Three ways for crypto companies to expand their influence: listing, Nasdaq 100 and SP 500?

ผู้เขียนต้นฉบับ: 1912212.eth, Foresight News

MicroStrategy has been officially selected for the Nasdaq 100 Index, and will take effect before the market opens on Monday, December 23. This also makes MicroStrategy the first การเข้ารหัสลับ company in the crypto industry to be selected for the Nasdaq 100 Index.

Since then, MicroStrategy Chairman Michael Saylor has predicted that Bitcoin mining company MARA will be the next crypto company to be included in the Nasdaq 100 Index.

The reason behind the inclusion of crypto companies in the index with strict standards is that the traditional financial technology industry is becoming more and more open to them. From listing to being selected into the index 100, crypto companies may be setting off a trend of imitation.

Crypto companies are going public in the U.S.

The United States is still the worlds largest technology country, and U.S. stocks occupy an important position in the global stock market. The expansion effect of the crypto industry is usually widely spread by listing in the United States. Crypto companies listed on Nasdaq have a positive impact on the companys legitimacy, capital acquisition, liquidity and other aspects.

The listing process and requirements in the United States often follow high standards. For companies applying for listing, there are very specific requirements and regulations in terms of their recent company revenue, company market value, market makers, corporate governance, financial reporting, and compliance review.

Since 2020, mining companies, exchanges, and crypto wallets have been listed in the crypto market. In the exchange track, Coinbase landed on Nasdaq in April 2021. Coincheck Group NV, a merged subsidiary of Japanese brokerage and crypto exchange operator Monex Group, also went public on December 11.

Mining companies include CleanSpark, Mara Digital Holdings, and Riot Platforms. In the field of crypto wallets, Exodus Movement was listed on the New York Stock แลกเปลี่ยน on December 18.

It is worth mentioning that some companies’ main business was not in the crypto industry when they first went public, but later switched to the crypto industry, such as Riot Blockchain and MicroStrategy.

In addition to the above-mentioned crypto companies that have gone public, companies that are still preparing for listing include Bitcoin financial services company Fold, DeFi Technologies, and online trading brokerage company eToro.

Kraken, a US exchange, appointed a new chief financial officer, Stephanie, in November this year. Its CEO said that it was preparing for the listing. Circle’s CEO also said in an interview in October this year that he had been eager to go public for many years and has not changed this vision.

In each cycle, many crypto companies will be officially listed. In 2025, with the continuous advancement of compliance and influence, there may be more crypto companies listed in the United States.

Nasdaq 100

After crypto companies are officially listed, the Nasdaq 100 Index becomes a stepping stone for them to further gain influence and visibility.

The Nasdaq-100 Index is a stock index launched by the Nasdaq Stock Exchange, which includes the 100 largest non-financial companies listed on the Nasdaq Stock Exchange. The index reflects the overall market performance of these companies and is one of the important indices that global investors pay attention to.

Being selected into the Nasdaq Index 100 means that the market has met its stringent standards for its market capitalization, stock liquidity, financial profitability, compliance, etc.

MicroStrategys coin hoarding strategy and impressive profitability over the past few years have earned it a ticket to the list.

Since 2020, MicroStrategy has used BTC as its main reserve asset. As MicroStrategy bought frantically, its stock price has also been rising in the new cycle with the strong rise of Bitcoin. In January 2023, MSTRs stock price was only $150, and in March 2024, the stock price reached a high of $1999.99, with a market value of hundreds of billions of dollars. In just over a year, its stock price return rate exceeded 1000%. On December 18, Michael Salor announced that MicroStrategys financial operations brought shareholders a net income of 116,940 BTC this quarter, with a yield of 46.4%. Calculated at $100,000 per Bitcoin, the net income for this quarter was approximately $12.28 billion.

Not only have its stock price and profit levels performed well, its market value is also around hundreds of billions of US dollars, making it one of the few crypto-listed companies with a market value of over $100 billion.

In addition, after being officially included in the Nasdaq 100 Index, it was also officially classified as a financial stock, but as a technology stock based on its main business of software as a service.

MicroStrategy initially provided business intelligence (BI), mobile software, and cloud-based services. Its main competitors include SAP AGs Business Objects, IBM Cognos, and Oracle Corporations BI platform. According to the 2020 financial report, MicroStrategys full-year revenue was US$480 million. Since the large-scale investment in Bitcoin in 2020, MicroStrategy has gradually been regarded as a Bitcoin concept stock, and its main revenue business has also been affected by Bitcoin investment, but its core business is still software and services.

For the crypto industry, the influence of the Nasdaq 100 may also encourage more companies to follow MicroStrategy and join the ranks of Bitcoin investment.

MARA, the next crypto company to be included in the Nasdaq 100?

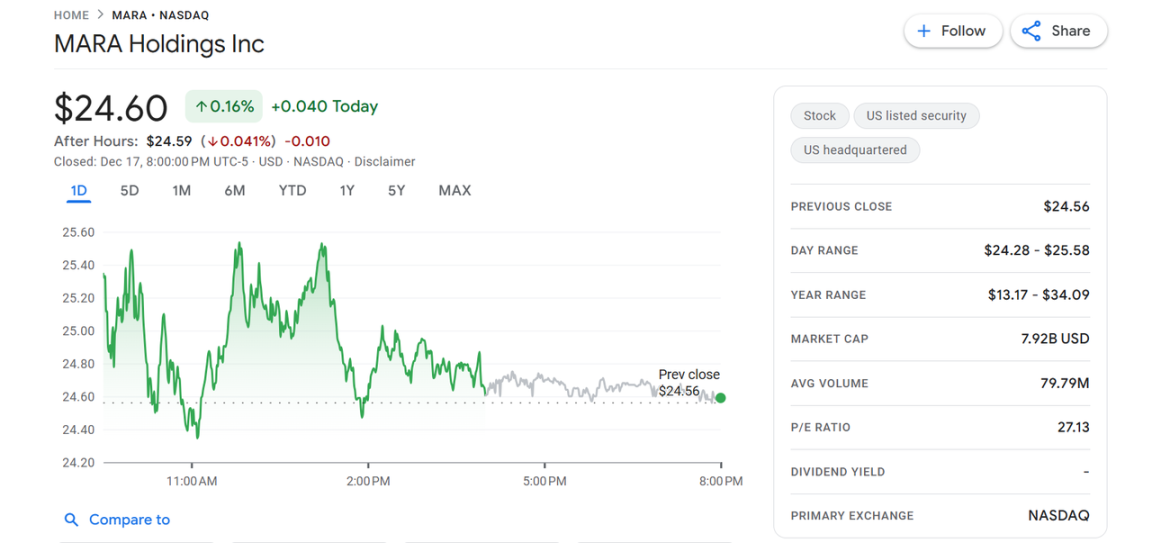

Bitcoin mining company MARA has become the next company that has attracted much attention and may be included in the Nasdaq 100.

Similar to MicroStrategy, MARA has raised hundreds of millions of dollars through the issuance of convertible limited notes in the past few months to continue to increase its holdings of Bitcoin. However, it is not easy to be included in the Nasdaq 100 Index.

Although MARA is a non-financial company, and its profitability and liquidity also meet certain requirements, it is still far behind MicroStrategy in terms of market capitalization. Generally speaking, the market capitalization of companies selected for the Nasdaq 100 is relatively high, and companies must reach a certain scale to be selected in the top 100.

As of now, MicroStrategys market value is more than 90 billion US dollars, and MARAs market value fluctuates around 8 billion US dollars, a difference of more than 10 times.

For new companies to be added to the Nasdaq 100, other companies must be removed. While MicroStrategy is one of the three companies added, Illumina ($22.7 billion), Super Micro Computer ($19.8 billion), and Moderna ($15.7 billion) will be removed.

The three companies that are about to be deleted have a market value of more than 15 billion US dollars, which is still more than double the market value of MARA, which also casts a shadow on its selection.

MARA is still a long way from the Nasdaq 100 Index. Perhaps in the near future, MARA will eventually be selected based on its data performance.

How far is it from the SP 500?

The SP 500 includes the 500 largest companies in the United States, covering approximately 80% of the total market capitalization of the U.S. stock market. The selection of constituent stocks is based on market capitalization, liquidity, profitability, and industry representation. The SP 500 is considered a benchmark for the health of the U.S. economy and the performance of large-cap stocks.

In comparison, the similarities between the selection criteria of the Nasdaq 100 and the SP 500 are that they both have higher market capitalization and stock liquidity requirements. However, the Nasdaq 100 places more emphasis on technology and innovation industries, which are important indicators for growth-oriented investments.

The SP 500 also emphasizes financial stability and profitability, which are relatively high standards for mining companies and crypto companies that have adopted a coin hoarding strategy.

As we all know, the four-year cyclicality of the crypto industry is still showing its effects. When the market is in a bull market cycle, companies often have large profits. Once the cycle enters a bear market and the price of the currency goes down, it will have a significant negative impact on mining and companies with Bitcoin as assets. Some companies may even suffer a setback due to factors such as cash flow.

In summary, the inclusion criteria of the SP 500 may be higher overall, because it not only considers market performance, but also includes strict financial health and industry diversity requirements. The Nasdaq 100 focuses more on market performance and innovation, and the inclusion process is relatively more automated, but for companies in specific industries, inclusion may mean higher market recognition.

The company meets the minimum market capitalization and trading volume criteria for inclusion in the SP 500, but does not currently meet the other requirement: total positive earnings for the past four consecutive quarters.

Benchmark stock analyst Mark Palmer analyzed that MicroStrategy has planned to adopt new Financial Accounting Standards Board (FASB) guidance to account for Bitcoin held on the companys balance sheet in the first quarter of 2025, which will enable it to immediately begin reporting positive earnings.

MicroStrategy has incurred $3.1 billion in cumulative impairment losses since launching its Bitcoin acquisition strategy in August 2020. Last December, FASB issued new guidance that allows companies holding digital assets on their balance sheets to measure those assets at fair value and record changes in the fair value of net income in each reporting period. The new rules take effect on January 1, 2025.

Palmer continued his analysis, saying, “MSTR is expected to achieve a one-time increase in quarterly net income of billions of dollars in the first quarter of 2025, which will be equal to the difference between the recorded value of Bitcoin on its books and its market value. If it turns out that the net income growth is enough to produce the positive numbers for the past 12 months, combined with MSTR’s losses in the first three quarters, the company will meet the criteria for inclusion in the SP 500 before the index’s second rebalancing in 2025, which is scheduled for the third Friday in June.”

If the market continues to perform well, MicroStrategy will have the opportunity to be included in the SP 500 index again in June next year, thus achieving a double harvest of Nasdaq 100 and SP 500.

This article is sourced from the internet: Three ways for crypto companies to expand their influence: listing, Nasdaq 100 and SP 500?

Original author: Biteye core contributor Viee Original editor: Biteye core contributor Crush Recently, many un-coined projects have successfully raised more than 10 million US dollars, involving tracks such as AI, L2, zk, and DeFi. In this article, Biteye will introduce these 18 projects one by one, including KOL attention, investors, and financing amounts. 1. Azra Games Raised US$42 million in financing from Pantera Capital, Andreessen Horowitz and others. A blockchain gaming company that aims to create mainstream collectible and combat role-playing games. 2. Glow Raised US$30 million in financing from Framework Ventures, USV and others. Glow is building Proof of Physical Work (PoPW) for carbon credits. 3. Nillion Raised US$25 million in financing from Hack VC, HashKey Capital and others. Build a decentralized public network based on zero computing to…