เมื่อมีข่าวดีเข้ามาอย่างต่อเนื่อง ZKsync จะนำพาให้เกิดยุคใหม่หรือไม่?

ผู้เขียนต้นฉบับ: Frank, PANews

ตั้งแต่การเปิดตัว ZKsync ต้องเผชิญกับข่าวร้ายมากมาย ข้อมูลด้านสิ่งแวดล้อมลดลงอย่างรวดเร็ว และราคาโทเค็นก็ลดลงอย่างรวดเร็วเช่นกัน จาก $0.29 หลังจากเปิดตัวเป็น $0.08 ซึ่งลดลง 72.8% ไม่เพียงเท่านั้น ยังมีรายงานอีกว่าพนักงาน 16% ถูกเลิกจ้าง

อย่างไรก็ตาม ตั้งแต่เดือนกันยายนเป็นต้นมา มีการรายงานความคืบหน้าใหม่ๆ ของ ZKsync อยู่บ่อยครั้ง เช่น การจ้างหัวหน้าฝ่ายการตลาดจาก Solana การเปิดตัวระบบการกำกับดูแลแบบออนเชน และการต้อนรับการโยกย้ายของ Treasure DAO ดูเหมือนว่า ZKsync กำลังได้รับการฟื้นฟู PANews ได้วิเคราะห์สถานะการพัฒนาล่าสุดของ ZKsync อย่างครอบคลุม เพื่อดูว่า L2 ที่ครั้งหนึ่งเคยได้รับความนิยมนี้กำลังจะได้รับการฟื้นฟูหรือไม่

เริ่มต้นด้วยการขยายวงเพื่อนของคุณ

การเปลี่ยนแปลงใน ZKsync ดูเหมือนจะเริ่มจากการเลิกจ้าง เมื่อวันที่ 3 กันยายน มีรายงานว่า Matter Labs ผู้พัฒนา ZKsync ได้ประกาศเลิกจ้างพนักงาน 16% รวม 24 คน ถือเป็นการเลิกจ้างครั้งแรกในรอบ 6 ปีที่บริษัทก่อตั้ง และ Alex Gluchowski ซีอีโอของ Matter Labs ชี้แจงว่าการตัดสินใจเลิกจ้างไม่ได้เกิดจากสถานการณ์ทางการเงินของบริษัท และขั้นตอนต่อไปคือการวางแผนสรรหาบุคลากรเชิงกลยุทธ์

ในความเป็นจริง ZKsync ได้รับการถ่ายเลือดหลังจากการเลิกจ้าง เมื่อวันที่ 11 กันยายน Matter Labs ประกาศว่าได้จ้าง Meghan Hughes อดีตรองประธานฝ่ายการตลาดของ Solana Foundation มาเป็นหัวหน้าฝ่ายการตลาด ก่อนหน้านี้ Meghan Hughes เคยทำงานที่ Google, Facebook, Niantic และ Stripe Matter Labs เปิดเผยกับสื่อว่า Hughes ได้รับการว่าจ้างให้มาช่วย Matter Labs แบ่งปันเรื่องราวและปรับปรุงเรื่องราวของบริษัท

สองวันต่อมา ZKsync ได้ประกาศเปิดตัวระบบการกำกับดูแลแบบออนเชน ซึ่งเป็นระบบการกำกับดูแลที่สร้างขึ้นจากหลักการของการแบ่งแยกอำนาจและการถ่วงดุลอำนาจ โดยการออกแบบแล้ว ไม่มีบุคคลหรือหน่วยงานใดสามารถเปลี่ยนแปลงโปรโตคอล ZKsync ได้ หลังจากที่ Alex Gluchowski ซีอีโอของ Matter Labs ประกาศข่าวนี้บน Twitter ก็ได้จุดชนวนให้เกิดการพูดคุยมากมายในชุมชน ในบรรดาพวกเขา ผู้ร่วมก่อตั้ง Solana อย่าง Toly ตั้งคำถามถึงคำกล่าวที่ว่าโปรโตคอล ZKsync ใหม่ไม่ใช่ลายเซ็นหลายรายการภายใต้ทวีตของ Alex Gluchowski การสนทนาระหว่างทั้งสองยังคงอยู่ในระดับทฤษฎีและไม่ได้ขยายไปสู่ระดับอื่น อย่างไรก็ตาม การสนทนาระยะไกลดังกล่าวยังคงทำให้ ZKsync ได้รับความสนใจในระดับหนึ่ง

เมื่อวันที่ 14 กันยายน Karel Vuong ผู้ก่อตั้งร่วมของ Treasure ได้เผยแพร่บทความยาวบนโซเชียลมีเดียเพื่ออธิบายว่าทำไม Treasure DAO จึงตั้งใจที่จะย้ายจาก Arbitrum มาใช้ ZKsync Karel Vuong กล่าวว่า ZKsync เหมาะกับวิสัยทัศน์ของโครงการในการนำไปใช้งานในวงกว้างมากกว่าในแง่ของความสามารถในการปรับขนาด ปริมาณงาน ต้นทุน ความเป็นไปได้ของเกม การเริ่มต้นใช้งาน และการทำงานร่วมกัน นี่คือเหตุผลหลักที่ทีมงานเลือก ZKsync

เมื่อวันที่ 23 กันยายน หลังจากทดสอบซ้ำเป็นเวลาหนึ่งเดือน ในที่สุด Aave V3 ก็ถูกใช้งานบนเครือข่ายหลัก ZKsync Era

เมื่อวันที่ 25 กันยายน Coinbase ประกาศว่าจะเปิดตัวโทเค็น ZKsync (ZK) ต่อมาโทเค็น ZK ก็พุ่งสูงขึ้นตามไปด้วย โดยราคาสูงสุดแตะระดับ 7.59% ภายใน 15 นาที เมื่อวันที่ 25 ราคาสูงสุดแตะระดับ 14.5% และราคาแตะระดับ 0.14 ซึ่งถือเป็นระดับสูงสุดเป็นประวัติการณ์ในรอบเกือบ 2 เดือน

นอกจากนี้ โปรเจ็กต์ต่างๆ เช่น Chainlink CCIP และ Stratis ยังประกาศการใช้งานบน ZKsync ด้วย

ข้อมูลบนเครือข่ายแสดงให้เห็นถึงการปรับปรุงเล็กน้อย

นอกจากจะขยายอิทธิพลในระบบนิเวศแล้ว ข้อมูลบนเชนของ ZKsync ยังได้รับการปรับปรุงเมื่อไม่นานนี้ด้วย เมื่อมองย้อนกลับไปที่ข้อมูลหลังจากการแจกฟรี เราจะเห็นว่า TVL จำนวนธุรกรรมบนเชน และจำนวนที่อยู่ที่ใช้งานบนเชนลดลงตั้งแต่เดือนมีนาคม หลังจากเข้าสู่เดือนกันยายน ZKsync ก็พบว่าข้อมูลเหล่านี้มีการฟื้นตัวอย่างมีนัยสำคัญ

เมื่อวันที่ 9 มีนาคม ปีนี้ TVL ของ ZKsync Era พุ่งขึ้นแตะจุดสูงสุดที่ $188 ล้าน เมื่อวันที่ 5 สิงหาคม ตัวเลขนี้ลดลงเหลือ $72 ล้าน ซึ่งลดลงมากกว่า 60% เมื่อวันที่ 29 กันยายน TVL ของ ZKsync Era พุ่งขึ้นแตะ $140 ล้าน นับเป็นการฟื้นตัวครั้งสำคัญ

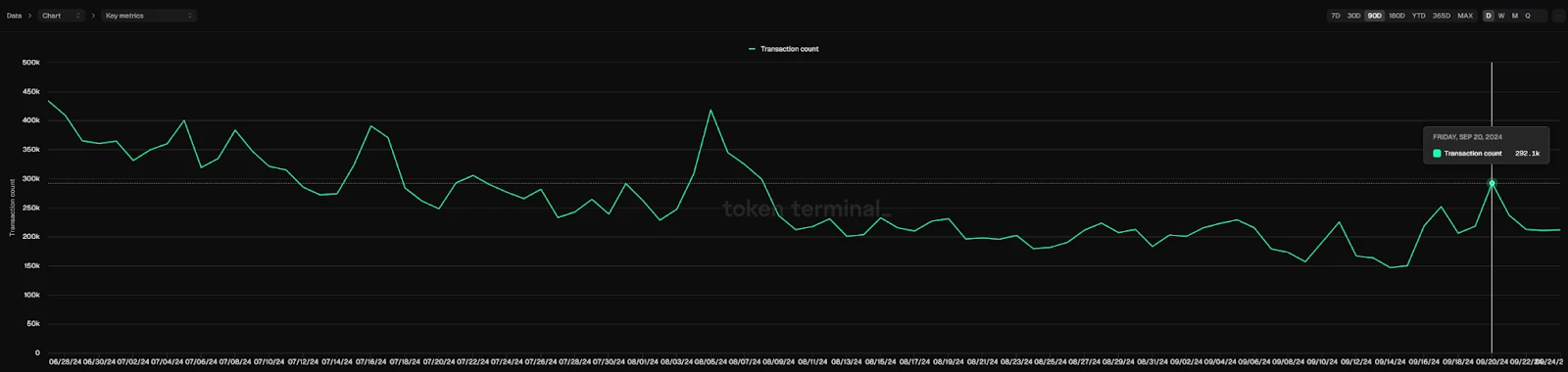

ปริมาณการซื้อขายรายวันเพิ่มขึ้น

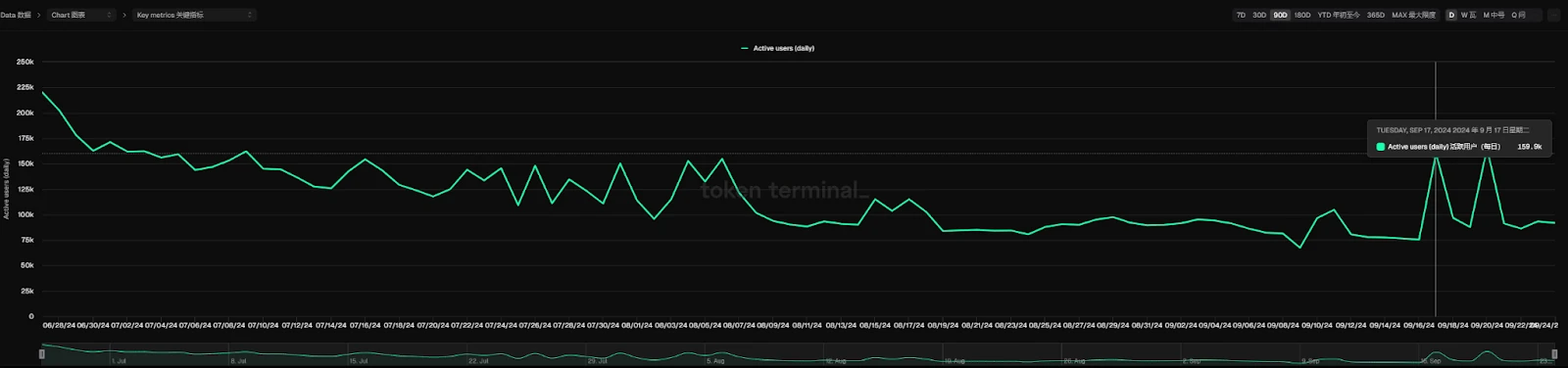

การเปลี่ยนแปลงที่เห็นได้ชัดเจนยิ่งขึ้นเกิดขึ้นในจำนวนผู้ใช้งานรายวัน เมื่อวันที่ 9 กันยายน จำนวนที่อยู่ที่ใช้งานรายวันของ ZKsync Era ลดลงเหลือเพียง 67,000 ที่อยู่ เมื่อวันที่ 17 กันยายนและ 20 กันยายน จำนวนที่อยู่ที่ใช้งานรายวันเพิ่มขึ้นอย่างมีนัยสำคัญโดยเพิ่มขึ้นเป็น 159,000 และ 164,000 ที่อยู่ตามลำดับ ในเวลาเดียวกันจำนวนธุรกรรมบนเครือข่ายก็เพิ่มขึ้นอย่างกะทันหันในสองวันนี้เช่นกัน ตั้งแต่วันที่ 15 กันยายนถึงวันที่ 20 กันยายน จำนวนธุรกรรมบนเครือข่ายเพิ่มขึ้นมากกว่า 1 เท่า

ผู้ใช้งานที่ใช้งานอยู่แสดงสัญญาณการฟื้นตัว

การเติบโตของข้อมูลเหล่านี้อาจมาจาก Tevaera ซึ่งเป็นแพลตฟอร์มเกมภายในระบบนิเวศ ตามข้อมูลของ DappRadar จำนวนที่อยู่ผู้ใช้ของ Tevaera ในช่วง 30 วันที่ผ่านมาได้สูงถึงประมาณ 150,000 ที่อยู่ เพิ่มขึ้น 160% ข้อมูลการสร้างสัญญาของ ZKsync Era อื่นยังคงอยู่ในระดับต่ำเมื่อไม่นานนี้โดยไม่มีการเปลี่ยนแปลงมากนัก ซึ่งยังยืนยันโดยอ้อมว่าการเติบโตของข้อมูลเหล่านี้อาจมาจากแอปพลิเคชันบางตัวมากกว่าโทเค็นใหม่จำนวนมาก

ยังมีช่องว่างใหญ่กับ L2 อื่นๆ และการขายแบบแบ่งเฟสผ่าน Airdrop ได้สิ้นสุดลงแล้ว

เมื่อเปรียบเทียบกับ Ethereum L2 อื่นๆ เราจะเห็นว่า TVL ของ Arbitrum และ Base ทั้งคู่สูงกว่า $2 พันล้าน และ Optimism อยู่ที่ $680 ล้านเช่นกัน แม้ว่าโครงการนี้จะนำการโยกย้ายโครงการแบบร่วมมือมาใช้บ่อยครั้งเพื่อเพิ่มกิจกรรมของระบบนิเวศในช่วงไม่นานนี้

เมื่อเปรียบเทียบกันแล้ว ZKsync ดูเหมือนจะต้องก้าวไปอีกไกล

ณ วันที่ 26 กันยายน จำนวนโทเค็นทั้งหมดที่สร้างขึ้นในเมนเน็ต ZKsync DEX คือ 507 และปริมาณการซื้อขายใน 24 ชั่วโมงไม่เกิน $10 ล้าน จำนวนคนที่ซื้อขายโทเค็นบนเชนมากที่สุดคือ 333 คนใน 24 ชั่วโมงเท่านั้น เมื่อพิจารณาจากข้อมูลเหล่านี้ กิจกรรมของระบบนิเวศบนเชนของ ZKsync ยังไม่เริ่มเติบโตอย่างแท้จริง

เมื่อพิจารณาจากประสิทธิภาพของตลาดโทเค็น โทเค็น ZK ฟื้นตัวเล็กน้อยในช่วงไม่นานนี้ ในช่วง 4 วันที่ผ่านมา ราคาของ ZK เพิ่มขึ้น 66% โทเค็นที่หมุนเวียนอยู่ในปัจจุบันคิดเป็น 17.5% ของทั้งหมด ก่อนเดือนมิถุนายน 2025 จะไม่มีการปลดล็อกโทเค็นใหม่ เมื่อรวมกับคอลเลกชัน airdrop โทเค็นในช่วงสามเดือนแรก การฟื้นตัวของราคา ZK อาจเกี่ยวข้องกับจุดสิ้นสุดของการขาย airdrop ร่วมกับข่าวความร่วมมือล่าสุดภายในระบบนิเวศ การจดทะเบียนบน Coinbase และโปรโมชั่นที่เอื้ออำนวยอื่นๆ และการฟื้นตัวโดยรวมของตลาด

โดยรวมแล้ว ดูเหมือนว่ายังมีเวลาอีกสักระยะก่อนที่ ZKsync จะฟื้นตัว อย่างไรก็ตาม เส้นทางการพัฒนาของ ZKsync นั้นแตกต่างจาก Sui ที่ได้รับความนิยมเมื่อไม่นานมานี้ ZKsync ยังไม่ได้เปิดตัวแพลตฟอร์มการออกเหรียญแบบคลิกครั้งเดียวสำหรับเหรียญ MEME แต่พึ่งพา Tevaera และเกมบล็อคเชนอื่น ๆ เป็นการชั่วคราวเพื่อเปิดใช้งานผู้ใช้ให้มากขึ้น หากเกมบล็อคเชนในอุตสาหกรรมคริปโตฟื้นตัวและแทนที่เหรียญ MEME ในฐานะเครื่องยนต์การเติบโตของขั้นตอนต่อไป ZKsync อาจเป็นตัวเลือกที่ดีในการฝ่าฟันในระดับ L2 โดยอาศัยเกมบล็อคเชน

บทความนี้มีที่มาจากอินเทอร์เน็ต: เมื่อมีข่าวดีเข้ามาอย่างต่อเนื่อง ZKsync จะช่วยฟื้นฟูหรือไม่

ที่เกี่ยวข้อง: การแนะนำสั้นๆ เกี่ยวกับ Firedancer ที่ทุกคนรอคอยใน Breakpoint

ผู้เขียนต้นฉบับ: Karen, Foresight News ในงานประชุม Solana Breakpoint เมื่อสัปดาห์ที่แล้ว บรรยากาศคึกคัก มีการเปิดตัวผลิตภัณฑ์ระบบนิเวศน์อย่างต่อเนื่อง และกิจกรรมเสริมสีสันต่างๆ มากมายเป็นไฮไลท์ของงาน ในงานเลี้ยงครั้งนี้ ไฮไลท์คือการเปิดตัว Firedancer ไคลเอนต์ตรวจสอบความถูกต้องของ Solana เวอร์ชันแรกบนเมนเน็ตอย่างเป็นทางการ ความสำเร็จครั้งสำคัญนี้ได้รับความสนใจเป็นพิเศษ โดยระบุว่าเครือข่าย Solana จะประสบความสำเร็จอย่างก้าวกระโดดในด้านประสิทธิภาพ ขณะเดียวกันก็หลีกเลี่ยงความเสี่ยงของการหยุดทำงานของเครือข่ายที่เกิดจากไคลเอนต์ตัวเดียวที่ขัดข้องบน Solana การพัฒนา Firedancer ย้อนกลับไปในปี 2021 และ 2022 ในฐานะไคลเอนต์ตรวจสอบความถูกต้องของ Solana ตัวที่สองที่พัฒนาโดย Jump Trading Group (ไคลเอนต์ดั้งเดิม Agave พัฒนาโดย Anza) การออกแบบเดิมคือการกำจัดความเสี่ยงต่อความล้มเหลวของจุดเดียวและปรับปรุง...