การแข่งขันของ Stablecoin: USDe สามารถท้าทายอำนาจครอบงำของ USDT ของ Tether ได้หรือไม่?

The rapid growth of Ethena and its flagship USDe stablecoin is one of the most eye-catching events in the DeFi field in recent times. At the same time, due to its cooperation with BlackRock and various influences, in just a few months, the TVL of USDe has exceeded 3 billion US dollars, a growth rate rarely seen in the history of stablecoins. Ethena initially focused on creating a safe and reliable high-quality stablecoin that has remained stable after experiencing severe market fluctuations. Now, Ethenas goal seems to be aimed directly at the big brother of the crypto market – Tether. And Tethers market share of more than 160 billion US dollars is also facing challenges.

In this article, the author will analyze Ethena鈥檚 business model, USDe鈥檚 revenue mechanism, and compare the advantages and disadvantages of Ethena and Tether, and then explore the future development trend of the stablecoin market and the position of stablecoins such as Ethena and Tether in the future competitive landscape.

Potential stocks to challenge Tethers hegemony

It all starts with Ethenas strategy. From a pure DeFi native stablecoin project, Ethena hopes to transform into a comprehensive stablecoin competitor with higher value proposition and improved distribution channels. The recent announcement of the launch of USTb, cooperation with traditional financial giants such as BlackRock, and the downward trend of global interest rates have provided a favorable external environment for Ethena. It seems that Ethena has the opportunity to build USDe into the dominant stablecoin in the cryptocurrency field. However, the challenges are still huge. Can Ethena succeed? The result depends on many factors.

Judging from the current market environment, meme coins are prevalent and speculation has become dominant… Investors are keen to pursue short-term gains, regardless of the long-term value and fundamentals of the project. This phenomenon is called financial nihilism by some people, that is, the pursuit of narratives alone, indifference to fundamentals, or even contempt. Although this strategy has brought considerable or even huge returns to some investors in the past bear market, its sustainability is questionable.

However, the basic laws of the market still exist: successful speculative behavior is often based on at least a certain basis in reality. The prosperity of meme coins is mainly due to the behavior dominated by retail investors in the market. This type of user often overlooks that in the long run, the parabolic growth shown by the best performing highly liquid assets is often based on solid fundamentals. Only when the fundamentals are supported can a consensus be formed among all participants (including retail investors, hedge funds, proprietary trading and long funds).

$SOLs rapid growth in early 2023 is a good example. At that time, its growth was based on the premise of continuous developer participation and ecological prosperity. Similar examples include Axie Infinity and Terra Luna, which also experienced short-term surges, but eventually exposed their native problems.

Although financial nihilism is the mainstream trend in the current market, projects with strong product-market fit still have the potential to change market consensus.

Ethena may be a potential player.

Investment prospects of high-yield stablecoin USDe and $ENA tokens

After analyzing the market trends, let鈥檚 take a look at why Ethena has such great potential. At present, it can be seen that the project has two main killer weapons: value proposition and distribution channels.

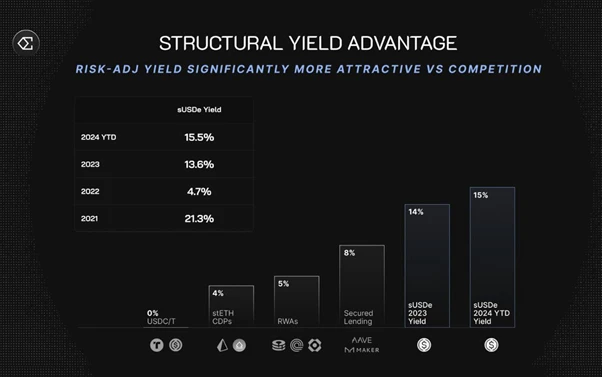

USDes value proposition is clear. Users deposit $1 and receive a delta-neutral position split between collateralized ETH and ETH short positions, earning yield at the same time. In a normal funding rate environment, sUSDe offers the highest sustainable yield (10-13% annualized) among all stablecoins. It is this strong value proposition that has driven Ethena to become one of the fastest growing stablecoins in history, with a peak TVL of $3.7 billion in 7 months and stabilizing at around $2.5 billion after the funding rate dropped. USDe is significantly higher than other DeFi products in terms of yield. However, Tether still dominates, the key is that Tether has more access to channels and its extremely high liquidity.

Lets talk about the distribution problem. Distribution channels are crucial to the success of any new stablecoin. USDT is able to dominate the market because it is a benchmark currency in almost all centralized exchanges. This is a huge competitive advantage that takes years for new stablecoins to achieve. However, Ethena successfully brought USDe to the market through cooperation with large centralized exchanges such as Bybit, and built automatic income functions into the platform, lowering the threshold for users to use it. At present, this is difficult for other decentralized stablecoins to replicate.

Currently, centralized exchanges hold about $38.6 billion in stablecoins, which is 15 times the current supply of USDe. Let鈥檚 do the math. If 20% of this stablecoin turns to USDe, the available market for USDe will grow nearly 4 times. If all major CEXs use USDe as a margin asset, the impact will be self-evident.

The two main catalysts facing Ethena are: one is the structural decline in interest rates, and the other is the launch of USTb.

Since Ethena was founded, sUSDes yield premium has been 5-8% higher than the Federal Reserves federal funds rate. This structural advantage has attracted billions of dollars in capital inflows. However, the Feds interest rate cut policy may have an impact on USDes yield. Although the interest rate cut itself has nothing to do with Ethenas source of income, it may have an indirect impact on the funding rate.

The supply of USDe is very sensitive to the yield spread relative to Treasury bonds. Historical data shows that when the yield premium is high, the demand for USDe also increases accordingly. And vice versa. Therefore, the return of the yield premium in the future may once again drive the growth of USDe.

The launch of USTb is considered a key factor in changing the rules of the game. USTb is a stablecoin 100% backed by BlackRock and Securitizes tokenized fund BUIDL. It can be integrated with USDe to provide treasury bond returns to sUSDe holders. This, to a certain extent, eliminates the markets doubts about the stability of Ethenas returns.

Finally, lets analyze the economic model of the $ENA token. The $ENA token faces a common problem of many VC coins: the unlocking of tokens by early investors and teams will trigger increased selling pressure in the market. Since its high, the price of $ENA has fallen by about 80%. However, the inflation rate of $ENA will be significantly reduced in the next 6 months, which may reduce the selling pressure. At present, the price of $ENA has bottomed out and rebounded.

The future competitive landscape of stablecoins

Ethena now sets its long-term goal of expanding USDe to tens or even hundreds of billions of dollars. Considering the growing demand for stablecoins for international cross-border payments, a trillion-dollar market cap is not completely impossible. If Ethena can achieve this goal, the value of the $ENA token will also increase significantly.

However, I believe that this is still a journey full of challenges and uncertainties. Whether Ethena can compete with Tether for the stable currency remains to be tested by time.

This article is sourced from the internet: Stablecoin competition: Can USDe challenge Tethers USDT hegemony?

Related: How are the well-known Web3 projects settled in Hong Kong doing in compliance? | Mankun Law

As a financial center in Asia, Hong Kongs virtual currency market has always been at the forefront of regulation worldwide. For example, the new Virtual Asset Trading Platform (VATP) licensing system implemented on June 1, 2023, the recently released regulatory consultation document on stablecoin issuance, and the sandbox application list all mark important steps taken by Hong Kong in virtual currency regulation. These measures aim to enhance the overall integrity and stability of the market by improving investor protection and market transparency, while also providing clear regulatory guidance for crypto projects operating in Hong Kong, attracting the attention of global investors and crypto companies. Attorney Mankiw is often asked in consultations which well-known projects have settled in Hong Kong. Therefore, this article briefly reviews the main crypto projects operating under…