฤษฎีขาลงนั้นไม่ถูกต้อง และอาจส่งผลให้ราคาเพิ่มขึ้นอีก