DeFi mining, on-chain transfer, what new gameplay will Solana Meme have in the second half?

In the second half of the meme track, in addition to PVP on Sol and internal disk on Base Virtual, meme gameplay has also been updated and more and more varied. Repump began to recycle junk memecoins, and Farmer meme attracted users to build pools through high APR. The funds in the meme track gradually overflowed into the services and narratives around the main line of meme.

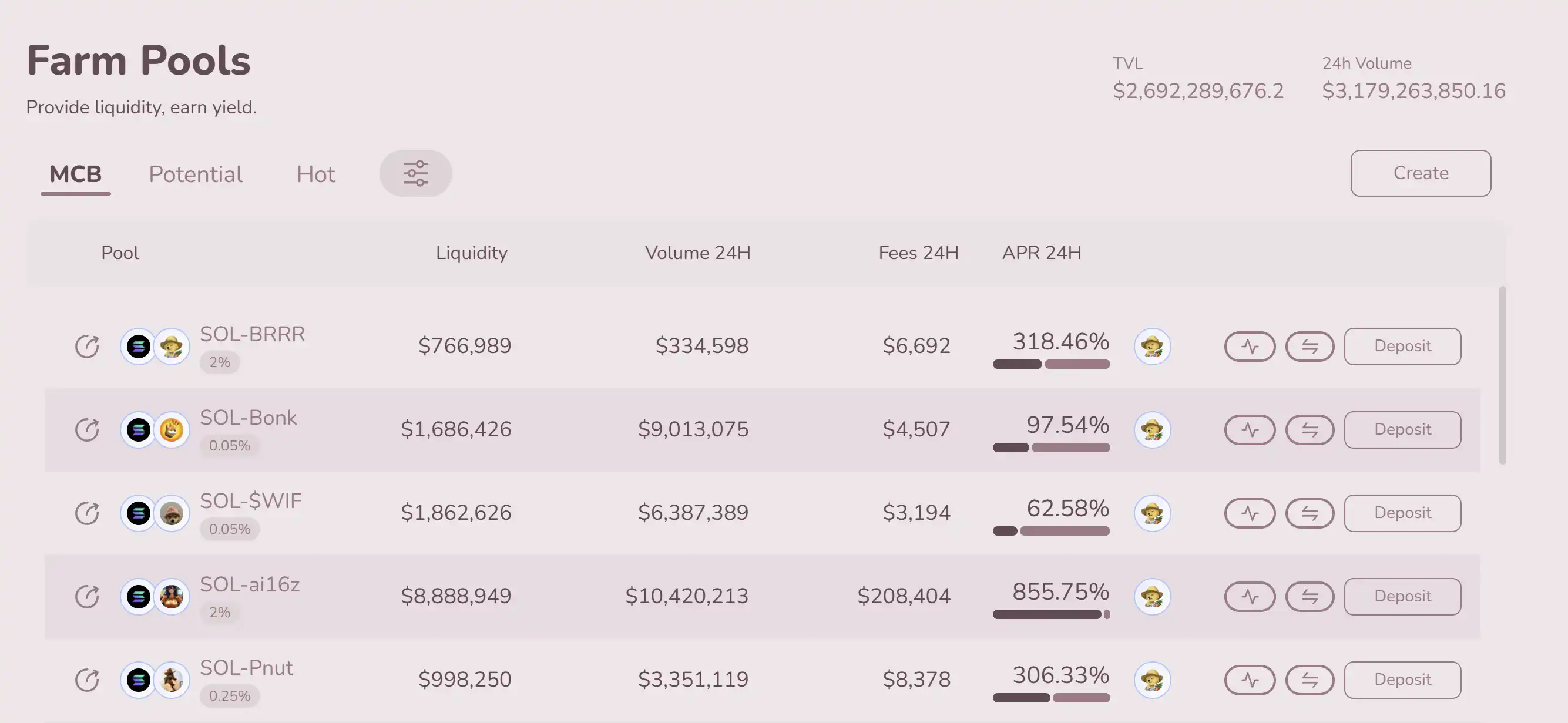

Farmer meme: MemeFi increased 50 times in 3 days

Blogger X LSP earned 50 times the profit in 3 days by forming a KACY/SOL pool on November 30. He earned the transaction fee by forming a pool of KACY and SOL, and deposited the transaction fee (30 SOL and 50 SOL equivalent of KACY) again for rolling 12 hours later. Although the final FDV of KAYC dropped to 20 M, it still earned higher returns than simply holding the currency.

Although some memecoins are very easy to return to zero, as long as the transaction volume is large enough, LPs can still make huge profits through handling fees. The best way to enter Farmer meme is still to form a group of LPs with higher APR. Farmer meme adopts CLMM (centralized liquidity market making) instead of AMM. The liquidity provider (LP) specifies the price range in which its liquidity can be used for trading, and users need to set the range manually. If the price range is not adjusted in time, a large impermanent loss will occur.

But it is worth noting that part of the rewards finally obtained are issued in the form of $BRRR tokens. $BRRR is the governance token of MEME Farmer, which enables users to participate in decision-making and ecosystem activities. โทเค็นs can be obtained through LP Farming, staking and community contributions. In addition, a 10% fee will be charged for harvesting income (all tokens in LP will be converted to SOL). 50% of the income will be used to repurchase $BRRR and sent to the vault address.

In the early days, the reason why the APR was high was largely because the increase in $BRRR was also taken into account, so there would be a certain amount of selling pressure after the mining, withdrawal and selling. Although $BRRR has a buyback plan in the later period, it is a pity that $BRRR has already started to Christmas tree.

It should also be noted that the project has not passed the contract audit and there are certain security risks.

Repump: On-chain “transfer” launched

With the outbreak of the new narrative of on-chain asset issuance brought by Pump.fun, memecoin has ushered in a significant market for getting rich, but the golden dogs that can run out are still one in a million. Instead, after the feast, people found that there were excess memecoins left in the market, and even the investment and research-oriented P players would laugh at themselves for picking up garbage.

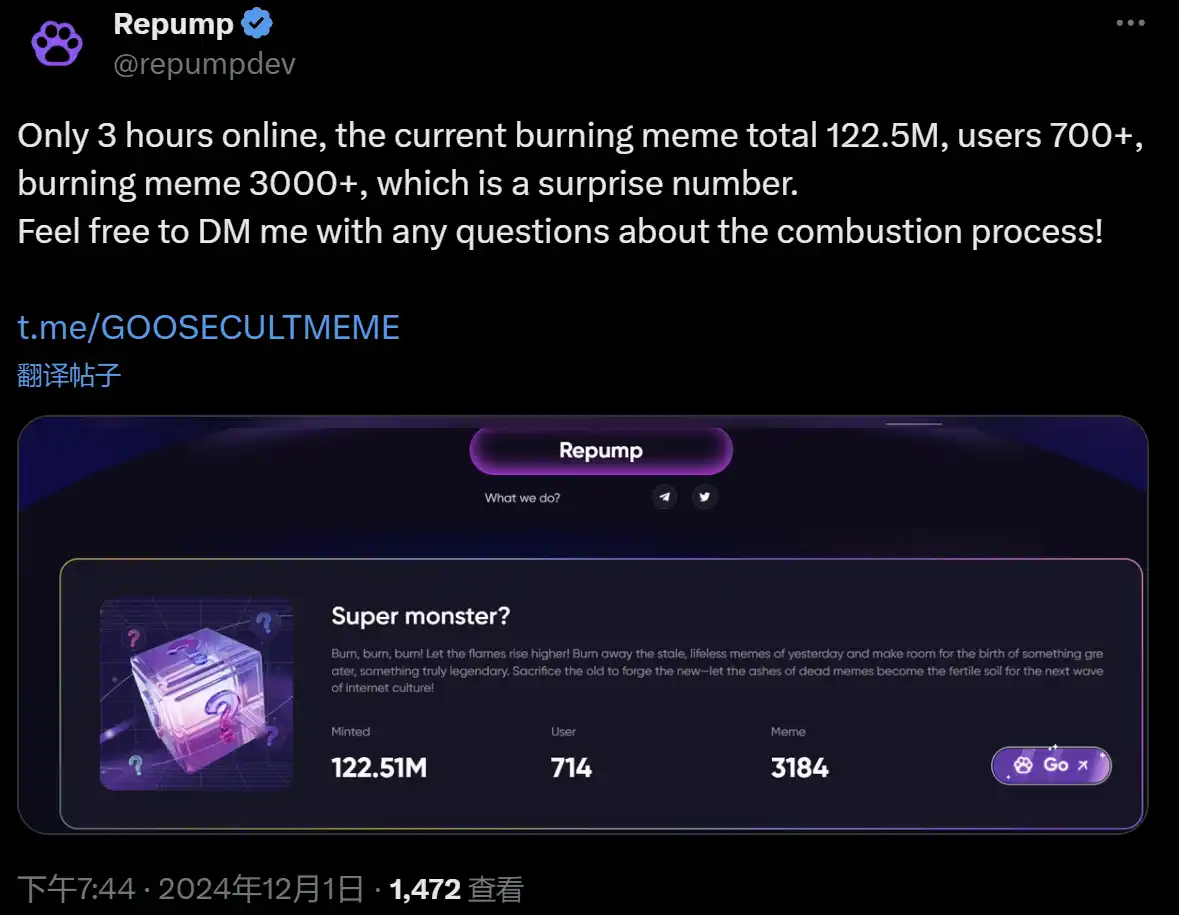

The product design of Repump is exactly the same as that of Zhuanzhuan. Due to the proliferation of asset issuance, there are too many deposited tokens that cannot be circulated and utilized. Repump can activate the liquidity of shit memecoin. Users can put excess memecoin into the Repump contract for destruction. After the destruction, users can use the corresponding destruction points at the end of the activity, which can be used to redeem the new token Super Monster.

It is worth noting that the points earned from the destruction are only related to the value of the tokens destroyed, not the number of tokens destroyed. It is also related to the total value in the destruction pool. The Super Monster that the user finally receives will be calculated by dividing the value of the users personal destruction by the total value in the destruction pool.

According to Repump’s official Twitter account, more than 700 players burned more than 3,000 memecoins in just three hours after the second phase went online, with a total value of more than $122 million.

The top 10 tokens currently burned on Repump are: $PNUT (33.31%), (11.67%), $RIF (9.68%), $SCIHUB (2.11%), $WIF (1.77%), $ACT (1.51%), $SSS (1.31%), $NuCouché (1.3%) and $Riemann (1.28%), and other tokens account for 33.45% of the total burned. It is worth noting that the points reward can only be claimed after the Burn is over.

Repumps platform token Goose has also started its main upward trend. Since its launch, it has been rising steadily, taking the path of higher high, lower low. The current market value is stable at around 10 million US dollars, and the trading volume fluctuates around 800,000. The platform token Goose will also be empowered in the future.

The market voted with its feet and chose the mainstream narrative of this meme super cycle. Although there are still many voices expressing FUD sentiment towards these projects, at a time when memecoin is cooling down, these new ways of playing in the meme track can be regarded as a new ray of hope.

*This article does not involve any investment advice. The above projects are still in their early stages, so readers should be aware of the security risks of investment.

This article is sourced from the internet: DeFi mining, on-chain transfer, what new gameplay will Solana Meme have in the second half?

Original author: TechFlow Amid the excitement of Devcon in Bangkok and the bright lights of the streets, AI Memes had their moment of glory. From Binances lightning-fast launch of ACT to GOAT breaking new records, all attention may have started from the terminal of truth behind the goat – when AI Agent can also issue a coin by itself, everything will be different. Around AI agents, from simple Bots to complex intelligent entities, everyone is thinking about what more sparks AI and Crypto will create. Today, Binance Research Institute also released a report on AI Agents, detailing recent AI Agent-related highlights, from the issuance of Truth Terminal coins, to Virtuals IAO platform, to daos.funs new model, and analyzing subsequent trends. The report also quoted a classic quote from A16Z partner…