แนวโน้มตลาดสกุลเงินดิจิทัลในเดือนตุลาคม: การแยกโซ่ การแข่งขันเลเยอร์ 1 และการติดตามสกุลเงินดิจิทัลที่เสถียร

Original author: Sleeping in the rain, crypto KOL

As mentioned in the previous introduction, this October Outlook will be very concise. I will only talk in detail about the 3-5 tokens that I personally want to participate in. I hope everyone will like this format (it was too scattered before and the information efficiency was not high).

TLDR: $UNI $SOL Berachain $TAO $WELL $ENA

ตลาด hype is generally divided into two modes. One is artificial narrative, which generally pushes a leading token to an independent trend, such as $SUI. The other is the brewing, emergence and outbreak of innovation. This innovation may be a fun Ponzi, or it may be a narrative that largely meets market demand, such as $AXS (this round of memecoin is an atypical case).

Generally speaking, the first wave of narratives will give ordinary people more opportunities. This kind of big innovation is often born in the context of macro liquidity spillovers – funds have a higher demand for money-making effects and capital efficiency, and demand drives innovation.

A big problem in this round is that there is no narrative that can แนะนำ the inflow and transfer of liquidity like in the previous round, and liquidity is the key to asset pricing. If the narrative cannot guide liquidity, it will be difficult to hype assets. Everyone is hyping memes and paying attention to memes. As long as there is some movement, related memes will quickly appear. But meme narratives are also the easiest to make investors tired, and ultimately a mess.

So is there still a chance in the cryptocurrency world?

I think yes, at least there are several main narratives in the cryptocurrency world that are developing in parallel.

Intention Abstraction Chain Abstraction

The ultimate goal of this narrative is to allow users and liquidity to enter and participate in Crypto in a low-threshold and non-sensing way, which seems to have a bright future. But this is not Ponzi, and there is a high probability that there will be no large-scale wealth opportunities.

Essentially, these hypes are based on the idea that cryptocurrency users think this narrative can bring them new buyers. But whether it can eventually bring a large number of real users and liquidity to the cryptocurrency circle remains a question.

The core catalyst of this narrative is the launch of $UNI v4.

The launch of Uniswap v4 is a catalyst that draws market attention to this narrative. In the future, as this narrative develops, the front-end may become the most popular hype target, followed by infrastructure layer targets like Uniswap v4 and liquidity interaction layer targets. But at the beginning, $UNI should still have the biggest opportunity. At the same time, $COW $1INCH with similar concepts should also have corresponding opportunities.

Layer 1 Competition

In the current market, Layer 1 competition is the most mainstream narrative, no doubt about it.

During this cycle, the main line of market hype is Solana, and from time to time other Layer 1s will pop up to compete with Solana.

For example, the previous $AVAX, Avalanche promoted the growth of token prices through hype memes and official announcements and PR with top companies. The same is true for $SUI now. They use OTC transactions to make English CTs shout orders (doubtful, uncertain) to create a new narrative, memecoin hype (now there are some good wealth effects on Sui) and use $SUI tokens to incentivize liquidity (similar to Arbitrum) to attract market attention and increase liquidity stickiness. It is worth mentioning that the DeFi yield on Sui is still good.

Now many Layer 1s have begun to try to use memecoin to attract market attention and liquidity, but ultimately with little success (such as BSC).

Therefore, I think the Layer 1s you sing and I come on stage is most likely a short-term event. If you participate in these Layer 1 activities in the short term, you will definitely make a profit – because your behavior matches the needs of the project party.

Another Layer 1 gameplay is Fantoms Rebrand – creating a better-performing chain for brand upgrade. If no one plays the blockchain at the beginning, then use the expectation of future airdrops as incentives. In essence, it is similar to the previous Layer 2 gameplay, not very innovative, but effective before the airdrop.

Speaking of Layer 1s that I鈥檓 optimistic about, my list is: Solana $SOL and Berachain.

The reason for being optimistic about Solana is simple. Just look at which company has more large-cap memecoins on Binance. Memecoin is a trump card of Layer 1.

Berachains PoL is the only major innovation in the Layer 1 consensus mechanism in this cycle, which introduces a dynamic game between users, nodes and project parties. At the same time, they are also actively supporting ecological projects in a transparent, decentralized and fair way. I am deeply involved in the Berachain ecosystem, so I will give my support, DYOR.

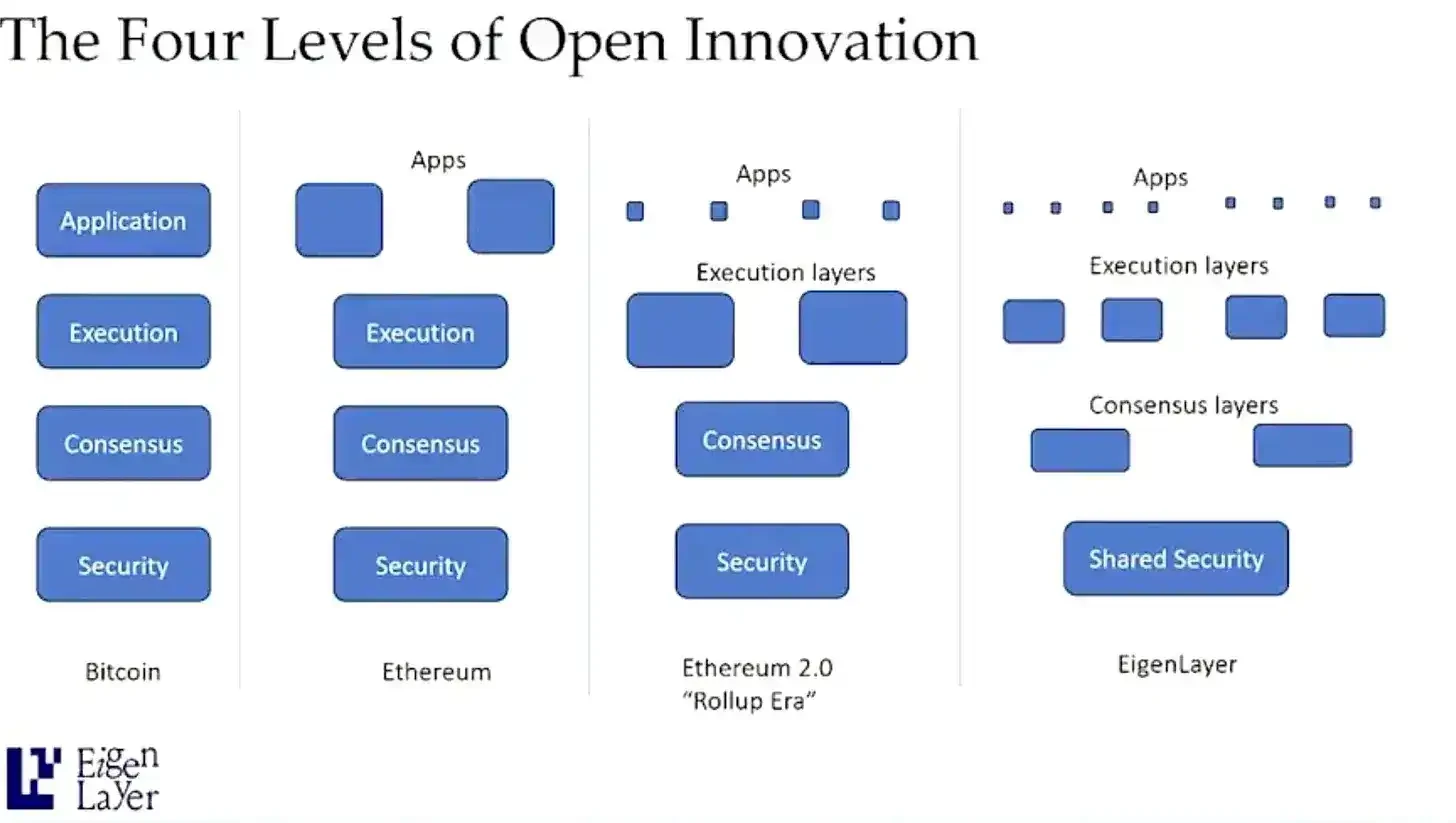

In addition to the basic Layer 1 competition, I also like the modular narrative, which is a new narrative that is being discussed a lot in this cycle. In fact, just look at the picture below.

However, it is hard to describe modular projects. I wanted to support $EIGEN, but I didn鈥檛 expect that $EIGEN had a hacker incident, which caused a great response from the community. In short, I am still optimistic about $EIGEN, and I think $EIGEN may suck blood from other modular projects, and there will be a wave of price performance in Q4 (it will take the next cycle to really hype it up on a large scale).

AI

There is no need to talk about the AI narrative, just look at OpenAIs recent operations. Also, AI tokens used to follow Nvidias stock. Recently, the best performing token in the Crypto AI track is $TAO. If you want to choose a target, choose the strongest one. The hype of AI tokens has nothing to do with fundamentals. We should still focus on the changes in the AI industry. (Chinas TAO $NMT can also be paid attention to, but its hype is a matter after $TAO) The key words are price performance during the market correction and appropriate time node.

This kind of hype will continue until the AI bubble bursts. Before it bursts, all we can do is enjoy the bubble.

Stablecoin Competition and DeFi

The competition in the current stablecoin market is becoming increasingly fierce. For example, with the entry of Paypal, Binance has turned to support FDUSD, BlackRock is also actively developing the stablecoin market, and Coinbase has USDC and euro stablecoins on Base.

Under this fierce competition, the three tokens that we can hype at present are mainly Sky (formerly MakerDAO), $LQTY and $ENA.

Sky is the oldest decentralized stablecoin project, and is currently promoting the transformation of its governance token and native stablecoin. It is clear that Sky hopes to reduce the impact of interest rate cuts on project products, and transform from the model of using RWA income to incentivize adoption to the model of using tokens to incentivize adoption. Later, Sky will open a new plate by issuing SubDAO to maintain the scale of adoption of the projects stablecoin. There will definitely be wealth opportunities, but the community is not buying into Skys recent operations. I have also seen some negative comments from the community.

In addition, as Mr. Shenyu said, the interest rate cut will definitely increase the competitiveness of DeFi. DeFi tracks, including Ethereum and Solanas DeFi, have opportunities. In short, the higher the activity on the Layer 1 chain and the higher the TVL, the more popular the DeFi project tokens on that chain will be. Later, the demand for high returns may also give rise to new plates. But thats a matter of the big bull market, so lets take it one step at a time.

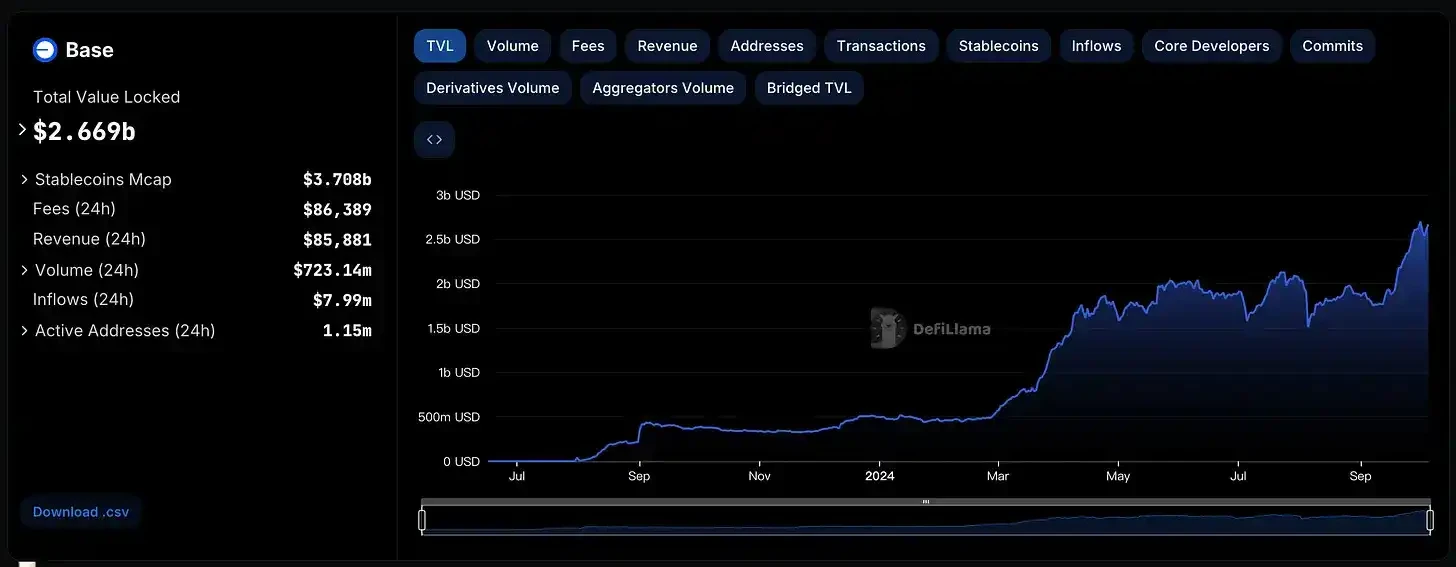

Here I want to mention Ethereum Layer 2 Basechain separately. Base has performed very well recently, and TVL has increased a lot in September. The growth of fundamentals will bring new wealth opportunities. Here we need to clarify Coinbases needs for Basechain: Base can expand Coinbases influence in the crypto industry and bring sorter income to Coinbasse. If Base is good, Coinbase will benefit, and then Coinbase will have every motivation to promote the continued growth of the Base ecosystem (the same is true for the previous pull of $AERO).

What is Coinbase promoting now?

cbBTC.

Moonwell and Aerodrome will be the main places for cbBTC to grow. Currently, Moonwell has launched cbBTC liquidity mining subsidies. Pulling $WELL can promote more cbBTC adoption (personal opinion).

$LQTY has a v2 expected (November), and is also a decentralized stablecoin recognized by the community. Skys transformation itself is good for $LQTY, which is one of the reasons why it has risen so fiercely in the past period of time (my personal opinion). The impact of industry changes and the upcoming fulfillment of expectations may affect the future price performance of $LQTY.

The competitiveness of $ENA lies in: a new stablecoin in this cycle and cooperation with BlackRock to launch a new UStb stablecoin. The influence of this form of cooperation is much greater than those projects participating in BlackRocks Buidl Fund. In-depth cooperation is the best catalyst. The recent airdrop and unlocking of $ENA should give us an opportunity to enter the market.

Other promising tokens are $PENDLE and $BANANA. $PENDLE has been discussed many times before. Recently, it is promoting BTCFi and has v3 expectations. For $BANANA, you can refer to this article by @BensonTWN (very well written): https://x.com/BensonTWN/status/1839664439093813397

For games, we will consider $PIXEL $PRIME $PIRATE. I personally think that we cannot look at these projects from the perspective of the game sector, but need to look at the catalysts corresponding to these projects separately.

The BTC ecosystem needs further observation (the core demand is still there, for details, please see my metagame article). We are still at a stage where the market believes that miners need on-chain activity to increase their income, and we look forward to new plates emerging in the BTC ecosystem. But the problem is that the surge in on-chain fees is likely to be a short-term phenomenon. Miners may like it, but the market cannot continue to pay for it.

Regarding the memecoin narrative, I personally think that the mainstream memecoins will see a huge surge after the return of liquidity, and $WIF $PEPE have the greatest chance. Memecoins cannot be predicted, and we can only follow the trend. Overall, I am still optimistic about the memecoin track, and I think that this track will have at least two memecoins with a market value of 10 B+, just like $DOGE $SHIB in the last round.

Finally, lets take a look at whats going to happen in October:

-

$JEWEL Colosseum PvP on Metis: I don鈥檛 know what kind of sparks these two projects can create, but $METIS is indeed doing well;

-

$XRP ETF and SEC: I think there is a chance for a nice rally;

-

$STX Nakamoto Upgrade: It is good for $STX, and there is a high probability that there will be good wealth opportunities on Stacks;

-

$DUSK Mainnet Launch: We are not paying much attention to this track at the moment;

-

$AVAX Summit ( 16-18 Oct)$WLD New World with Sam Altman: also related to the AI industry;

-

$RENDER Migration Rewards End$TIA Unlock of $ 1.05 BJPY Interest Rate Decision

For details, please refer to this article: https://x.com/breadnbutter247/status/1840435197893857689

This article is sourced from the internet: Cryptocurrency Market Outlook in October: Chain Abstraction, Layer 1 Competition and Stablecoin Track

ที่เกี่ยวข้อง: LBank จัดงาน 'Meet Your Meme' TOKEN2049 Afterparty ที่สิงคโปร์สำเร็จ

The highly anticipated ‘Meet Your Meme’ TOKEN2049 Afterparty, hosted by LBank in collaboration with Shiba Inu, Babydoge, and SaitaChain, concluded with resounding success. The event brought together a vibrant crowd of meme enthusiasts, crypto innovators, and community members for an unforgettable evening filled with fun, creativity, and interactive experiences. Held alongside TOKEN2049, Asia’s leading crypto event, the afterparty celebrated the growing influence of memecoin culture within the blockchain industry. Attendees were treated to a night packed with immersive experiences, exciting competitions, and engaging displays that showcased the creativity and strong community spirit behind memecoins. Event Highlights The ‘Meet Your Meme’ afterparty stood out for its diverse range of activities and interactive elements: Interactive Memecoin Showcases: Attendees explored dynamic displays featuring top memecoin projects such as Shiba Inu, Babydoge, and SaitaChain.…