Coincheck will be listed on Nasdaq. Will the Trump administration give the green light to more crypto companies IPOs?

ผู้เขียนต้นฉบับ: Weilin, PANews

The traditional capital markets in the United States are about to welcome a new การเข้ารหัสลับ visitor.

On November 13, Japanese brokerage and crypto exchange operator Monex Group announced that the registration statement (Form F-4) submitted by its subsidiary Coincheck Group BV (CCG) to the U.S. Securities and แลกเปลี่ยน Commission (SEC) became effective on November 12, which means that Coincheck will be listed on Nasdaq as early as December 10 through the SPAC form, becoming the first Japanese crypto exchange to be listed on Nasdaq.

This news has attracted widespread market attention. Under the Trump administration, as the regulatory framework is expected to be clearer, will the IPO process of crypto companies be accelerated? ARK Invest is optimistic in its latest newsletter that Trumps return to the White House may open the door to IPOs for digital asset companies and bring a clear regulatory environment. ARK Invest pointed out: It may include reopening the IPO window for digital asset companies such as Circle and Kraken.

Amid expectations of policy changes, there are reports that investment bankers from JPMorgan Chase, Goldman Sachs and Morgan Stanley have begun contacting crypto companies, showing that investment banks interest in the crypto field is gradually increasing.

The company is expected to be listed on Nasdaq as early as December 10.

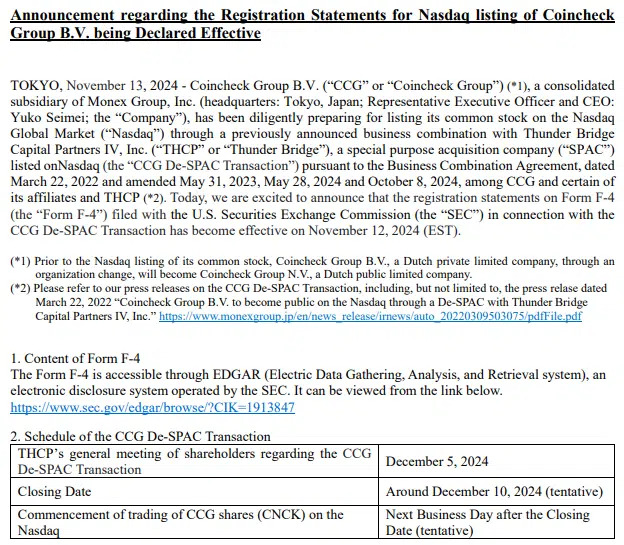

According to the published schedule, Coinchecks IPO will be achieved through a merger with Thunder Bridge Capital Partners (THCP). The special acquisition purpose company (SPAC) Thunder Bridge Capital Partners IV (THCP) will hold a shareholders meeting on December 5, and the merger is expected to be implemented around the 10th of the same month. Coincheck Group BV (CCG) shares (ticker: CNCK) are expected to start การค้าขาย on Nasdaq on the next trading day after the merger is completed.

As early as March 2022, Coincheck announced that it would merge with THCP to achieve an IPO, which was originally planned to be completed in the second half of that year, but then underwent three contract changes in May 2023, May and October 2024, and finally obtained SEC approval.

Founded in 2012, Japanese crypto exchange Coincheck began offering cryptocurrency trading services in 2014 and became the leading exchange in the Japanese crypto market in 2017. In January 2018, Coincheck was hacked, resulting in the theft of $530 million worth of NEM (XEM) tokens, one of the largest hacker thefts in crypto history. The exchange had to compensate affected users, which had a significant financial impact.

In 2018, Japanese brokerage Monex Group acquired Coincheck, reorganized the company, and strengthened its security in an effort to regain user trust.

On the X platform, HARA, CFO of Japanese IoT crypto project Jasmy, said, “Coincheck’s listing on the Nasdaq in the United States is an announcement with great potential, which can stimulate the trading of cryptocurrencies through the capital of the stock market and become a place to create many entrepreneurs.”

The Trump administration may give the green light to crypto companies IPOs, and investment banks are approaching crypto companies

In the United States, several cryptocurrency mining companies and well-known cryptocurrency exchange Coinbase have been listed on stock exchanges. This has set a precedent for crypto companies to transform into publicly traded companies, but there are still some crypto companies that are being dragged down by the SEC.

The most turbulent listing is Circle, the issuer of the USDC stablecoin, which began its listing journey in 2021, but ultimately failed in the bull market. It is reported that Circle confidentially submitted an IPO application in January this year. However, according to a report in Barrons in June, the SEC expressed reservations about Circles core products, which may delay or affect the companys listing process. The stablecoin issuer also moved its headquarters to the United States in May, a move that was seen as an effort to boost market confidence. However, according to Barrons, the SEC expressed concerns about the risks of stablecoins. The regulator remains cautious about these assets, especially as their market continues to grow.

Another major cryptocurrency exchange, Kraken, is also preparing for an IPO. According to Bloomberg in June, the company raised $100 million in a pre-IPO funding round, indicating that investors are confident in its future. However, Krakens listing will still largely depend on regulatory support and legislative progress.

The coming to power of the new US government is expected to bring about a shift in crypto regulatory policy.

Jay Clayton, former chairman of the U.S. Securities and Exchange Commission, recently pointed out that the U.S. Congress may pass legislation to regulate cryptocurrencies after Trump takes office. Clayton said he favors relaxing regulatory burdens to encourage companies to go public, which foreshadows the broad changes in public policy that the crypto industry is currently looking forward to, as they have spent heavily to influence this months presidential election.

On November 13, ARK Invest expressed optimism in its latest newsletter that Trump’s return to the White House could allow digital asset companies such as Circle and Kraken to go public and achieve regulatory clarity. “Possibilities include reopening the IPO window for digital asset companies such as Circle and Kraken,” ARK Invest wrote. The company noted that potential legislative reforms, such as the Financial Innovation and Technology Act of the 21st Century (FIT21), could provide regulatory clarity for stablecoins and digital assets. In addition, the asset management company expects the end of SEC Chairman Gary Gensler’s “enforcement regulation” approach, which could create a more competitive environment for cryptocurrency companies.

Some industry insiders have also expressed their views on the possibility of an IPO window. Matthew Kimmell, an analyst at crypto asset management company CoinShares, pointed out that the Trump administration may nominate leaders who are more favorable to crypto assets based on its pro-digital asset rhetoric, which will affect the prospects of cryptocurrency IPOs, especially changes in the SEC leadership and the regulatory framework it establishes. Haseeb Qureshi, managing partner of Dragonfly Capital, a San Francisco cryptocurrency venture capital fund, said that the post-election environment should be better for cryptocurrency IPOs.

According to The Information, as the IPO prospects of the crypto industry are promising after the US presidential election, investment bankers from JPMorgan Chase, Goldman Sachs and Morgan Stanley have begun meeting with crypto companies. This is a sharp shift from the past two years, when many Wall Street banks considered crypto companies too risky and were reluctant to take them as clients.

Previously, there were rumors in the industry that companies such as Circle Internet Financial, Kraken, Fireblocks, Chainalysis and eToro might go public in the next one or two years. Although these companies have been rumored to be going public for months, there has been no substantial progress. Investment bank consultants said that a robust plan for crypto companies to go public in 2025 or 2026 is gradually taking shape.

Currently, the list of potential crypto IPOs includes crypto custodian Anchorage Digital, blockchain and staking infrastructure company Blockdaemon, crypto custodian BitGo, crypto data analysis company Chainalysis, stablecoin issuer Circle, cryptocurrency brokerage company FalconX, crypto custody technology provider Fireblocks, crypto exchange Kraken, crypto wallet provider Ledger, and Bitcoin financial services company NYDIG.

This article is sourced from the internet: Coincheck will be listed on Nasdaq. Will the Trump administration give the green light to more crypto companies IPOs?

Guest message: Web3 is decentralized, open and fair, and is an industry with both opportunities and risks. OKX has always been one of the best exchanges in the industry, and the OKX wallet is my favorite multi-chain wallet. It is really rare that OKX can develop such a wallet product while doing a good job in centralized exchange business, bringing convenience to users! 0xSun , a veteran player on the blockchain, an Alpha trader, and a 100x Golden Dog discoverer. He first came into contact with blockchain during his graduate studies, and the opportunity to enter the circle came from the meme craze. During the last bull market, he quickly earned several times the profit by trading memes. Not only that, he also earned nearly 200e on the Monkey Land…