Task

Ranking

已登录

Bee登录

Twitter 授权

TG 授权

Discord 授权

去签到

下一页

关闭

获取登录状态

My XP

0

Onyxcoin has been on a persistent downtrend since reaching its all-time high of $0.049 on January 26. Trading at $0.015 at press time, the coin has since shed 57% of its value.

With mounting bearish pressure, the decline may not be over as market indicators signal further downside risks.

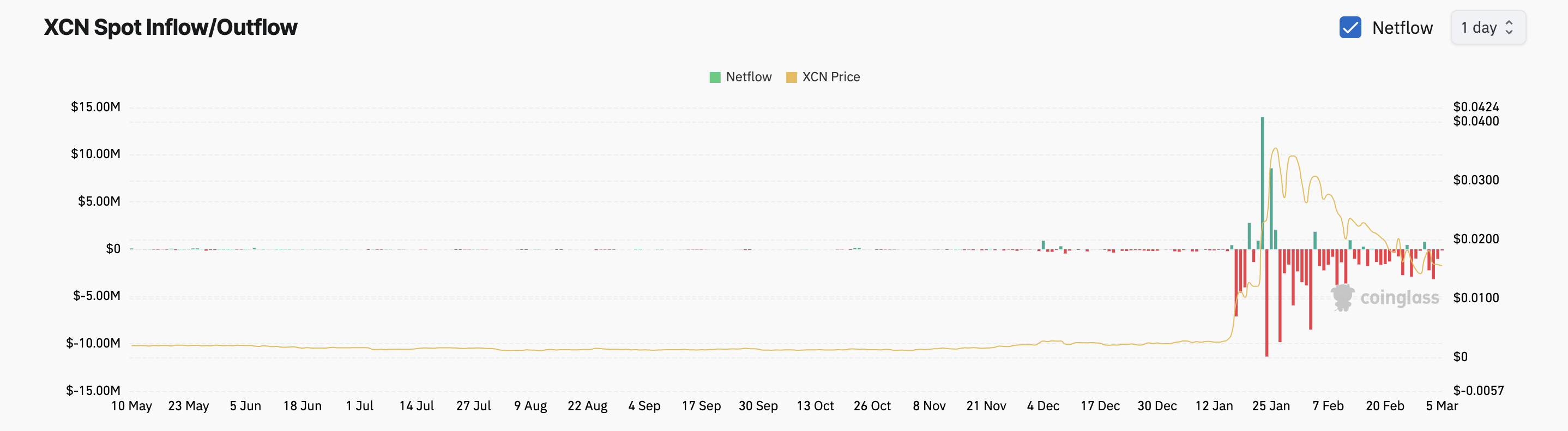

The steady outflows from XCN’s spot markets over the past month reflect the increased selling activity among its investors. Per Coinglass, in February, the altcoin only recorded four days of inflows, which totaled just $3.5 million. Conversely, XCN spot outflows exceeded $15 million during the same period.

Outflows from the XCN spot markets have reached $6.45 million so far this month. When an asset records significant spot outflows like this, its investors are selling their holdings.

This trend indicates that profit-taking is significant among XCN traders. It is a sign that there is no new demand for the altcoin, potentially lowering its prices in the short term.

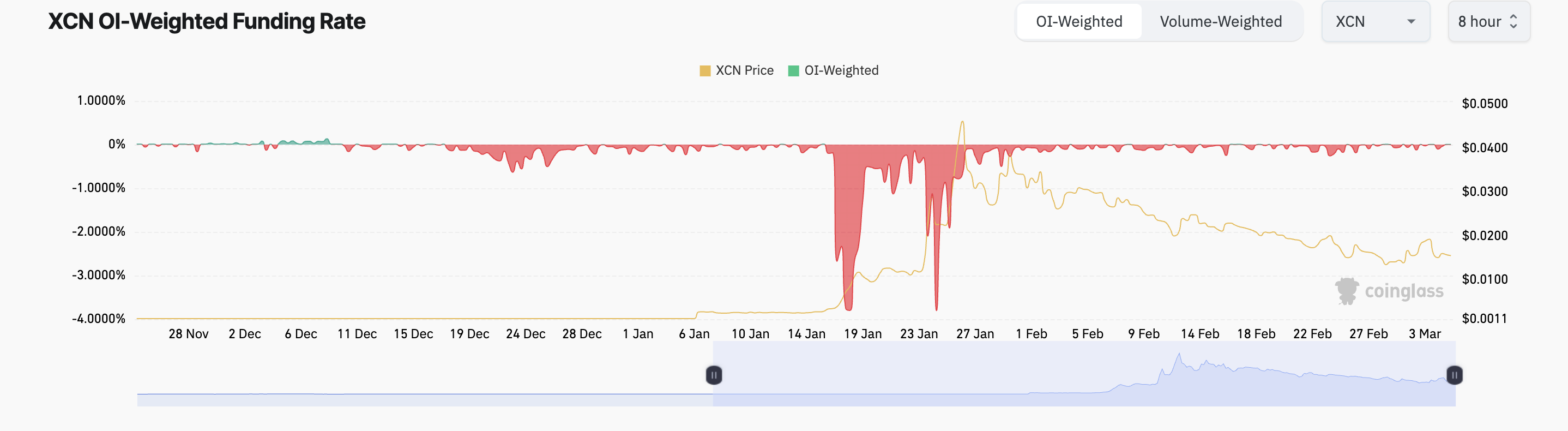

Moreover, its funding rate has been predominantly negative since the beginning of the year, highlighting the bearish bias toward XCN.

This periodic fee is exchanged between long and short traders in perpetual futures contracts. It is designed to keep contract prices aligned with the spot market. When persistently negative like this, it means short positions are dominant, indicating traders are betting on further price declines, which can further reinforce bearish sentiment.

On the daily chart, XCN remains within the descending parallel channel it has traded within since January 26. This bearish pattern is formed when an asset’s price moves between two downward-sloping parallel trendlines, indicating a sustained downtrend.

The pattern suggests that XCN sellers are in control. A drop below the lower trend line, which forms support, hints at further downside. If this happens, XCN’s price could drop to $0.0075.

However, a bullish resurgence in the XCN market could prevent this. If new demand soars, the token’s value could climb to $0.022.

บทความนี้นำมาจากอินเทอร์เน็ต: Onyxcoin Struggles with Heavy Sell-Offs, Down 57% from January’s ATH

Related: From HODL to disposable memes, how to find a way to survive in a highly fragmented market?

Original author: Route 2 FI Original translation: TechFlow Gm, friends. The การเข้ารหัสลับ market is undergoing tremendous changes, and we must adjust our strategies and tactics because what worked in the past no longer applies. The traditional “buy and hold (HODL)” strategy is gradually losing its effectiveness. As market volatility increases and new projects emerge one after another, the belief in long-term holding becomes more fragile. Today, the rule of survival in the market is to trade flexibly, constantly adjust positions, and look for opportunities in a decentralized and uncertain environment. Whether you can successfully adapt to this new situation will determine whether you survive or are eliminated by the market. Let’s take a deeper look to see if there is any hope in this market. Altcoin Casinos: How to Survive…