IOSG Ventures: DePayFi, any asset can be increased in value at any time and anywhere

ผู้เขียนต้นฉบับ: IOSG Ventures

Thanks to John@Asylum, Jerome@immersive, Mortiz@Fluidkey, Eddie@AEON, Wyatt@VanEck, Momir@IOSG for their support on this article.

Proof of Success for Web3 Payments

The rapid growth of stablecoin payments is reshaping global finance, with transaction volumes on par with major payment networks. However, this is just the beginning of a transformative financial era.

source: visaonchainanalytics

source: ycharts

Inefficiencies in traditional systems, such as cross-border payments, create huge opportunities for stablecoins:

“Cross-border payments typically incur high transaction fees, exchange rate markings, and intermediary costs (and also take a long time to settle)… The market size for B2B cross-border payments is huge… FXC Intelligence estimates the total market size for B2B cross-border payments to be $39 trillion in 2023, and expects it to grow 43% to $53 trillion by 2030.” – The Future of Payments by Andreessen Horowitz

Real-world adoption is already underway:

“There are now approximately 30 million active users moving $3.2 trillion worth of stablecoins per month, where traditional payment rails are too difficult, slow, and expensive.” – Sequoia Capital, Partnering with Bridge: A Better Way to Move Money

The advantages of a blockchain-based payment system are obvious:

“Unlike most traditional financial payment methods, which take days to settle, blockchain rails can settle transactions almost instantly across the globe… Crypto-enabled payments can offer significantly lower costs than existing offerings due to the elimination of various intermediaries and superior technological infrastructure.” – The Future of Payments by Andreessen Horowitz

Traditional financial giants are taking notice:

“These numbers are growing rapidly as industry giants including Stripe launch new payment options for these assets… Bridge is built on the blockchain, it operates 24 hours a day, in nearly every country – at just 10% of the cost of traditional FX railroads.” – Sequoia Capital, Partnering with Bridge: A Better Way to Move Money

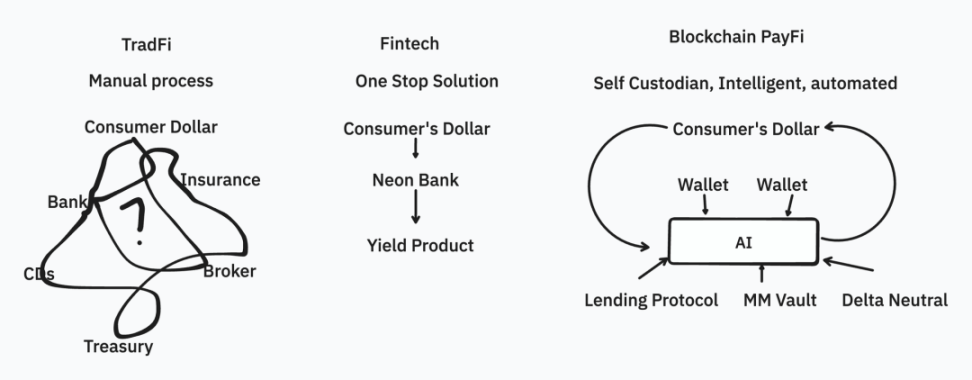

PayFi: The Smart Dollar

Not every dollar is created equal. Some are able to enter into premium opportunities while others are waiting to depreciate.

PayFi integrates DeFi into payments, turning every dollar into smart, autonomous money. It transforms idle funds into productive assets that can generate yield while maintaining liquidity.

Historically, only large capital holders have had access to high-quality financial opportunities.

Historically, access to quality financial opportunities has often been limited to large capital holders due to high minimum investment requirements, exclusive access to private markets, and barriers to entry for specialized financial vehicles like hedge funds or private equity. PayFi democratizes this advantage, making competitive yields available to even small amounts without sacrificing accessibility. Smart stablecoins can solve the time, risk, and liquidity trilemma, such as allowing users to receive discounts by paying bills in advance.

Advantages of Web3 Payments

Web3 payments are like high-speed trains: they move value around the world efficiently, quickly, and reliably. PayFi goes a step further and adds an intelligent layer similar to an automated logistics network. Not only does it move value quickly, it also provides some key features:

-

Smart Routing: Automatically directs assets based on user-เด็ดขาดned logic (smart contracts).

-

Aggregation efficiency: Merging multiple trades to achieve better liquidity.

-

Dynamic optimization: redirection during times of congestion or high network costs.

-

Programmable Finance: Automate payments based on complex conditions.

-

Asset conversion: Interchange assets as needed during the journey.

PayFi does more than just move money—it makes money smarter and more efficient. Almost all products use one or more of these features.

Solving the “cash problem”

While cash remains king due to its liquidity, autonomy, global offline acceptance, and privacy, it has one critical flaw: depreciation. Inflation constantly erodes its value, forcing users to choose between liquidity and yield.

Traditional fintech apps like PayPal and Venmo offer yield products, but these solutions are fragmented, offer limited returns, and require users to actively transfer funds to specific accounts.

PayFi revolutionizes the space with a seamless solution. Whether in the form of stablecoins, loyalty points, or pending refunds, funds within the PayFi system can seamlessly generate returns, whether they are stored in wallets, payment channels, or shopping platforms. Users enjoy returns comparable to their investments while keeping their funds instantly available.

This means:

-

There is no idle capital: every dollar is constantly put to work.

-

Global income: Even non-cash assets can generate income.

For example, interest-bearing stablecoins demonstrate how PayFi can integrate money-making opportunities into everyday financial systems.

Chance

By leveraging the composability of blockchain, PayFi unlocks top financial opportunities for everyone, every asset, everywhere. Developers can build on existing protocols without having to start from scratch and provide a seamless user experience.

Financial products when paying

User profile/demand: For individuals or small and medium-sized enterprises with stable income sources but tight cash flow. The goal is to provide flexible payment options, alleviate cash flow pressure, and reduce the risk of overdue payments.

Users benefit through tailored financial planning, reduced costs through exclusive discounts, and uninterrupted access to essential goods and services even when cash flow is tight.

The benefits to merchants are reduced payment delays, faster reinvestment of funds into operations, and enhanced customer loyalty through flexible provisioning.

These products provide users and merchants with greater flexibility and fairness in financial transactions. For example:

-

Early payment discounts: Users can enjoy a small discount if they pay their bills immediately after receiving funds, incentivizing timely payment.

-

Installment and buy now, pay later options give consumers the ability to manage their cash flow, making large purchases more affordable without having to pay the full amount up front.

-

Accelerated Payments for Merchants: Merchants can capture payments faster, which, although incurring a small fee, improves liquidity and smooths cash flow.

Some Web2 projects, such as Affirm, Afterpay, Klarna, and PayPal, offer installment payment solutions.

Embedded Revenue Solutions

User profile/demand: Focuses on small-scale fund management for individuals who hold mainstream currencies and have some idle funds. The product provides a low-risk, high-liquidity, convenient and flexible US dollar income solution. Users want to easily grow a small amount of capital while maintaining strong liquidity for financial needs. Some users have preferences for specific assets, such as US Treasury bonds or DeFi lending income.

PayFi transforms idle assets into yield-generating capital. Compared to traditional “yield” products, PayFi’s embedded yield solution works seamlessly across a variety of asset types and products, such as points from online stores, pending refunds, or gift cards.

Common yield solutions on the market include farm modules embedded in wallets, stablecoins with yield, and flexible yield products on centralized exchanges (CEX). The yield mainly comes from DeFi lending, protocol airdrops, delta neutral strategies, and US bonds.

On-chain embedded yield solutions are somewhat superior to both fintech and traditional banking solutions, primarily due to liquidity management limitations caused by the custodial nature of funds in traditional systems.

Embedded yield solutions improve transparency and capital efficiency by enabling users to self-custody and manage their own liquidity. For example, Revolut held $13 billion in deposits last year, but could only offer 3% interest due to liquidity constraints. Moving such systems to the chain will enable users to directly control their funds, allocate funds to liquidity pools or other yield opportunities, and maximize returns without the constraints of centralized management.

For users and institutions, this improves access to loan and credit products that are different from traditional finance.

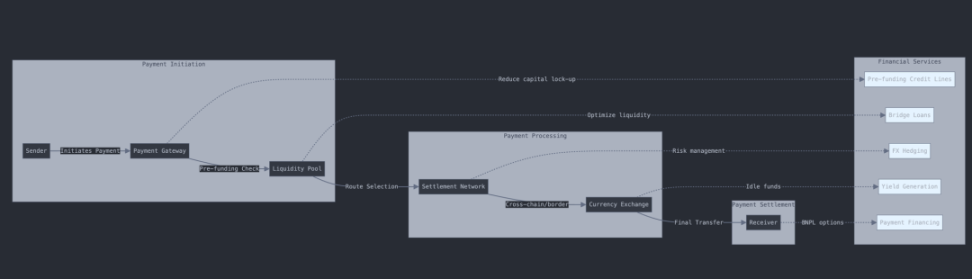

Payments are a complex process and there is a lot we can do to improve capital efficiency by financing each step.

PayFi apps often rely on third-party integrations, making the space competitive. However, PayFi can stand out by focusing on three core strengths:

-

User attraction: Build a moat through high transaction volume and frequency.

-

Orchestrate complexity: Simplify the fragmented payment process for users.

-

Functionality: Provides functionality that traditional Web2 systems lack.

Also need to consider:

-

The efficiency gains they bring

-

Their role in the payment process and potential market size

-

Regulatory and risk management aspects

PayFi Pillars

Infrastructure: Huma

Huma built everything from scratch, introducing the PayFi stack.

-

Transaction layer: handles payment processing and settlement

-

Currency layer: managing stablecoins and digital assets

-

Custody layer: ensuring safe storage of assets

-

Financing layer: providing loans and credit services

-

Compliance layer: Maintaining regulatory compliance

-

Application layer: provides user-oriented services

Huma is different in that it focuses on short-term financing within the payment and supply chain sectors. The platform enables real-time credit assessment and automated underwriting through smart contracts, making it possible to provide instant financing decisions for payment transactions.

Some other Web3 RWA funding platforms include Centrifuge (the first RWA project) and Ondo.

Web2-like players: SWIFT, Visa, Mastercard

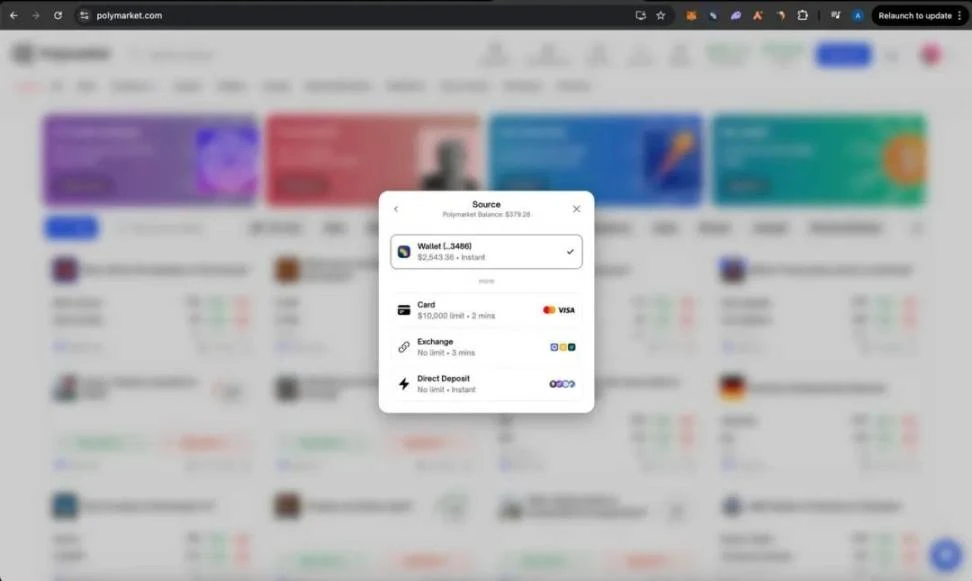

Payment: Fun

Fun.xyz launches Checkout, a versatile tool designed to simplify any on-chain activity by allowing users to complete transactions with any asset at the point of purchase. Checkout aggregates multiple payment options, improving user experience and maximizing dApp conversion rates.

-

Liquidity Aggregator: Aggregate funds from EVM wallets, Solana wallets, centralized exchanges, and credit cards to enable cross-chain payments.

-

Routing Engine: Executes complex, batched on-chain actions while ensuring transaction finality and price optimization.

-

Checkout SDK: A lightweight integration that increases app conversions by accommodating users’ preferred payment methods.

The advantage of Fun.xyz is that it removes common barriers to Web3 transactions, making it easier for users to perform on-chain actions without the hassle of asset conversion or deposits and withdrawals.

Other players include Aeon, which provides a one-stop checkout experience in the Telegram Mini App.

Embedding Profits: Morpho

Morpho is a modular lending protocol. It offers different segregated high-yield pools to potential investors. Its magic lies in its modular approach. It is embedded in many asset management protocols such as Brahama and Infinex to provide savings yield.

We are looking for more embedded yield products. Wallets or any product that involves capital custody can be integrated with a few lines of code. This way, you can earn interest no matter where your funds are.

Web3 Card: Offramp

Offramp offers stablecoin holders a USD-based product that provides up to 5% yield on USD, a stablecoin-backed การเข้ารหัสลับ card, and ACH and wire payment acceptance. It functions like a neo-bank, offering bank accounts, payments, and savings capabilities.

This is a mature space with numerous card issuers, KYC providers, and upstream/downstream products. Different card issuers vary in terms of regulation, fees, payment support (e.g. physical cards, Apple Pay). Some players include Rain and Immersive, the latter of which is also a principal member of the Mastercard network.

However, these are typically prepaid debit cards that require users to deposit funds before use, unlike traditional credit cards. With credit cards, users can use the interest generated by DeFi protocols to pay down credit debt, although credit also incurs costs due to interest payments over time.

A crypto credit card is a valuable asset for DeFi protocols as it enables users to seamlessly access their funds for everyday spending without having to withdraw funds from the protocol.

Deposit and Withdrawal: Bridge

Bridge simplifies global payments through stablecoin-based solutions, enabling businesses to move, store and manage funds at Internet speeds. Through its Orchestration APIs, Bridge eliminates the complexity of compliance and regulation, allowing for seamless integration of stablecoin payments with just a few lines of code. Bridge supports USD, EUR and major stablecoins such as USDC and USDT, and its reserves are invested in US Treasuries, providing opportunities for returns of more than 5%.

Through the bridge’s issuance APIs, companies can issue their own stablecoins and expand into global markets by offering USD and EUR accounts and international currency transfer options.

Vision

As a transformative solution, PayFi effectively solves the impossible triangle in traditional finance: yield, liquidity, and risk. In traditional finance, investors often face a trade-off: achieving high returns usually requires sacrificing liquidity or accepting higher risks, while maintaining liquidity and security usually means having to accept lower returns. This triangle has long limited financial opportunities, especially for small capital investors.

PayFi breaks this pattern by leveraging blockchain and DeFi. By integrating payment infrastructure with DeFi capabilities, PayFi transforms every dollar into smart, autonomous capital that automatically seeks opportunities to generate returns. With the rapid settlement of blockchain, the dollar can maintain liquidity while providing good returns.

This article is sourced from the internet: IOSG Ventures: DePayFi, any asset can be increased in value at any time and anywhere