BitMEX Alpha: Bitcoin มีโมเมนตัมเพียงพอที่จะทำลายจุดสูงสุดตลอดกาลใหม่ได้หรือไม่?

ผู้เขียนต้นฉบับ: BitMEX

In last week’s article, we recommended a call spread strategy to go long Bitcoin at $62,000. This trade has performed very well so far as we approach the expiration date on the 18th. We are currently trading around $67,000 – close to all-time highs. Hopefully, you have made a nice profit.

In this article, we will evaluate the probability of Bitcoin breaking through $70,000 and share an options strategy that can profit by next Friday regardless of whether Bitcoin falls, consolidates, or rises modestly to $69,000, as long as it does not break through $71,000.

Let’s dive in.

Factors driving recent gains

Before we dive in, let’s review the underlying factors for this week’s gains.

-

Harris’ support for the cryptocurrency industry: Vice President Harris recently made her support for cryptocurrency explicit, suggesting that it could be positive for Bitcoin regardless of the outcome of the November election. However, given that Trump has expressed his interest in including Bitcoin as part of the U.S. monetary reserves, a win for Trump could be more beneficial.

-

Chinese stock market adjusts, USDT discount narrows: The strong upward momentum of the Chinese stock market has recently reversed, and it has performed significantly poorly in the past week, falling more than 13%. This adjustment in the Chinese stock market may draw attention and funds back to the cryptocurrency market. It is worth noting that the over-the-counter discount of USDT in RMB has narrowed slightly to about 1.3% after exceeding 1.5% for two consecutive weeks. This change indicates that the selling pressure may have eased, and it may also indicate a renewed interest in cryptocurrencies among Chinese investors.

Does Bitcoin have enough momentum to break new all-time highs?

It’s likely that smart traders still have good reasons to take profits as Bitcoin approaches its all-time highs.

Andrew Kang เชื่อ that some of the bullish factors may be exaggerated, and while the market remains generally positive, a breakout to new all-time highs may require more substantial drivers unique to the cryptocurrency ecosystem:

-

Over-emphasis on Fed rate cuts: The impact of Fed rate cuts on cryptocurrency prices may be exaggerated. Bitcoin’s 4.5x increase during periods of high interest rates suggests that the correlation between interest rates and BTC prices is weak.

-

China stimulus has limited impact on crypto markets: Optimism around China’s economic stimulus may be more relevant to stocks than cryptocurrencies. Evidence shows funds moving from cryptocurrencies to Chinese A-shares, with USDT trading at a 3% discount to the yuan.

-

Realistic ตลาด Outlook: While not bearish, a more cautious approach suggests Bitcoin will likely remain in the $50,000-72,000 range until a significant crypto-specific catalyst occurs.

Our co-founder Arthur Hayes has also shifted to a more neutral stance on cryptocurrencies as he sees escalating geopolitical risks around the world, advocating for careful position sizing and preparing for potential “insane market cap paper losses.” In his latest article , Arthur Hayes lays out several compelling reasons why Bitcoin may not break out to new all-time highs anytime soon, despite current bullish sentiment:

-

Increased geopolitical risks: The escalating conflict between Israel and Iran poses a significant threat to the cryptocurrency market. A major escalation in the conflict could lead to a “significant drop” in cryptocurrency prices.

-

The Unpredictability of War: Hayes stressed that war is uninvestable, highlighting the potential for sudden and severe market turmoil.

-

Energy Price Volatility: While Bitcoin may benefit from rising energy prices in the long term, volatility could be high in the short term if Middle Eastern oil infrastructure is affected.

Put your market views into practice: Trading options

Taking the above into account, we believe that Bitcoin is unlikely to break through $71,000 in the short term – 1) Bitcoin may rise modestly, but 2) it is unlikely to break through $71,000 or set a new all-time high in the next 1-2 weeks.

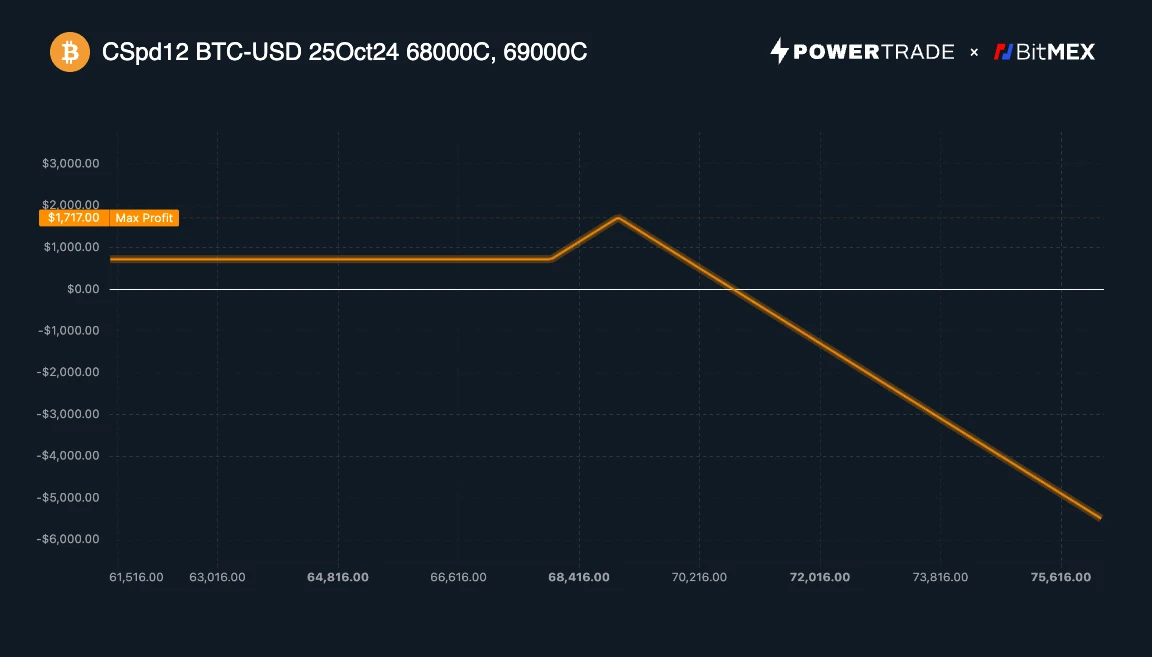

Consider the Call Spread 1 x 2 Strategy

The Call Spread 1 x 2 strategy, also known as the 1 x 2 Ratio Vertical Spread strategy, involves buying one call option with a lower strike price and selling two call options with a higher strike price. The second call option sold is uncovered (naked) and carries unlimited risk. The profit potential is limited, and the maximum profit can be achieved if the price reaches the strike price of the sold call options at expiration. However, once the breakeven point is exceeded, the risk becomes unlimited as the stock price can rise indefinitely.

This strategy allows for potential profits with limited risk while also providing some downside protection.

Trading strategies

-

Buy 1 $BTC call option with a strike price of $68,000, expiring on October 25

-

Sell 2 $BTC call options with a strike price of $69,000, expiring on October 25

Potential Benefits

-

Breakeven point: $70,716

-

Max Loss: If $BTC breaks above $70,716, potential loss is unlimited, similar to a short position

-

Max Profit: If $BTC is $69,000 on the Oct 25 expiration date, max profit is $1,683

ข้อดี

-

Higher profit potential: This strategy can be more profitable than a regular call spread if the asset price rises to the strike price of the sold call option. It also has a higher chance of profit as long as Bitcoin does not significantly exceed the breakeven point.

-

Lower initial cost: Selling two higher strike call options can reduce the overall cost of the strategy, potentially resulting in a credit.

-

Flexibility: Strike prices and ratios can be changed to accommodate different market outlooks.

risk

-

Unlimited risk: If the asset price significantly exceeds the higher strike price, large losses may occur due to the naked selling of call options.

-

Complex payoff structure: The strategy has multiple break-even points and a non-linear risk profile that may be difficult to manage.

-

Margin Requirements: This strategy may require significant margin, especially when the underlying asset is volatile.

This strategy is suitable for traders who have a mildly bullish to neutral view on the market, expecting asset prices to rise modestly or remain relatively stable. It offers higher profit potential than a plain call spread, but with increased risk. It is best suited for experienced options traders who can actively manage positions and understand the complexities of ratio spreads.

This article is sourced from the internet: BitMEX Alpha: Does Bitcoin have enough momentum to break new all-time highs?

Original author: Lila On August 27, official data showed that the market value of PayPals stablecoin PYUSD has exceeded the $1 billion mark, and its supply has more than doubled since June. According to Visas stablecoin dashboard, PYUSDs user activity has soared, with monthly active wallet addresses jumping to more than 25,000 in July, compared with 9,400 in May. This is also the explosive growth of PYUSD after it expanded to the Solana network in May. It grew from zero to $650 million in just three months, exceeding the supply on the Ethereum chain. According to DefiLlama data, the supply of PYUSD on the Solana chain has increased by 171% in the past month. Why did PayPal choose to build on Solana, and what drove the adoption of PYUSD? In…