Will it be a shock or a bullish rebound? What do you think of the market after BTC’s “V-shaped reversal”?

Amid last weeks continued doubts about the Feds suspension of rate cuts, a series of negative non-farm payroll data showed the strong resilience of the US economy. The US dollar index hit new highs one after another. The employment problem seemed to have eased, and the Feds demand for rate cuts did not seem so strong. From large financial institutions, such as Citigroup and Goldman Sachs to small individual traders, they are reducing their bets on the Feds rate cut in 2025.

The price of BTC also showed a huge sweep state, fluctuating up and down by 10,000 points. Many people in the market joked that the price remains unchanged, but the position is gone. ตลาด sentiment also showed huge fluctuations, quickly turning from greed to panic and then to greed. Yesterdays PPI data was positive, and the inflation problem did not ease well, which increased expectations for the Fed to cut interest rates.

It has been less than a week since Trump took office. The US CPI data will be released again at 21:30 ET tonight. Will a rate cut in 2025 be on the agenda? Has Trumps narrative been priced in or does it still have great potential? Lets see what traders think.

การวิเคราะห์มหภาค

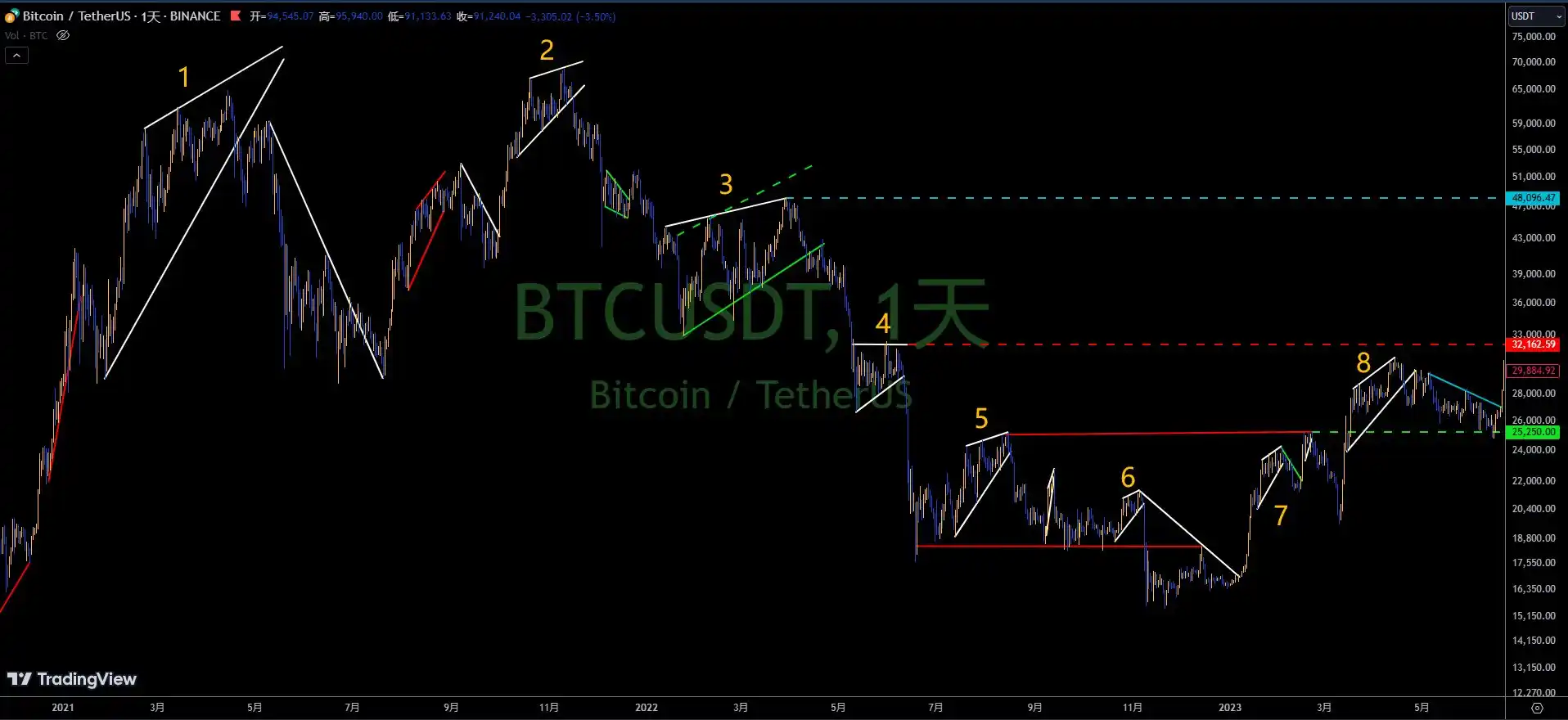

Todays market data focuses on BTCs trading volume. Referring to the third wave of wave C mentioned in the market, the third wave is often accompanied by a sharp decline and panic selling in the market, which will lead to a surge in short-term trading volume. Therefore, by looking at the increase in BTCs trading volume, we can see whether the third wave has been completed!

The overall market fell, BTCs share sucked the blood of ETH altcoins, and the market risk appetite accelerated its decline.

BTC trading volume increased by 25%, which is not obvious enough compared to the 150% increase in the overall market trading volume. It is clear that it is not yet in the stage of completing the third wave. The trading volume of altcoins increased by 277%. Today, BTC fell below the key position, causing ETH and many mainstream altcoins to fall below the key support. The altcoin market should have a large-scale liquidation, which led to a surge in trading volume.

In terms of funds, the market stock increased by 400 million, and currently it is 212.5 billion.

USDT: The official website data is 137.449 billion, an increase of 30 million compared to last Saturday. Although the market has fallen sharply, the net outflow of funds in the Asian and European markets has actually stopped, which is a small good data. At the same time, the activity of USDT funds has increased by 1 times, which should be due to large-scale liquidation leading to a surge in trading volume.

Looking at the overall funds at present, the funds that ended transactions during the decline did not leave the market on a large scale. Instead, they chose to remain in the market or return to trading again. This situation does not currently belong to the panic expansion stage.

There was no FOMO in the US market on Monday, and there was a net outflow for four consecutive days. Even from 89,000 to 97,000. This is also an important reason why I don’t think 89,200 is the bottom. 89,000 consumed a lot of funds from retail investors in non-US regions. URPD data shows that a large number of short-term holders who bought the bottom have taken profits.

According to SoSoValue data, yesterday (January 14, Eastern Time), the total net outflow of Bitcoin spot ETFs was $210 million, and the net outflow continued for 4 consecutive days. The Bitcoin spot ETF with the largest net inflow in a single day yesterday was WisdomTree ETF BTCW, with a single-day net inflow of $10.2372 million. Currently, the total net inflow of BTCW has reached $239 million, followed by VanEck ETF HODL, with a single-day net inflow of $5.4596 million. The current total net asset value of Bitcoin spot ETFs is $108.981 billion, and the ETF net asset ratio (market value to the total market value of Bitcoin) is 5.7%, and the historical cumulative net inflow has reached $35.722 billion.

Since there was no second wave of risk aversion on Tuesday, it either means that investors have already had sufficient expectations for CPI, or that investors have enough positive sentiment to offset the negative sentiment that CPI may bring. In fact, as for the CPI data, I really don’t think this data is important.

Because it is almost 100% certain that the Fed will not cut interest rates in January, the inflation in December will not actually change the Feds decision. Even in March, the Fed will most likely not cut interest rates. If we go by the dot plot, there will only be two interest rate cuts in 2025, and it is very likely that both will be in the second half of the year. There may be no chance of a rate cut in the first half of the year.

Therefore, a CPI data is not even as important as the non-farm data. After all, the Federal Reserve has already had certain expectations for the current inflation. Of course, it is true that the lower the inflation data, the more beneficial it is to the market. However, even if inflation in December drops to 2%, the Federal Reserve may not cut interest rates immediately.

Back to the BTC data, although the turnover rate has increased, panic has not appeared as the BTC price rebounded. Currently, more investors are leaving the market with short-term profits, and earlier investors, including those who have suffered losses, have no obvious signs of reducing their holdings, which shows that at least for now, investor sentiment is still relatively stable.

การวิเคราะห์ทางเทคนิค

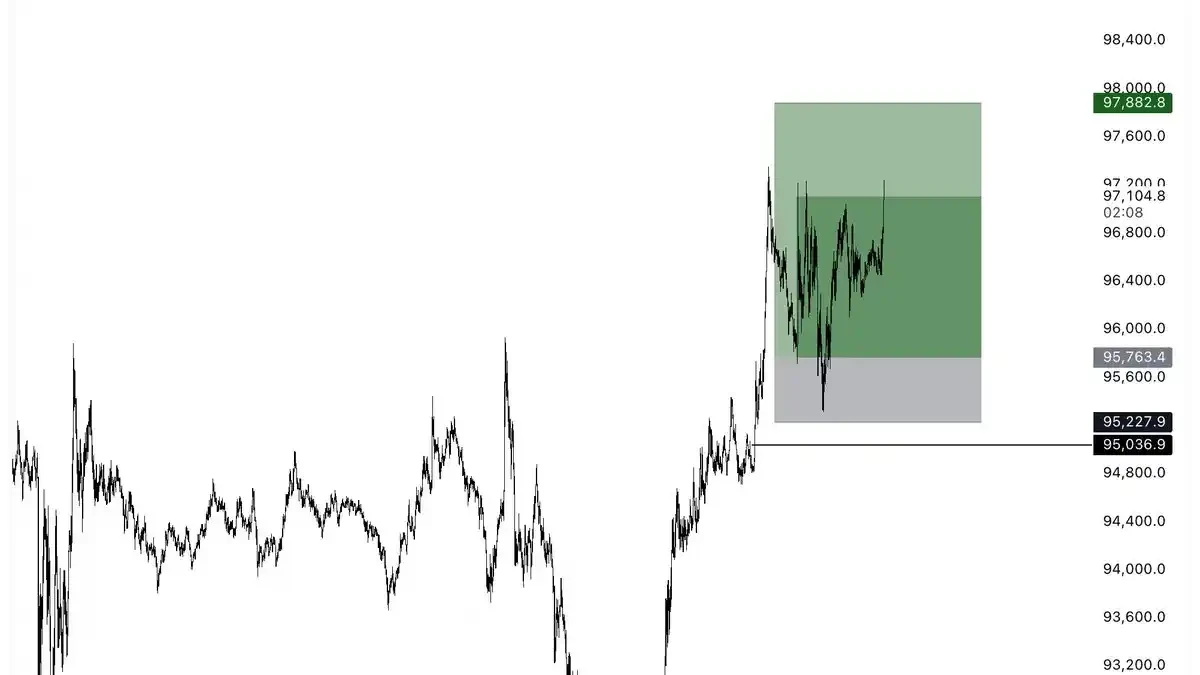

BTC has broken through the first trend line and is looking forward to breaking through the second one. In the short term, wait for the moving average to catch up with the price, take a break and continue to rise.

Added more BTC long positions here

Reviewing history, history is our teacher. This kind of structure has a high probability of occurrence, and it is followed by a large-scale retracement, at least 50% to 0.618% of the previous large band. The most brutal one was on May 19, when it returned to the starting point. That was an extreme situation that required various factors to support it. We only talk about the normal situation. The 85,000 mentioned last week was calculated based on this.

การวิเคราะห์ข้อมูล

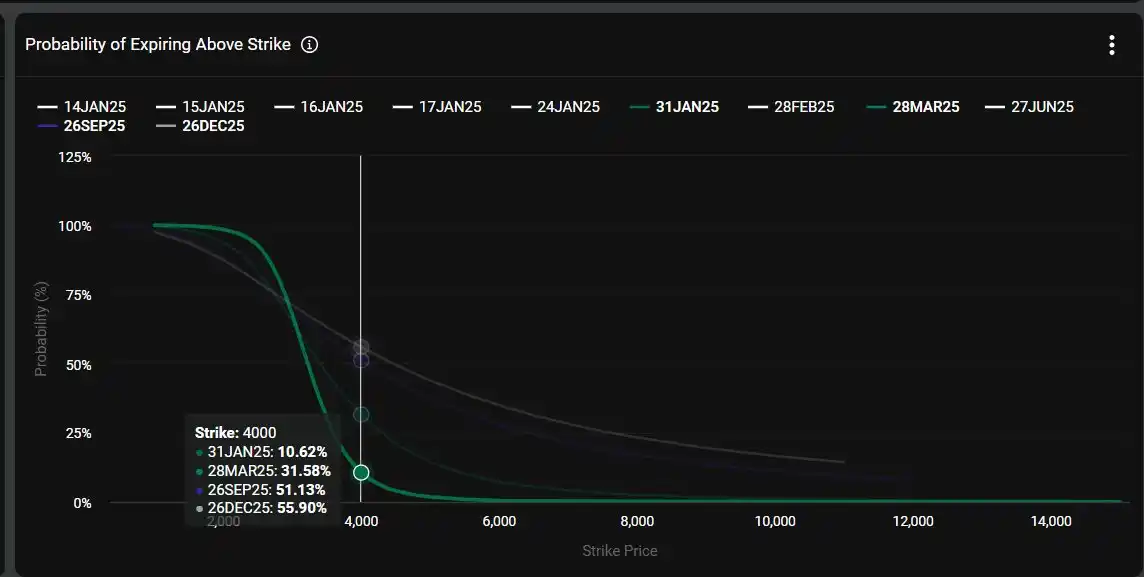

The probability that ETH price will exceed 4K by the end of January is only 10.62%.

The price continues to rise, and the premium is still recovering towards 0, indicating that the demand for spot is still entering the market. Only when the premium fully recovers to a positive value and reaches a higher level, the entire BTC market will enter a safe mode.

Therefore, the current price increase and the simultaneous recovery of the premium actually represent that as spot demand enters the market, futures longs begin to gradually take profits, while futures shorts begin to gradually increase their positions;

When the premium returns to near 0, it means that the futures long position is almost profit-taking. If the short position does not increase its position further, the premium will not go up. On the contrary, if the short position continues to increase its position, the premium will return to positive.

In short, when the premium returns to zero, a small-scale trend reversal or continuation is likely to occur;

In a bullish trend, every time the premium reaches zero, it is a time for a correction to be in place or a time to turn to a bearish trend. Similarly, in a bearish trend, every time the premium approaches 0, it is a time for a rebound to be in place or a time to turn to a bullish structure.

According to the fact that the price has fallen below $90,000, it can be seen that market demand has weakened, so the key support has been broken by the price. The current price range has certain conditions to become a distribution range; just like the volatile market in 2024, the existence of distribution signs does not mean that the market will eventually go bearish, and stronger demand can also pull up the market;

On-chain whale dynamics

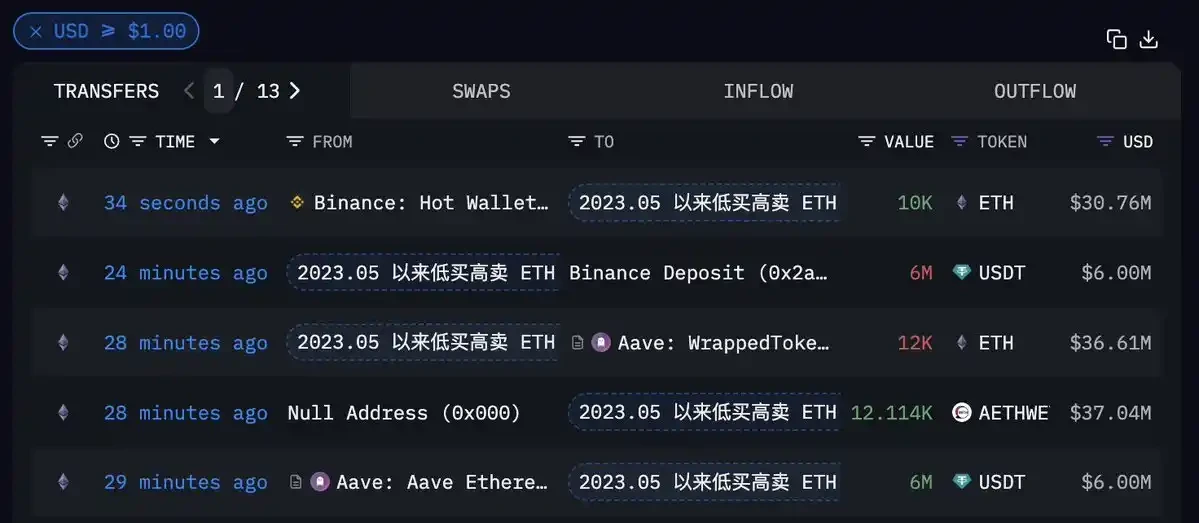

The whale who bought low and sold high $ETH and made a profit of $33.67 million On January 13, he withdrew 10,000 ETH from Binance, worth $30.76 million, at a cost of about $3075.57; currently he holds a total of 55,166.12 ETH, worth up to $169 million

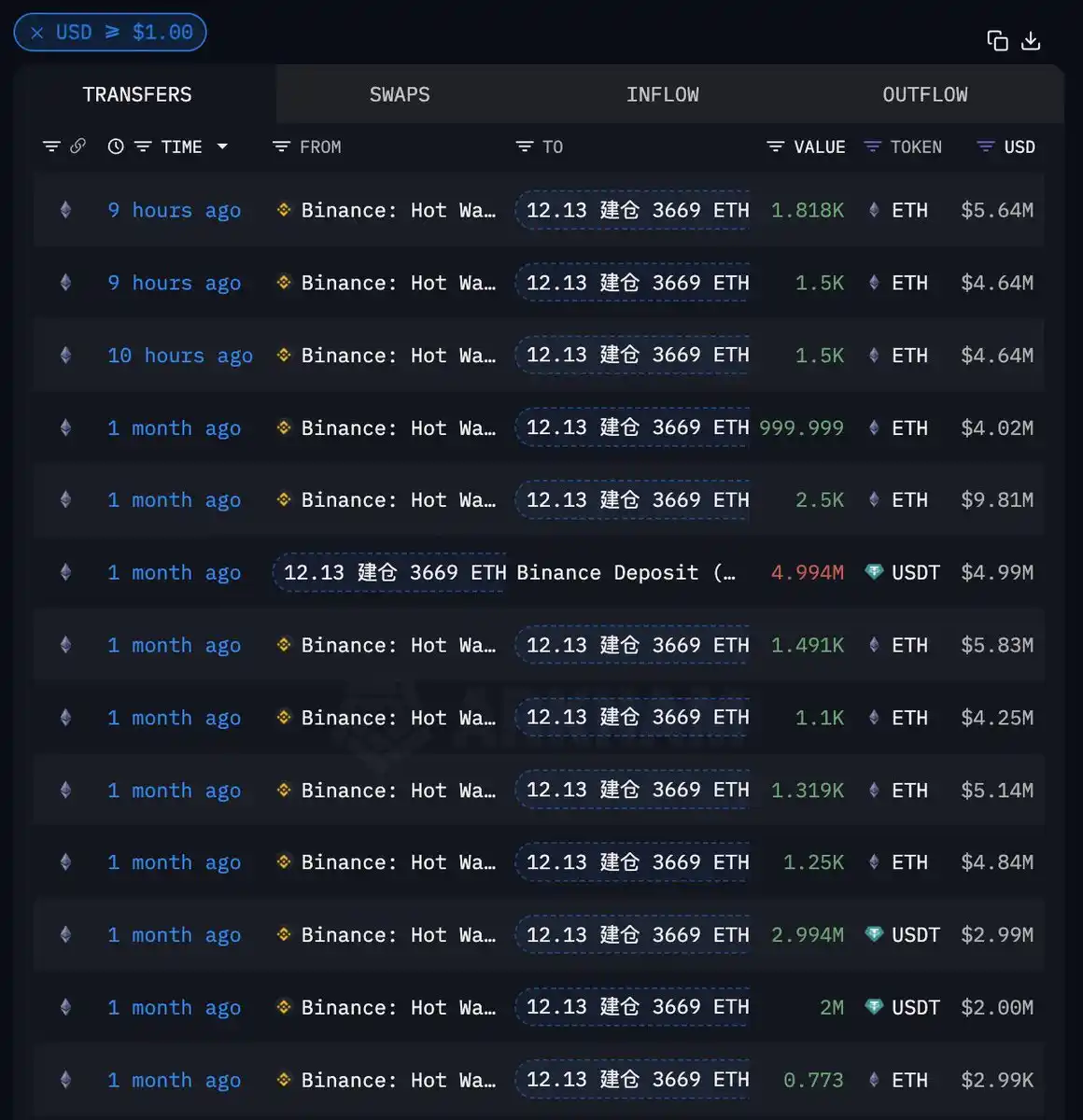

A month later, the new address with 3,669 ETH opened on December 13 added another 4,817 ETH worth $14.92 million when the market plummeted on Monday. Since December 5, 2024, the address has accumulated 13,479 ETH with a total value of $42.78 million, costing $3,622, and currently has a floating loss of $5.9 million.

The ETH whale with a winning rate of 83.3% reduced its position by 5,872.63 ETH (the part added during the plunge last night) at an average price of $3106.53, with a small loss of $530,000. Currently, there are still 11,252.98 ETH (about $35.39 million) left in the two addresses, with a cost of $3,196.85.

This article is sourced from the internet: Will it be a shock or a bullish rebound? What do you think of the market after BTC’s “V-shaped reversal”?

The 2024 US election has finally come to an end, and Trump, who has received much attention and support from the การเข้ารหัสลับ industry, has returned to the White House. I wonder if your circle of friends was flooded with his posts. Unlike the last term, his return to the White House this time may bring a more friendly and favorable regulatory policy environment to the crypto industry. *Image source: X.com During the election, there were many weird moves such as BTC strategic reserves, Americanization of mining, and the removal of the current SEC chairman. But the key law that will affect the development of crypto assets and Web3 projects in the next few years is the Financial Innovation and Technology for the 21st Century Act (FIT21). Currently, the bill has…