BitMEX Alpha: กลยุทธ์ตัวเลือกที่นักลงทุน Bitcoin ทุกคนควรรู้

ผู้เขียนต้นฉบับ: BitMEX

Welcome back to our weekly options alpha series. That’s right — Bitcoin has officially broken out to a new all-time high, and many of you are probably planning your next trade to ride this giant pump.

In this article, we’ll share how options can help you better manage risk and give you the tools to outperform in a bull market. Specifically, we’ll share three scenarios on how to strategically use options to take advantage of Bitcoin’s continued momentum. We’ll dive into specific setups, allowing you to:

-

Buy on dips,

-

Betting on a big rise, and

-

Profit from range trading.

Whether you want to enter the market with less risk, aim for explosive gains, or trade within a price range, don’t miss these options strategies that will help you trade smarter and more nimbly in the bull market.

Scenario 1: Buying a pullback using a put option

If you are long-term bullish on Bitcoin, you might want to buy every pullback, but that’s easier said than done — setting limit orders is not perfect. Imagine your buy order is not filled because it is only $0.01 away, and then Bitcoin starts to rise — we are sure many of you have experienced this.

Strategy 1: Selling put options to optimize entry strategy

One way to improve the above problem is to sell a put option at a specific strike price below the current market price. This approach is smarter than simply waiting for the price to fall for the following reasons:

1. Earn Premium: When you sell a put option, you receive a premium, which is a guaranteed profit if the Bitcoin price does not reach the strike price before expiration.

2. Set a target price: If the price of Bitcoin falls to or below the strike price you selected, you are obligated to buy the asset at that price, which is actually executing a buy pullback strategy while also earning additional income from the premium.

3. Downside protection through premiums: The premiums received provide some cushion against potential losses, making this strategy less risky than outright spot buying.

ตัวอย่างเช่น:

-

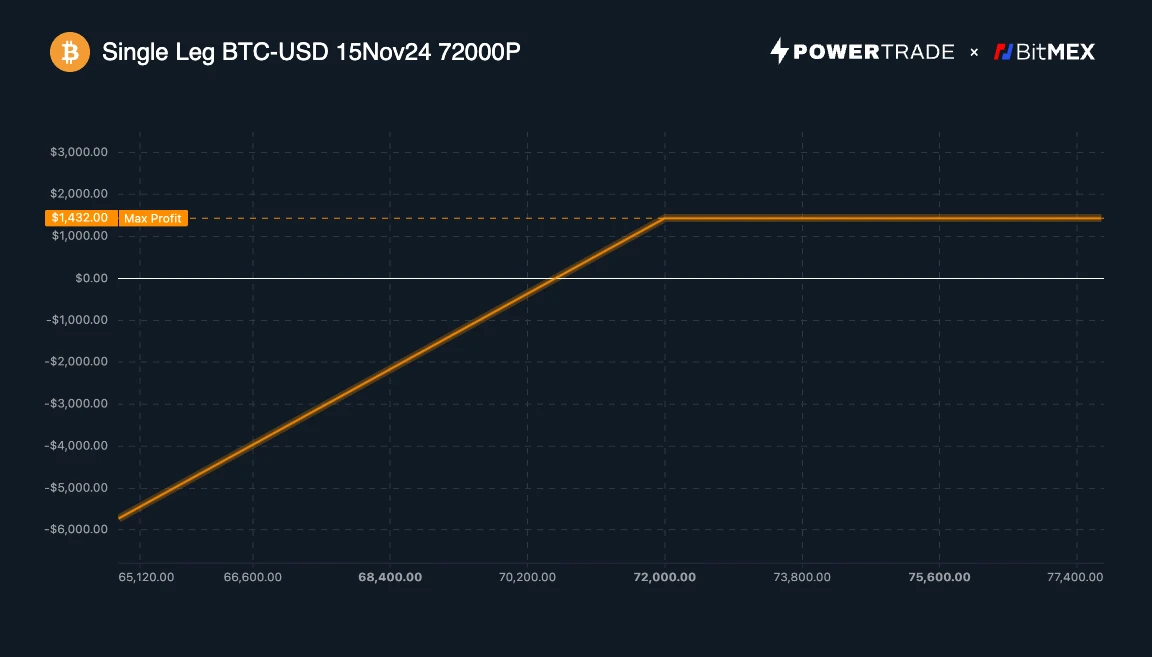

Assume that Bitcoin is currently trading at $75,000. You sell a put option with a strike price of $72,000 and an expiration date of November 15th.

-

If Bitcoin falls below $72,000 before expiration, your put option will be exercised on the expiration date, and you will actually be obligated to buy Bitcoin at the strike price of $72,000. If Bitcoin does not fall below $72,000 at expiration, although you did not buy any Bitcoin, you collected a substantial premium of $1,432.

Alternative strategy: Use risk reversal strategy

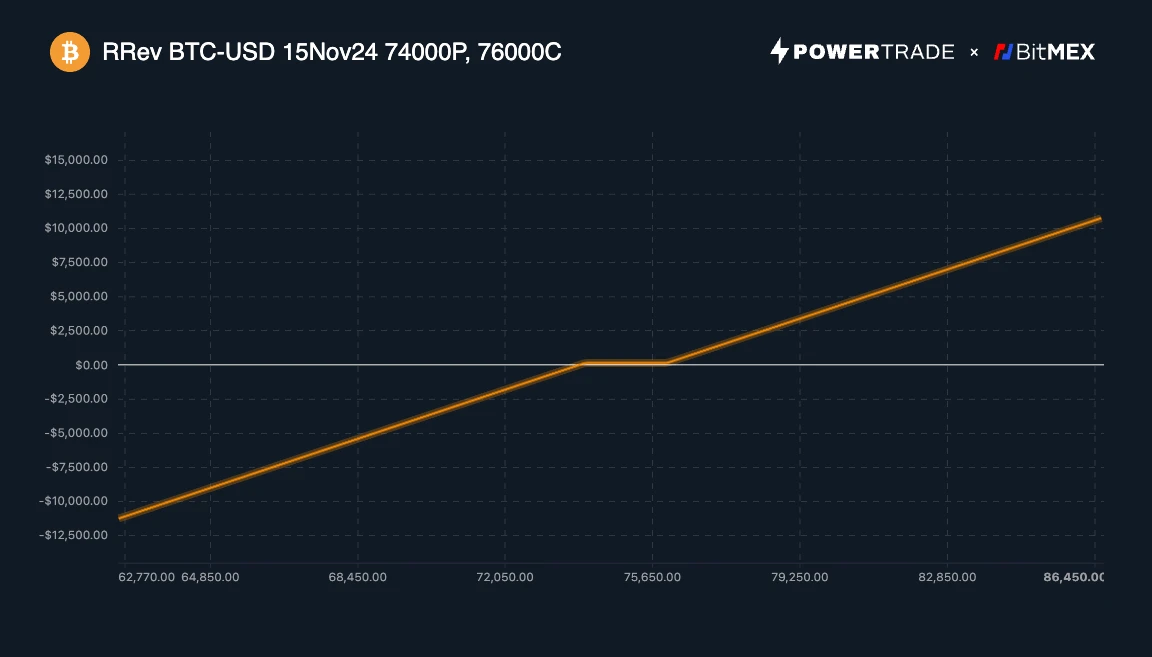

If you are willing to take on more risk for the potential gain, you can consider a risk reversal strategy, which involves simultaneously selling a put option and buying a call option with a higher strike price. Here’s how this strategy works:

-

Downside Buffer: Selling a put option generates premium income that helps cushion against minor price declines.

-

Upside Participation: The premium received from selling a put option can offset the cost of buying a call option, allowing you to participate in the upward trend at no additional cost.

-

Risk-reward balance: This approach provides you with an ideal entry price while giving you the opportunity to profit from price increases, especially when a rebound after a minor pullback is expected.

With the risk reversal strategy, traders can profit from both minor pullbacks and bullish momentum at the same time, which makes it a smart choice during a volatile bull market.

Scenario 2: Betting on a big rally – Betting on Bitcoin to $100,000 using out-of-the-money (OTM) call options

Are you sure Bitcoin can reach milestones like $100,000 by the end of the year? While buying spot directly at current prices is risky and requires a lot of capital, out-of-the-money (OTM) call options offer an attractive alternative for betting on a significant rise.

Solution: Bet on a big gain with out-of-the-money calls

1. Low-cost entry: OTM call options have a strike price higher than the current market price, making them cheaper than in-the-money (ATM) calls or spot purchases. This means you can get a potentially large upside gain with less cost.

2. Controllable risk: The maximum loss of this strategy is limited to the option premium paid, which is suitable for traders who want to limit downside risk.

3. Asymmetric returns: The more the Bitcoin price exceeds the strike price, the more profitable the option becomes, which makes out-of-the-money call options highly leveraged in rising markets.

ตัวอย่างเช่น:

-

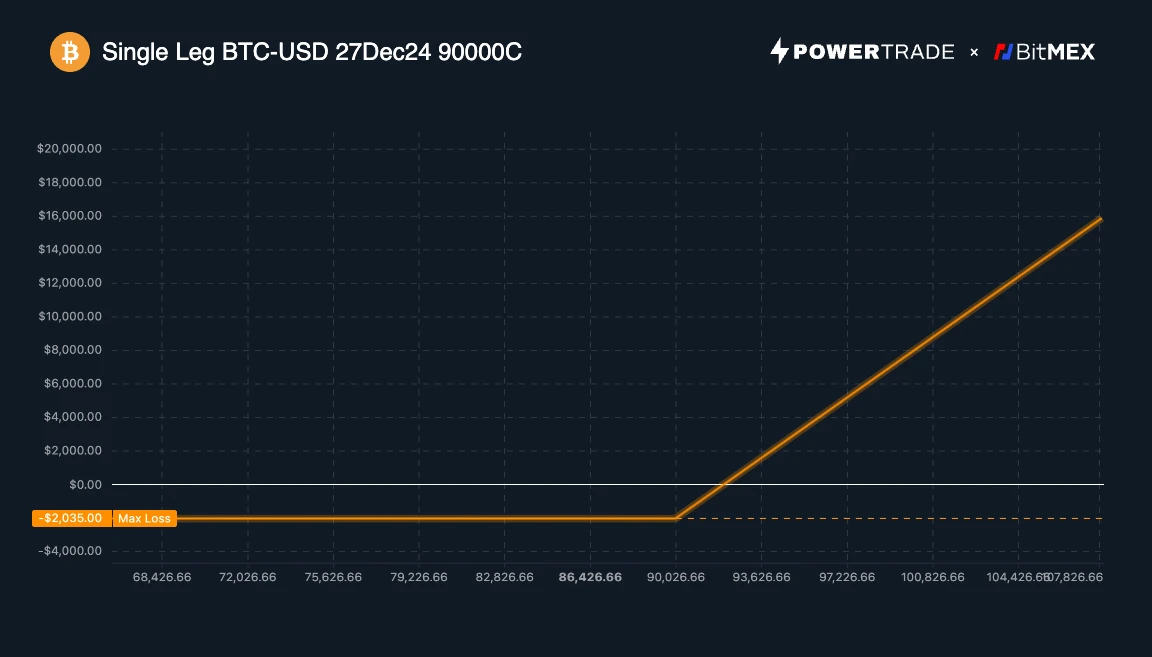

Assume that Bitcoin is currently trading at $75,000. You purchase an out-of-the-money call option with a strike price of $90,000 and an expiration date of December.

-

This call option will generate a significant profit if Bitcoin reaches $100,000 by the expiration date. If Bitcoin fails to reach the target price, your loss is limited to the premium you paid to purchase the option.

In a bull market, out-of-the-money call options are a popular strategy for capturing big upside moves, especially when probability assessments show a reasonable chance of reaching high prices. In addition, this approach exploits the asymmetric payoff structure unique to options.

Scenario 3: Swing Trading with Vertical Spreads

Bitcoins bull run doesnt always go in a straight line; it often sees pullbacks and consolidations. During these periods, swing trading is a smart move, and vertical spreads can be a powerful options strategy.

Solution: Use vertical spreads to make swings

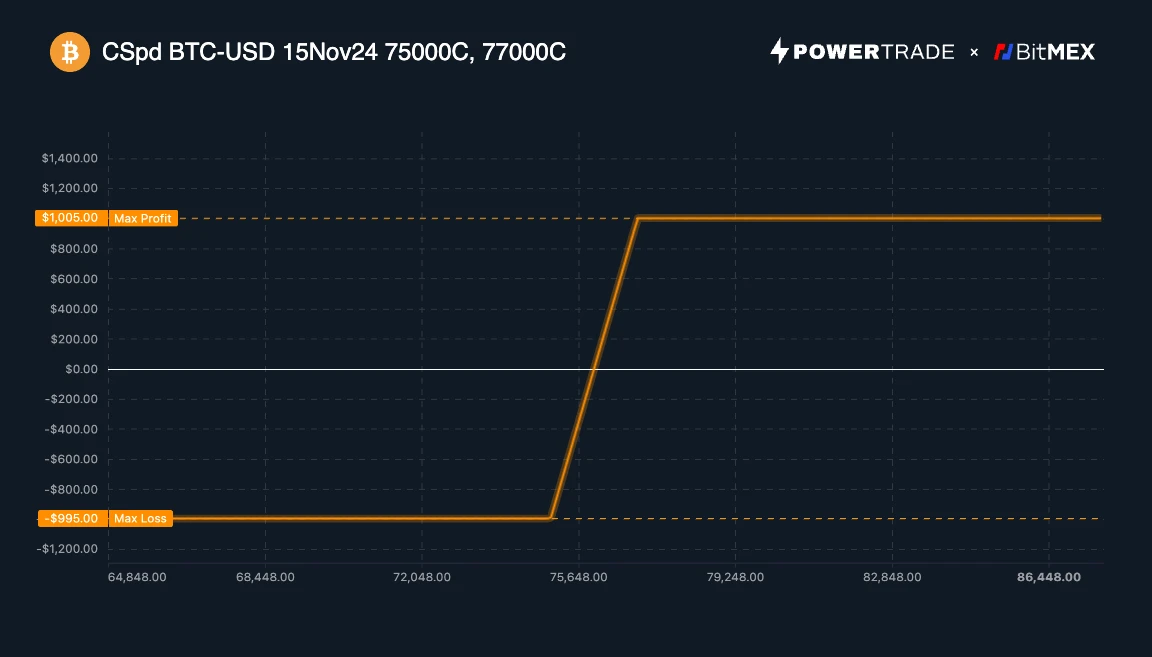

A vertical spread is buying and selling call or put options with different strike prices on the same expiration date. This strategy is particularly useful when you expect Bitcoin to rise slowly. Here are its benefits for swing traders:

1. Reduced costs and risks: Vertical spreads require less capital than buying individual options directly. For example, a call spread (buying a lower strike call option and selling a higher strike call option) provides limited risk call exposure with a lower premium.

2. Profit from volatility: In a range-bound market, when Bitcoin is expected to fluctuate within a specific price range, vertical spreads can help you capture gains without precise timing or taking excessive risk.

3. Predictable risk-reward ratio: Since the maximum profit and loss are determined at the beginning of the trade, traders can make precisely calculated bets based on the expected price range.

ตัวอย่างเช่น:

-

Let’s say Bitcoin is currently trading at $75,000 and you expect it to rise to between $77,000 and $78,000.

-

A bull call spread strategy might involve buying a call option with a strike price of $76,000 and simultaneously selling a call option with a strike price of $78,000.

-

If Bitcoin does rise, this spread strategy allows you to profit from the difference in strike price with much less risk than a full position.

Vertical spreads are perfect for slow bull markets as they allow traders to precisely manage risk and reward ratios and are ideal for range trading.

Conclusion: Strategic Advantages of Options in a Bull ตลาด

In summary, options offer traders a sophisticated set of tools to effectively play the การเข้ารหัสลับ bull run:

-

Buy the dip: Selling put options or using a risk reversal strategy enables traders to profit from a pullback or secure an ideal entry point.

-

Capture Big Moves: Out-of-the-money call options are ideal for traders who have a strong conviction in a large price move, offering significant upside potential while limiting downside risk.

-

Swing Trading: Vertical spreads offer a cost-effective way to trade within a desired price range, reducing risk in range-bound markets.

Each of these strategies can help traders refine their approach to bull markets, managing risk while maximizing gains. As you consider your next move in the cryptocurrency market, options trading may be the edge you need to confidently ride market volatility.

This article is sourced from the internet: BitMEX Alpha: The options strategy every Bitcoin bull needs to know

Original author: TechFlow introduction State channels (Lightning Network), side chains (Stacks), Rollups (BitVM), UTXO + client verification (RGB++ Layer)… Who will stand out and truly unite the forces of the Bitcoin ecosystem, achieve scalability, interoperability and programmability, and introduce innovative narratives and significant increments to the Bitcoin ecosystem? Overcapacity in infrastructure is a community voice that cannot be ignored in this cycle. When supply > demand, we can see that both new public chains and L2 are doing their best to avoid becoming ghost towns, but in the Bitcoin ecosystem, we see a completely different picture: Since the Everyone Inscriptions craze, the market has seen the communitys enthusiasm for participating in the Bitcoin ecosystem, but due to the scalability limitations of Bitcoin, the Bitcoin ecosystem urgently needs a thorough infrastructure…