Brilliant performance after TGE, revealing the explosive growth momentum of deBridge

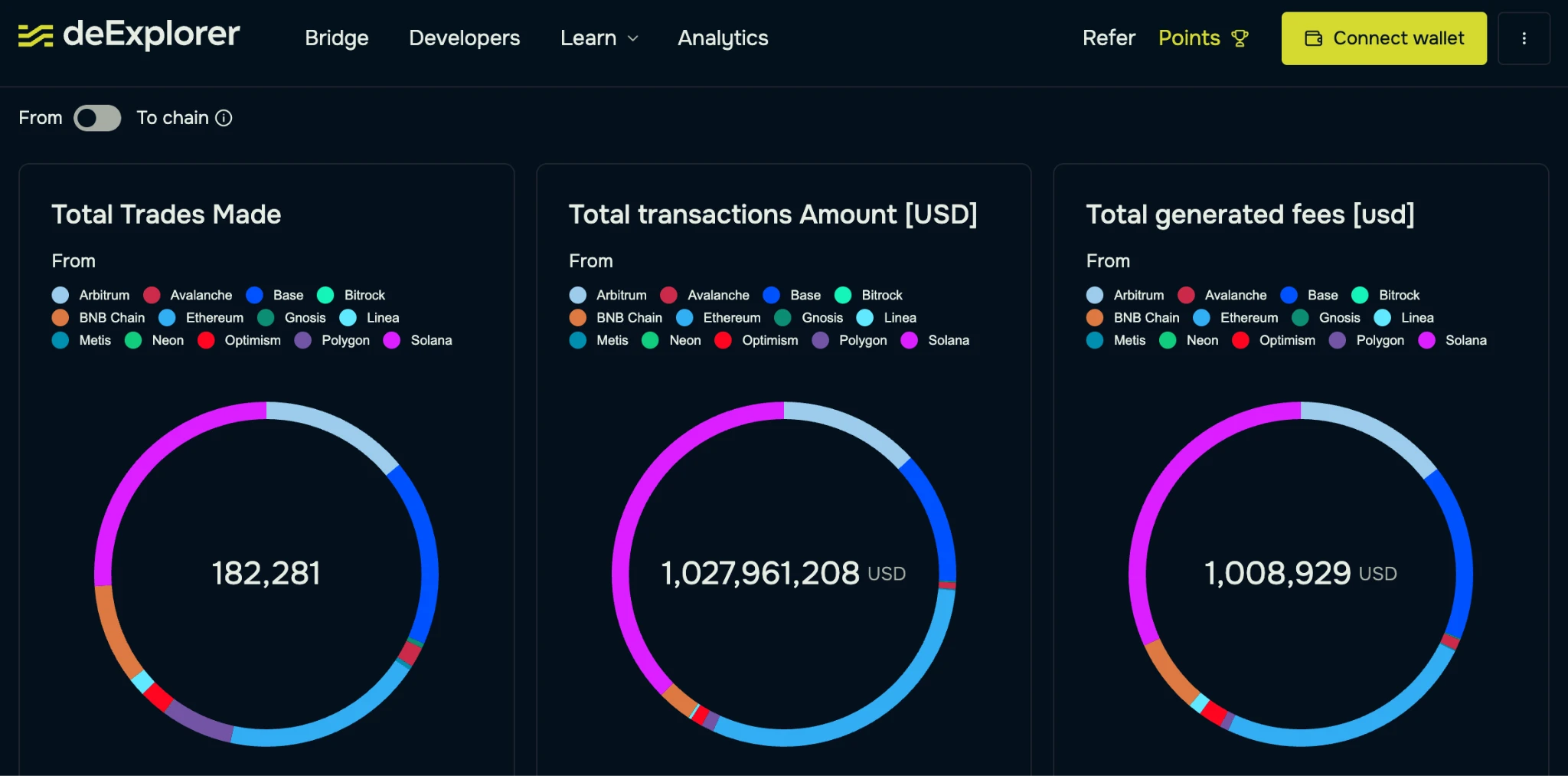

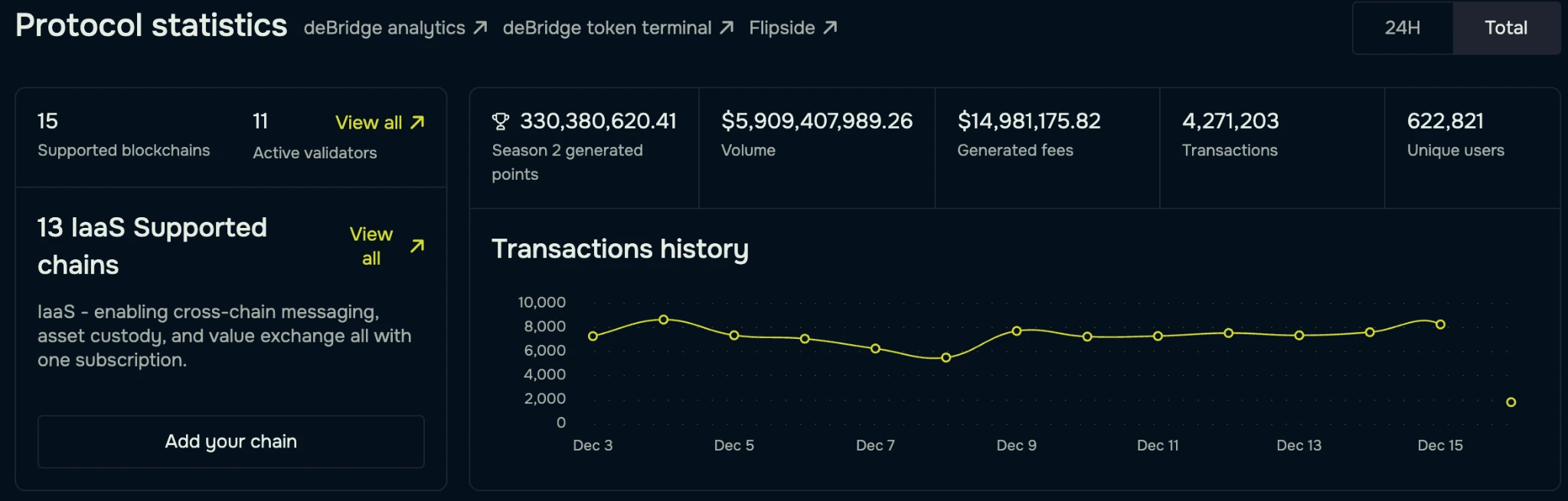

According to on-chain data, the total settlement volume of the deBridge cross-chain protocol is about 5.9 billion US dollars, with an average daily cross-chain settlement of about 40 million US dollars. In 100 days, 100,000 new users were added, and the protocol revenue was about 15 million US dollars. In the past 30 days, the cross-chain settlement volume exceeded 1 billion US dollars, and the cross-chain fee in the past 30 days exceeded 1 million US dollars. It is currently the cross-chain bridge with the highest fee income. In addition, 90% of the large cross-chain funds on Solana are transferred using deBridge.

แหล่งข้อมูล: https://app.debridge.finance/analytics

Consolidation of market leadership

Cross-chain fee income ranks first

In the past 30 days, deBridges cross-chain fee income exceeded $1 million, which shows that it has become the preferred protocol for users and institutions to transfer assets across chains. deBridge provides efficient, secure and attractive cross-chain services. In the market competition, users are willing to pay higher fees for high-quality services to ensure the liquidity and security of funds. The sustainability of income will provide financial support for further research and development, market expansion and ecological cooperation of the protocol.

Solana is the main channel for large cross-chain funds

90% of Solanas large cross-chain funds are completed through deBridge, which shows that its technical capabilities have gained the trust of high-value transaction users. This trend shows deBridges irreplaceable role in the Solana ecosystem, especially its competitive advantage in serving high-net-worth users and institutions. It also proves the stability, security and efficiency of the protocol when processing large transactions.

100,000 new users in 100 days

In a short period of time, deBridge attracted 100,000 new users, which is a remarkable success in user experience, product promotion and market strategy. As the number of users increases, the overall transaction volume and activity of the protocol will be further improved, and more participants will promote the self-circulating development of the ecosystem.

Agreement revenue and business model sustainability

Agreement revenue reaches $15 million

In the cross-chain field, cross-chain protocols that achieve stable and high revenue are rare. Outstanding profitability: Compared with projects that rely solely on financing and token issuance, deBridges revenue growth demonstrates the uniqueness and sustainability of its business model. Premium brought by technological innovation: The charging model has been recognized by the market, and users are willing to pay fees in exchange for high-quality cross-chain services. Future expansion space: The accumulation of revenue can support the protocol for more technological innovation and marketing.

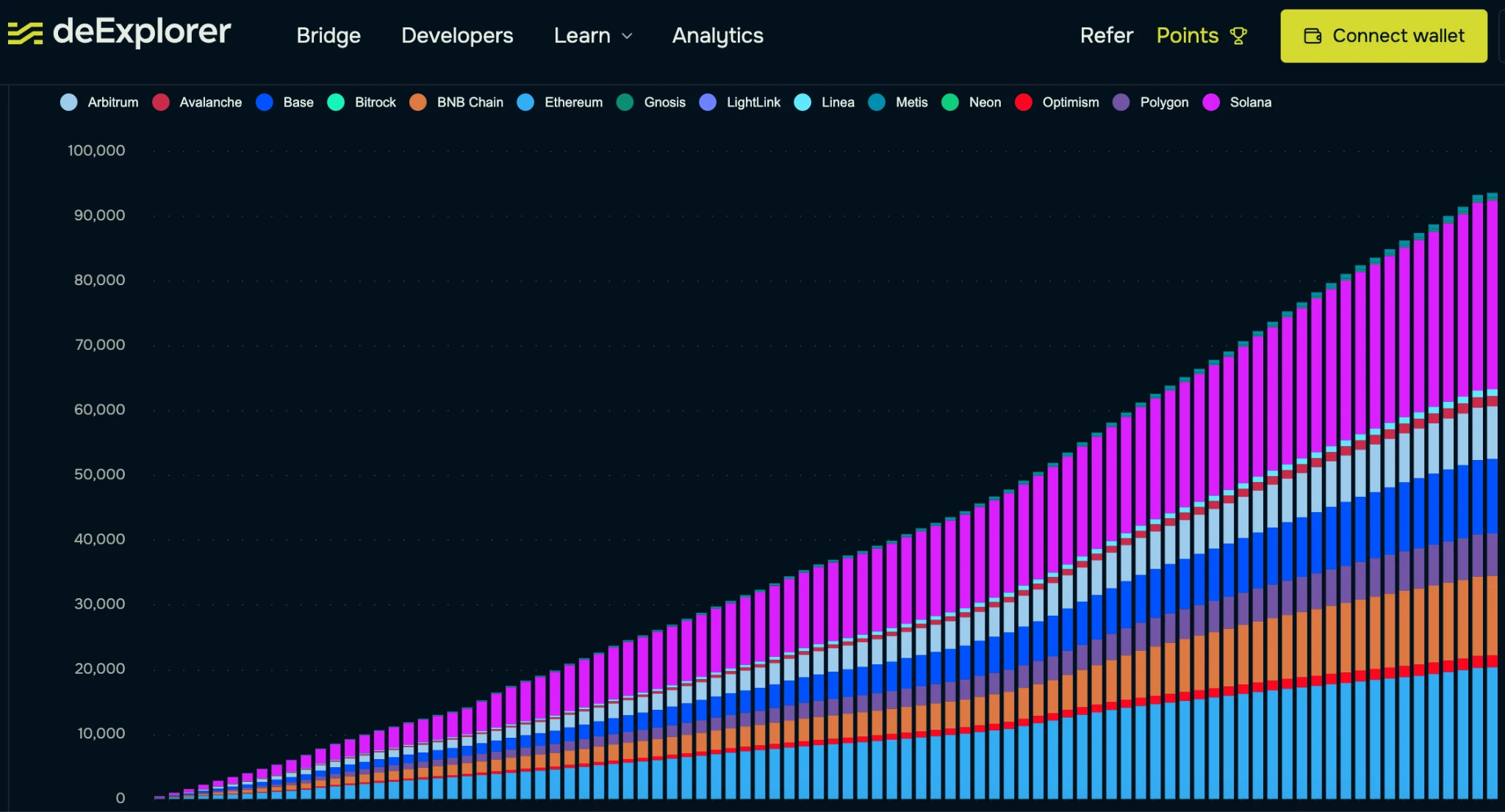

Steady growth in transaction volume and market demand

Total cross-chain settlement volume reached $5.9 billion, with an average daily volume of $40 million

The steadily increasing daily settlement amount shows that deBridge has become one of the core infrastructures for cross-chain asset flows. As the การเข้ารหัสลับ market share grows, more and more users and institutions need efficient cross-chain tools, and deBridge fills this key market demand. While supporting such large-scale transactions, the protocol can maintain stable operation, further enhancing user trust.

Cross-chain settlement volume exceeded $1 billion in the past 30 days

The recent growth in transaction volume shows that the market demand for cross-chain technology continues to rise, and deBridge has become a beneficiary and promoter of this growth: new users have begun to actively use the protocol, increasing the actual utilization of the protocol

Technology Core Competitiveness 0-TVL

With 0-TVL, the core competitiveness of extremely fast cross-chain transactions, deBridge may attract more users from competitors and further consolidate its market share. 0-TVL means no fund custody risk and avoids becoming a target of attack. Higher capital efficiency, enhanced user asset liquidity, decentralized verification network to ensure transaction security and transparency. Avoid TVL-related economic risks. In the long run, the 0-TVL model will further enhance deBridges market competitiveness in the cross-chain ecosystem, while providing new ideas for the security and sustainable development of the entire industry.

Future potential behind growth data

deBridge鈥檚 growth data not only reflects its own success, but also highlights the mainstreaming of cross-chain transactions. The cross-chain flow of large amounts of funds shows that the blockchain ecosystem has tended towards a multi-chain coexistence pattern, and the demand for cross-chain bridges as key infrastructure has increased significantly.

According to the data from the on-chain data platform DefiLIama, the settlement volume of all cross-chain protocol transactions in 30 days was about 20 billion US dollars, and the settlement volume in the past 7 days exceeded 4 billion US dollars. The demand for cross-chain by DeFi users is increasing rapidly, and the cross-chain bridge can maintain stable growth, which is inseparable from the core competitiveness. If it is to maintain its leading competitiveness, it will be a long-term issue.

Ecological cooperation and expansion of cross-chain application scenarios

deBridge is further expanding the ecosystem by working with more public chains, protocols, and decentralized applications. This will bring more trading volume and user base. deBridge launched OP Horizon , a growth plan for users and projects in the deBridge ecosystem, and also launched Arbtium Horizon a few months ago. This time, with the support of the Optimism Foundation, 150,000 OP grants will be issued to refund fees and gas fees to users and provide liquidity to the Optimism ecosystem.

DBR token value empowerment

The growth of protocol revenue and the expansion of user scale will provide more practical support for the value of DBR tokens and bring long-term returns to investors and the community. According to the official tweet of the deBridge Foundation, DBR, as an important core of deBridge DAO, will play an important role in voting governance, staking, protocol fee sharing, and coin holding fee reduction in the future.

The next step for deBridge is to support more public chains and Bitcoin networks in different languages, integrate more liquidity fragments and achieve seamless interoperability earlier. In addition to the programmable cross-chain, chain abstraction and account abstraction that are being developed, the team will also try more technological innovations to bring more possibilities to the เด็ดขาด field.

This article is sourced from the internet: Brilliant performance after TGE, revealing the explosive growth momentum of deBridge

Original author: @Web3 Mario The MEME ecosystem has been very hot recently, so the author continues to pay attention to and study related knowledge. Last week, many MEMEs have achieved several times or even dozens of times of growth, but most of the stories I saw and heard were still large losses. Therefore, before the narration, I still hope that everyone will remain rational when participating, and must do a good job of risk control, strictly implement trading strategies, and must not be overwhelmed by survivor bias. Back to the topic, when studying the MEME track, the author started with DOGE, the leader of such projects, and found that DOGE is experiencing some interesting things recently. I have some experience and hope to share it with you. In general, affected…