DeSci: How to use on-chain Meme to challenge the existing scientific research system?

ผู้เขียนต้นฉบับ: นักวิจัย YBB Capital Ac-Core

สรุปแล้ว

-

The birth of the DeSci hot spot mainly stems from Binance Labs investment in BIO Protocol, CZs new direction speech involved biotech adoption, CZ and Vitalik discussed DeSci together, and a16z led the investment in the DeSci project AmionChain;

-

If DeSci is viewed as a meme, its fundamentals are more in need of strong narratives and character support than memes in different directions such as zoos, AI, and art, and it also has greater potential to break out of the circle;

-

From a practical perspective, the economic volume currently available in the DeSci market is not enough to support the expenditure of scientific research funds. DeSci is still in the early stages of its market value dream, and hot speculation is a necessity.

1. Background

1.1 What is DeSci

A more official explanation is that DeSci (Decentralized Science) is decentralized science, which aims to build a public infrastructure for scientific research through the fair and equal use of Web3 technology. Its focus is on solving problems such as review, scientific research funding, intellectual property management, data transparency and review mechanisms.

To put it in plain language, DeSci is to endow the pure speculation of the การเข้ารหัสลับcurrency circle with zero speculation in scientific research. However, DeSci is not a new concept that has only appeared this year. VitaDAO, which focuses on funding and promoting early longevity scientific research, was established as early as 2021 and even received investment from the world-renowned pharmaceutical company Pfizer. However, DeSci has always developed mediocrely and has not received much attention from the market. It was not until recently that Binance Labs announced its investment in BIO Protocol and CZ and Vitalik jointly participated in the DeSci conference that the track re-entered the public eye.

1.2 The emergence of hot spots

-

Binance Labs exclusively invests in BIO Protocol:

BIO Protocol can be seen as a crowdfunding platform for raising funds for scientific projects, obtaining funds through token sales and using these funds to support and advance the development of biotechnology projects. Intellectual property rights exist in the form of IPT (Intellectual Property โทเค็น) of Molecule Protocol and are shared by participants.

The proceeds from BioDAOs intellectual property and product sales will flow back into BioDAOs coffers to fund the next generation of research and development projects. Binance Labs said: BIO can be seen as the Y Combinator of on-chain science. Currently, the total value of the 100 startups with the highest valuation or market value under Y Combinator has exceeded US$100 billion, including well-known companies such as Airbnb, Coinbase, Stripe, and Reddit.

-

CZs new direction speech includes biotechnology and discussing DeSci with Vitalik:

In his first speech after being released from prison at Binance Blockchain Week 2024 in Dubai, CZ described his relationship with artificial intelligence and biotechnology in the following words: Now I mainly do two things: one is Google Academy, and the other is investment. The investment is mainly concentrated in the three fields of blockchain, artificial intelligence and biotechnology. CZ then attended the DeSci Day event held by Binance in Bangkok and discussed DeSci with Vitalik. This move triggered heated discussions in the market, and the prices of various DeSci project tokens rose sharply.

-

a16z leads the investment in DeSci project AmionChain:

Recently, AminoChain announced that it has received a $5 million seed round of financing led by a16z. Together with the previous investment from private funds such as Cercano, the total financing amount has reached $7.8 million. Its vision is to build a decentralized biobank on L2, allowing researchers to easily find and access samples, while patients retain control and receive compensation for the use of their data.

Image source: X (@BinanceLabs)

2. Real needs and real use cases of DeSci

2.1 DeSci: Funding requirements for scientific research

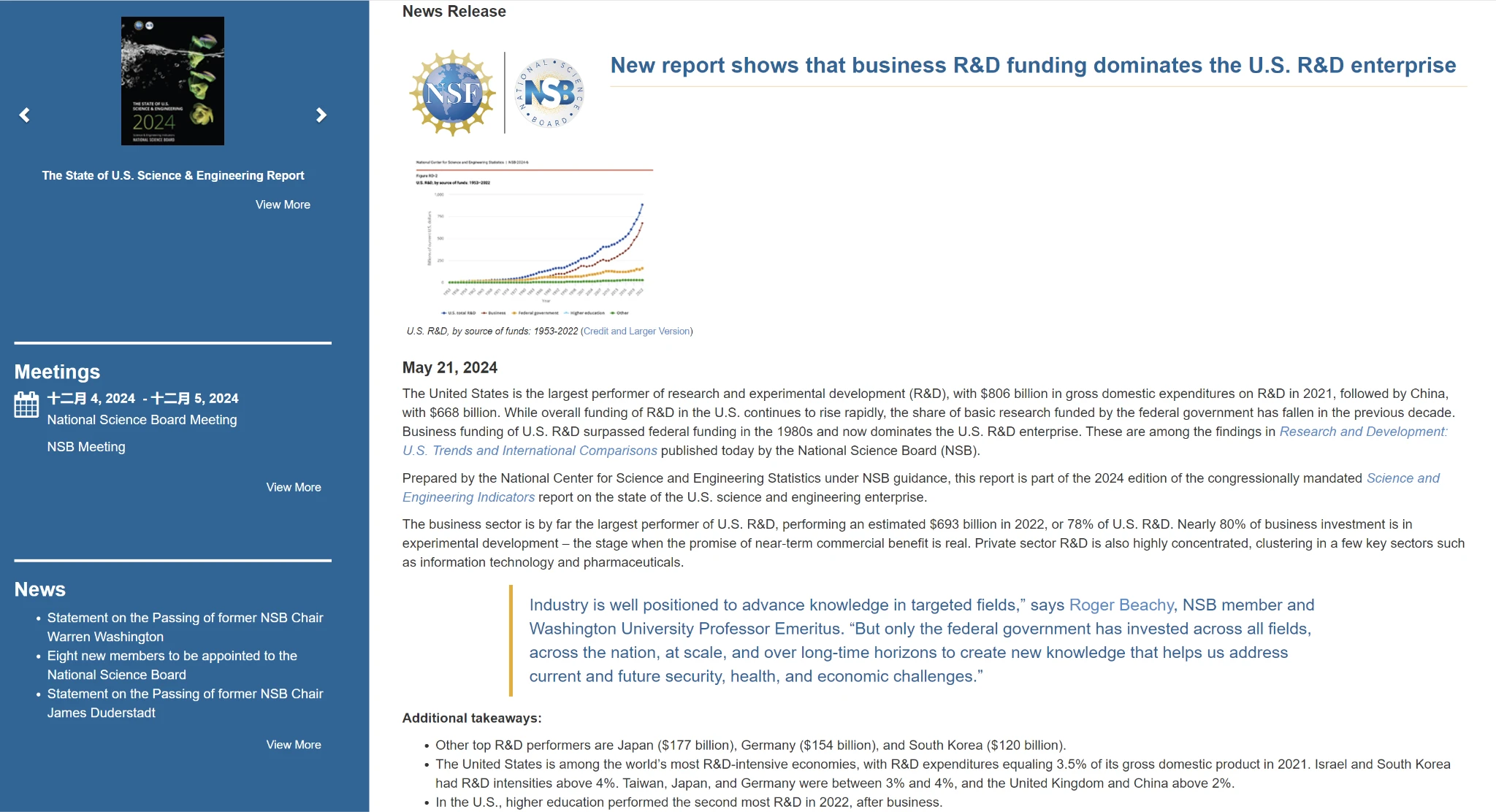

According to a 2024 report by the National Science Foundation (NSF) and the National Center for Science and Engineering Statistics (NCSES), the United States scientific research spending in 2023 is estimated to be US$710 billion, and RD spending in 2022 was close to US$700 billion, of which corporate RD dominated, with about 78% of RD investment coming from the private sector, especially in areas such as information technology and pharmaceuticals.

In 2021, in addition to China and the United States, the other countries that performed best in terms of research spending were Japan ($177 billion), Germany ($154 billion) and South Korea ($120 billion). In 2021, US RD spending was equivalent to 3.5% of GDP, Israel and South Korea had RD intensities of more than 4%, Taiwan, Japan and Germany were between 3% and 4%, and the United Kingdom and China were above 2%. In 2022, US higher education RD investment ranked second, second only to business. Funding for life science research by various institutions was the highest in the science and engineering fields, reaching $42 billion (44% of the total), mainly from the Department of Health and Human Services (data see extended link 1).

Image source: See extended link 1

Chinas RD expenditure will exceed RMB 3.3 trillion (approximately US$458.5 billion) in 2023, an increase of 8.1% year-on-year

. The investment in basic research was RMB 221.2 billion, an increase of 9.3%. Compared with the past, China has maintained a relatively high growth rate in recent years, especially in high-tech and basic scientific research, showing the driving force of the strategy of building a strong country in science and technology (data see extended link 2).

Comparison of research expenditure growth: Chinas research expenditure has grown rapidly, especially in the field of basic research, which shows the countrys determination to innovate in science and technology and its emphasis on high-end science and technology. Although the United States has a higher absolute amount, its growth rate is relatively stable, and it focuses on investing in areas with long-term technological advantages.

From the actual application of DeSci, it is currently more at the narrative stage of Meme, and it is difficult to directly promote the development of science and technology. Whether it is donations driven by narrative empathy or market flows brought about by speculative transactions, the existing economic scale is still far from enough to support the huge expenditure required for scientific research. Therefore, DeSci is still in the early stages of the market value dream. If DeSci wants to be truly implemented in the future, in addition to meeting regulatory requirements, it also needs to obtain the continued support of powerful and influential people.

2.2 DeSci’s real-life academic finance case: South Korea’s LK-99 room-temperature superconductivity incident

Image source: Taj Quantum – Taj Quantum official website

2023 is known as the Year of Room-Temperature Superconductivity mainly due to several studies claiming to have discovered room-temperature superconductors, which attracted widespread attention from the global scientific community. However, as subsequent investigations deepened, these findings were proven to have serious problems and even set off an academic scandal.

The beginning of the incident Ranga Dias, a physicist at the University of Rochester in New York, published a paper in the journal Nature, claiming to have discovered a material that can achieve superconductivity at room temperature. The discovery was initially seen as a major breakthrough, as the emergence of room-temperature superconductors could revolutionize technological development in the fields of energy transmission, medical devices, and electronic components. Typically, superconductors need to work at extremely low temperatures (below -196 degrees Celsius), and superconductors that can operate at room temperature have always been the goal pursued by the scientific community. However, Diass research has been questioned since its publication, especially since his academic reputation was controversial in 2020 due to similar research.

As early as 2020, Dias became famous for a paper on room-temperature superconductors, but the paper was retracted by Nature magazine two years later. Despite this, Dias published a similar study again in 2023, which attracted attention again. However, many of his peers accused him of manipulating data and even plagiarizing the content of his doctoral thesis. Several well-known media, including The Wall Street Journal and Science magazine, have launched investigations on him and exposed the problems in his research. The University of Rochester also launched multiple internal investigations into Dias, and eventually external experts confirmed that his paper had data reliability issues, which led to the revocation of his authority to manage laboratories and students. In November 2023, Nature magazine officially withdrew his latest research paper on room-temperature superconductors.

The inside story behind this scandal gradually surfaced. According to the investigation of the Nature magazine news team, members of Dias research team did not observe the key superconducting phenomenon Meissner effect in the experiment, but received the manuscript sent by Dias in a short period of time and were asked to cooperate in submitting it. These graduate students were puzzled by some experimental data in the paper, but under the authority and pressure of their supervisor, they did not publicly question these issues. Subsequently, more reviewers and experts expressed doubts about Dias experimental data and found that his data may have been tampered with.

While Dias’ first paper was being questioned, he claimed to have discovered room-temperature superconductivity in another material (a compound of lutetium and hydrogen, LuH). But the measurement data for this study was also full of problems, and many students pointed out that there were systematic errors in the experimental results, and they even thought they were deceiving themselves. Faced with increasing doubts, Dias still chose to push forward with the publication of the paper, but 8 of the 11 co-authors eventually decided to request a withdrawal.

This series of academic scandals not only dealt a serious blow to Diass reputation, but also affected the entire scientific research field. The career prospects of many young scientists have become uncertain due to their participation in these studies, and the trust of the academic community has also been damaged. Paul Canfield, a physicist at Iowa State University, said, This scandal has damaged the careers of young scientists, especially those in the field of superconductivity.

Meanwhile, another protagonist in the field of room-temperature superconductivity, the LK-99 team in South Korea, has been involved in a similar controversy. Although they claimed to have discovered a new room-temperature superconductor – PCPOSOS again in 2024, many in the scientific community have expressed doubts about the authenticity of their research. The data presented by the team at the academic conference was similar to that of the previous LK-99 research and lacked sufficient verification support.

Image source: Bloomberg

After the news of the breakthrough in superconductor technology was released, some Korean stocks related to superconductivity in the stock market attracted a large number of investors. Korean superconductor concept small-cap stocks such as Duksung Co. and Sunam Co. rose by 30% for the third consecutive trading day. Sunam Co. has soared about 260% in the past six trading days, and Duksung has risen by 170%. Mobiis Co. rose 30% on Thursday, while Shinsung Delta Tech Co. briefly rose 21% to a record high.

Later in the incident, the Korean Society of Superconductors Verification Committee stated that LK-99 did not show the Meissner effect and could not be proved to be a superconductor. This news caused fluctuations in Chinese superconducting concept stocks, with the share prices of Fasten and Zhongfu Industrial falling sharply. The former did not get involved in superconducting technology, while the latter only provided site and equipment support. At the same time, the share price of American Superconductor fell by 29%, and Sumitomo Electric Industries also declined due to poor performance.

3. Overview of DeSci Ecosystem

3.1 BIO Protocol

BIO Protocol, which has received investment from Binance Labs, has been named the on-chain scientific version of Y Combinator, which is used to incubate early-stage companies and provide funds and resources to accelerate project development. According to the content of TechFlow, the main components include BioDAO, curation system, liquidity and IP, and incentive mechanism.

Image source: TechFlow – Interpretation of BIO Protocol – BioDAO

$VITA (VitaDAO): Founded in 2021, VitaDAO focuses on funding and promoting early longevity science research with the goal of extending human healthy life span and is managed by $VITA holders;

$RSC (ResearchCoin): used to reward users’ contributions on the ResearchHub platform. It aims to accelerate scientific research by incentivizing contributions within the community. Anyone can earn $RSC by sharing, curating, and discussing academic science within ResearchHub.

$ATH(AthenaDAO): AthenaDAO is a decentralized community of researchers, funders, and advocates dedicated to advancing women’s health research, education, and funding;

$GROW (ValleyDAO): A decentralized organization focusing on anti-aging drugs and life longevity projects.

3.2 Pump Science

Solana Ecosystem DeSci Platform Molecule DAO is a Meme launch platform launched at the Solana Breakpoint 2024 conference. Pump.science will issue Meme tokens representing drugs on Pump.fun. Its related concept tokens are:

$RIF: Rifampicin (rifampicin), according to the official website: Rifampicin is an antibiotic that has attracted attention for its surprising effects on aging. In microorganisms such as Caenorhabditis elegans (a model organism often used in aging research), rifampicin has been shown to activate cells natural defense mechanisms to resist stress and damage. Imagine it as a kind of cell coach, encouraging cells to stay healthy and resilient by protecting them from harmful oxidative stress and maintaining the quality of proteins within the cells. These protective effects help worms live longer and healthier.

$URO: Urolithin A, according to the official website: This is a compound that your body produces when you eat foods rich in ellagitannins, such as pomegranates. What makes Urolithin A special is its ability to do a spring cleaning for your cells. It helps clear out old, dysfunctional mitochondria (the energy factories of cells) so that fresh, healthy mitochondria can thrive. This process is called mitophagy, and studies have shown that it can extend the lifespan of C. elegans because it makes cells more efficient and energetic.

3.3 Donation Concept

$Scihub: An unofficial token donated by @0x AA_Science, which aims to support open-source scientific research paper websites. The token direction comes from the Sci-Hub shadow library and is only a community Meme token. Sci-Hub is a non-profit, non-governmental academic website that provides free academic paper downloads. In addition to resources such as Google Scholar, Sci-Hub, LibGen and PubMed, it also integrates a series of other Chinese and English academic resources that are publicly available on the Internet. It can search and download domestic and foreign literature, patents, books and other academic materials for free in one stop.

3.4 DeSci Quantum Meme

$ANTI- Antitoken and $PRO – Protoken: They are a pair of tokens that express support and opposition to Meme Token respectively. They were created by algorithm engineer and mathematical physics expert @sshmatrix_. 1 $ANTI= 1 $PRO and they rise and fall together.

4. How long can the elixir on the chain last?

DeSci is not a concept that has only appeared this year. Its sudden popularity today is mainly due to the combined influence of three factors: Binance Labs investing in BIO Protocol, CZ and Vitalik discussing DeSci together, and a16z leading the investment in the DeSci project AmionChain. The market also needs the impetus of pulling the market is justice. Looking at the current market, DeSci is still driven by Meme as a whole, but its fundamental attributes are different from other Meme logics.

-

Different from other memes: Compared with memes of different directions such as AI, zoos, and art, DeSci needs a strong and influential person to promote the product. It may be difficult to support it by relying solely on traffic within the circle, and it needs real people with scientific research attributes outside the circle;

-

The valuation of leading projects needs to continue to rise: Currently, the DeSci track has not yet produced a leading project with a market value of 1 billion. Compared with Meme in other tracks, it still has greater market potential. Mainstream centralized exchanges have not yet listed related tokens, and there has been no large-scale financing at the primary level.

-

DeSci may have more potential to break out of the circle: the current PVP market is highly competitive, but if an outsider with a scientist background uses DeScis narrative to donate or raise funds, there will be more room for development. Similar to $PEOPLE, which crowdfunded the purchase of the rare original version of the U.S. Constitution, and the NFT of Everyday: The First 5000 Days auctioned at a high price of $69.34 million at Christies, Musk brought $DOGE to the moon. DeSci and these cases all show similar core logic, and the marketing effect is comparable to Jia Yuetings plan to build a car in the cryptocurrency circle with a PPT.

ลิงค์ส่วนขยาย:

(1) https://www.nsf.gov/nsb/news/news_summ.jsp?cntn_id=309719org=NSB

(2) https://english.www.gov.cn/news/202403/05/content_WS65e6ff4dc6d0868f4e8e4b66.html

This article is sourced from the internet: DeSci: How to use on-chain Meme to challenge the existing scientific research system?

Animoca Brands, a company dedicated to promoting games and digital property rights in the open metaverse , announced today that it has completed a $10 million financing for its Mocaverse, which has previously raised $31.88 million in financing (see the announcement on December 8, 2023 for details ). The funds raised will be used to build an interoperable infrastructure technology stack for consumer adoption of cryptocurrencies and build a large user base ecosystem. At the same time, the investment comes with a free warrant for the utility token MOCA, which has a fully diluted value (FDV) of $1 billion. Participants in this round of financing include OKX Ventures, CMCC Global, Hong Shan (formerly Sequoia China), Republic Crypto, Decima Fund, Kingsway Capital, etc. Their participation will help Mocaverse expand its operating…