การตีความรายงาน Binance Meme: ปัจจัยมหภาคและข้อเสนอคุณค่าเบื้องหลังการเติบโตของมีม

ผู้เขียนต้นฉบับ: TechFlow

Even a powerful company like Binance cannot ignore the rise of เหรียญมีม.

Creating a Meme Pandemic, How Did This Super Cycle Come About?

Recently, Binance Research released a report titled Understanding the Rise of Meme Coins , which comprehensively analyzed the rise of Meme, the macroeconomic factors behind it, its value proposition, and its potential impact on the การเข้ารหัสลับcurrency industry.

TechFlow has compiled and interpreted the report to help everyone quickly understand the key points.

ประเด็นที่สำคัญ

Big picture: Global money supply expansion and investment behavior

Against the backdrop of a rapid expansion of global money supply, high-risk investments have become more attractive. This phenomenon can be divided into the following levels:

Most of the money went into traditional assets, such as the SP 500 and real estate. Some of the money went into major cryptocurrencies, such as Bitcoin (BTC) and Ethereum (ETH).

At the far end of the risk spectrum, memecoins emerge as high-risk, high-return investment vehicles, attracting some of the excess capital.

Micro-environment: Retail investors seek new ways to grow their wealth

Many retail investors are exploring new avenues for wealth creation, reflecting a changing view of traditional finance.

Meme Coin seeks to embody these principles by reducing internal advantages and increasing equal accessibility to investors around the world.

Trend: Financialization of Internet Culture

Memes have demonstrated virality and community-driven appeal since the early days of the internet, a phenomenon that is now extending to the financial sector through crypto, enabling the financialization of memes.

Inspiration: Take the essence

Key features such as fair launch and low circulation token economics have been successfully demonstrated by well-known meme coins; these features are worthy of consideration for any project planning a future token launch.

Meme Macro Data

What does the meme represent? The other side of the industry that has always existed: a greater focus on financial profits rather than technological progress.

-

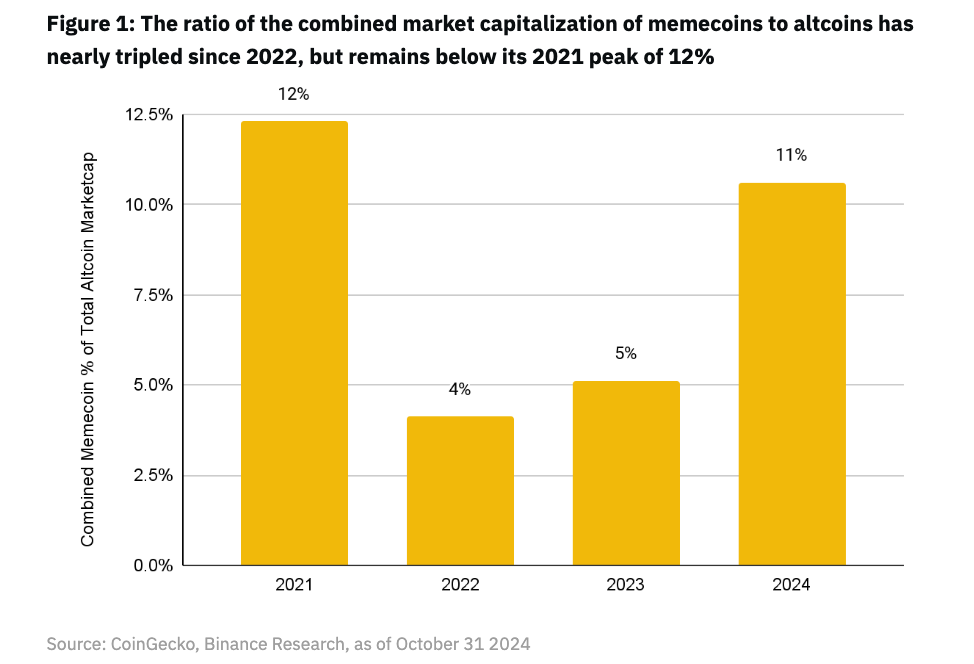

Since 2022, memecoins’ share of the total market capitalization (excluding BTC, ETH, and stablecoins) has increased from 4% to 11% in 2024.

-

This ratio is still lower than the peak in 2021, when the market capitalizations of $DOGE and $SHIB reached $80 billion and $39 billion, respectively.

-

From 2022 to 2024, the market capitalization share of memecoins almost tripled.

Meme’s global economic context: massive money printing and young people’s financial nihilism

Fiat money printing, global money supply increases

-

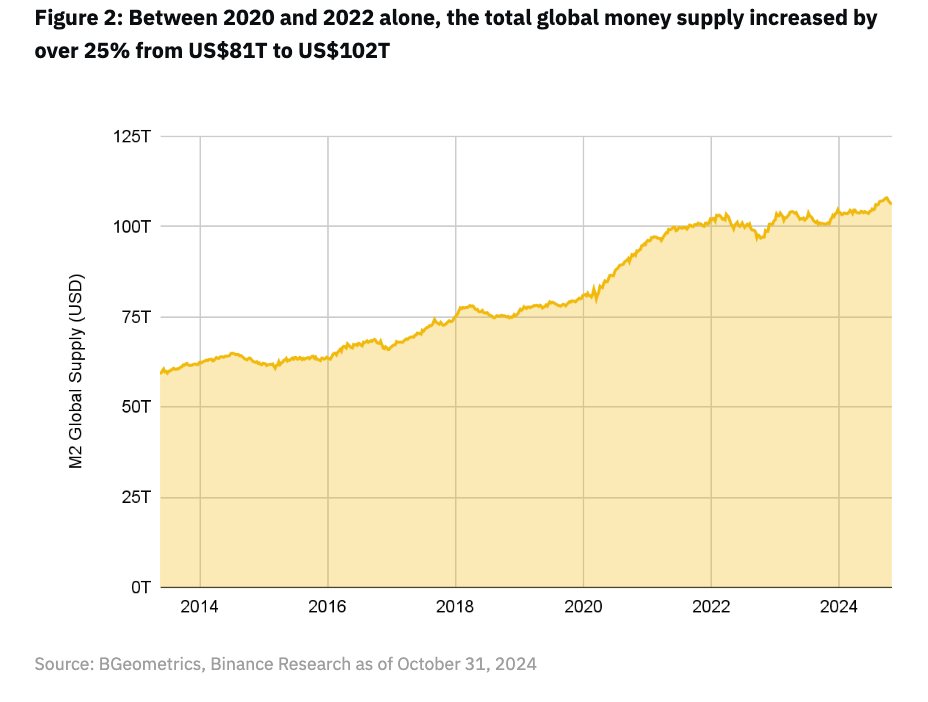

During the 2020 coronavirus crisis, central banks around the world increased fiat money supply at an unprecedented rate.

-

Figure 2 shows that between 2020 and 2022, the total global money supply increased from US$81 trillion to US$102 trillion, an increase of more than 25%.

Inflation and rising commodity prices

-

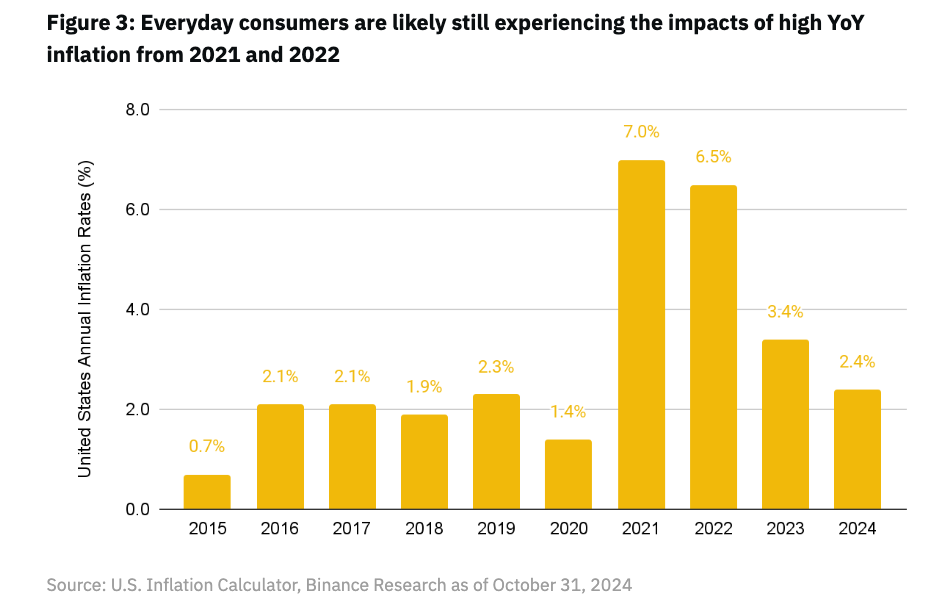

The US inflation rate reached 7% in 2021 and 6.5% in 2022.

-

Faced with currency depreciation, rational actors put money into assets that are perceived to have long-term value.

-

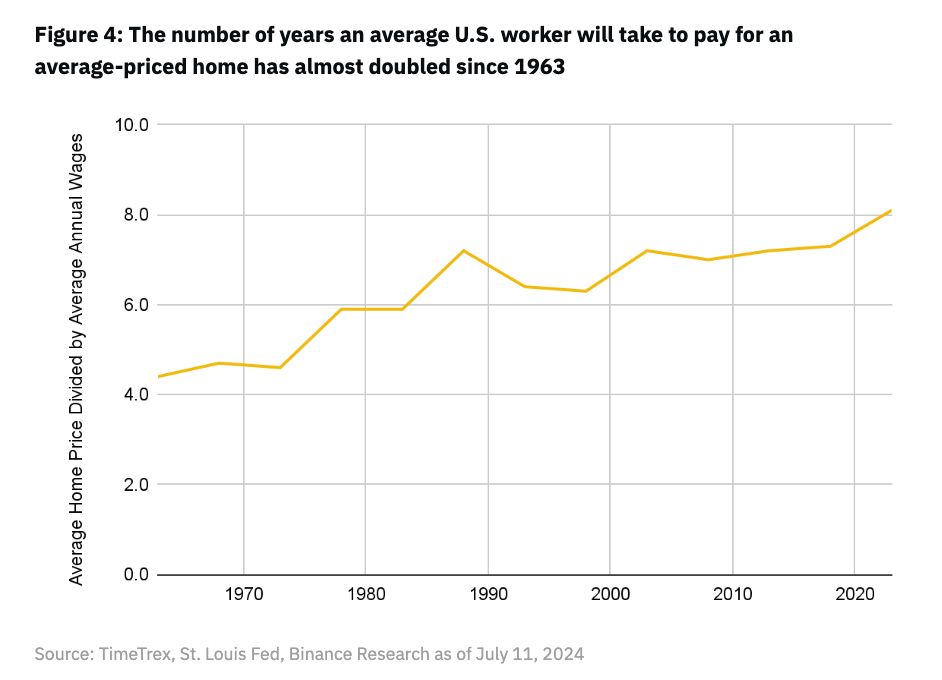

Wage growth has not been able to keep up with the rise in house prices. Figure 4 shows that the average number of wage years required to buy an average-priced home has nearly doubled from 4.4 years in 1963 to 8.1 years in 2021.

The attitude of the younger generation: financial nihilism

-

The macroeconomic situation has put pressure on the younger generation. Young people have lost confidence in the traditional financial system, which is particularly evident in the cryptocurrency market.

-

94% of cryptocurrency buyers are millennials and Generation Z, aged between 18-40.

-

Key Event: The 2021 GameStop short squeeze reflected young investors’ skepticism of traditional financial structures.

Meme coin value proposition: no utility, but attractive

Meme coin เด็ดขาดnition: Based on internet culture, memes, or popular trends; usually has no clear utility or intrinsic value.

-

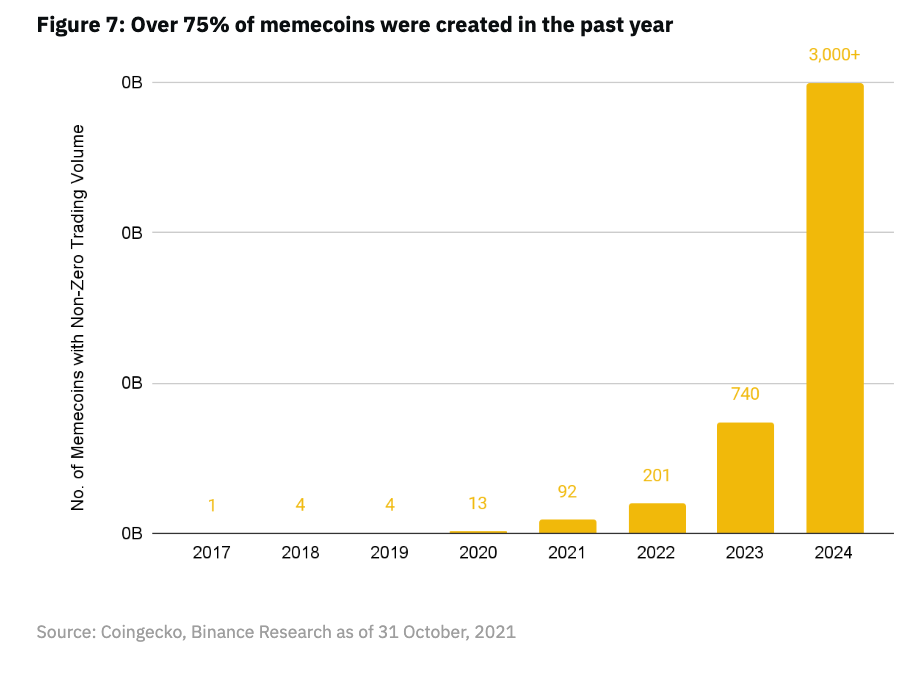

The number of memecoins has surged since 2020. 75% of memecoins were created in the past year.

Alternative attraction: It represents a newer, fairer and more people-friendly wealth creation opportunity.

-

There is no pre-mine, team allocation, or venture capital allocation.

-

All tokens are equally available to all participants at the time of issuance.

-

There are usually simple, easy-to-understand narratives, making it easier for ordinary investors to understand and participate.

-

Driven largely by investor sentiment and group psychology.

Risk Considerations

A life-threatening situation, but control remains unchanged

-

97% of memecoins have failed. Only a few memecoin projects survive and remain relevant in the long term.

-

Cabals and rug pulls are everywhere, and you could be “exit liquidity”.

-

Low liquidity can lead to sharp price swings and difficulty exiting investments.

ตลาด saturation and stagnant innovation

-

New projects may have difficulty gaining attention and investment, or attention span may be limited

-

The memecoin market may be saturated. Its prevalence may divert attention and resources from truly innovative projects, affecting the long-term development and innovation of the entire cryptocurrency industry.

Outlook: โทเค็นized Software Business vs. Tokenized Concept

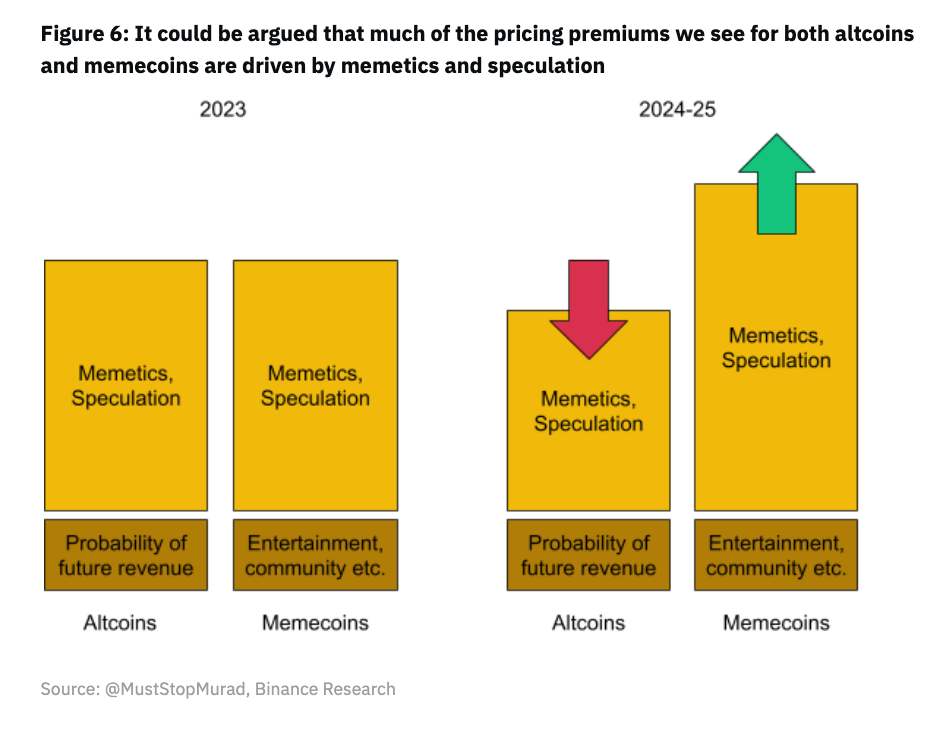

Altcoins vs. Memes

-

We can describe technology-driven altcoins as tokenized on-chain software businesses, and memecoins as tokenized ideas and narratives.

-

In the long run, the most successful altcoins will need to create and maintain useful, well-differentiated software products with real market fit.

-

The most successful memecoins will likely need to create and maintain differentiated, unique narratives and ideas.

Win the users, win the world

-

Memecoin demonstrates that there is significant retail demand for tokens that are fairly issued and open to all blockchain participants from day one.

-

The brand and connections that established VCs offer (acquired through private token sales) may be attractive to new projects, but it will be retail participants who ultimately make up any product’s user base.

-

Giving retail participants the opportunity to invest in a project from the early stages and grow with the team is critical to fostering a strong, loyal community around any crypto asset.

Globalization of price discovery

-

The rise of memecoins demonstrates that tokens issued in this way can reach market caps in the millions or even billions through organic price discovery driven by the borderless, permissionless nature of decentralized markets.

-

The rise of memecoins is an exciting new trend that at the very least demonstrates that blockchain technology’s ability to unite individuals on a global scale and foster organic communities around tokenized assets appears to be stronger than ever.

This article is sourced from the internet: Interpreting the Binance Meme Report: Macro Factors and Value Propositions Behind the Rise of Memes

Hosts: Fraokh; Tyler; Mando; @FOMOHOUR Guest: Murad Mahmudov Original translation: zhouzhou, BlockBeats Editors Note: In this article, Murad shares how he entered the cryptocurrency field and gradually formed his own Meme investment thesis. He discussed how to choose Meme, why he thinks Meme launched in 2023 will be better, and how he tested and verified his investment strategy. Murad emphasized the connection between NFT and Meme, and believes that Meme will have huge room for growth in 2025, and put forward the view that belief is more important than short-term trading. TL;DR: Murads journey into crypto: He came into contact with crypto when he was studying in China, and he believed that 2025 would be a year of great opportunities in the crypto field, especially Meme. Meme is, to some…